How to Value a Website (+ Examples of REAL Sales Data)

Building a successful online business is hard work.

You’re putting in countless hours and working way more than any person in a 9–5 job ever would, just to make something out of nothing. After some time putting in all this effort, you may start to ask yourself: What is the end goal here?

Before you decide to offer your business up for sale, you should ask yourself two pivotal questions: “What can I gain from selling my site?” and “How much is my website worth?”

We aim to answer these questions and more in this article. But before we dive into why you should or shouldn’t sell your website, we will cover how websites are valued.

How to Value a Website

We’ve sold hundreds of websites on our marketplace over the years, so we know all there is to know about finding your website value according to current sales metrics. Most online business owners who have never sold a digital property will often misvalue what their business model is trending at. To avoid the letdown that results from thinking the value of your website is worth more than what potential investors will offer, we suggest you obtain a website valuation on a regular basis before you decide to ever make an exit.

Online businesses come in many shapes and sizes. For this article, however, we will focus primarily on sites monetized through Amazon Associates, affiliates, and display advertising sites—better known as content sites for those familiar with these monetizations. There are plenty of other business models out there that we accept, but this article will focus on content sites, as they are the most common for first-time business owners.

Side note: The valuation for an ecommerce site will be different compared to a content site that focuses more on organic traffic. The same goes for SaaS business valuations where other metrics, such as lifetime value, referrals, and metrics outside of SEO, come into play. Focusing primarily on content site valuations for this post means we can get way more granular in what actually goes into these types of valuations. If you would like more information on what actually takes place in valuing an SaaS business you own, be sure to check out our SaaS business valuations article. For those ecommerce owners looking to get a better understanding of what their site is worth, we have a more detailed article on ecommerce valuations for those who are interested.

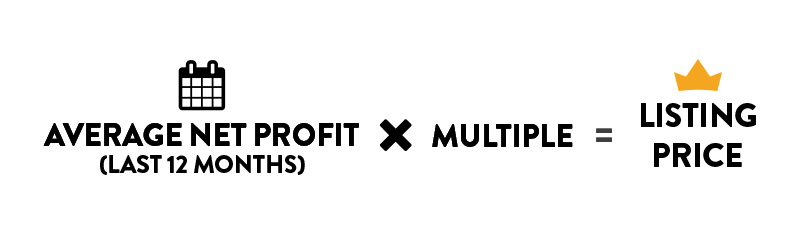

As a general guide, in determining your top-level valuation based on financials alone, we use the following formula no matter which monetization your business happens to be generating income through.

As you can see from the figure above, we use this general guide to give you a basic idea of how much your online business is worth using your financial data alone, which is then aggregated against a multiple. The beginning part of this basic valuation formula makes sense; however, it’s the multiple part that usually stumps most first-time sellers when determining what they should expect from their business valuation.

There are plenty of factors that come into play when determining what will increase or decrease your business multiple that we will cover in this article, but understand that this is just a general guide to determine what your business will be valued at. For an even more in-depth valuation tailored to your specific business based on further input you may have that may increase your business’s value, make sure you use our valuation tool. Before we dive deeper into what makes up your business valuation multiple, let’s cover the actual financial numbers that we use to determine what your average net profits will be in the first part of this formula.

SDE vs. EBITDA

There are two different ways to look at financial earnings when determining which net profit numbers will be used, and they are based on how you look at the actual earnings of your company.

The first method is Seller Discretionary Earnings (SDE). SDE is what is left after you have paid all expenses, such as your employee payroll and content expenses. This method will have you add these expenses like your own salary to the business earnings to showcase the business’s true net potential. For a majority of the content businesses you’ll see on our marketplace, SDE makes the most sense. The majority of content site owners out there are sole operators, with maybe one or two virtual assistants at most helping on the backend. Businesses under the $5 million in annual revenue range are almost always priced using an SDE model.

The valuation model for your business becomes a little more complicated if you’ve scaled your income to higher than $5 million in annual revenue. Usually, when you move into these larger media-type companies, there are more shareholders and investors involved, and an Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) model makes more sense.

EBITDA is a more formal valuation method that takes into account many factors to come up with a market-going valuation for a more complex, seasoned business. While similar to the more informal SDE, the EBITDA valuation method tends to reflect a business’s earning power more accurately at the $5 million and up annual revenue range.

Almost 100% of all businesses bought and sold on the market will use one of these two methods.

What Are Add-Backs?

Add-backs are any expenses to your business that are not necessary to maintain the current state of your net profit—expenses such as your salary, any content expenses that inherently have no effect on increasing or decreasing your profits within a short amount of time, any employee payroll expenses that have no direct effect on your cash flow, etc. These expenses are added back onto your net profits to indicate the business’s real profitability. This is important, as a potential buyer looking at the ballpark net income of your business may see a lower figure than what the true monthly revenue actually is.

What Are Pricing Windows?

Pricing windows are the amount of monthly sales data your business has obtained to show any potential buyers what your average monthly net profits have been. These pricing windows will vary for every business valuation, depending on the performance of your business. Some businesses that have been successful for many years will use a 12-month window, while other businesses that have shown rapid growth or decline may use a shorter window to accurately reflect the current state of their business. Here is a breakdown of each pricing window along with their advantages and disadvantages:

12-Month Window – The Gold Standard

For content sites that have been around for more than one year, a 12-month pricing window will be used to show the full spectrum of your business’s performance. This window often has the widest buyer pool, as investors are keen on getting a better idea of how the business will perform throughout the entire year. Using a 12-month window will also offer the best possible multiple for your business since it shows more data than a smaller window shows. If your goal is to get the highest multiple for your business, using this window will give potential investors peace of mind in offering you a higher multiple with more sales data to offset any potential risks they may be concerned with. As such, most investors will want to see this type of pricing window, especially if your content site happens to be within a seasonal niche or is marketing products that might be more popular during certain months than others.

6-Month Window – The “New Reality”

When you consider everything mentioned above with why you would want to have a larger pricing window over something shorter, you may ask yourself why anyone would want to use a smaller window to get the best possible business valuation. A 6-month window will often be used for those businesses that happen to be either in a sudden decline or scaling at an incredible rate. This shorter window will often be used in the seller’s favor to better market the business in either outcome to show a more accurate depiction of it. This previous 6 months of data will reflect closer to the “new reality” of the business and may often be used on younger businesses as well. This can be a benefit for a rapidly growing business to help increase the multiple in the seller’s favor; however, it may also hurt the business’s multiple should the business be experiencing a rapid decline. No matter which side of the fence your business happens to be on, using this shorter window will inevitably lead to a lower multiple than those using a 12-month window; however, if planned properly, those looking to make a timely exit might offer just enough data to still walk away with a substantial amount of capital. If the business is still new, you may want to consider waiting for more sales data to shift in your favor prior to accepting a final 6-month pricing window valuation.

3-Month Window – The Window that Shall Not Be Used

As the title of this section suggests, the 3-month pricing window should only be considered in very extreme cases and, if at all possible, only used in dire straits. This pricing widow is often reserved for extremely young businesses that are around five to eight months old, as well as smaller businesses between the $30–100k range. The $100k listing price range is often the highest price point you will see this window being used at. Investors will almost never buy anything on a 3-month window over this price range, as there is just not enough data to show any type of reward over risk potential. If your business is worth $500k or more, you will have an extremely difficult time finding a buyer using a 3-month pricing window alone. Not only that, but, at the same time, you will also receive the worst possible multiple for your business’s valuation. If your business falls within this price point, consider holding off until you have gained more sales data to use a 6- or 12-month pricing window, as this will offer you more money at a much larger multiple.

What if My Website’s Seasonal?

If your content site is within a seasonal niche or offers content related to something that users will use at a specific time of the year, you will almost always use a larger pricing window. Doing this will more accurately reflect the seasonality of the business, which is something most investors looking to acquire your business will look for first and foremost. Based on using this longer pricing window, it really doesn’t pay off to wait until the high season to exit your business, as this window (which, in the case of most seasonal sites, is almost always a 12-month window) will nullify any huge rise in your valuation. So, now that you have a better understanding of what goes into the financial side of the basic valuation formula we use for content sites, we can dive deeper into the second part of this formula: how your multiple is determined.

What Goes Into a Multiple?

In this section, we will dive deeper into what makes up your multiple—that is, the number your monthly net profits will be multiplied by to give you your final suggested listing price. This is not an exhaustive list of everything that our vetting team collects to determine what your final valuation will be, but it should give you better insight as to how multiples are determined.

Growth Trends

Based on the countless number of niches and categories within the content site space, growth trends will make up a small portion of what your final multiple will be. The term “ever-green” is something many content site owners use to label content that will be around for years to come. If your niche happens to be within this category, you may see a slight uptick in the multiple your business receives based on limiting the risk investors are taking in, knowing that your site will not suddenly lose traction once a new owner takes over. For those content sites that are heavily reliant on a new trend or niche that is still unproven (think fidget spinners), your multiple will obviously be much lower, taking into account the inherent risk of a sudden drop in both traffic and revenue.

Stability and Diversity of Earnings

One thing that many investors often look at when performing their due diligence on a potential acquisition is how diversified the earnings are. Is all of your revenue coming from only one source? If so, this is a huge red flag to potential investors looking to acquire your business because there are no safety nets in place should the revenue source suddenly drop. Take, for example, a site that is monetized through Amazon Associates alone. When the platform made an update to their commissions for their program and revenue suddenly dropped, those content site owners who had no other revenue source being generated for their business lost a substantial amount of revenue and therefore received a much lower multiple for not diversifying their income sources. In this example, had the owner included display advertising within the business model or other affiliate offers producing another stream of income, the risk would have been far lower to potential buyers, and therefore, a much higher multiple would have been offered in the seller’s favor as a result of spreading their income across multiple sources.

Stability and Diversity of Traffic

Just as risk should be spread across multiple income sources, traffic should be spread across multiple sources to limit any sudden drop for one reason or another. With content sites, the biggest fear most site owners face when it comes to a sudden loss in traffic are the dreaded Google algorithm updates that happen once or twice a year. If your content site’s traffic is heavily dependent on Google, you may want to consider sourcing other means of gaining traffic to your business outside of Google to limit this risk and thus increase your multiple. Social media has become a great tool for diversifying traffic streams and thus will help to limit the risk should a Google update hit you where it hurts the most. Diversifying your traffic sources is important, but building a stable source of traffic is just as important to maintain constant numbers and to limit sudden shifts in either positive or negative directions. In doing so, you are showing potential buyers that your business can weather any sudden upticks or downshifts in traffic and still remain profitable through other sources of traffic, no matter what may happen on any one source.

Owner Involvement

This is where things can get a bit tricky when determining whether you should be the sole mastermind behind your business’s operations or you should outsource some of the workload to virtual assistants (VAs) and other help. On one hand, it may be beneficial to have outsourced VAs helping with the daily operations of your business—though this often means that your operational expenses will be higher. On the other hand, if you limit your operational expenses by managing and operating every aspect of the business yourself, you present a much more challenging asset to a potential investor who might not have the same core skills that you possess. In this case, we say that you should lean towards the side where you have some involvement with the business’s operations but you also have one or two outsourced workers helping you maintain the business. Not every buyer is looking for a full-time job—instead, they are often in search of a passive investment opportunity. If you can limit the amount of time you spend maintaining the business, you can present a passive investment opportunity to potential buyers, and your multiple will increase as a result.

Business Age

When it comes to content sites, especially those that rely heavily on Google organic search traffic, business age is just as important as domain age. The longer your business has been around, the more trustworthy your site becomes in the eyes of Google. As such, the longer your business has been around, the more sales and traffic data you will have inevitably collected and can therefore present to potential buyers as a means of showing that your business will not suddenly fall off the face of the planet without notice once they take over full ownership post-sale. Having a seasoned business that has been around for some time will help increase your multiple for the sheer fact that your business has now weathered a few storms and is still profitable today. This is a huge bonus in the eyes of a potential buyer, as you have shown a steady track record of building your brand over the years within your target niche.

Email List and Social Media

If you’ve been in the online business space for any amount of time, you will have certainly heard the phrase “the power is in the list,” and for good reason. Digital property buyers will often favor a business with a large email list over one without. The reason behind this is that your email list is a direct extension of your addressable audience that comes to your business organically through Google or social media signals. While a large social media following does help move the multiple needle in your favor slightly, having a large email list will certainly do so even more. The fact that your audience has opted into your email list in the first place offers the potential to monetize this audience further with optimized email campaigns geared towards generating more revenue for the business. Social media followers can give your business a slight advantage, but focusing on growing a quality email list will give your content site the best possible advantage to increasing your multiple, as buyers are always on the lookout for those who have focused on this channel.

Backlink Profile

Your content site’s backlink profile is also important when it comes to pushing the multiple your business receives during its valuation review. Websites with quality backlinks from high-authority sites will demand a much higher multiple than those who receive backlinks to lower domain rank (DR) sites. If your business uses public blog networks (PBNs), you will notice that this hurts your multiple, as it is considered a risk to potential buyers should these PBNs suddenly shut down or be impacted by any Google algorithm updates down the road. PBNs are not all bad, and some buyers who use these types of links within their other projects might even prefer a site that also uses them. However, the majority of potential buyers looking to acquire your content site will prefer white hat backlinks only. Therefore, in order to get the best possible multiple for your site valuation, it is best to steer clear of these types of links to move the multiple in your favor when the time comes to exit your business.

Platform

The platform on which your content site is built may also impact your valuation multiple, as many buyers may not be familiar with coding or other types of website publication software outside of the most common ones used on the market today. WordPress is the go-to platform most buyers are familiar with and therefore should be considered your go-to choice in order to get the best possible multiple. Custom-built sites using Joomla or similar platforms will reduce the pool of interested buyers who are familiar with this software and therefore also reduce the multiple. Stick to what most buyers know, and you should have no problem demanding a higher multiple knowing that most buyers will be familiar with this platform.

Affiliate Contracts

If you are monetizing your content through affiliate offers, having contracts with your affiliate network is crucial to demanding a higher multiple. Limiting the risk of losing your main revenue drivers is something that many business buyers will want to ensure before they even think about sending an offer your way. Put yourself in the shoes of a buyer. Would you want to purchase a business where the main products could suddenly disappear along with all the revenue those products were generating for the business? Having contracts in place with your top-performing affiliates limits this risk substantially and therefore gives you the ammunition you need to demand a premium multiple that buyers are more than willing to pay for this added safety net.

Overall Appeal

This part may be considered subjective, as not every buyer will see the value in your business as you do, but it is worth noting as a multiple factor regardless. In short, how attractive is your business? Is the website well designed and appealing to the reader, or does it look like things were smashed together with no real thought behind the look and user experience? Having a well-designed, branded website will increase your multiple, as it means you have set yourself apart from the competition. You should approach your content creation in the same way as you do the design of your website. Your content should be professionally written with a native level of English to captivate your target audience and keep them hooked on every word you write. The quality and look of your site will have a direct impact on the multiple your business receives, so you should focus on producing the highest quality you can in order to get as much from your valuation as possible. So, now that you have a huge list of considerations to make in gearing your business towards the best possible valuation, let’s dive deep into some REAL sales data for businesses that we have sold on our marketplace.

Tracking Real Life Multiples from Our Marketplace

When you take a look at our latest scoreboard, you will notice that we have sold a ton of online businesses. As the largest curated marketplace in the world, we have more data to back up the current state of digital acquisitions than anyone else. In 2020 alone, we sold more than 153 content sites, which was quite consistent with previous years. In 2019, we sold more than 143 content sites, and in 2018, we sold more than 151. Based on these numbers, we can confidently say that we have noticed a trend in rising multiples for content sites over the years. With the rise in multiples over time, sales prices also reflected an increase, showing a steady growth trend not only for content sites, but for all digital assets being sold on our marketplace.

In 2018, the average sales multiple for content sites was 27.6, and in 2019, it was 29.9. In 2020, this number grew even further, demanding an average of 31.6, which is proof that these multiples are not slowing down any time soon. All of this data translates to increasing sales prices, as these types of investments are continuing to grow in demand by investors looking to cash in on digital properties. Across the board, when we look at the actual sales prices for these content sites, the average sales price in 2020 was $94,419, a 4% increase from that of 2019 and a whopping 23% increase from that of 2018. However, this does not give you the full story of just how much these numbers are increasing over the years, so let’s break this data down even further:

Multiples for content sites in 2020:

Sub $100k = 31.1

$100–250k = 32.5

$250–500k = 35.4

Other businesses that stood out from the pack were an $830k site and another site that sold for $1.4M, which demanded 34 and 35x multiples, respectively. These types of multiples for content sites were unheard of in the past, which goes to show just how much the demand for these assets has increased within the past couple of years alone. There may be some tapering off today, as this past year has been quite a challenge for content site owners when you consider that the world is facing a global challenge we will leave unnamed; nonetheless, all this data is still interesting to see. We have also seen a huge increase in competition from high-net-worth investors and private equity firms looking to capitalize on these types of assets based on the increasing growth potential such assets offer. This is pushing multiples to new heights for content sites and is huge for business owners looking to make a big exit from businesses they may have only started a few years ago. Depending on where you turn to receive a website valuation, you may notice that not all valuations are created equal. Let’s break down why this may be the case.

Not All Automated Calculators Are Built Equally

There are plenty of automation tools available today that will give you a general idea of how much your website is worth, but it is worth noting that they are not all the same. Some only require you to input your domain name; however, you should know that this valuation is based on estimating your domain value, NOT your business as a whole. It is also worth mentioning that these calculators are not always accurate, as they only estimate your domain’s value based on data from sources like Alexa and Google.

When you compare these generic calculators to our valuation tool, you will notice right away how far off these generic reports are from presenting the true value of your business. A valuation tool will only give you an accurate estimate if the developer has spent enough time building the tool using real sales data in direct response to your specific data inputs. This is why we must mention that not all automated valuation calculators are created equal. The only true way to get an accurate report on the current value of your business compared to what similar businesses are being sold for is to speak with an industry expert. Of course, obtaining an accurate valuation for your business is just the first step of the entire exit-planning process, but when you use a well-developed valuation tool such as the one we have been perfecting for years, you will want to connect with a valuation expert to ensure your exit goals are met.

A High Website Valuation Is Meaningless Unless…

One of the most common mistakes entrepreneurs make within the content business space is focusing too much on their valuation and not enough on building an attractive business for investors. When looking for the next big improvement to grow their revenue—thinking that this will increase their valuation—they often do more damage than they had anticipated trying out new marketing strategies that end up costing them more in the long run. We often tell sellers who are planning their exit to stay away from trying anything new on their business to avoid these common pitfalls that end up hurting their valuation instead of increasing it.

When you start cutting costs by, for instance, letting go of team members that play a vital role in your business or switching to a different affiliate network, you create a higher risk for potential buyers. When you take a step back, increasing your overall business valuation from a numbers standpoint alone doesn’t necessarily mean that your business is more attractive to potential buyers. A higher valuation than the one you received a few months ago doesn’t always mean that your business will be more attractive to investors. Cutting costs that in turn require more of your time to maintain the business is the exact opposite of what potential buyers are looking for in a business acquisition. These investors are looking for a somewhat passive opportunity, not a 9–5 job that requires more of their time to maintain, let alone scale, which is often the case for most. When you focus your efforts on building an attractive business over increasing your final valuation, you will have a much better outcome when the time comes to finally make your exit. Focusing on the attractiveness of your business will also lead to a higher multiple organically, a much quicker sale, a smoother negotiation, a larger pool of potential buyers who will be competing for your business, and a higher sales price.

The Most Common Mistakes When Valuing Websites

Some of the most common mistakes we see on our marketplace when sellers are looking to make a profitable exit is when a seller compares their business to other assets that have sold in the past. This may seem counterintuitive to what we mentioned earlier in making sure you receive a valuation based on similar assets being sold on the market. The mistake that sellers make, however, is that they will try to compare what they believe their business is worth to another business that was sold in the past that does not match their business. Because every digital asset is unique in its own right, you must try to avoid comparing your business to others since every business is unique in one way or another.

Another common mistake that content site owners often make when planning to make an exit is overvaluing their traffic. Just because you receive 50k views on Pinterest every month doesn’t mean your business should demand a higher valuation over an asset that has a monetized email list with 10k subscribers. The fact that the business with those 10k subscribers is being monetized and trackable automatically indicates that it is a more attractive asset to potential investors—that is, unless you are able to prove how you’ve been able to monetize your Pinterest traffic. Steer clear of unrealistic expectations when it comes to valuing your traffic, and get a business valuation from a professional before you start thinking your website’s traffic is worth more than it actually is to potential buyers. Lastly, too much focus on “potential” is another game stopper that many sellers fall victim to and something that seasoned buyers are able to see right through. Talking up your business with plans to improve xyz, which will result in xx% increased profits, will almost always scare away potential buyers. Focus less on the business potential and more on key improvements that will optimize the business overtime, and buyers will be far more interested than listening to your speech on how the business will be the best of its kind if they improve this, that, and the other.

When Should You Sell Your Website?

Since the online business market stays active all year round, the best time to exit your business is based on your specific business goals. Some of the most common reasons sellers go on to exit their content sites include personal reasons, such as purchasing a home, accessing a large amount of capital to scale other passion projects they are currently pursuing, or reaching a plateau in their ability to scale the business any further than they have. We often hear from many sellers on our marketplace that they would like to see the business go to someone who has a passion for the niche they have been in for the past few years and are looking to pass the torch on to someone who can push the business to its full potential. No matter what your reason may be for exiting, it usually comes down to what your business and personal goals are.

How Exit Planning Will Maximize Your Valuation

As we have mentioned exit planning quite a bit already within this post, we will keep this short and simple. When you make an effort to properly plan your business exit, you are ensuring that your business and personal goals are met through proper execution well before you list your asset on the market. Planning your exit before you ever list your business on the market will ensure that you reach these goals with plenty of time to spare before you pass the torch on to the next investor. If you are not quite sure of how you can plan your exit to gain the valuation you would like to receive for your content-based business, be sure to schedule a call with one of our business advisors, and they will coach you through this entire process. Even if you don’t plan on exiting your business until a year from now, these advisors can help you make educated decisions on what key improvements will get you closer to the valuation you are expecting for your asset without making any of the common mistakes we mentioned earlier. After reading this article, if you are more than confident that you have made all the proper improvements to your content site and are ready to list your business on the market, submit your business to get the ball rolling and take the next step to securing your profitable exit today.