How to Value an E-Commerce Business (+ REAL Sales Data)

E-commerce can be an incredibly valuable online business model.

The trouble is, not many people know how to value an e-commerce business correctly. This could be a difference of tens of thousands of dollars when it comes time to sell it.

We’ve sold five-figure e-commerce businesses all the way up to multiple seven figures on our marketplace. We like to think this means we know a thing or two about valuing e-commerce websites.

We’ll use this information to share the latest industry sales data so you can see where the market currently is and what the future might hold for selling your e-commerce business.

How to Value an E-Commerce Business

Understanding how valuations works is very important for e-commerce store owners.

A valuation should be an impartial figure that’s based on more than just profitability. Learning more about valuations will help you create a more profitable and desirable e-commerce store.

This is why we recommend store owners get a valuation every few months to track their progress.

You might think that the valuation formula would be complicated; however, it’s rather simple:

To see what your business is worth, take a few minutes to fill out our free online valuation tool. It’s built specifically with e-commerce in mind and uses real industry sales data to give you an accurate estimate of what your store would be worth right now.

We’ll talk in detail about both parts of the above formula later on, but let’s first establish the type of formula used for an e-commerce valuation.

SDE vs. EBITDA

There are several ways to value an e-commerce website, but almost all will be valued in one of two ways.

The first and most common is based on seller discretionary earnings (SDE). Pretty much any online business on our marketplace, and most other brokers’ marketplaces, will use this method.

SDE is calculated based on net earnings before tax. This means the cost of goods sold and necessary operating expenses will be subtracted from the revenue.

Any owner compensation, AKA salary, will be added back on so that you get a true understanding of the business’s earnings. Discretionary earnings, which are the costs that aren’t necessary to operate the business, will also get added back.

This method works well because it shows how the business performs on a pure cash flow basis. It takes the current owner out of the equation and makes it easier to see how much the business is making should anyone ever take over. This is why SDE is sometimes referred to as seller discretionary cash flow.

SDE is the most common valuation method and most suitable for businesses up to around $5 million in annual revenue.

When businesses earn over this amount, they usually have a more complex structure in terms of a hierarchy of staff, as well as multiple stakeholders. This is where the EBITDA model comes in, which stands for earnings before interest, tax, depreciation, and amortization.

EBITDA uses a lot of the same methodology as SDE; however, it takes into account that more complex businesses are not owner-operated. Large businesses often have managers and layers of employees underneath the managers.

Therefore, EBITDA will not add these salaries back in, as they are seen as necessary running costs. We won’t go into too much detail about the EBITDA method, as it won’t apply to many business owners.

If you would like to understand more about how we create valuations, you can set up a call with our business advisors.

What are Add-Backs?

As previously mentioned, add-backs are costs that aren’t necessary for a new owner to continue running the business. They can also be one-time expenses that aren’t going to happen again.

If your store is built on Shopify, the monthly cost of that is a necessary operating expense, whereas a home office is not. As in most cases, an e-commerce business can be run completely remotely, so a new owner won’t need to continue the home office expense.

This is why a home office would be an acceptable add-back and Shopify would not. Some other examples of add-backs could be:

- Trademarks

- Personal travel expenses

- A one-off website redesign

- Co-working space

As you can see, there is quite a bit that can be added back when trying to calculate the net benefit to a new owner. These are sometimes costs that are put through the business for tax purposes.

There is somewhat of a grey area of what can be considered an add-back, however, and there might be a slight disagreement between broker, buyer, and seller.

E-commerce store add-backs tend to be minimal costs when compared to the total earnings of the business, so they shouldn’t affect the final valuation too much if they aren’t added back in.

If it’s a contentious decision, as long as it’s displayed in the profit and loss (P&L) statement, a buyer can analyze it as part of their due diligence.

What About Inventory?

When it comes to generating an e-commerce business valuation, inventory is not a direct consideration. Inventory only comes into play if your store has recently suffered any significant stock-outs or is anticipating any upcoming stock-outs.

When you sell your e-commerce business, inventory is usually an added cost for the buyer. This is done at product landed cost, which keeps it fair for both buyer and seller.

At Empire Flippers, we don’t take any commission on the cost of inventory, but it’s important to note that some business brokers do. What happens to inventory should always be a consideration when you’re doing your due diligence on which broker to sell with.

What are Pricing Windows?

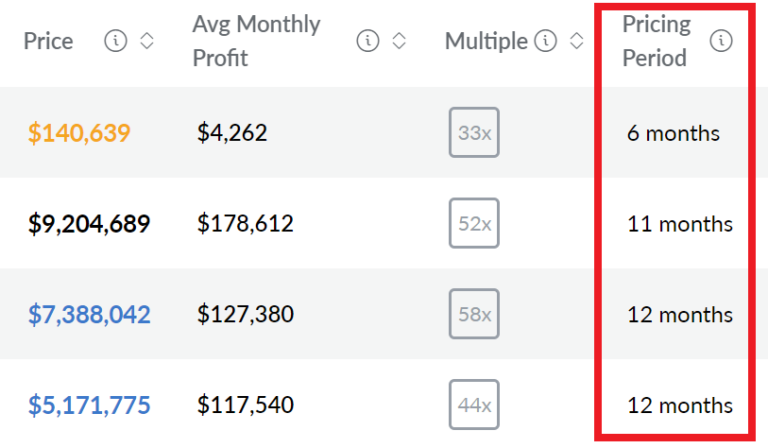

The first part of the valuation calculation, the 12-month average net profit, is what’s known as the pricing window.

The pricing window is the period over which your average net profit will be calculated. As far as the valuation is concerned, this determines the profitability of your store.

However, there are some key implications of using a window of fewer than 12 months. All of which we’ll go over next.

The 12-Month Window—The Gold Standard

A 12-month pricing window is seen as the gold standard because it makes your store attractive to the widest pool of buyers.

The longer window is seen as the most accurate representation of the business as a whole, rather than only capturing a sharp period of growth or decline.

While sharp growth can be a good thing, most buyers will want an asset that is stable. Taking a longer look at earning history allows any anomalous results to even out.

Because of this, the 12-month window will allow your business to receive a better valuation multiple than a shorter window.

Finding the balance between choosing the pricing window that maximizes your valuation and the one that provides the most accurate picture of your business is a skill.

While a seller might push for a shorter pricing window that generates a higher valuation, investors prefer a 12-month window. This trade-off is something that you will have to consider when it comes to valuing your e-commerce business.

The Six-Month Window—The “New Reality”

Even though a 12-month window is preferred by buyers, there are times when this won’t be applicable.

In a case where the first six months don’t represent the current state of the business, the pricing window can be shortened to better reflect the “new reality.” This is usually reserved for stores that are in a sharp period of growth or decline.

This can also be used for young businesses where it’s understood that during the first few months, the business was still getting off the ground. This is due to the fact that in the first few months, revenue grows considerably, and the current six months are a more accurate representation of where the business is now.

Because of the uncertainty of where a business’s earnings will level out, a six-month pricing window will result in a lower multiple. The buyer pool will be smaller for a business with a shorter pricing window, so the multiple has to be lower to take this into account.

The Three-Month Window—The Window that Shall Not Be Used

When valuing online businesses, a three-month window is almost never used.

This is for good reason, as it’s very difficult to get an accurate understanding of a business’s history using such a short window. There is hardly any interest from buyers for businesses valued in this window.

The only time a three-month window will be used is for very young businesses. These small businesses are five to eight months old and almost always end up in the $30–100K valuation range.

Most buyers won’t pay more than this for a business using the three-month window. If your business is six figures and above, it’s going to be very difficult to find a buyer.

This window will give you the worst valuation multiple possible. If you have an e-commerce store, it’s almost always better to wait until your business has a better pricing window.

What if My E-Commerce Business is Seasonal?

Almost all e-commerce businesses will have some sort of seasonality, especially around November and December.

However, if a business is highly seasonal, then a longer pricing window, usually 12 months, will be used to account for this.

This is why it doesn’t really pay to wait until the high season to value your e-commerce website. The longer pricing window will negate any great rise in potential valuation.

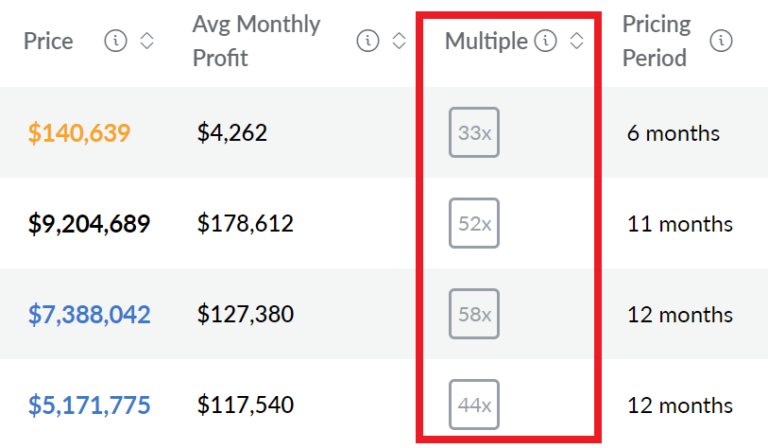

What Goes Into a Multiple?

Now that we’ve cleared up how the first part of the valuation formula works, it’s time for the second part—the multiple.

At Empire Flippers, we use a monthly multiple, whereas some brokers use an annual one. A monthly multiple typically falls between 30 and 50 but can be upwards of this.

Whichever one is used, what determines a multiple is often the main cause for confusion when people look at the valuation formula.

Almost all aspects of your e-commerce business will be considered when determining a multiple. This is why a valuation is about a lot more than just your profitability.

To help you understand what goes into e-commerce valuation multiples, we’ll list the main considerations when valuing an e-commerce business.

Having spoken to a lot of buyers, we’ll also be able to tell you what they’re looking for when buying an e-commerce store. Working on these factors will allow your e-commerce company to sell for maximum value.

Growth Trends

Whichever way your business is trending will be one of the first factors a buyer will analyze when assessing if it’s the right fit for them.

Upward growth is obviously more preferable than downward growth, and this will allow your store to receive a better multiple.

However, the level of growth is also a factor. While it’s exciting to see a business in a phase of hyper-growth, most buyers will prefer an e-commerce store that is sustainable. Rapid growth is less predictable and will leave many buyers questioning where it will level out.

A business that is scaling aggressively may also be scaling inefficiencies. Buyers will have to do their due diligence on what your methods of growth are.

Your store doesn’t have to be perfect, and there are some buyers that will look for assets that aren’t using processes or marketing channels effectively.

If there are issues, the buyer pool will be lower, which would mean you’ll get a lower multiple. But, this shouldn’t put you off selling your business, if that’s what you want.

There are even some buyers that will buy declining businesses. Although, this will greatly affect your ability to sell depending on the level of the decline. These businesses will always receive lower multiples due to having a smaller buyer pool.

Stability and Diversity of Earnings

We’ve talked about how buyers prefer your earnings to trend, so we don’t need to go into that here. However, where your income comes from will need to be analyzed.

Products that have staying power and don’t need to be updated regularly will be more appealing to buyers.

It’s also seen as a positive to be earning through multiple products. If you only have one product that’s driving the vast majority of revenue, your store will be seen as having one critical point of failure. What happens if more competition arises or demand waivers? This makes your business a riskier investment.

We recommend that you keep a P&L statement with a month-by-month breakdown of your earnings. It is also useful to include the number of units sold per product.

If you decide to sell with Empire Flippers, our vetting team will create your P&L for you.

Stability and Diversity of Traffic

In order for buyers and brokers to view your traffic data, it’s important to have an analytics platform installed on your e-commerce website. Google Analytics and Clicky are the two most widely accepted platforms.

Traffic stability will be analyzed in the same way as your earnings. Steady growth is preferred over most other forms.

If there are any sharp spikes or dips in traffic, then these should be investigated. A buyer will want to know what might have caused this.

The channels that are driving revenue will also be of keen interest. Most stores will use paid advertising to drive traffic, and this is perfectly fine. Ranking with organic traffic using search engine optimization (SEO) is seen as attractive by buyers.

Paid ads, however, constantly require money to be put in to get a return. SEO, on the other hand, requires little in the way of upkeep once it’s created.

This could be optimizing your product descriptions to rank organically or setting up a blog for your online store.

A few other things that buyers will want to know:

- Which countries are responsible for the traffic?

- The top few pages by the percentage of total traffic

- The bounce rate

This will help buyers understand what’s successful and what the opportunities are.

Customer Satisfaction

Background research will be done on your business to establish that there aren’t a bunch of unhappy customers. Sites like Trustpilot will be used by both a broker and potential buyers to discover what customers are saying about your business.

If you know there are negative reviews, it’s best to be open about them. Provide some insight as to why it happened as well as the steps you’ve taken to rectify the situation. Buyers appreciate transparency.

Another sign of customer satisfaction is your customer retention metrics. E-commerce platforms like Shopify will allow you to easily see metrics like the number of new customers versus repeat customers. The product return rate is another metric that shows customer satisfaction with your products.

A high return rate is a sure-fire way to get a lower valuation, as improvements are going to be made in order to make the business more sustainable.

Trademarks

Pretty self-explanatory, trademarks prove that your brand is established and protected. This helps to prevent copycat sellers, which is always a concern for successful e-commerce businesses.

Strength of the Supply Chain

The backbone of any e-commerce store is its supply chain.

How the products are manufactured and distributed to the customer’s doorstep is paramount to the success of your store.

To have the strongest possible supply chain, you should source at least two different manufacturers for your products, ideally from two different countries.

Doing so will position your business very well should any problems arise. This was evident more than ever with the restrictions that were imposed as a result of the global pandemic.

It’s also essential that you outsource fulfillment; otherwise, you’re making it incredibly difficult for yourself to find a buyer. Most e-commerce store owners will have a 3PL setup that takes stock of inventory in the relevant geo and will deliver it to customers for a small fee.

If you, as the seller, are handling inventory for any other reason than the occasional quality control check, then you need to start outsourcing.

Delivery time is also a key part of the supply chain, as consumers become increasingly used to fast delivery. Three to five business days have become the norm, so this should be something to bear in mind when sourcing fulfillment solutions.

Try to get any deals you have with manufacturers and fulfillment providers in writing. Buyers will want to know that these deals are transferable should someone else take over. If you’ve negotiated better rates, then a contract can be an asset to your business.

Owner Involvement

The truth of the matter is that buyers don’t want to be spending thousands of dollars to work a full-time job.

You’ve built your store from the ground up, so it can be hard to trust other people to run it for you. However, a high level of owner involvement is going to reduce the number of prospective buyers.

Around five to ten hours a week is perfectly acceptable, any higher than that, and it will start to affect your multiple.

There are many tasks within an e-commerce store that can be outsourced. Order fulfillment and customer service are two easy ones that could be outsourced to freelancers. It’s not always necessary to hire full-time employees.

Consider setting up standard operating procedures (SOPs) to make it easier to outsource tasks. SOPs are also useful to hand over as part of a sale to help buyers better understand operations.

Before selling your e-commerce business, speak to any freelancers you have and make sure they would be okay working with a new business owner. Transferring a team makes the buyer’s life a lot easier, and therefore, makes your business more attractive.

Business Age

The age of your business will have an impact on the multiple you receive.

A business that has less than a year of profitability will be considered young. There just isn’t enough data to definitively say that the business has market staying power.

Businesses over two years old will have likely found their footing in the market. This is where more buyers will start to take note. Businesses with three years of profitability and above will have proved their worth and can be given a higher multiple.

Email List and Social Media

An email list can effectively be described as a traffic source on its own. This is because you own the list completely, and you’re not at the mercy of Google algorithm updates or increases in ad pricing.

This is what makes email lists a valuable asset to own. It’s not uncommon for an e-commerce store to be driving a quarter of its revenue from having an email list. The key components of an email list are not just the number of subscribers but also whether the list is monetized.

If you have an email with several successful campaigns, such as abandoned carts, holiday offers, new product launches, etc., then this will raise the multiple you’ll receive.

A following on social media is also seen as a nice bonus, as it helps show that you’ve built a brand. Consumers like to buy from people they know and trust.

When valuing an e-commerce website, we’ll take into account email lists and social following. However, most buyers see these things as an added touch and not a necessity.

It’s understood that building both of these things takes time. It shouldn’t be a huge factor in deciding whether you’re ready to sell yet, as it won’t affect your chances of a sale as much as some of the other factors we’ve talked about.

Tracking Real Life Multiples from Our Marketplace

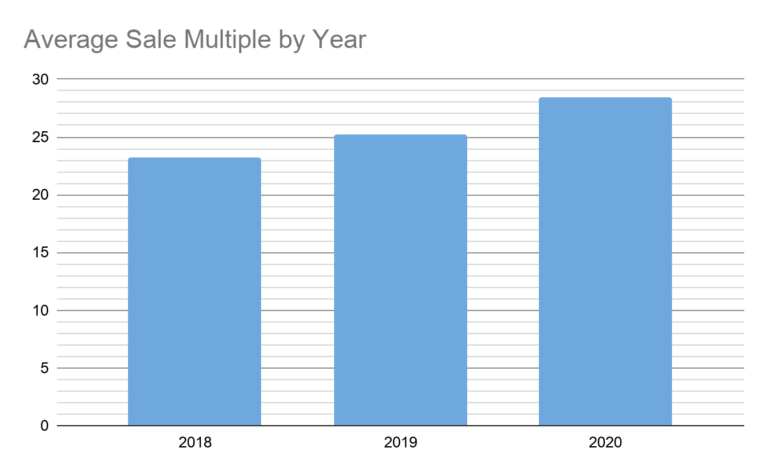

We sold 114 e-commerce businesses throughout 2020. This is up 10% from last year and 24% from 2018.

These figures include Amazon FBA and dropshipping businesses, as it’s common to see these three monetizations mixed.

Whether your e-commerce business earns from multiple monetizations shouldn’t deter you from selling; in fact, some buyers might prefer this.

Taking a look at the way the multiples are trending makes for interesting reading for sellers. In 2020, the average sale multiple was 28.4, which is an increase from 25.2 in 2019.

We predict that there is likely to be at least some leveling off when compared to explosive growth over the past few years.

However, we are seeing more and more high-net-worth buyers and institutional investors join our marketplace looking to acquire e-commerce businesses. Due to this increased competition, multiples and sales prices are being driven up.

The bottom line is that now, more than ever, is an exciting time to sell an e-commerce business.

Not All Automated Calculators Are Built Equally

You may have heard some people within the industry say that automated calculators are useless when valuing e-commerce stores.

If you’ve ever used one of those “What’s my website worth?” style calculators, then you might be inclined to agree. This type of automated calculator typically only asks for your domain name and scrapes site data from places like Alexa and Google Keyword Planner.

The results will be pretty funny in how wrong they are. This is because they fail to understand that you’re selling physical products and not advertising space. What this means is that these types of calculators simply aren’t fit for e-commerce business valuations.

That’s not to say all automated calculators are useless for e-commerce.

Valuation tools can give you a good estimate of the value of your business if the time has been taken to develop a tool that is built using real sales data and if it responds to your specific data inputs.

This is how we created our valuation tool, which responds to the data points we’ve talked about in this article, such as business age, average monthly revenue and profit, number of products, and social following.

There is, of course, no substitute for a professional valuation that takes a look into all aspects of your business. However, we’ve found our valuation tool provides a great estimate as to what you could receive.

Once you’ve filled out our valuation tool, you can connect with someone on our vetting team who would be happy to value your business personally.

A High Business Valuation is Meaningless Unless…

Throughout this article, we’ve tried to get you thinking about not just how much your e-commerce business is worth, but also how attractive an asset it is.

The truth of the matter is that increasing the valuation doesn’t mean you’re increasing your ability to sell. A high valuation is pointless if no one thinks the business looks good.

Entrepreneurs tend to get caught up in valuation while not understanding what the buyers are actually looking for. Or worse, they start to cut necessary operating costs at the time of sale to get a better valuation.

We’ve seen sellers cancel software subscriptions and get rid of team members to inflate profit. This is a big negative and will put investors off buying your e-commerce business.

Buyers don’t want to spend thousands of dollars to get another day job. They want an investment that can be run hands-off.

Entrepreneurs should try to focus on this concept more, and if they do, they’ll have a better experience selling their business.

An attractive business is more likely to fetch a premium valuation multiple, sell far quicker, have easier negotiations, and create the largest possible buyer pool for what you’ve built.

The Most Common Mistakes When Valuing an E-Commerce Business

You should already have a much better understanding of valuation than most people if you’ve made it this far.

But, there are two traps that even the most experienced e-commerce owners fall into when valuing their business.

Comparing Yourself to Other E-Commerce Businesses

Looking at our marketplace, you might think you can work out your business’s valuation by matching up businesses with similar earnings.

If X business sold for this, I’m worth the same, right? Unfortunately, it doesn’t work like this.

There’s too much that goes into valuing an online business for it to be as simple as that. Save yourself the confusion and get an expert valuation.

Too Much Focus on Potential

Buyers on the open market buy on hard data, not potential.

Potential is way too hard to quantify, and when you’re spending thousands, maybe millions, of dollars on a business, the decision needs to be backed up with data.

The data we’re talking about refers to revenue, profit, traffic, etc. We’re not saying that potential doesn’t come into it.

Buyers will look for the potential of a business to see how they can grow it, but this potential is usually backed up by the data. Quantifiable data can be forecasted to show potential.

Therefore, potential doesn’t come into valuation too much. If you get your valuation and you find yourself questioning why your potential hasn’t been accounted for, it’s usually best to go away and implement it before selling.

When Should You Sell Your E-commerce Business?

As far as the market is concerned, there’s no one time of year that’s better than another.

This is because the market stays active all year round. What’s more important is that you find a time that best suits you and your business. For most people, the biggest factor in deciding if they’re ready to sell is how much their business is worth.

Keep a figure in mind of what you’d be happy to receive and get regular valuations while working on your business.

Although, having gotten to know many of the entrepreneurs that sell with us over the years, there are a few common reasons why we see entrepreneurs decide to sell their e-commerce business.

Personal Reasons

The first of these is for personal reasons. Maybe there is something going on in your personal life that means you don’t have the time or mindset to dedicate to running your business.

The good side to this is that there is a very active market for e-commerce businesses. It’s easy to list your business for sale using a broker, and they should take care of the heavy lifting for you.

To Receive a Lump Sum of Capital

Another enticing reason is to get a lump sum of capital that’s typically anywhere from three to four times your average annual net profit.

You can use this as you wish; it could be to self-finance other business ventures or to sip cocktails by the beach.

It also has to be understood that online business can be volatile. There’s no guarantee that they’ll remain successful forever. This is why some entrepreneurs prefer a big chunk of cash in hand rather than constantly maintaining their business.

Needing a New Challenge

It’s common for entrepreneurs to have multiple projects on the go. Selling a business allows your focus to become more streamlined.

Alternatively, it might be that you’ve just become fatigued from working on one business for so long. While e-commerce sites can be run with a few hours of work a week, if you don’t put in the effort they need, then it will eventually lead to a drop-off in performance.

If you’re starting to lose the passion for your business, then it’s probably best to cash in while you can.

How Exit Planning Will Maximize Your Valuation

Exit planning is the best way to maximize the price you’ll get for selling your e-commerce business.

An exit plan is a strategy that focuses on making your business as attractive as possible leading up to a sale. This can help your business to become more profitable and receive a better valuation multiple.

Whatever stage of your business you’re in, you should always have selling in the back of your mind. Now that you have a better understanding of how a valuation is determined for an e-commerce business, take a few minutes to fill out our valuation tool and find out what your business is worth.

If you’ve already done that and you’ve seen a number you like, you can list your e-commerce business for sale with Empire Flippers, the largest curated marketplace for online businesses.

To find out more information about our sales process, you can set up a call with one of our business advisors. They’ll also be able to give you free exit planning advice tailored to your specific business.

Even if you’re not ready to sell just yet, creating a 12, 6, or 1-month exit plan can make a big difference when it comes time to sell.

Discussion

As always, a great overview in this article – but I feel like there’s a missing component in the market here. This has been the topic of discussion in a few other investor groups – so I’d like to get a view in the context of this article.

“Growth investments” essentially eat profits.

In the context of a content website which publishes content – the content purchases are see as “one off expenses” and thus are removed from the monthly operating costs (unless of course, the content is very transient and not evergreen).

The parallel or analogy for an eCommerce business is the acquisition of returning customers.

eCommerce businesses invest in the growth of their customer base, onboarding new customers with the aspiration of getting them to return over the next 12-48 months and beyond (much like when investing in content, you’re hoping that content will yield traffic over a similar period).

As an eCommerce business investing in customer acquisition, if the cost of customer acquisition is factored into the operating expenses, and therefore monthly operating profit – assuming you’re reinvesting all profit to grow the business – the business will be worth $0.00 x multiple = $0.00

When in reality, the eCommerce business could have acquired customers to a level where if they were to stop investing in growth altogether, the monthly profit could be say $50,000+ yielding a valuation of $2,000,000+

It’s REALLY easy to see the customer acquisition routes within an eCommerce business

Paid advertising can be split down by targeting of “cold leads” vs remarketing to existing customers – so you can see how much money is being spent on new customer acquisition vs the operating cost of bringing existing customers back to the store.

You can also see how much traffic is coming through organically from Google et al – that being a sustainable, lower cost form of traffic that pays off over a longer period of time.

Further to that, you can see the size of the buyer list (not to be confused with just an email list) – and the number of customers who repeatedly purchase on a monthly / quarterly / yearly basis.

So it’s relatively easy to establish:

“operating expense” of engaging and marketing to existing customers (typically the lowest cost and highest ROAS)

vs

“growth costs” of acquiring new customers (typically the highest cost and lowest ROAS)

Without this clarity, an eCommerce business owner is driven in the wrong direction with regard to business growth – as the pursuit of profits is in direct opposition to the pursuit of business valuation and asset growth.

What’s your advice on reconciling this and making the growth of an eCommerce business AS AN ASSET aligned with a growth in valuation?

Would really like to hear Justin and Greg’s input on this one – as I think it’s a significant issue we’re seeing not only within our own business, but the market as a whole – especially with the surge in eCommerce demand.

Cheers

Ash