Free Financial Templates that Keep You on Track

When you’re a business owner, there’s nothing worse than feeling disorganized. It’s vital to keep track of every dollar spent and every dollar earned, even if some things feel miniscule in the grand scheme of the business.

Larger businesses and corporations have an entire accounting team that keeps track of all the numbers. If you run a startup or an online business, you might have a pretty lean team — or maybe you’re the accounting department, in addition to being the CEO, and the sales department, and the marketing department, and so on …

But even if you don’t have an accountant, keeping track of financial records is still an important thing to do for yourself as the owner of a business.

Pristine financial records can make your online business even more appealing when you’re getting ready to sell. While it’s important to budget ahead of time, your financial records should reflect all of the activity over the past month, quarter, or year (or all of the above!).

If you’re a publicly traded company, you’ll have to provide these records to the government in the form of balance sheets, cash flow statements, and profit and loss (P&L) statements. Balance sheets help you organize your business’s assets, shareholder equity, and liabilities, and the U.S. Securities and Exchange Commission (SEC) will request at least two years’ worth of balance sheet information. Cash flow statements are also required by the SEC on a quarterly basis. These statements reflect the cash inflow from investments and ongoing operations, as well as the outflow of money due to business activities.

Even if you’re a private company and you aren’t required to report it, it’s good to have a P&L statement, also known as an income statement, completed and ready to review. A P&L statement includes non-cash items, unlike cash flow statements, which show only the incoming and outgoing cash, and it also shows how the assets listed on a balance sheet are actually used.

Having a P&L statement will make your business more attractive to buyers, since buyers can use the P&L to see the trend of the business after purchasing it. When you can communicate the health of your business in a clear and succinct way, with numbers in the right columns and calculations completed using accurate formulas, then potential buyers will trust the transaction taking place (and you!).

Keeping track of your financial records doesn’t have to be a laborious, painstaking effort. If you start keeping track early on, you’ll find it much easier to calculate important pieces of financial information — and there are even free templates to help.

Balance sheets and cash flow statements are definitely important documents to consider, since they’ll help you keep track of your money on a regular basis and remind you of your assets and liabilities. But since P&L statements encompass both of these aspects, I’ll be focusing primarily on why these statements are important to generate. Whether you’re privately or publicly owned, a big business or a small-scale operation, every online business should have a P&L statement when preparing to sell their business.

Why Does a P&L Statement Matter So Much?

P&L statements are also referred to as income statements — if you’re keeping good financial records, they aren’t too difficult to put together, especially for the businesses sold here on Empire Flippers.

P&Ls provide a snapshot of what you’ve earned and what you’ve spent over a period of time in a very detailed way, showing the measure of your business’s performance:

- Revenue: the first item you need, as everything is subtracted from this number. It’s basically the value of a company’s sales, or the amount of money received over a certain period of time; the “top line.”

- Expenses: the outflow of money, or economic costs accrued through operations (broken down into smaller categories below).

- Cost of goods sold: the expenses incurred during the production of goods, depreciation expenses, and purchase cost of merchandise.

- Operating expenses, including general and administrative: the overhead daily expenses that a business incurs, such as payroll, rent, equipment, inventory costs, marketing, and insurance.

- Tax expense: liabilities owed to the government.

- Operating profit and interest expenses: profit earned from core business operations, as well as the cost of what a company is borrowing.

- Net income: the “bottom line,” also known as your profits or earnings.

By breaking down each and every expense and each type of income, you can see where your business is and where it’s going in terms of profitability and growth. This type of statement also helps you calculate a key piece of financial information: your net income.

A P&L statement is also used to calculate your gross profit margin, operating profit margin, net profit margin, and operating ratio — even more pieces of information that together can provide a bigger picture of your business.

Especially if you’re managing all aspects of your business (you go-getter, you!), it’s easy to lose track of some of these items, which is why it could be beneficial for you to compile a P&L quarterly. And as mentioned before, if you’re looking to buy someone else’s business, these statements can let you compare and analyze the differences between different quarters and years, helping you determine if the business is worth investing in or not.

In addition to a balance sheet and a cash flow statement, if you’re a publicly owned company, a P&L is issued to the public once a quarter and once a year. It’s also a document that banks will request to see before they decide to lend money to a business.

On a business level, too, a P&L can also be used as a tool to identify places to eliminate expenses or boost your income. Once you see exactly where each dollar is spent, you can figure out whether it’s something that’s significant to running the business, or if you can cut out an expense to make room to develop a new product or service.

While P&L statements can be pretty simple to compile, you can always use QuickBooks for more complex situations — however, it does cost a fee of $15 to $50 per month, depending on the size of your business.

It might sound a little daunting to make this type of statement, but it’s incredibly valuable. Identifying trends in this way will also help you feel prepared for the upcoming year.

Don’t Forget Your Add Backs

While you’re in the middle of gathering all the essential pieces of information for your P&L statement, there’s one more expense that you’ll need to find: your add backs.

An add back is where you add certain expenses back into the profits of your business, with the purpose of improving your business’s profits. Adding certain items back will help a potential buyer understand the actual costs of your business, and it also adds more value to your business.

As long as the expenses weren’t technically needed expenses, it’s totally legitimate to add these back. These expenses are typically extraneous, one-time, or at the owner’s expense. Typically, these items are removed in order to lower the amount of income and reduce tax liability. But by adding them back in, you can adjust your net income to reflect higher earnings.

Some examples of add backs that you may have as an online business have to do with adjustments to your compensation, having family members on the payroll, or being part of a health or country club. Maybe you took a “business trip” to Hawaii or something along those lines that wasn’t really a requirement of the business to keep running — this could potentially be an item to write off.

Add backs might be easy to forget about, but keeping track of these expenses throughout the year will make it much easier once you reach the step of preparing the revenue side of your financial records.

Free Resources for Tracking Finances

Getting organized isn’t easy — at first. It’s all about creating a habit of organization and maintaining that habit. And if you find yourself grumbling about keeping track of all this information, just remember how a P&L statement can be used to convince someone to buy your business down the line.

Once you make the decision to start tracking your finances, there are plenty of templates out there that you can use to keep all your information in one place. You can even keep track of different aspects of your business, such as budgeting your money, using several of these templates.

Here’s a list of easy-to-navigate templates that can help you get on track with your business’s finances — and they’re free.

Smartsheet’s Business Budget Templates

With templates that work for many different types of companies, Smartsheet helps you compile your business budget in order to keep your finances under control by focusing on your budget for goods and services. While this isn’t precisely a P&L statement yet, it helps you gather all your sources of income and all of your expenses (and you can use a lot of this information for a cash-flow statement as well).

Their business budget worksheets help you figure out your company’s spending (and where you can cut it), along with tracking revenue, expenses, and cash flow, which leads you to setting and achieving profit goals.

Their website is very explanatory, stepping you through the process of how and why it’s important to create a budget for your business.

If you’re looking for a wider variety of templates, they’ve also got a 12-Month Business Budget Template that breaks down items even more, allowing you to track month-to-month expenses and cash flow. Their 5-year Template is especially useful for start-ups looking to project into the future, but they’ve also got a Start-up Budget Template that takes the unique needs of start-ups into account!

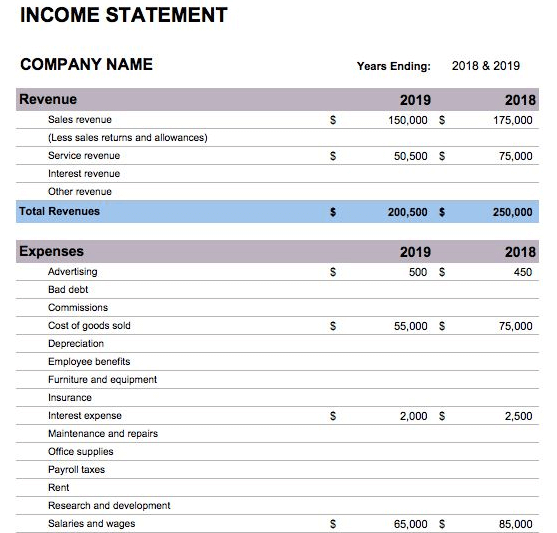

Smartsheet’s Accounting Templates

In addition to helpful business budget templates, this specific template helps you generate your P&L statement. This template uses similar information as the information for Smartsheet’s budget templates, except with even more details.

They offer free templates for income statements, balance statements, and cash flow statements. The income statement template is designed to compare your year-end numbers, while the balance sheet template represents the financial status of the business based on assets, liabilities, and equity. The cash flow template will let you see the incoming and outgoing cash, the flow of cash over three years, and a 12-month statement.

Microsoft Office Excel Template

Excel provides a free P&L Statement Template where you can plug in your revenue and expenses. There aren’t as many items on the list, as this one is geared more for smaller businesses or entrepreneurs with fewer avenues of revenue and less expenses.

If you’re already an Excel junkie, you’ll love the simplistic layout of Excel’s template, along with the graphs it calculates for you. On the left side are the various pieces of information you’ll need to provide, and it asks for the numbers from each month. If you don’t want to plug in the numbers for each month, you can change the template to quarterly!

The line graph at the top of the chart compares the Gross Profit with the Total Operation Expenses, giving you a quick overview of how each one is doing before you dive into the numbers.

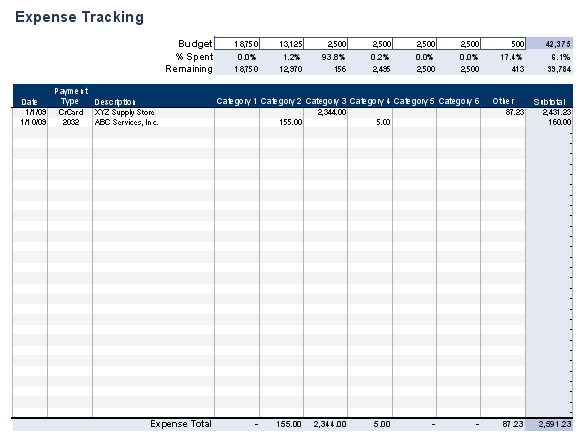

Vertex42’s Expense Tracking Sheet

While this one doesn’t generate a P&L statement immediately, it helps you gather the information that you’ll need to create one. For an extra-simple way to get started with tracking your expenses and profits, try Vertex42’s Expense Tracking sheet — made for Excel as well, this expense tracking sheet was made to work for any occasion. You can personalize it to fit your business however you’d like, so if you have categories for specialized types of expenses, you can customize those easily.

The difference between this sheet and the P&L statements is that the Expense Tracking sheet has a place for you to plug in your budget, and it doesn’t calculate your net income or profit (although it isn’t difficult to figure out your profit after seeing the expense breakdown). It shows you how much of your budget has already been spent and the remaining balance of each budget. The expenses are broken down in a line-item fashion, by date, so this template works great if you’re a very detail-oriented person.

If you want to develop a P&L statement for your business as well, this sheet pairs really well with …

Vertex42’s Income Statement Template

Paired with their other budget templates, this Income Statement template is particularly useful if you’re an online retailer or a small, service-oriented business. They provide two templates depending on the format you prefer for your P&L statement: a “single-step” income statement and a “multi-step” income statement.

Both templates calculate the year-end net income, rather than by month or by quarter. The “single-step” is definitely more simplified, with items divided into Revenue, Expenses, and Below-the-Line items (unusual expenses that you don’t expect to occur again). The “multi-step” breaks things down into Revenue, Cost of Goods Sold, Expenses, and Below-the-Line items, but it also calculates the Gross Profit and asks for the Operating Income (which are not on the “single-step” template).

Depending on the type of business you own, you can customize the revenue section to reflect where your revenue comes from (sales, service, interest, or other).

Stay Organized from the Beginning

Just like when you’ve moved into a new house, or you’re setting up shop at a new office space, it’s important to be organized with your financial records from the beginning. Otherwise, you’ll find yourself tearing through desk drawers (or maybe online folders), yelling, “Where is that receipt?! I know we have it somewhere!”

Don’t be like that.

If you keep track of your numbers, a P&L statement will be simple to generate, whether you want to create one each month, each quarter, or each year — and you’ll have all the critical information you need to sell your business. Once you’re preparing to sell your business, you must have your financial records in order — no ifs, ands, or buts.

Use a template that keeps the information organized the way you like it, depending on the system that works best for you, and update it as often as possible. Maybe it’s once a month, or maybe it’s once a week — schedule a block of time to input those numbers on a regular basis, and you’ll feel so much more relieved when a potential buyer asks to see the numbers behind your net income. So download that template and start inputting those numbers today!

Photo credit: .shock