What Are the Average Churn Rates for SaaS and How to Decrease Yours

We recently talked about Software as a Service (SaaS) companies and how many businesses, both online and physical, have come to rely heavily on the services they provide in order to manage their day-to-day operations.

Which is why many entrepreneurs are excited by the prospect of creating a SaaS business. The idea of having a continuous stream of monthly or yearly revenue from loyal subscribers sounds like a dream, but the SaaS business model suffers from its own challenges — the biggest being churn.

The same way the only two certainties in life are death and taxes, in the SaaS world there is only one certainty, and it’s churn.

We’re going to run through what churn is, how to calculate it, why it’s bad for your business, and what you can do about it to make sure you can build a sustainable long-term SaaS operation.

Churn is a big, complicated topic, so we’ve tried to keep the math to a minimum.

Let’s dive into it…

What Is Churn?

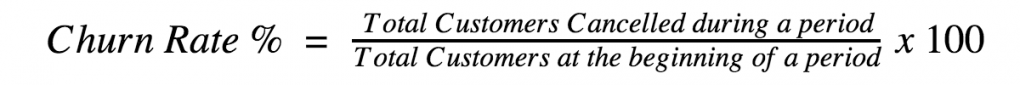

Churn is the rate (in percentage) at which SaaS customers cancel their recurring subscriptions to the service in a given time frame. Churn can be calculated in a number of ways, but in its simplest form, it is stated as the number of customers canceling during a period (month, quarter or year) divided by the number of customers at the beginning of that same period.

Churn is a key metric for any SaaS business for tracking its past performance as well as forecasting future revenue.

For a SaaS company to stay afloat, its growth rate (new customers subscribing) has to outpace its churn rate (percentage of customers canceling).

There are many factors that can affect your churn rate and the accuracy of the calculations, such as having too few customers, variations in contract renewal periods, and many others. If you really want to dive in deep, check out Joel’s article from Chaotic Flow for a full breakdown of all the different calculations and how to make sure they are accurate for your situation.

Why Is Churn Bad?

A big reason why churn is the dominant SaaS metric above all others is that it has a major negative impact on both the profitability of the business as well as the overall valuation of the business if it were to sell or obtain funding.

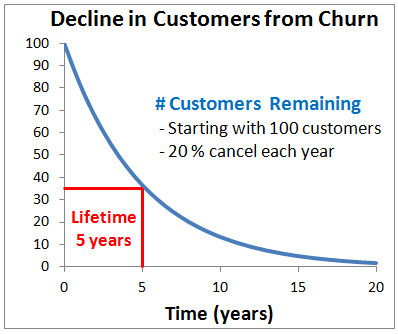

Churn also tends to increase as the customer base increases. If you were to use a graph to illustrate what churn looks like, it typically follows a negative exponential distribution, which makes overcoming churn very difficult to achieve.

The long and short of it is that you spend tons of money on getting new customers for your SaaS and the only way to recover this cost is over time, which is why it’s important that your customers stay subscribed to your service as long as possible.

The time a customer sticks around is referred to as Life-Time Value (or LTV) and is basically calculated like this:

A lower churn rate usually means an increase in the length of time that your customer continues to pay for your service, resulting in a longer LTV. This is a good sign of a stable and profitable SaaS business and increases its value.

Pro tip: Be aware that if your customer churn rate is either monthly or yearly, then your LTV will be based on that time period.

For Example: If your monthly churn is 1.5 percent, then using the above calculation 1/0.015 gives you a 67-month LTV. If you your annual churns is 32 percent, then 1/0.32 gives you just over three years.

Customer Churn vs. MRR Churn

Just to add more confusion to the mix, it’s important to note that there are two types of churn you need to be aware of when running a SaaS — customer churn and revenue churn.

Customer Churn — refers to the number of customers that have discontinued their subscription on a given period. This value is calculated using the formula shown earlier.

Revenue Churn — is how much those lost customers represent in revenue. This value is calculated by using the same formula as customer churn but substituting the number of customers with your monthly recurring revenue (MRR).

For example, your SaaS has two products: one is $20 a month, and the other is $300 a month. If you were to lose 10 customers who were paying $20 a month, it would still be preferable than if you lost a single customer at $300 a month.

MRR churn is just as important (if not more so) than your customer churn rate because it gives you a better picture of your business’s financial health.

Negative Churn

Negative churn is when the revenue earned from your existing customer base (through expansions, up-sells, and/or cross-sells) exceeds the revenue that you are losing because of churn. To achieve negative churn, you need do one of the following:

- Up-sell — where your customers upgrade to a more expensive, better-featured pricing tier for your product.

- Cross-sell — where customers purchase other products and services in addition to their current plan.

- Expansions — where your pricing model is based on increased usage.

Negative churn is notoriously difficult to achieve — if you are in the early stages of running your SaaS business, it’s more important to focus on getting more people onto your platform and using your products with simple pricing models. You can worry about negative churn much later once you have a stable user base.

Reasons Why Customers Churn

There are a variety of reasons why customers churn, and there is no guarantee a customer will use your service indefinitely, which makes it impossible to eliminate churn entirely.

Here are just some reasons why customers may choose to stop using your SaaS product, some of which are completely out of your control:

- Customer can’t afford it — they may have run out of money, no longer have the budget available, or your price has increased to a point where it’s too expensive.

- No value to the customer — they no longer see or understand the value proposition of your product for their business.

- Doesn’t/no longer meets expectations — either your product doesn’t do what they are expecting, is poor quality, or is missing key features your customer needs.

- Bad customer service — you can have the greatest product in the world, but if your customer service is terrible, they will go elsewhere; which can lead to…

- Switching to a competitor’s product — because their product meets the criteria above that your product may not provide.

- Customer bought out or acquired — when businesses are acquired by a new owner, be it an individual or another company, they may stop using your service because they prefer using a different one.

We’ve seen reasons why customers may churn, but let’s take a look at what’s considered an acceptable churn rate for an SaaS business.

Average Churn Rates

In an ideal world, your churn rate should be as low as possible; however, that’s not particularly useful when trying to assess whether your SaaS is doing well or heading for trouble.

There are two main factors that affect if something is an ‘acceptable’ churn rate:

- Who your target customer is (individuals, small business owners, medium or large enterprises).

- If your SaaS is a startup/new to market or well established.

Bear in mind that if your SaaS is a startup and in its first 12-24 months of operation, you will typically be dealing with higher than normal churn rates and fluctuations in your customer LTV as you iterate and improve your product over time. As your business grows and the product improves, your churn rate tends to drop and stabilize.

Individuals and Small Businesses

It’s hard to give an average churn rate for an SaaS targeting individual operators and very small businesses (think mom and pop operators). Even if your service is extremely good and valuable to your customer, the volatility in this market means there’s a good chance you’ll have a high churn rate.

The challenge with this type of customer is that there is not as much of an opportunity to upsell them unless they are scaling — which is one way you can help lower your churn rate. These micro-enterprises are also at a much higher risk of shutting down or completely changing their business direction, which makes it difficult to effectively reduce your churn rate.

Another thing to consider is that switching costs (the difficulty and expense of a business to change platforms) are usually pretty low, making it relatively easy to change to a competitor’s service.

Small to Medium Enterprise

Small to Medium Businesses/Enterprises (SMB/SME) are usually more established, and as a result, it is more likely you’ll get a longer customer LTV with them, reducing your churn.

If your target market is the SMB/SME space, monthly churn rates can be anywhere between 3-7 percent, although many argue that even this number is too high and that you should have an annual churn rate of less than 10 percent. For example, assuming your monthly churn rate is, on average, three percent, when you annualize the figure, it becomes just over 30 percent — higher than the recommended 10 percent.

Large-Scale Enterprise

If you are targeting large enterprise customers with products which cost in the 4-figure range or higher, you should expect churn rates as low as one percent, in part because high dollar value SaaS products usually have higher setup costs and switching fees can be prohibitive.

Also, larger enterprises tend to be a lot slower to change and more likely to keep using the same product. However, this is assuming you are already a well established SaaS. You need to bear in mind that if you are a startup targeting high dollar value clients, you are still likely to experience higher churn rates in your first year or two of operation.

So if you are in the early stages of starting your SaaS or serve a small business owner with a low price point product, you can expect your churn rates to be much higher due to high-risk factors outside of your control as well as low switching costs for customers. But if you are targeting the enterprise space, you can expect lower churn, as more established businesses tend to stick to what they know and are comfortable with, and are concerned about potentially high switching costs.

How to Reduce Your Churn Rate

Even if you are an early stage startup, reducing your churn rate should be a priority. High churn can be indicative of your product not meeting your customers’ expectations.

In order to address a high churn rate, you need to understand your customers, track their engagement and satisfaction, and aim to fix any problems or issues that are under your direct control.

When you spend time analyzing why your customers are churning, you can gain insights you may not have considered in the past, and those insights could lead to a new product roadmap — one where you add a new range of products or features. Adding these new features and meeting your customers’ needs can effectively help reduce your churn rate.

Here are some things you can do to help reduce your churn rate:

Improve your customer service — Your customer support team is on the front lines talking to your customers every day. By investing in the selection and training of the right people for your customer support team, not only will it increase customer satisfaction and retention, but you can gain interesting insights into what your customers really think about your product.

Speak to your customers — Reach out to your customers and ask them what you want to know directly — either by phone or email. If they are canceling, ask them why. You as the CEO should reach out personally, especially in the early stages. For one thing, gathering this sort of information is too important to delegate to just anybody; plus, you are more likely to have people willing to talk to the CEO instead a customer satisfaction representative — it makes your customers feel they’re being personally attended to.

Track and measure your customer engagement — This action is a little more technical, but if you get your development team to log every time a customer uses a feature, you can measure not only how often they use the feature but in what way they use it. Tracking these metrics will help you figure out which customers are getting a ton of value using your product. By figuring out who hasn’t used it in a while, you can reach out and re-engage them before they decide to unsubscribe

Improve your product by increasing its stickiness factor — When a tool is integral to somebody’s workflow, where they can’t operate without it, it is considered to have a high stickiness factor. You have a sticky tool when you offer a feature nobody else in the market has or if your product becomes the core repository for a customer’s critical data. You should be able to work this metric out through a combination of usage data and surveying your customer base. These sticky factors make it harder for a customer to switch, and can reduce your churn and increase LTV.

Improve your customer onboarding — A big reason why customers cancel their subscriptions is because it’s too complicated to use your product. Some products need to be inherently complex; however, you can reduce your churn rate by improving your onboarding process. One way to create a better process is to set up a series of training webinars using tools like GoToWebinar, where you walk groups of people through your product and how to use it while also having the ability to answer questions directly. You can also create a free video or email course where your customers can work through step by step training and learn what they need to get the most out of the tool. If your product is a high-end, enterprise-grade product, you may do one-on-one consultations or even have consultants visit your clients at their offices.

Test different pricing options — One way to test options is to offer annual-only plans where you require a longer-term commitment from customers, which can get people on the platform long enough that they decide to stick around. However, this path may not resolve your churn issue if your product isn’t any good or your onboarding is weak. You may also adjust your pricing or feature sets at certain tiers to see if your price point is either too high or doesn’t have enough features.

Avoid the Burn and Reduce Your Churn…

Well there you have it — churn in a nutshell.

Churn is a big and complicated topic, but once you wrap your head around it, you’ll have a much better idea of which direction your business is heading and if it can maintain its profitability over the long term.

If you can reduce your churn, you can boost the profitability and value of your SaaS business. If you’re a new SaaS business, especially in the first 12 months, you can expect higher churn rates than normal. However, you should still aim to reduce your churn as a priority. The key takeaway here is a low churn rate is beneficial for any SaaS regardless of its size.

So long as you focus on growing your user base, and your growth can outpace your churn while you keep improving your product to better serve your customers, you should be able to reduce your churn naturally as your business stabilizes.

Are your churn rates in line with what we’ve talked about here? Let us know in the comments below.

Photo credit: ASphoto777