How to Sell a Small Business in 6 Steps

Whether you outgrow your business, need the capital for another project, or decide to retire, the time will eventually come for you to sell your online business.

The problem is that this is often easier said than done. Selling a business takes a fair amount of preparation and many business owners don’t have the necessary plans in place to ensure a smooth exit.

The good news is that it’s not too late to start piecing together your exit strategy and setting yourself up to make a healthy profit from your years of hard work.

To help you wrap your head around what’s to come, I’ve broken down how to sell your small business into six easy steps.

By the end of this article, you’ll be armed with all the knowledge you need to make a stress-free exit from your online business.

1. Clean Up Your Small Business Financials

As part of their research, potential buyers are going to want to take a deep dive into your business’s finances to make sure everything is above board.

To help them do this, you’ll need to clean up your financials and prepare certain documents and reports for buyers to look through.

The most important reports to prepare are a balance sheet and a profit and loss statement (P&L).

A P&L is a spreadsheet that shows your income and expenses over a certain period of time. It indicates how your expenses are subtracted from your earnings to reveal your business’s net profit. Similarly, a balance sheet also helps to indicate the performance of your business by providing a snapshot of your company’s assets and liabilities.

Additional financial records to prepare include software costs, accounts receivable, add-backs, agency retainers, inventory value, and lines of credit.

An easy way to keep track of your financial records is to hire accountants and bookkeepers who are specialists in small business accounting. They will help you get your finances in order before you sell your business.

Keeping your books up to date and knowing your numbers before you market your business for sale will make the valuation process a breeze.

2. Determine the Value of Your Company

The biggest question entrepreneurs ask us when preparing to sell their business is “How much is my business worth?”

To answer this question, our vetting advisors examine your business to determine its strengths, weaknesses, and assets. They then take the information they’ve gathered and plug it into our valuation formula to determine the value of your business.

Business valuation formulas differ slightly depending on whether you’re selling a content site, digital product, lead generation, or eCommerce business.

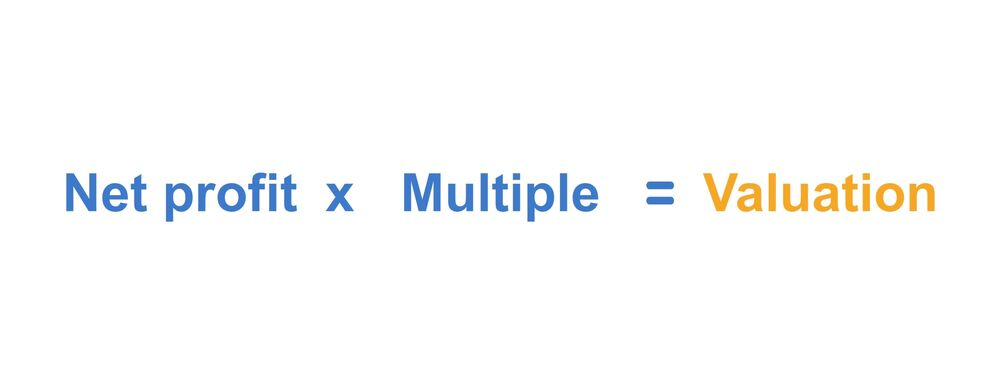

Here’s the basic formula we use for all business models to generate a baseline value:

Many brokers in our industry use annual figures in their formulas. We’ve gone against the flow by using a monthly multiple and monthly net profit figures. This gives us a better idea of fluctuations in earnings throughout the year as well as any seasonality that your business may experience.

Now, you might be wondering what a multiple is. This is a figure that represents the stability and future longevity of your business and it is calculated using several factors.

Again, these depend on your business model, but some of the common factors include:

- Diversity of revenue streams

- Diversity of traffic

- Level of owner involvement

- Business age

- Growth trends

- Strength of supply chain

If you’re working towards a specific sales price before you sell, you can use our free valuation tool to see how you’re tracking towards your goal.

Now let’s take a look at how the size of your business might impact the way we calculate your net profit…

SDE vs. EBITDA

In order to use the valuation formula above, you need to determine the net profit of your business. When valuing a business, net profit isn’t as simple as income minus expenses. It can be calculated in one of two ways.

The first way is known as Seller Discretionary Earnings or SDE. The theory here is that the business can’t operate without a certain level of owner involvement and various other necessary expenses. Therefore, the owner’s salary and expenses are added to the business’s earnings to paint a more accurate picture of the company’s true net potential.

The second method is referred to as Earnings Before Interest, Taxes, Depreciation, and Amortization. Or, EBITDA for short. This method is a lot more involved than SDE and is commonly used for businesses valued over $5 million that inevitably have a lot more moving parts.

Businesses over this value tend not to be owner-operated. Instead, they have layers of employees, managers, and investors. These expenses are seen as necessary running costs, so, under the EBITDA method, these salaries are not added back into the business’s earnings.

There are more nuances to the EBITDA method that I won’t go into here, but you can book a call with one of our expert sales advisors if you’d like to learn more about how we value online businesses.

3. Prepare Your Exit Strategy in Advance

Whether you’re planning to exit your business within the next few months or only plan to sell it a few years down the line, it’s a good idea to prepare an exit strategy early on.

An exit strategy is a long-term plan that details all of the actions necessary to achieve a financially sustainable exit from your business. A well-executed exit plan should maximize the profit you make from the sale. If your business is struggling, it should help you avoid or minimize losses.

When outlining your exit strategy, you need to identify how you plan to sell or exit your business. In most cases, businesses are sold through acquisitions ie, you sell 100% ownership of your business to the buyer. Other methods of exit include mergers, selling your shares to your business partner, an IPO (selling your shares to the public), or liquidation.

Next, you should refine your business to make it more attractive to buyers. This includes building a protective moat around your business, creating SOPs, and outsourcing or automating tasks and processes.

Finally, if you don’t know your ideal buyer personally, consider the best way to market your business to buyers. You can search for prospective buyers yourself, or use an online marketplace or brokerage to source buyers for you.

4. Find a Buyer

Take a minute to think about who the ideal buyer of your business might be.

What skills will they need to run your business effectively? What industry or niche are they currently operating in? How much experience do they have in running an online business?

Answering these questions helps you narrow down the best way to market your business to potential buyers.

There are a number of platforms that you can market your business on. If you decide to use an online business broker, keep in mind that different brokers specialize in different niches, price points, and business models. Doing a little research into brokers and marketplaces will help you hone in on your ideal buyer pool.

Once your business is live and starts generating interest from buyers, you’ll need to develop a system to eliminate unsuitable candidates. Asking buyers to verify their identity and available liquidity is a good starting point to weeding out tire kickers.

You can then arrange meetings with qualified buyers. Keep in mind, just as you’ll want to learn all you can about each buyer, they’ll want to do due diligence on your business too.

Due diligence refers to the process of investigating a business to confirm that all facts have been presented accurately. This due diligence checklist will give you an idea of the sort of things buyers will look into so that you can prepare accordingly.

5. Should You Use a Broker?

Admittedly, we’re a little biased here, but we believe there are many advantages to using a professional business broker to sell your online business.

Instead of spending countless hours sifting through potential buyers to eliminate the chancers and time wasters, brokers like Empire Flippers give you access to a large pool of buyers.

What’s more, all of the buyers in our pool have been verified to ensure they have enough liquid capital to purchase your business. In fact, we are currently sitting at over $7 million in verified buyer liquidity.

With so many buyers frequenting our marketplace, there is a healthy amount of competition helping to drive up sales prices.

We also go above and beyond, giving you access to qualified specialists who will guide you through the sales process, pre-sale calls, negotiations, and the migration of your business assets to the new owner.

It’s a common misconception that selling through a broker is more expensive than a private sale due to the commission fees earned by the brokerage.

What many people overlook is that brokers are experts in selling businesses. It’s in their best interest to ensure you achieve the highest selling price possible, and they have many resources at their disposal to make this happen.

So, while selling your business privately will save you from paying various fees, you could be missing out on an extremely lucrative deal as a result. We’ve seen this first hand with a recent Amazon seller who would’ve lost $700,000 by selling privately instead of through Empire Flippers.

6. Get Your Business Contracts in Order

As you may have suspected, there’s a long list of legal documents and contracts you’ll need to sign at various stages of the sales process.

I won’t go into detail about every document you might encounter, because they vary from sale to sale, but here’s a breakdown of the important contracts you’ll need to sell a business:

Confidentiality Agreement

The first document you’ll need to organize is a confidentiality agreement or a non-disclosure agreement (NDA). This will prevent people from copying your business or using your business’s data outside of the sales process.

Sale Declaration Document

If your business is owned by multiple parties, each owner needs to sign a sale declaration document. This document declares their intent to sell the business, preventing one of the owners from backing out at the last minute and jeopardizing the sale.

Letter of Intent

A letter of intent (LOI) is a document that protects both the buyer and seller. The document signals both parties’ commitment and intent to proceed with the future purchase agreement.

While an LOI is in force (they usually last for 30 days), the seller is not allowed to enter into an LOI with another party. This means the buyer can conduct their due diligence on the business without the threat of competition. An LOI also protects the seller as it forbids the buyer from sharing the business’s data.

Asset Purchase Agreement

There may be certain software or tools related to the business that you want to retain ownership of after the sale. An asset purchase agreement outlines which assets the buyer will purchase with the business and the associated terms and conditions.

Non-Compete Agreement

A non-compete agreement prevents the seller of the business from starting or purchasing another business that will directly or indirectly compete with the business they are in the process of selling.

The non-compete agreement remains in force for a predetermined period of time after the sale of the business; typically two to three years.

Employee Contracts

Employee contracts outline the responsibilities of each staff member and their respective salaries and benefits.

You can also share the contact information of any freelancers or contractors you’ve previously worked with who are keen to work with the new buyer.

Supplier and Manufacturer Contracts

Not every eCommerce business has a contract with its suppliers, however, having a formal contract can be reassuring for potential buyers. A contract ensures that the buyer can continue operations smoothly without the manufacturer taking advantage of their inexperience, raising prices unfairly, making unreasonable demands, or refusing to work with the new owner.

You can also sign an exclusivity agreement with your supplier. This agreement means that the seller works exclusively with the supplier, and the supplier manufactures the products in question exclusively for the seller.

This helps to build a moat around your business as it limits the ability of other sellers to produce similar products to yours.

Now that you have an idea of the steps involved with selling a small business, let’s take a look at some of the common pitfalls that trip sellers up.

6 Mistakes to Avoid When Selling Your Business

1. Not Planning Ahead

As you can see, there’s a lot that goes into selling a business. Leaving this list of tasks until the last minute will not only cause you unnecessary stress but could potentially derail the sale.

Planning for your eventual exit from your business in advance gives you time to anticipate potential problems and pivot accordingly. Having an exit strategy in place also gives you the flexibility to pounce on great acquisition opportunities at a moment’s notice.

2. Waiting Too Long to Sell

There are many reasons why small business owners wait too long to sell their businesses.

Some are chasing that next wave of growth, waiting to hit certain milestones before they call it day.

Others aim too high, rejecting perfectly good purchase offers while they wait for a large corporation or brand aggregator to swoop in and snap up their business.

Some sellers might simply be afraid of change or are intimidated by the idea of starting over.

Whatever the underlying reasons might be, waiting to sell your business is a risky game. A Google algorithm update, shipping crisis, or resource shortage could sink the value of your business overnight.

Once you’ve made the decision to sell, there’s no sense in waiting around. Hang up that “For Sale” sign, collect your well-deserved payout, and enjoy the fruits of your labor.

3. Misrepresenting Your Business

When advertising your business for sale, you should highlight its strengths and unique advantages, but even weaknesses can be turned into growth opportunities.

Interested buyers are often looking for businesses that they can grow post-acquisition. Highlighting areas of weakness within your business in a positive and transparent manner shows buyers potential areas of growth that they can leverage.

That said, it’s easy to stray from enthusing about your business’s accomplishments to over-exaggeration or misrepresentation.

Distorted truths and inflated performance metrics will be exposed during the due diligence process, and breaking the buyer’s trust is simply not worth it. Misrepresentation will not only cost you the sale but could result in legal action.

So, while there’s nothing wrong with boasting about your business’s achievements, avoid the temptation to embellish the features of your business.

4. Not Keeping Business Confidentiality

While putting your business on the market is an exciting milestone in your life, we wouldn’t advise that you shout about it from the rooftops.

You should only reveal the identity of your business to serious buyers. This will keep copycats at bay and prevent competitors from discovering that your business is for sale.

Similarly, if employees become aware of the sale too soon, it could cause them to resign in panic or have an adverse effect on morale.

5. Finding the Wrong Buyer

You’ve invested a lot of blood, sweat, and tears into your business, so you don’t want to sell it to someone who will run it into the ground.

Remember, not all buyers are created equal. Don’t let your excitement to close the deal stop you from seeing potential red flags.

Seasoned business buyers will be old hands at this stage of the game, and will likely provide you with all of the necessary information you need to qualify their credentials.

If you’re working with an inexperienced or cagey buyer, you’ll have to ask some probing questions and trust your instincts when assessing their commitment levels. Make sure you verify their identity and available liquidity before revealing any sensitive information about your business.

6. Trying to Sell Your Business Alone

Whether you’re using a broker or selling your business privately, it’s always helpful to have experts in your corner who can guide you through the various stages of the sale process.

Schedule a free, no-obligation exit planning call with one of our sales advisors who will walk you through the ins and outs of selling your business.

Using professional accountants to get your financial statements in order and lawyers to help you draft and review legal documents will prevent a lot of headaches down the line.

Joining online communities where you can meet other buyers, sellers and entrepreneurs is also a great way to learn about common mistakes people make when selling their businesses. Browse through LinkedIn, Reddit, and Facebook to find a community that suits you.

It’s also wise to consult a financial advisor to find out the best ways to invest your money once you’ve successfully exited your business.

How to Sell a Business FAQs

How Do You Sell a Small Business Without a Broker?

Recruiting the help of a broker is often the most hands-off way to sell your business. That said, there are many other ways to sell your online business without a broker.

Here are a few options:

- For-Sale-by-Owner Marketplaces

- Social Media Groups

- Private Networking

How Much Does it Cost to Sell a Business?

The cost of selling an online business relies largely on the method of sale.

For-Sale-by-Owner Marketplaces tend to charge a fee for you to list your business. This will either be a flat-rate fee or a sliding scale, depending on the listing price.

Here at Empire Flippers, we use a tiered commission structure based on the listing price of the business.

You should also factor in the cost of hiring an accountant to clean up your finances, and lawyers to draft sales documents (if you’re not using a broker).

How Do You Sell a Business to a Competitor?

Selling your business to a competitor involves many of the same steps already outlined above.

The benefit of selling to a competitor is that you already know the buyer has experience running a business like yours.

If your competitor is an aggregator, you can reach out to them directly, or list your business on a large marketplace like Empire Flippers to drum up some competition and see which of your competitors is interested in acquiring your business.

How Do You Sell a Business Quickly?

Selling a business is a marathon, not a sprint. It represents a big milestone for both the buyer and seller, and there’s a lot of money on the table, so this isn’t a good time to take shortcuts.

That said, having a solid exit strategy in place, and lowering your asking price, will go a long way to helping you sell your business quickly when the time comes.

Selling Your Online Business Doesn’t Have to Be Hard

Starting a business from scratch is tough. Growing a business is really hard work. Selling a business? That’s the easy part.

With a bit of forethought and planning, you can achieve a smooth exit from your business, no matter its size.

If you’d like to learn more about how to sell a business on our marketplace, schedule a no-obligation exit planning call with one of our knowledgeable sales advisors. They’ll explain how each step of the process works, from registering an account on our website, to achieving a life-changing exit.

If you are ready to begin your exit journey, submit your business for sale on our marketplace today.