It’s the Season of the Seller—Here’s How You Cash Out While the Market Is Hot

It seemed like 2020 was wild and couldn’t be outdone. But just one quarter into 2021, and this new year appears to be screaming, “Challenge accepted!”

The world has been a roller coaster, and unsurprisingly, so has the world of online business. Despite the gloom of countless difficult situations this past year, we’ve entered a strangely positive time, albeit for a niche group of people.

Amazon FBA business sellers have (for the most part unknowingly) walked into a market environment leaning in their favor. In the past year, laser focus from private equity (PE) emerged in best-in-class FBA business acquisitions, and a surge of capital behind them is funding an acquisition spree.

The demand, deal structures, and timelines to secure these acquisitions are unlike anything we’ve ever seen. During a chaotic year, we entered a new era for online acquisitions at a dizzying speed.

It’s time for everyone, especially sellers, to take note of what is happening in the market. The influx of new capital and buyer demand is having a ripple effect across our marketplace. Multiples are rising, and deal making is being transformed. Paying attention and taking action sooner rather than later can lead to your own windfall.

It’s the season of the seller. You’re either cashing out or missing out.

Why buyer demand and multiples are rising

Amazon is no longer a billion-dollar game just for Jeff Bezos.

Thanks to a handful of bold FBA acquirers who set an example, swaths of institutional investors are waking up to the incredible ROI and rapid growth available to them with Amazon FBA. With the right FBA acquisition and operational efficiencies implemented, FBA assets have proven to be incredibly profitable and scalable. Thus, the investment thesis of FBA acquirers was proven, and an FBA gold rush was born.

What was just a few institutional investors buying from our marketplace a couple of years ago has blossomed into countless portfolio buyers with capital behind them.

PE groups have gone into aggressive capital raising. According to Forbes, there has been a reported $1.5 billion raised for Amazon FBA acquisitions from 10 to 15 groups. In addition, our marketplace itself has over $1 billion in verified funds, only a portion of the capital available in the buyer’s net worth to deploy.

Even though capital for acquisitions has crossed the billion-dollar mark, we are keenly aware there is more capital surging into the digital acquisitions space. We can only report on the capital tracked, and at this moment, that’s likely only a fraction of capital that’s actually available.

Safe to say, there’s major money to be spent on FBA businesses. This now means sellers of large FBA businesses are in a sweet spot.

Thanks to buyer demand and increased performance of FBA businesses, FBA sale multiples have seen a sizable boost.

A rising tide lifts all boats. Now that FBA is demanding premium multiples, the value of online businesses across the board has risen. Almost every seller is enjoying a high season.

How much are multiples rising? A one-year snapshot

To put the “high season” into perspective, here’s what our data has revealed on marketplace increases:

In 2020, we sold 298 businesses worth a total of $81,636,851.73. That’s a 10% increase from the previous year in terms of businesses sold and a 66% increase in overall sales volume. To break this down further, in Q4 of 2019 we sold 58 listings while Q4 of 2020 82 listings—a 41% increase.

The average list price of a business on our marketplace ($284,838.04) was up 58% compared to 2019, while the average sale price increased 73% to $269,200.81.

To understand how multiples have risen, we first have to explain TTM (Trailing Twelve Months) sales multiple.

TTM is essentially an average based on the trailing twelve month performance. Most businesses on our marketplace use a 12 month pricing window, however, some businesses use a shorter pricing window (three-months or six-months, for example) as it best represents the current reality of a given business.

For ease of comparing our valuations to other brokers across the industry, we are moving towards more standard use of TTM multiples and it will likely become more prevalent on our marketplace over the coming months and years.

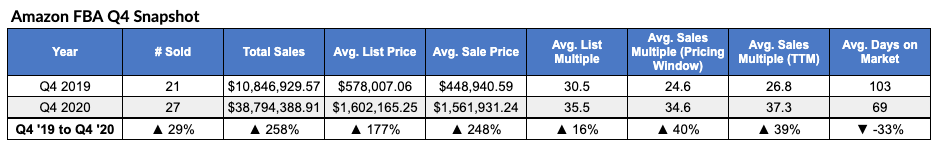

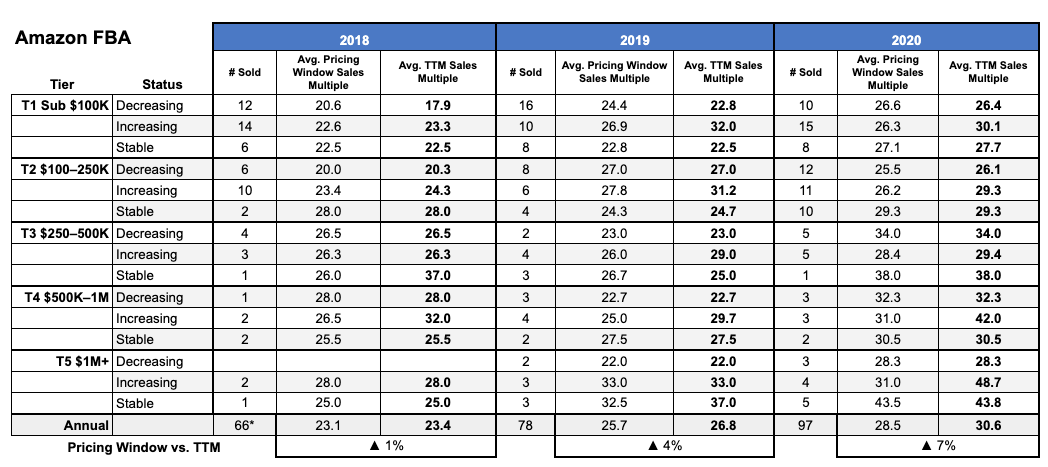

We break down TTM multiples in 2019 vs 2020 in the graph below. While the data shows an interesting shift overall, what feels most exciting is a YoY (year over year) comparison of the data. Comparing YoY shows an average 31.5x to a 40.9x TTM sales multiple, which is a 9.4x difference from Q4 2019 to Q4 2020.

It’s exciting to see 2020 have a positive impact somewhere in the world, though it was FBA in particular that experienced a stellar year. The data of businesses on our marketplace with Amazon FBA brought in the majority of profit and shot up from the 2019 data:

- The average list price went up 55%.

- The average sale price went up 80%.

- The average sale multiple (TTM) went up 14%.

- Total sales rose 98%.

What makes this data even more amazing is that these are businesses that had gone from being virtually paralyzed for months at the start of the pandemic to barely able to keep stock on hand. Everything seemed stacked against FBA midway through 2020, and FBA businesses managed to finish the year with transformational revenue and demand.

The end of the year truly was transformative for FBA. By Q4, we were seeing data that would’ve been unrecognizable the previous year:

- Average sales price for FBA—Q4 2019: $448,940.59 vs. Q4 2020: $1,561,931.24

- The largest FBA business sold—Q4 2019: $2,124,893.00 vs. Q4 2020: $11,800,000.00

- Total FBA sales—Q4 2019: $10,848,929.57 vs. Q4 2020: $38,794,388.91

It doesn’t take a math wizard to see that going from $10,846,929.57 to $38,794,388.91 in total FBA sales is a quantum leap.

For an even more granular view, and the one that best pinpoints the growth we allude to most in this article, it’s important to note the multiple jumps in strong FBA assets. Comparing 2019 to 2020 FBA TTM multiples in growing FBA businesses over the $1M range shows a compelling increase:

- Average TTM multiple growing +$1M FBA businesses in 2019 vs. 2020—2019: 33x vs. 2020: 48.7x (15.7x difference)

- Total Number of sold of growing +$1M FBA businesses in 2019 vs. 2020—2019: 3 vs. 2020: 4 (33.3% increase)

The speed with which the FBA marketplace has changed in a year shows us that expectations surrounding FBA deals are ever-changing.

While we would never suggest timing the market, if you are in a position to sell you’re going to find yourself in the best time we’ve ever seen to sell an FBA business. Right now our M&A brokerage is able to demand some of the highest exit prices we’ve ever seen, and our business advisors are often having several well-funded buyers competing for your business. It can be overwhelming, but when you decide to sell with us, we can help you through every step to make it a smooth process.

What large buyers are seeking

While demand and multiples are, in fact, increasing, the wildly high demand belongs mostly to the upper echelon of FBA businesses.

The buying trend seems mostly clear cut; PE buyers are generally looking for less than 30 SKUs, the main SKUS having 4.7+ star reviews with 1,000 plus reviews on listings, and great branding to sustain the brand’s growth.

They mostly seem to be buying in the $500,000 to $15 million-plus range, as these businesses can be acquired and optimized to get the returns investors want. The reason we point this out is we want to make it clear who is getting 50x and higher multiples. These businesses can demand these multiples based on their quality, price point, and buyer appetite.

While all sellers can see a benefit to higher multiples across the board, the intensity of large buyer demand remains with multi-million-dollar FBA businesses.

Sellers beware—how sellers need to be careful in the craze

The sellers who have built such strong FBA businesses are clearly good at what they do. They’ve managed to reach a threshold of success millions can only dream of.

Though they are masters of selling products on Amazon, it doesn’t equate to being able to sell multi-million-dollar businesses with nuanced complexities. And this is where sellers can lose out on their hard work.

While it’s tempting to do it all alone and put up your own “for sale by owner” sign to make the most money possible in an exit, doing so means you’re missing out.

Lots of sellers are leaving cash on the table selling on their own. They’re getting undersold because they simply don’t know how to price themselves appropriately in a hot market.

They don’t know what they don’t know, and the ones benefiting are expert buyers whose success rides on getting the best deal possible for themselves and their investors.

Anecdotally, these upper-echelon sellers are confirming this. Almost all of them are getting approached by buyers to sell to them directly, and all of them are getting pitched a sales price less than what they’d get by selling on our marketplace.

That’s why there never has been a better time to leverage a broker.

All bias and any kinds of sales pitch aside, we want to make it clear that sellers are making more money by selling with us. Period.

The same sellers getting lower offers directly from buyers have come to us and actually gotten paid higher listing prices with better deal structures. They’ve taken home more pay even after our commission—from the same buyers who gave them initial lower offers.

Buyers won’t pay more than they have to UNTIL they have to. And they have to when you sell with a broker.

Many of these PE-like groups are amazing FBA operators and aggregators in their own right. The ones who promise to run your business well and let you share their success with a performance earn out will likely do their best to make it happen. A year ago, the groups who could follow up on that promise were few but now there are dozens more by the day.

It’s a limiting belief to think that there’s only one group who would seriously consider buying your business. You deserve an offer from all the new potential buyers vying for FBA assets. The only way to get all those buyers in the room to make competitive offers for your business is to work with a broker.

You could sell your FBA business to one of these institutional buyers, and your business may go on to fuel one of these large groups’ claims to fame.

If you’re going to build someone else’s legacy, at least get what your business is fully worth.

Pro-seller deal structure trends

The deal structures emerging from fierce competition have unparalleled benefits for sellers. Never before has a seller been able to walk away with more cash up front with even more potential to earn from the business after it’s sold.

For these top-tier FBA businesses, we’re seeing trends emerge that break down to this simple question: What different kinds of levers can buyers pull?

Since buyers are focused on outdoing other buyers to win the best FBA businesses in the industry, the ball is very much in the seller’s court. Here are consistent levers we see buyers pull to get ahead of the pack:

Up-front payment amount: Winning bids for larger, 7-figure FBA businesses typically include the most amount of cash paid upfront. In 2020, eleven of the twelve $1M+ businesses sold were earnouts where an average 65.88% was paid upfront. As competition increases, the percentage paid upfront will continue to rise.

Earnout payment timeline and terms: If an earnout is included in these deals, they often revolve around future performance of the business and are paid out on a yearly basis. For large performance-based earnouts, the seller needs to trust the buyer’s ability to run an Amazon business that hits these performance metrics for the payout to be released. This is a vital reason for seller to come to our marketplace as it gives them a chance to meet with multiple buyers and determine which buyer they are most comfortable moving forward with.

Inventory payment and timeline to pay: All inventory is usually paid for at the close of the deal or no later than 3 months after close.

Exclusive due diligence timeline: Most or all offers for larger businesses on our marketplace will include a time of exclusive due diligence. The buyer will want to further verify all financial, banking, and inventory information before committing to the sale. The standard timeline is 30 days, but the shortest timeline is preferred.

Seller assistance timeline and required work: How much assistance the seller can give buyers post-sale is negotiable. Usually 30 days is the standard for email and Skype support, but it can vary from buyer to buyer. Sellers want to give as little assistance as possible (they usually want to be done with the business and enjoy the rewards of selling), and experienced portfolio buyers can move forward with very little help from the seller. This varies from offer to offer based on the experience of the buyer or complexity of the business.

Though these are the main trends we are seeing, our Business Advisors have used their experience to work with buyers to create creative deal structures. For example, that may mean advising buyers to shorten earnout periods, lower thresholds for performance earnouts to be released, or shorten payment timelines from yearly payouts to monthly or quarterly.

Often, out-of-the-box deals come from less established players in the market. Newer brands are making aggressive offers because they have to get a foot in with these businesses, so they are making very high or creative offers to try to outplay more well-known players.

What does this mean for buyers?

Buyers may have noticed the rise in multiples and been a bit perplexed if they had been out of the market for some time. Those who have been active in bidding on large FBA businesses can confirm firsthand how fierce the competition is and understand why multiples have climbed the way they have.

This should not cause any lost hope; consider this friendly expectation setting. We want to see buyers win and get the business right for them.

The following is our best advice to win in the current marketplace environment:

Buyers of FBA businesses from $500,000–$15 million

If you are a buyer set on buying FBA businesses in the upper six figures and multi-million-dollar range, you must be prepared to meet the multiple. You will likely need all cash up front to meet the listing price. You may even need to produce extra incentives on top to come out ahead of other buyers.

You’ll also need to be fast. Whereas making an offer five days after a business went live could have won you the deal a year or two ago, that won’t cut it anymore. Your alarm needs to be set for 10 am EST Mondays when deals go live. You need to be ahead of the curve and have verified liquidity and all supporting documentation on file.

You can stay vigilant on live businesses by signing up for our newsletter and filtering your criteria on the platform to get notified when businesses that hit your criteria hit the marketplace.

Buyers of smaller FBA businesses and other monetizations

If any of these strategic moves sound out of reach, that’s okay. You don’t have to dive into the fiercest competition to get a great business.

If you had high hopes for an FBA business in the previously mentioned price range, you may just need to pivot.

Consider businesses that have been on the marketplace for a bit of time to avoid fast-moving competition. Or you can attack opportunities in a lower price range or acquire distressed assets and aim to improve them.

Businesses outside of the top buyer’s criteria have a good level of opportunity for creative deal structures. If you can produce solid unconventional deal structures and deploy the necessary resources, there’s no reason you can’t win against the competition.

How can sellers reap the benefits now?

This is an incredible time to sell. We’re seeing sellers able to choose between a dozen buyers on multi-million-dollar businesses offering strong deals and extra incentives to outpace the competition.

Sellers also can take advantage of the lowest commission we’ll ever offer on seven- and eight-figure businesses. As we sell more 7-figure deals consistently and 8-figure deals regularly, our rates will increase.

This truly is the season of the seller.

Remember, you want all potential buyers in the same room, looking at your business at the same time. It creates healthy scarcity and makes every group work harder to create compelling offers.

If you sell privately, you don’t know the other side of what you could make with a brokerage, even after the commission. You miss the chance to know for sure if someone else would have paid more for what you’ve built, offered you better terms, and made the deal process far easier for you. No one should have to ask “what if” when there are millions of dollars on the line.

You can very easily avoid this with a free 30-minute call with our team. Doing so can only help you better understand if you’re getting the true worth of your business.

How we’re keeping up with demand

With a market moving at turbo speed, we’ve had to make adjustments.

We know that we are the top broker for Amazon FBA businesses in the industry—105 FBA businesses sold in the past year—and we have set our own high bar. To keep that bar high and still win the trust of the best FBA businesses in the industry, we’ve streamlined our process to cut straight to the heart of what needs to be done, ensuring the best deal outcome for all parties.

We’re also the only market with verified funds to eliminate tire kickers early on. As more money floods in to fund large deals and more investors want FBA businesses, it leads to more potential false buyers. FBA buyer wannabes will say they have the assets in hand and point to some investors they’ve drummed up when they simply don’t have the cash.

With over $1 billion in verified funds, we can cut through the noise and get the real buyers in the room when you decide to sell your business.

What the future holds

The year 2020 was tumultuous, and if we take away any lessons from that, it’s that no one can accurately predict what will happen. Judging by how 2021 has kicked off, it looks like predictability is still off the table for now.

We can only hedge bets and do the best we can with what we know.

We know the pandemic fueled unparalleled growth in ecommerce, and Amazon FBA businesses saw revenue only thought possible in their wildest dreams. The surge of online purchases on Amazon made many FBA businesses much more valuable.

We also know buyer demand has skyrocketed. What was just a handful of institutional buyers two years ago is now more and more buyers entering the space every day.

There is no reason to believe this trend will stop anytime soon.

Demand and multiples will most likely continue to rise to unprecedented levels, though no one can say how long this will last. Selling while buyer demand is strong and the population relies on the internet for their purchases will likely lead to a winning scenario for sellers.

As a company, we will work hard to meet the rising demand and ensure all parties get their best deal possible.

Sellers—this is your time. Amid a very unpredictable period, you have a silver lining. Unlike ever before, the market is yours. It’s up to you if you want a life-changing exit out of it.

You can set up a call with us to discuss your exit strategy or, if you are ready to take the leap, sell your business here.

Buyers have a unique opportunity to choose between the best FBA acquisitions in the industry. You can call our business analysts to discuss your buying criteria and, if you want to start buying, register on our marketplace.