Planning Your Business Exit Strategy: A Complete Guide

Many entrepreneurs don’t think about planning to exit their business until a significant change occurs in their personal life or market conditions require them to close or sell the business.

Planning your exit strategy gives you options when that time comes.

You’ll be able to present your business to the market with an accurate valuation, carefully review offers from multiple buyers, and earn the highest possible sale price.

What is An Exit Strategy?

A business exit strategy is a plan for a business owner to leave or sell their business. It acts as a guide for the entrepreneur to transfer ownership of their business to an investor or a larger company.

Many entrepreneurs want to sell their business when they’ve met their profit objective and want to move on to another business venture.

An exit strategy can also be a contingency plan for investors, traders, business owners, or venture capitalists to limit their losses in a financial asset through liquidation; it acts as a safety net to keep all parties protected in the event of an unprofitable investment.

Why Do I Need An Exit Strategy?

Exit strategies also allow investors to earn a return on their investment (ROI) into a business when it is sold for a profit.

For business owners, having an exit strategy in place allows them to sell for a substantial profit when they face a big change in their business or personal life.

It’s also a great asset to have when trying to secure funding. It allows angel investors or venture capitalists to protect their finances when they invest in your business.

With a plan for selling your business, you are able to earn a higher price than you would without a plan; the process of creating an exit strategy involves optimizing your business in all areas and as a result, you make your business more efficient and profitable.

An exit strategy can be used for a business of any size, from a small $10,000 content site to a nine-figure company. The size of your business is a big determinant of which strategy you use.

Other determinants include:

- Which party you are, i.e. investor, business owner, trader, or venture capitalist

- Reason for exit

- How involved you want to be in the business after the sale

- Your financial needs

6 Common Types of Exit Strategies

1. Merger

In a merger, your business gets acquired by a bigger business. You’ll remain with the company as an owner or manager of the new business.

Pros: With a big entity fueling growth, your business can scale to its fullest potential by taking advantage of economies of scale.You are able to be involved with the growth of your business.

Cons: Not suitable if you want to cut ties from your business. You are open to experiencing any downsides to the business valuation.

2. Acquisition

With an acquisition you sell 100% ownership of your business to an investor or company. You will migrate your business to the new owner in exchange for a purchase price in line with your business’ value.

Pros: You earn a large payout and become fully removed from your business. It’s an opportunity for your business to reach its full potential with a new owner with large capital and resources.

Cons: You relinquish control of your business.

3. Sell to Someone You Know

Selling to a friend, or a family member if you run a family business, makes sense if they have been working on the business with you as they are able to achieve the business goals and continue the legacy you have built. You could continue to be involved in the business after the sale or opt for a full acquisition.

Pros: Allows you to continue the legacy of your business. If the new owner has been working in the business, they will have a high chance of being successful with it. You can remain close to the business, for example in a consulting capacity.

Cons: Business transactions can potentially fracture relationships. You also never fully disconnect from the business.

4. Sell Your Shares to Your Partner

If you’re a part-owner of your business you can sell your shares to your partner.

Pros: Can be a quick and easy way to exit your business if the proper ownership contracts are already in place. You sell to a trusted party.

Cons: You might not earn as much as you could if you sold 100% of the business to an investor or venture capitalist.

5. Initial Public Offering (IPO)

An IPO, also known as “going public”, is when a private company sells its shares to the public. You can give up a portion or all of your control over the company through an IPO.

Pros: Gives you the opportunity to secure a significant amount of funds if your business does well on the market.

Cons: You will have to answer to stockholders. This is not an option for most business owners as your business has to be fairly large and established and meet particular requirements to be eligible for IPO. It’s an intensive process to go through.

6. Liquidation

Liquidation is where you sell off all of your business assets and pay off investors and creditors. Business owners use this exit strategy when their business is no longer profitable and they need to cash out what they can to pay off debts.

Pros: It’s an option to pay off debts when your business is failing.

Cons: You lose your business and its brand legacy with little to no payout. Your relationships with employees, partners, and customers could end with the closing of your business.

How to Prepare the Best Exit Strategy

An exit strategy should be something you’re preparing regardless if you want to sell your business or not. The process of preparing your business for sale helps you get your business in order, make it more profitable, and plan for its future growth.

If you do decide to sell, you have that exit map ready for a smooth transition out of your business. When that time comes you set yourself up to sell for the best possible sale price in the shortest amount of time.

Note: If you want a step-by-step timeline walkthrough of what you need to do to prepare your business for sale and when, check out this article on preparing your business for sale.

Prepare Reliable Financial Statements

The best way to get your finances in order is to create a profit and loss statement (P&L): a summary of your business’ revenues, costs, and expenses.

You should be tracking your business finances every month to keep on top of your business’ profitability.

We recommend that business owners do accrual accounting as opposed to cash-based to account for financial changes that occur over the course of a year. You can produce your own spreadsheet or use an accounting software like Sellerboard if you’re running an Amazon FBA business.

We also recommend that you use a bookkeeper who is specialized in your business model on a monthly retainer. Most business owners hand over their accounts to a chartered public accountant (CPA) once a year. The problem with this is the accountant does your finances for taxes, not your business, so they aren’t able to identify the key performance indicators (KPIs) you should be tracking to optimize the profitability of your business.

You should ideally have two-three years of accrual accounts in a P&L prior to selling, or accounts for the full lifetime of your startup if it is two years or younger.

Then you can look into getting your business valued.

Have Your Business Valued

To understand what the true value of your business is and what you should be expecting to sell it for, you should get a business valuation from a professional.

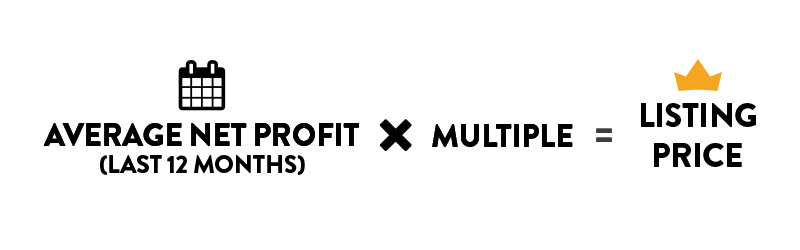

At Empire Flippers, we use the following formula to value businesses:

We like to get an average of a business’ net profits over a 12 month period to account for any variation in profit over the year and for any seasonality the business experiences.

As for the multiple, this is a figure calculated using a number of metrics that are indicators of how strong a business is, including:

- Business model

- Business age

- Consistency of earnings

- Brand presence in the niche

- Business assets

We use a monthly multiple as opposed to an annual EBITDA-based multiple, as a monthly multiple accounts for changes in profits and earnings over the course of the year and seasonality.

The benefit of getting your business valued by us when you submit it for sale is that we dig deep into your business’ financials to create a P&L so you can get a highly accurate valuation of your business.

See How You Can Organize Your Business’ Operations

When you’re assessing your business’ operations, you’ll be able to identify which processes are crucial to the success of your business.

To make your business more efficient, focus on those operations while cutting out unnecessary operations. This will help reduce costs, make your business produce more with less effort, and therefore increase its value.

The best way to assess how your business operates is to create standard operating procedures (SOPs) for all of the regular tasks required to run your business.

SOPs

SOPs are documented procedures that outline step-by-step how operational tasks are performed. They reduce human error as you create a repeatable process with steps that mitigate the risk of making mistakes.

When it comes time to sell your business, you’ll be able to hand over the SOPs in a succession plan to the owner so they can easily run your business.

But that’s not the only person you can hand over your SOPs to; you can use your SOPs to build your own team to run your business.

Outsource Tasks

When it comes to operating your business, your number one goal should be to pull yourself out of the daily processes as much as possible so you have more time to focus on growth.

You should outsource both tasks you’re weak in and the ones you’re strong in.

If you can outsource tasks you’re weak in, you improve those operations in your business.

If you outsource tasks you’re strong in, it can be hard to let go, but doing so will make your business more hands-off. Plus, if you’re strong in that area, you’ll be able to train someone to take over that task well.

You don’t even need to hire expensive employees. There are many software tools you can use to automate tasks that don’t require human input.

One software tool you should start using right away is an analytics tool; when it comes time to sell, being able to show your site’s traffic history to potential buyers increases trust and your ability to negotiate the best deal.

Track Analytics

When you track your website analytics, you can monitor traffic and make sure you’re not getting any spam traffic hurting your rankings in Google. You can also see how your marketing campaigns are performing and how well your site is converting overall.

Any potential buyer is going to want to see a history of site analytics so they can assess your site’s health and legitimacy.

With an analytics history ready for potential buyers, you can prepare explanations for when your site performance dipped or spiked. It’s important to be transparent about this as trust is key in a successful sale. More than that, while dips in performance may appear to be weaknesses, they can actually be opportunities for a buyer of your site.

For example, if your site experienced a drop in earnings but not traffic because of a serious site bug, then you’ll be able to explain what had happened to a buyer and put their mind at ease.

Clean Up Your Site’s SEO

Before listing your site for sale, you should do an SEO cleanup. This involves checking the health of your site’s backlink profile using a tool like Ahrefs or SEMrush.

You should also do a check for duplicate content. You could find that a competitor has stolen your content or that you’ve accidentally created duplicate content yourself, which if picked up by Google could lead to your site’s traffic taking a hit.

Prepare the Necessary Paperwork for the Sale

Outside of your P&L and SOPs, there are some other pieces of documentation you need when preparing your business for sale.

Supplier and Employee Contracts

It’s common for small business owners to not have supplier and employee contracts. This can be ok if you’re running the business, but when a new owner comes in, your product supplier could decide they aren’t obliged to offer the same production rates to the new owner.

As for employees, it’s good for the new owner to know whether they will be continuing with the business after the sale so they know whether they need to hire a new team.

Legal Sale Documents

The key documents related directly to the sale are:

- An asset purchase agreement (APA) – this is an official agreement between you and the buyer for them to purchase your business assets that are included in the sale.

- A confidentiality agreement – this protects your business’ data from being used outside of the sale process.

- A sale declaration document – this is confirmation from all parties agreeing to the sale of the business.

Avoid Unnecessary Risks

When preparing your business for sale it can be tempting to try new tactics to increase sales and make your business more valuable.

We advise business owners against making any significant growth strategies when they’re preparing for sale. It’s not worth the risk of the growth strategy failing and business profits dropping as a result.

You’re better off laying out a growth plan for a buyer to implement; this will be a valuable asset and it will help you in negotiations as you’re showing the buyer a clear path to them making an ROI from your business.

Carrying out all of these steps we’ve discussed today will not only allow you to be prepared when the time comes to make a quick exit, it will also increase the profitability of your business and help it reach its maximum value.

All of these areas are considered when determining the sale multiple of your business. The more they are optimized, the more money your business will be worth.

Where Can You Sell Your Online Business?

When it comes time to sell, you have two routes you can take: sell privately or sell through a broker.

Selling Your Business Privately

When you sell alone privately, you need to come up with a valuation figure, find a place to sell your business, market it to buyers, handle negotiations and due diligence processes alone (unless you hire an expensive lawyer), prepare all of the deal documents, migrate your business over to the buyer, and collect your funds.

Each of those steps has its own deep process that requires time, money, and expertise.

When you have a valuable asset like a profitable business, it’s likely a buyer will reach out to you with an offer. These buyers who actively look for online businesses to acquire have criteria of what they’re looking for and when they reach out to you, that means your business fits the bill.

They usually send you an email telling you that they’re interested in buying your business. Some savvy buyers will even put a purchase figure up in a letter of intent (LOI) early on.

This can be an exciting time for a business owner seeing a dollar value for their business for the first time.

However, what you might not know about the LOI you receive privately is that the cash amount they initially send is usually too high—they haven’t even seen your financials yet. And they aren’t legally bound to the LOI, but you are. They will be looking at multiple businesses while you’re not able to talk to multiple buyers.

Your business certainly is valuable, but be wary before going into a lengthy due diligence process where you could end up with less money than you expected after much longer than you anticipated.

So before you jump in and sell your asset to the first buyer who knocks at your door, plan your exit and see what you can get when you put your digital property on the market.

See What the Entire Market Wants to Give You for Your Business

When you sell your business through a broker, you’re able to present it to a network of numerous buyers. This network has been built up over time and usually, the buyers will have done multiple deals with the broker, so you have the comfort of working with those professional relationships.

Brokers act as trusted intermediaries who facilitate impartial processes that ensure both the buyer and the seller shake hands on a deal that benefits each of them as much as possible.

While brokers do charge a commission either to the buyer or the seller, the benefit of working through them is that you should be able to sell your business for more money than if you sold privately because of their processes and buyer connections.

In fact, we had one seller who received an offer of $2,100,000 for their business. They reached out to us to seek advice, we carried out a surface-level assessment of their business and concluded that their business was worth considerably more than that.

They decided to list their business on our marketplace and sold it for $2,800,000.

You’ll Have an Expert Team in Your Corner

When working with a full-service brokerage like Empire Flippers, you don’t have to face the task of selling your business alone.

Our sales advisors will help you tick all the boxes when preparing your business for sale.

After an initial introduction call to assess your individual needs and expectations, the sales advisors will check in with you every quarter to find out how your business is progressing and answer any questions you may have about your future exit.

They will also work with you to develop strategies for making your business more appealing to buyers and preparing for a smooth transition to the new owner.

The best thing about these strategy calls is there’s no obligation to list with us! And they’re all free.

We do all of this to ensure you have the best chance of achieving a successful exit.

How Empire Flippers Helps You Sell Your Business (For Its True Worth)

The team at Empire Flippers consists of 85+ experts in all areas of online business M&A. We shepherd sellers through the entirety of the sale, from preparing the business for sale, listing it on our marketplace (the world’s largest curated online business marketplace), and presenting it to our gigantic buyer network which has over $6.5BN in verified funds store on our marketplace, and handling migrations and collection of the funds.

While we’re working in the background to get your business sold, you’ll get access to our online platform where you can track the sale of your business and have a hub for everything associated with selling your business.

If you think you might be ready to exit your business within the next year or so, then reach out to us and we’ll be more than happy to give you some no-obligation advice on preparing your exit strategy.

If you’d like to exit sooner, then it takes just 5 minutes to submit your business for sale with us. Or if you’d just like to see what your business could be worth, use our free valuation tool and find out in just a few minutes.