How to Value a Digital Product Business

If you’re curious about how much a digital product business is worth, you’ve come to the right place.

Digital product businesses are often a great opportunity for aspiring online entrepreneurs, and with good reason. The startup time for this model might take a bit longer than an affiliate or Amazon Associates business, but it also offers a great scaling opportunity once that initial product launch uncovers what improvements can grow the net profits further.

When compared to an eCommerce or Amazon FBA business model with inventory and storage fees, digital product businesses offer much higher margins, as these types of fees are not applicable. Other than creating the product itself, your time or the expense involved in outsourcing the development of the product you plan on selling is usually the biggest startup investment required.

These digital products might be the latest search engine optimization (SEO) plugin for WordPress or a complete hosting service with optional paid upgrades. Investors enjoy the simplicity of these digital product monetizations due to the opportunity to capitalize on a huge exit in any market conditions. They can also offer a great opportunity in producing a passive income stream if optimized to their full potential using freelancers and other outsourced help.

Before we dive into how we determine the value of a digital product asset compared to similar models we’ve sold on our marketplace in the past, we should first discuss the different types of digital product businesses that are on the market.

Examples of Digital Product Businesses

With so many options to choose from when it comes to selling digital products online, it might be difficult to determine what a digital product business is.

Digital products come in all shapes and sizes, from diet guides to WordPress plugins. There are hundreds of successful businesses capitalizing on the digital product marketplace. Here are a few that showcase what digital products look like in digital property form.

ThemeForest

ThemeForest, which is a branch of the Envato marketplace, offers 1,000s of WordPress themes and website templates for marketers and web designers all in one place.

The Envato marketplace has been around for quite some time now, and shows what a great digital product business looks like while diversifying its product line. Expanding into offering various audio, image, graphic, and other files outside WordPress and website templates meant that this business scaled with what users were looking for most.

A few other digital products sold online outside the WordPress marketplace include various image and vector design graphics, which leads us to another great company within this digital product business model.

Pngtree

This is a well-organized marketplace where users can download graphic and photoshop stock photos, PNGs (as the brand’s title suggests), infographics, and an assortment of backgrounds, templates, and low-cost digital files.

This is a great example of a digital product business with huge scaling potential, as most of the designs have come from other users. This public platform allows designers the option to pay a small fee to showcase their work and sell their own digital product designs on the Pngtree marketplace.

If you are able to take what this company has done and sculpt it into a business model within a growing niche, offering a digital product marketplace can be a great opportunity for those looking to manage this type of business.

The Pros of the Digital Product Business Model

There are a ton of benefits to this model for interested business owners looking to sell the best digital products within their niche. What many returning buyers have told us is that the great profit margins these assets offer keeps them coming back and looking for more.

This is to be expected when you consider the lack of fees associated with the delivery of the digital product to the end-user: there are none of the fees associated with shipping physical products, such as taxes and duty fees.

Without the worry of dealing with logistics and shipping (since the customer will often download the product or gain access to a library of products they have already purchased), you won’t experience the headache of dealing with physical product management.

When you buy a quality digital product business that solves the end-user’s problem with fast, affordable solutions, you are skipping the uncertainty felt by many during the beginning stages within this specific business model. Yes, there are plenty of benefits to this model, but there are a few drawbacks as well.

The Cons of the Digital Product Business Model

While great profit margins are a huge part of what makes this business model so lucrative for digital property investors, there are common operational protocols that you should understand.

As refund rates are often higher than physical product returns, you should have your refund policy sorted by the time you start scaling your asset. Having inexplicable spikes in returns will not help increase your valuation should you decide to exit when a larger than average return rate occurs.

This is where having an excellent customer service team, frequently asked questions (FAQs) page, troubleshooting and support pages, and any type of community forum helps in resolving issues before they become unrepairable. Having video tutorials and video courses is also a great way to alleviate the issues your customers might have navigating your platform.

When it comes down to it, people buy digital products because they are affordable, fast, and solve a very specific problem. Bundle similar products, like one of the marketplaces mentioned earlier, and you have some great scaling potential.

What to Know Before Buying a Digital Product Business

To begin with, it is important to remember that every buyer on our marketplace must perform their own due diligence on any asset that comes to our marketplace. While our vetting team does an amazing job in reviewing the financials and making sure that the numbers are what the seller claims them to be, it is still up to the buyer to perform due diligence on the asset to ensure that it aligns with their business goals.

You want to make sure that the business is in a growing niche offering plenty of opportunities to expand or grow into offering other high-quality products as the business scales over time. Will you be producing the online course or creating new digital product ideas and content? Have a step-by-step plan on who will be producing your digital goods and new content before you make any serious considerations.

A buyer should be somewhat familiar with the niche so that they have a more in-depth understanding of the market trends and their potential customer’s needs. For example: offering meal plans and a digital download template could be a great opportunity on which to build a business model, but think of all the lost potential should you not be familiar with planning your own meals to begin with.

Since the product’s solution is what drives the revenue for this business model, having an understanding of why and how this solution fits your customers’ needs is something that can only benefit your future development. Digital products often receive huge spikes in sales right after a product launch in part to increased email marketing, social media promotions, and increased google ad spend which will usually taper off soon afterward. Check what the business profits are during the “slow time” between product launches, and that way you can gain a better understanding of what the actual profits look like on a regular basis.

How to Sell Your Digital Product Business

Let’s start from the beginning.

If you’re looking to sell your digital product business, you should first have solid financial proof and all proof of earnings and traffic metrics organized and accessible. In addition to this, you will need to gather your average refund rates from all your products, as some buyers would like to know this information from the very start.

Be sure to have your Lifetime Value of a customer (LTV) and Cost Per Acquired Customer (CPA) numbers available as well. LTV can be a strong indicator of whether your customers are purchasing a product only one time, or are purchasing new products repeatedly. Another metric many investors are interested in for digital product assets is CPA, the total cost to acquire each new customer which can offer great potential should this number be low.

Before you begin gathering your analytics and important documentation for potential investors to review, you should already have systems in place to make the migration of the asset as smooth as possible. The more you can automate on the backend of your business model, the more desirable your asset becomes to all the potential buyers searching our marketplace for digital product businesses.

Offering training support after the sale can help speed up the sales process, as the buyer knows that some type of walk-through is being offered to ease the transition.

How Do We Value Digital Product Businesses?

Now that you have a better understanding of which metrics buyers are most interested in knowing before they start their due diligence on any asset, we should cover how to determine the value of these monetizations.

As the largest curated marketplace for online businesses with the most deal flow in the industry, we have the data and experience to give every customer the best possible valuation for their business. Depending on the seller’s needs, we offer two types of valuations after determining what your digital product business is worth compared to other similar sites we’ve sold in the past.

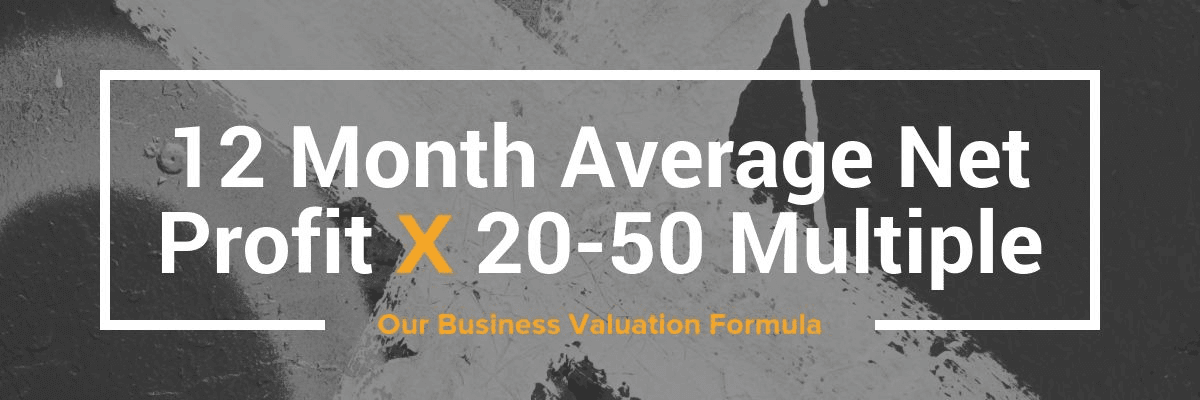

Using the figure below, you can determine a ballpark estimate of how much your digital product business is worth:

A more detailed formula we use is:

sales price = monthly net profit X multiple + discounted assets (if any) + wholesale inventory (if any).

Net monthly profit is usually determined by looking at the average of 3 to 12 months of revenue, subtracting any costs (COGS, marketing/advertising, hosting, virtual assistants, content, etc.) and dividing by three. In some instances where the business is seasonal or has been around for a long time, we’ll use a 12-month average instead to reflect seasonality, which is clearly mentioned in each listing. The greater the number of months we can use to calculate the average, the larger the multiple will usually be (along with other proprietary factors we take into account).

To determine the best possible valuation for any digital property submitted to our marketplace, we first give a typical valuation multiple. This multiple is backed by hard sales data and offers the seller the best possible multiple / valuation that offers the shortest acquisition time.

We also give an absolute valuation of the business. This is more theoretical and offers the seller the option to list at a higher than typical range if they wish to hold out for a bigger offer, or lower than the typical range for a seller wanting to make a quick sale.

This can be explained in more detail by one of our business analysts when you submit your business, but for now, all you need to know is that we give you a valuation range depending on your exit goals.

A few more factors that we take into consideration when determining what your listing multiple will include: how long your business has been around, the amount of new and existing traffic you receive, your LTV and CPA numbers, how large your email list is, the margins for your most profitable digital products, any graphic designs, downloadable and printable assets included with the deal, among others.

If you don’t already have a digital product business and are looking for a way to fast-track your move into owning one of these great models, consider purchasing an already established business. When you skip the startup time required to get this model up and running, you can focus on more important benchmarks like transitioning into a membership site from an online store, scaling, or general marketing growth.

If you’d like to learn more about how an online business is valued, check out our free Youtube video on how valuations work below:

Growth Strategies from Real Buyers on Our Marketplace

Having built the largest curated marketplace for online acquisitions, we’ve gathered a great amount of data from both buyers and sellers we’ve had the pleasure of working with over the years.

As you may have noticed in our latest return on investment (ROI) study for the lesser-known monetizations, a few buyers had given us some great feedback on the opportunities these types of business models offer. These digital product buyers told us about some of the key improvements that helped them gain a positive ROI from their acquisition, including:

- Adding new products

- On-site improvements (like SEO and CRO)

- Optimized PPC ad campaigns

- Adding additional monetizations

Expanding into other marketplaces and reaching a larger audience using other digital marketing platforms was something a few buyers also mentioned as a growth strategy in the coming years. This is important to mention, as again, the more diversified you are with your revenue streams, the better off you will be in terms of avoiding any unforeseen risks. Building a Facebook group community, starting podcasts, and blogging often was something buyers have also told us helped them to expedite their marketing growth strategy.

After you have grown your digital product business to what you believe is its full potential, make sure you’re not missing out on your own low hanging fruits before listing your business for sale. Giving the key improvements mentioned above a once-over in your own business structure might give you a more profitable exit without much effort needed when properly planned and executed.

What Is the Future of Selling Digital Products?

There is plenty of information out there on how to sell digital products, but not much outside what you will find here on our blog on the subject of turning this opportunity into a viable business model.

To be honest with you, this monetization might be easy to develop and launch from a beginner / intermediate standpoint; however, maintaining a consistent revenue-generating digital product is not as easy as one might think.

This is why the option of acquiring an established revenue-generating business is perfect for those looking to skip the beginning process and jump into scaling something already in motion.

Are you interested in acquiring a digital product business of your own? Check out our marketplace listings to find the one that matches your business goals.

If you have been optimizing a digital product business like the ones mentioned in this article and are looking for that big exit, submit your site to receive a more custom valuation tailored to your exit planning goals.