Do Older Businesses Sell for More?

What things grow more valuable with age?

You might think of fine wine, vintage baseball cards, or typical investment assets like gold and shares.

Leave these things alone for a while, and their value increases. People often think the same of businesses. An older business is perceived to be more trustworthy, and buyers sometimes consider age when putting an offer forward.

Many factors affect a business’s value. Age is usually included in sales discussions—but does it have the same impact for all business models?

The basic version of the formula we use to calculate listing prices can give us some insight.

Listing Price = Monthly Net Profit x Multiple

As we use the last 12 months to measure a business’s monthly net profit, you might imagine younger businesses to be less valuable because they generally report a lower average monthly net profit than mature brands.

While that makes sense, we were curious whether the sales multiple is positively or negatively associated with age. Should you wait to sell and if so, for how long?

How Does Age Affect the Sales Multiple?

We set out to find how strong the correlation between age and selling price is in our marketplace.

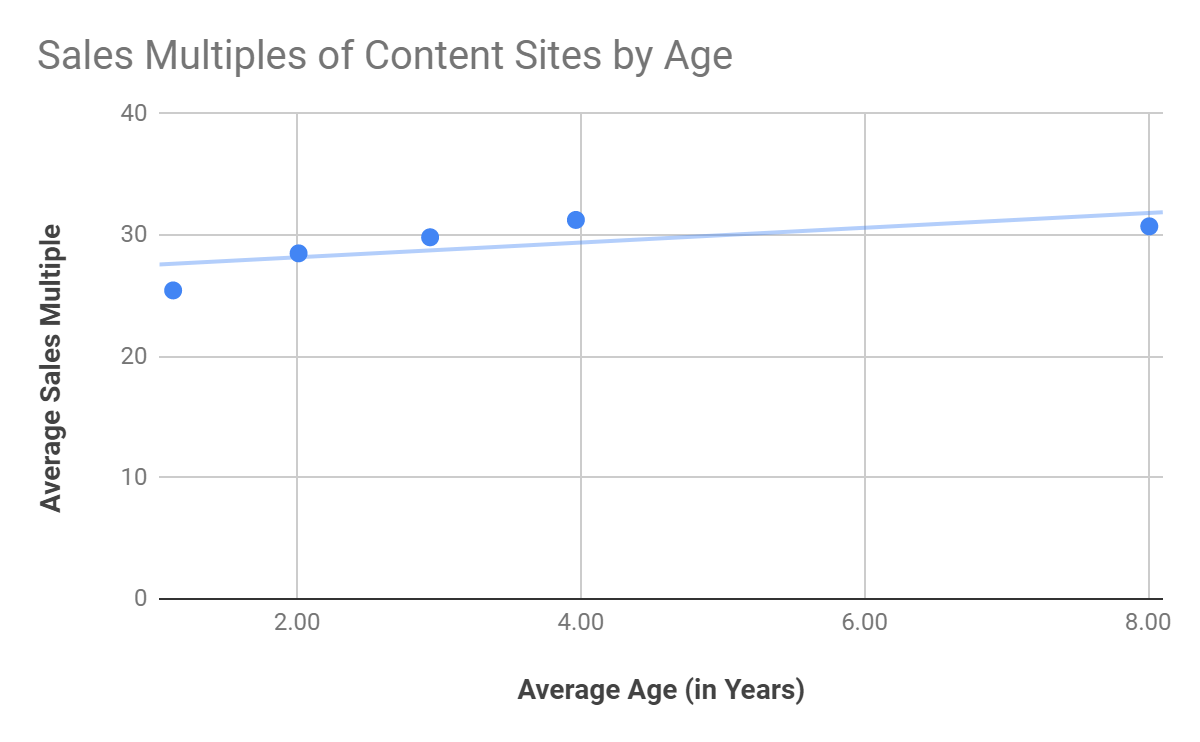

We measured all businesses sold in the past two years (544 in total), from May 1, 2018 to May 13, 2020. We split them into age ranges, as shown in the chart above, to make them easier to compare.

The data revealed that, across the board, age is positively associated with the sales multiple.

However, on closer examination, the effect of age was nuanced across different categories. To show these effects more clearly, we’ve displayed the data for each category separately.

Content Businesses

This finding is consistent with the factors that create profitable content sites.

One benefit of an aged domain is that it becomes easier for your content to rank in Google.

Search Engine Optimization (SEO) experts agree that it takes at least three to six months to start ranking through SEO in any meaningful way for a new website.

In short, it takes time for your content to become visible to your target audience, which explains why content businesses are more valuable with time.

Why Do Buyers Acquire Young Content Sites?

The youngest content sites were sold at around one year and two months old, and they garnered the lowest valuation for sales multiples.

Why buy such a young content site when they become more valuable over time?

In their business’s early stages, owners need time to create content and generate traction in terms of traffic. They also need to gauge which topics resonate with the target audience by measuring the overall impressions.

Despite a content site’s immaturity at this stage, some buyers treat young sites as an investment to be bought for their potential and not their current value. This kind of potential is something that is not reflected in our valuation since we only value businesses based on where they are at the moment rather than where they might be going.

A Flipper Fred might buy a young business and use their experience and knowledge to drive growth, optimizing the site to sell for greater profit.

Exploring Opportunities in Older Businesses

As you can see from table 1, we sold the most content sites when they were roughly two years old.

When comparing sites bought between 0-1.5 years with sites bought between 1.5 and 2.5 years, monthly net profit of content sites increases by 31%, and their sales multiple increases from 25 to 28. Buyers can see a steady increase in income over these 12 months of data and growth opportunities.

Reviewing two years of data clarifies what works and where there’s room for further growth. By this point, a business owner has created enough content to rank for several targeted keywords and has had a chance to test which topics resonate most with readers.

From here, a buyer can add more content, drive traffic through organic and paid marketing channels, or do both.

Whether a buyer chooses to maintain the business and draw passive income or intends to grow the site, content sites are an accessible route to entrepreneurship through acquisition.

As table 1 reflects, $90,000, which was the average sales price for businesses this age, is a relatively low barrier to entry compared to other monetization models.

Old is Gold

Content sites older than three and a half years had the highest average sale multiple valuation.

A content site’s age is a testament to its durability, as it will have survived several changes in Google’s algorithm. Such a business is more likely to survive future updates as well.

A steady stream of traffic over the years indicates that a business has evergreen content about relevant topics. This is a solid foundation to build on, as a buyer can focus on adding content on the same topics or start exploring shoulder niches.

A positive trend of recurring traffic also shows that the products advertised in the content aren’t fads or of low quality and that affiliate partners have remained with the content site.

These factors help build trust in buyers and brokers as they reflect a business’s resilience.

Let’s recap what we discovered about content sites. As businesses grow older, their sales multiple tends to increase, which we expected based on our knowledge of the growth factors of these monetization models (such as affiliate and Adsense sites). We also found that two years was the typical entry point for content site buyers.

The two-year mark is a happy medium at which sites can show proof of their profitability and also potential for growth. If you want to sell your affiliate site, a good rule of thumb is to wait until you have at least two years of history.

How does this compare to e-commerce? Let’s see if and how the trends differ.

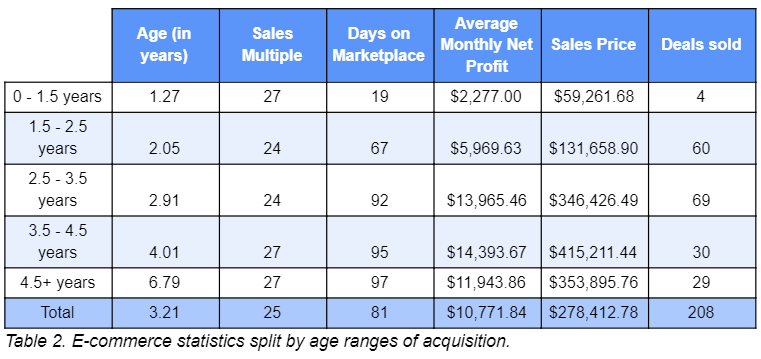

E-commerce Businesses

Like content sites, e-commerce businesses also show a slight positive association between age and sales multiple, as seen in this graph. However, you may notice that the youngest businesses have a very high sales multiple, which decreases slightly for a couple years before increasing again from 3.5 years on.

A few businesses about one year and three months old were acquired. Their sales multiple was particularly high, which may be due to these businesses’ position in profitable niches or a large volume of sales in a short time that is unrelated to their age.

Creating a Strong E-commerce Brand Takes Time

Three-year-old businesses attracted the widest range of buyers.

By that point, business owners have had time to build a strong brand, which is crucial to scaling e-commerce companies.

At the heart of a strong brand is a good product. After three years, owners have tested and found a good product range that works for their audience. If a brand’s products have a strong sales performance and a high average rating, some of them may receive Amazon Choice badges as a recognition of quality if they’re an Amazon FBA business.

Another desirable asset is to be enrolled in the Amazon Brand Registry 2.0 program. This makes an FBA brand’s products eligible for Amazon Prime, which can seriously influence a customer’s choice between two similarly priced products.

Amazon Prime eligibility and high product ratings help to build a defensible “moat” around a business.

Owners of mature e-commerce brands have been able to create streamlined operations and standard operating procedures (SOPs) to make their business as hands-off as possible.

Turnkey solutions are highly attractive, no matter the business model. A hands-off e-commerce business that requires as little time-consuming work as possible is even more desirable because of all the moving parts the owner would otherwise need to manage.

Successful FBA and e-commerce owners usually hire a reliable freight forwarder to manage third party logistics (3PL) services. Then, they’re concerned mainly with managing Amazon pay-per-click (PPC) campaigns and monitoring inventory levels. It’s not unusual for owners of older businesses to spend five hours per week or less.

It’s also worth noting that buyers can see proof of a steady stream of revenue with at least three and a half years of data to view. Consistent sales mean competitors haven’t squeezed margins, and the business hasn’t relied on undercutting the competition’s prices.

So what have we learned about e-commerce? The stats align with our view that older businesses with SOPs and stronger brands are more valuable. Of course, there are other factors that go into the valuations of e-commerce businesses for sale, but age remains an important part of the mix.

Other

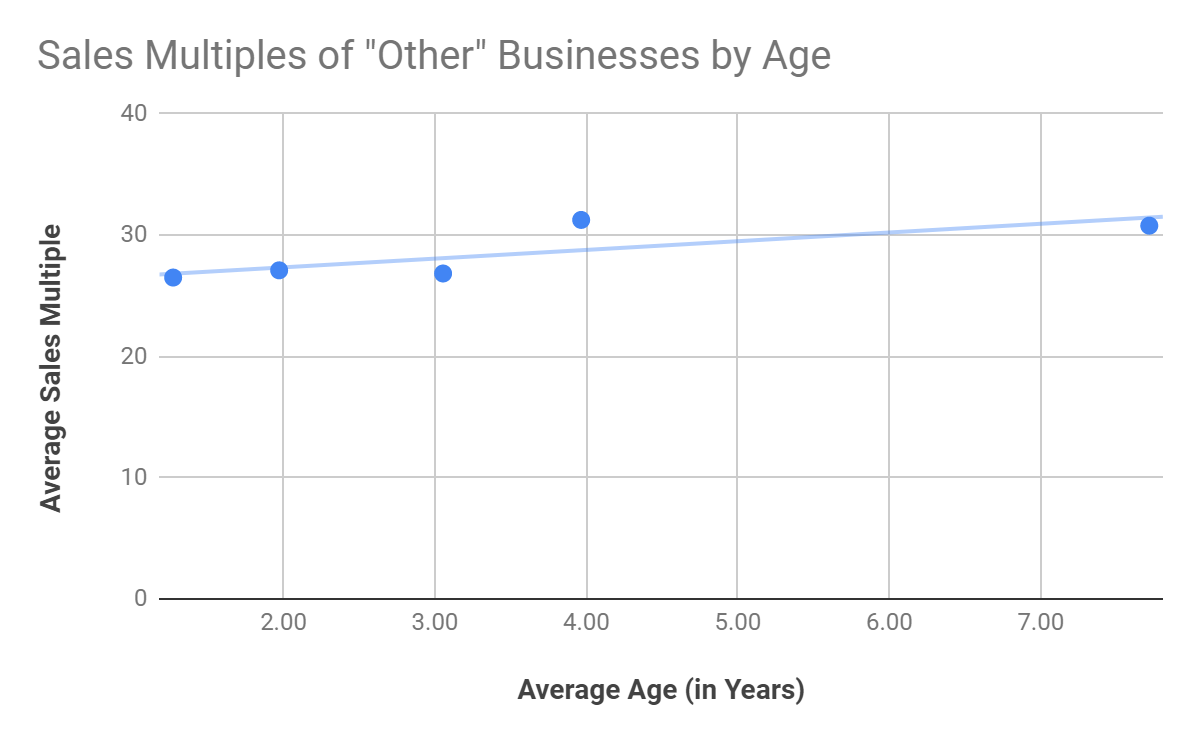

Last but not least, we arrive at the category of “other” businesses. Like the categories before it, the trend of increased value with age holds true.

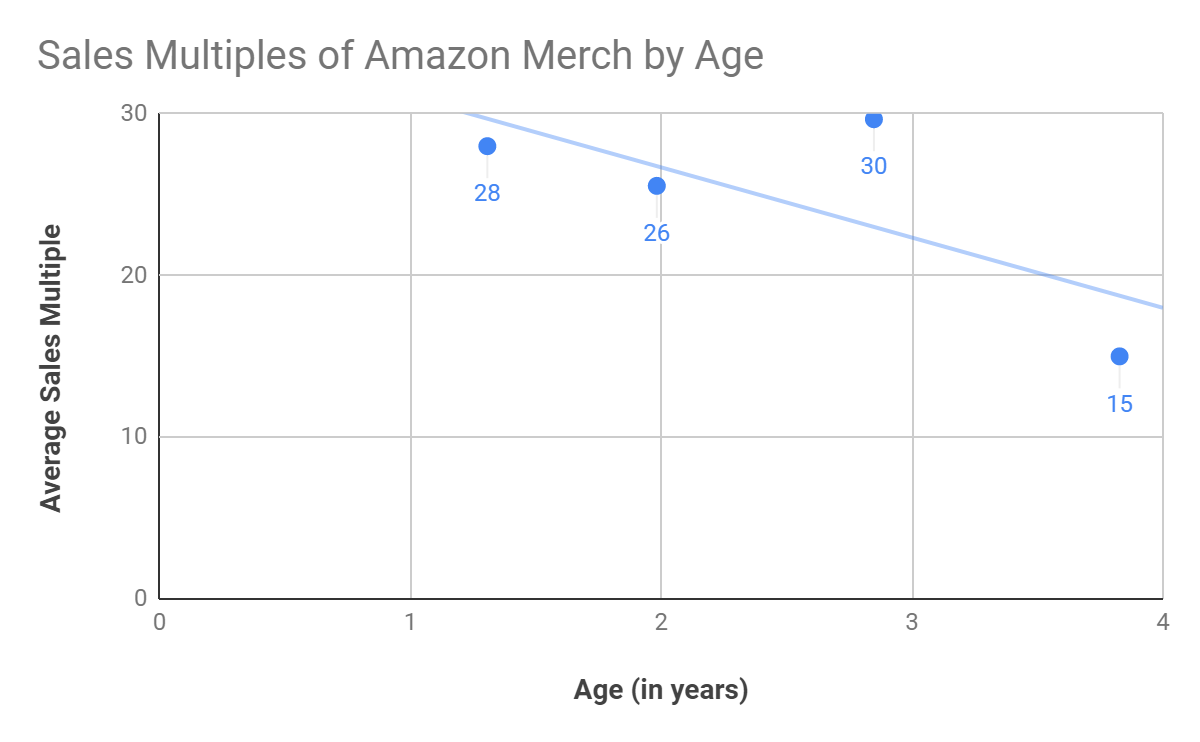

However, this category encompasses many different models, so the data can be confusing to analyze in detail. We’ll focus on the two models with the most sales (Amazon Merch and Software as a Service [SaaS]) in this category.

Amazon Merch

Amazon Merch

However, that doesn’t mean it isn’t an attractive monetization model for buyers. Creative entrepreneurs who want a hands-off business would benefit from entering this space, as Amazon does the heavy lifting in terms of creating the product and fulfilling orders.

Some factors that can hamper an Amazon Merch business’s sales multiple are copyright infringement and seasonality.

Younger businesses with less exposure and experience are at risk of receiving warnings and having designs taken down if Amazon believes one of your listings violates copyright standards.

If an account receives too many copyright warnings, it can be banned, so owners need to do their due diligence on designs and what Amazon considers copyright infringement.

Even if a brand’s designs are original and at low risk of copyright infringement, a store’s sales multiple may be lower if its products make most of their sales in specific months year after year.

Fewer sales outside these peak periods can affect a store’s ability to move up tiers and upload more designs.

This means it will have fewer products to display, which makes it difficult to increase overall revenue and, in turn, lowers a business’s scalability.

The sweet spot for an Amazon Merch business’s age is around two years, the point at which most Amazon Merch acquisitions occurred in the past two years.

Two years of data gives some insight into whether a company is affected by seasonality and if monthly profits are on an upward trend. You can check out our Amazon merch businesses for sale here.

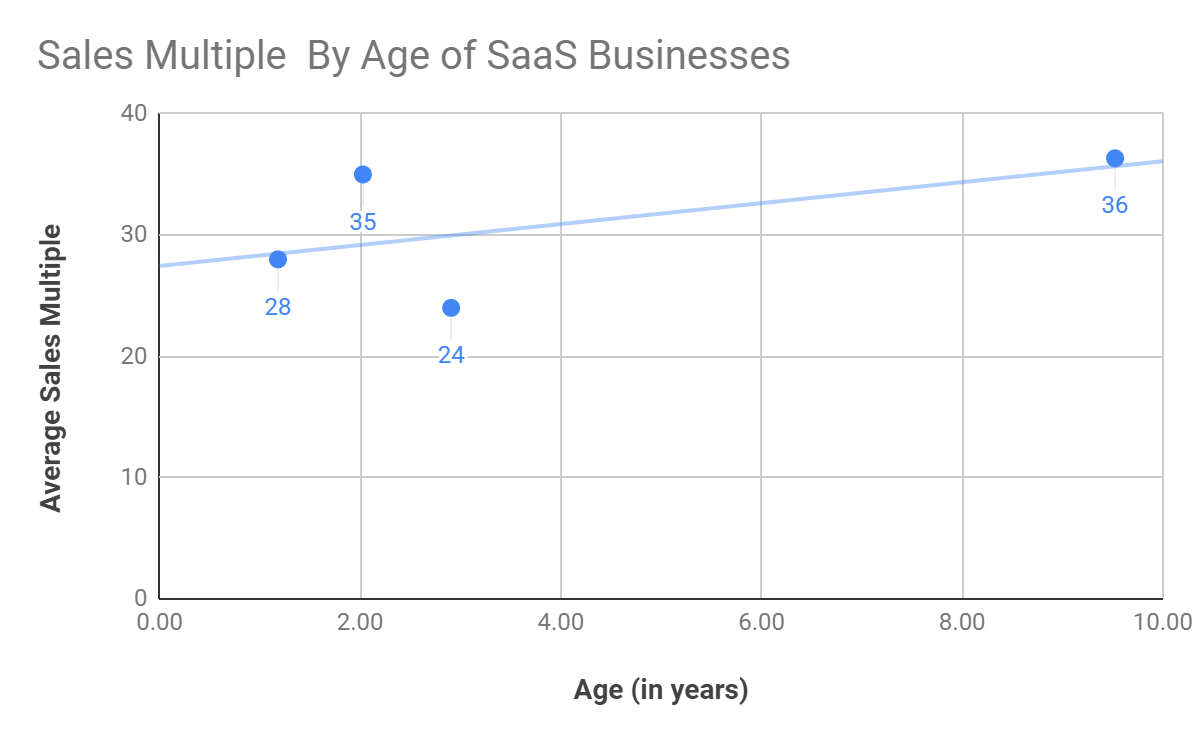

Software as a Service (SaaS)

This trend aligns with our understanding that a mature and profitable SaaS product reflects the business’s sustainability, transferability, and scalability, all important factors in understanding how SaaS valuations work.

An older business has had the opportunity to demonstrate that its product and pricing plans are sustainable, making it easier for buyers to forecast its potential profits.

Similarly to previous categories, SaaS businesses at least two years old are the preferred acquisition for a couple of key reasons.

For one, SaaS owners want to keep their churn rate as low as possible.

Older SaaS businesses tend to have lower churn rates because they’ve identified their product’s target audience. Knowing who to sell to makes future marketing decisions much easier and reduces an owner’s workload. Younger businesses naturally have higher churn rates as they focus on retaining customers who are a product–market fit.

Another benefit of an older company is having the time to create a source code with good documentation.

Putting the source code through rigorous testing takes time, but it ensures the SaaS product launches smoothly and easily on a variety of operating systems. Younger businesses don’t have this luxury, which likely affects the sales multiple.

It’s worth noting that younger businesses still sell for similar or slightly lower multiples, but they appeal to investors with a higher risk threshold.

Our data shows that time gives SaaS businesses an advantage, allowing them to implement SOPs and improve their product in order to scale. Using that time wisely to work on the software creates more leverage for a higher valuation when it’s time to sell your SaaS business.

Age Matters

The general finding for all categories (content, e-commerce, and others) is that the sales multiple increases are correlated as a business grows older.

Several universal reasons can explain this observation, at least in part.

For one, an aged domain is more trustworthy than a younger business in Google’s eyes, and it becomes easier to rank for keywords over time. An older business’s age also proves that it’s enduringly profitable and has survived changes in Google algorithms and has weathered storms in general as a business.

Another aspect of a business’s endurance is whether it is seasonal, and we get a better sense of seasonality when more data is available.

Spikes in revenue and profit seen over 12 months alone cannot predict seasonality because other factors may be at play in the first year. On the other hand, if the same pattern repeats across three years of financial data, the business is likely to be seasonal.

Our ability to accurately evaluate a business also applies in the opposite case.

If certain months had a poorer sales performance that wasn’t repeated in other years, something unforeseen, such as inventory issues, personal issues, or a lack of maintenance, may have caused it.

Taking into account these exceptional circumstances helps us rule out seasonality.

Many factors go into working out a business’s sales multiple, and age is just one. For this reason, it was surprising to observe that two years is the minimum age preferred by the majority of buyers for businesses in all categories.

At least two years of financial data helps buyers decide if a business is sustainable and has potential to grow.

While Empire Flippers vets businesses thoroughly, we give buyers the tools to perform their own due diligence as well within their free Empire Flippers account. This increases buyers’ trust, as they can crunch the numbers themselves before deciding whether to make an offer.

Whether or not you’re considering selling your business, we recommend all entrepreneurs enter their ventures with the mindset of preparing their business for sale.

The next section explains why…

Prepare to Sell from the Very Beginning

Robert Kiyosaki famously said you should want to work “on” your business, not “in” your business.

We interpret his words to mean that people look to buy businesses, not jobs.

When an owner prepares their business for sale, they adopt the mindset of finding turnkey solutions, so potential buyers know they could spend minimal time working on the business.

Sellers will often ask themselves, “Would I buy this business?” to identify areas of concern for buyers. That mindset helps to optimize operations and reduce the number of time-consuming jobs to manage.

In addition to streamlining their company’s workflow, owners can think about what circumstances would make them seriously consider selling their business.

They can set a list of criteria that, if met, signal it’s time to consider selling.

These criteria could include a minimum price threshold, the lowest acceptable average monthly net profit, or even whether the economy is shrinking or expanding.

When owners want to sell, they can either find a buyer and negotiate a private sale or use a broker to facilitate the deal.

Private sales can save money on commission fees, compared to using a broker.

However, sellers forego some security benefits of a good broker. Not only do brokers help negotiate the deal, they protect a business’s details, provide a valuation of the brand based on years of experience, and offer reversal protection when a buyer violates a contract.

We’ve brokered over 1,100 deals in a variety of niches and know how to make a deal as frictionless for all parties as possible. You can see how our process works here if you like.

One of the factors that most distinguishes us from other brokers is our transparency.

We also facilitate the smooth migration of a business’s virtual assets, which can be tricky if a site has many moving parts.

We’re here to help if you have any questions. Schedule a call with our team of business analysts to find out your business’s worth—for free.

Whether you choose to use a broker or go for a private deal, don’t feel pressured to pull the trigger and put your business up for sale.

The right time will come to sell. Before that opportunity arises, focus on optimizing your business into a turnkey solution.

Good things certainly come to those who wait.

Amazon Merch

Amazon Merch