Our Q4 and 2017 Year in Review Report

2017 went by in a breeze.

We saw 2017 as another year of HUGE growth for our brokerage. This was our biggest year by far, and all indications show that 2018 will be even bigger as we wrap up midway through Q1 2018.

Since our first 7-figure deal closed, we have consistently been seeing more 7-figure businesses being submitted to our marketplace. This is a huge win for us. As a brokerage, you’re always playing a bit of the chicken and the egg game; no 7-figure business owner wants to use your brokerage to sell their business if you haven’t sold a 7-figure business.

Now that we have successfully done this feat more than once, we’re starting to show that we are up to the challenge of serving these sellers and buyers. Our first 7-figure business took us eight months to sell, and now we’ve recently sold one in less than a month’s time (we should have a case study on that coming soon).

We accomplished a lot this year, so let’s dive into what we did and what the plans for the future are as we grow our team, hone our process, and level up our brand.

It goes without saying that we would not be here if it wasn’t for all of you in our audience. It is you that keeps putting your trust in us as the best solution for buying and selling online businesses, and that allows us to keep growing.

For that, we thank you.

While this report serves as a bit of bragging rights for us, we also truly hope this inspires YOU to build something even better in 2018 and soar to new heights. After all, everything we do always comes back down to helping you achieve your goals, whether they are professional or personal.

Alright, let’s dive into it!

Executive Summary – Q4 2017 and Annual Report

Q4 2017 and Annual Review

Here is a look at deals for the quarter:

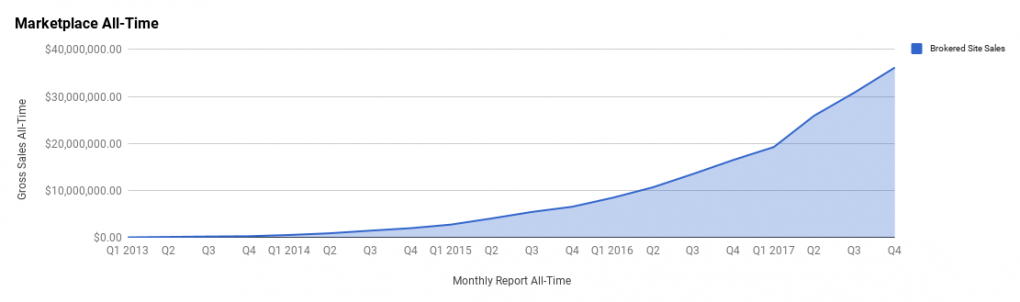

Here is a look at our all-time marketplace growth quarter over quarter:

Q4 and Annual Business Data for 2017

Total Team Members: 26

Customer Heroes: 14

Managers: 3

Employees: 6

Apprentices: 0

Contractors: 5

Email Subscribers: 46,764

Q4 Site Visits: 235,560

2017 Annual Site Visits: 890,528

Q4 Revenue

Brokered Site Sales: $5,328,905.75

Listing Fees: $14,444.00

Investor Program Raised: $0.00

Investor Program Overall Earnings: $0.00

Average Deal Size: $115,845

Total: $5,343,485.85

Q4 Gross Earnings

Brokered Site Earnings: $617,228.34

Listing Fees: $14,444.00

Investor Program EF Earnings: $0.00

Additional Revenue: $136.10

Total: $667,099.98

2017 Annual Revenue

Brokered Site Sales: $19,684,534.29

Listing Fees: $51,024.00

Investor Program Raised: $0.00

Investor Program Overall Earnings (Actual): $44,132.29

Additional Revenue: $114.16

Average Deal Size: $96,932

Total: $19,790,905.05

2017 Annual Gross Earnings

Brokered Site Earnings: $2,298,452.08

Listing Fees: $51,024.00

Investor Program EF Earnings (Actual): $11,224.58

Additional Revenue: $328.07

Total: $2,361,028.73

Revenue Breakdown

Let’s dive into these numbers a little bit deeper to analyze what was happening at the brokerage during 2017.

Brokered Site Revenue

We brokered 46 deals in Q4 for $5,328,905.75 revenue.

That puts our total annual revenue at $19,790,905.05, just about $210,000 shy of our goal of $20 million. We’ve continued to set aggressive goals for ourselves. Every time we set these goals, there is a bit of a stress-test that everyone at the brokerage goes through, thinking that they’re unachievable, but then… lo’ and behold, we get frustratingly close to that mark, landing just beneath them.

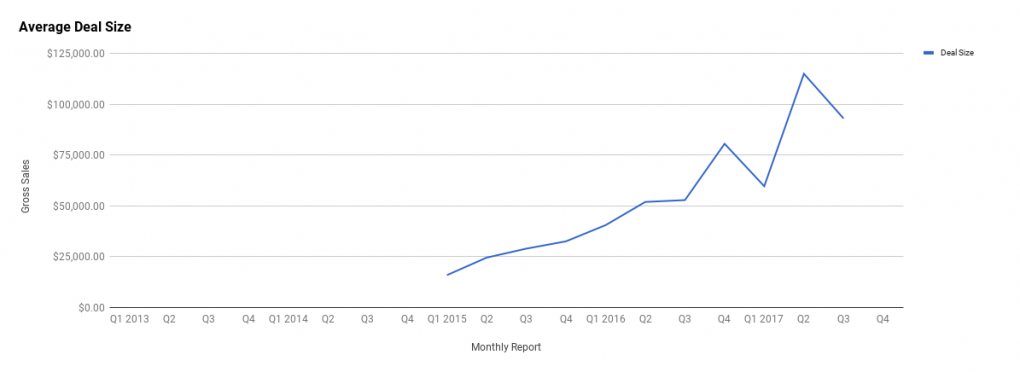

Our average deal size saw an uptick in Q4 from Q3 as we went back up to $115,845 being the average deal size, a similar number to Q2 numbers. You can check our deal size growth in this chart below:

In Q3, we had an average deal size of $93,093.61, which was lower than the $115,103.62 deal size we had in Q2. It is great to see that in Q4 we beat out Q2 in terms of deal size by a little bit. This fact gives us faith that Q2 wasn’t an anomaly, but rather the start of a trend.

As we continue brokering bigger businesses, we will likely see this average deal size continue shooting up in swings. We only need to sell a couple of 7-figure businesses to skew this average upwards, and we are now starting to see many entrepreneurs trust us in helping them either sell or purchase a 7-figure deal.

Since our first 7-figure deal was sold on our marketplace in Q2, we’ve been able to sell others and list more. You can check out our current 7-figure businesses for sale below:

It’s safe to say that, when people claim Empire Flippers only has the “small deals,” that means they haven’t visited our marketplace or stayed up to date on our massive growth. Our goal has always been to become the leader in buying, selling, and investing in online businesses, and now we are firmly there when it comes to smaller businesses — and soon bigger businesses as well.

Right now we are in an awkward position with our goals just because of where we are as a company. We are going through some growing pains; we just started seeing bigger businesses on our marketplace, which means in terms of our goal setting, one brokered business right now can often make or break our goals.

In Q4, we actually saw this happen when a sizable earn-out payment didn’t come through. These situations are super rare, and when they do occur with a large business, it definitely hurts our ability to reach our goals.

Fortunately, this kind of loss shouldn’t be an ongoing issue. As we continue to become the go-to choice for entrepreneurs looking to sell their bigger enterprises, we will eventually be back on a more predictable revenue trajectory. These income spikes and dips are similar to when we started selling businesses in the $40-100k range. Eventually, our process beat out our competitors as being the best, and we started seeing a FLOOD of businesses priced at that level coming to our marketplace.

Our prediction is that we will see the same flood happen with 7-figure businesses and beyond as we continue to scale up our team, processes, and marketing, which will lessen the impact one business has on us reaching our goals in a massive way.

Website Listing Fees

Listing fees have never been a huge earner for us. They are mainly there to filter out people who are not serious about selling their businesses. We find that a $297 entry fee to our marketplace for first-time sellers is a great filter.

Some people we have talked to, especially at conferences, will claim their businesses are so huge that they shouldn’t have to pay the $297 fee. Our reply is if their business really is so big, then a $297 charge should be a drop in the bucket for them. For repeat sellers, we are still charging a $97 listing fee, which helps to cover our costs when it comes to actually vetting the businesses before we put them live on our marketplace.

In Q4, we made $14,444.00 in listing fees, which matches just under selling one extra $100,000 business. We made a total of $51,024.00 for the 2017 year, which is similar to a commission that we would get on a $340k business.

Investor Program

This will officially be the last quarterly report to feature our Investor Program section, and only because this is an annual report. We actually made no money from this arm of our business in the latter half of 2017 since we sold off all of these assets to one of our portfolio managers.

Unfortunately, the investor program just wasn’t for us. Our first rendition was not set up to succeed correctly, and our second rendition of the program never really took off due to getting bogged down in finding the correct legal structure for the business.

We were dumping all of these man-hours into the program to no real success. In the end, we decided our time was far better spent in continuing to grow the brokerage to new heights of success and sold off the remaining assets in our investor program.

Just to be clear, we still think this is a FANTASTIC business model. It is just a business model that is not for us, at least for the time being.

Additional Revenue

Nothing of significance to report here. The majority of this revenue comes from legacy affiliate deals from years ago.

Traffic and Audience

Below is a breakdown of our website traffic, podcast downloads, and email lists.

Blog Traffic and Analytics

As you can see, our traffic is up from last quarter. We went from 203,751 to 235,560 visitors. We did do a little Reddit AMA in Q4, which is where you can see that spike in the analytics. I say little because, unlike the one we did in Q2, we didn’t make it to the home page of Reddit. But we were also doing the AMA in a much less trafficked subreddit than the iAMA subreddit.

Honestly, it’s great news that our traffic is up without any too-dramatic spikes. It shows that our content strategy is working, and we are seeing more traffic come in as “routine” traffic rather than from a special event like a Reddit AM, which means less work for similar amounts of leads opting into our various funnels.

Q4 2017 Google Analytics

Here is a snapshot of ALL traffic we got in Q4 2017:

Here is a snapshot of our annual traffic:

2017 Google Analytics

That BIG spike right around April is from the Reddit AMA where we got to position #11 on the Reddit homepage. We saw a huge boost in traffic from this event, obviously, but even more importantly, we were able to convert some of that traffic into real deals being bought and sold on our marketplace.

Since the Reddit AMA was in the iAMA subreddit, we were also exposed to a much more mainstream audience than where we typically hang out. One thing we see is that so many people, even people in the online business space, have no clue they can buy or sell online businesses.

In 2018, we hope to reach even more of these people and grow our industry overall, rather than just keep growing current market share, by getting bigger media mentions and content pieces published.

For reference, here is a look at our 2016 Google Analytics:

As you can see, we’ve gotten significantly MORE people to our website than last year. Not just new people but getting our audience to come back to our site over and over again. We have increased our average session as well, meaning people are spending more time on our website too.

In 2018, we hope to increase this number again in big ways!

Content in Q4 2017

Content remains one of our biggest investments and pay-offs when it comes to our marketing strategy. It gets us more visibility in Google, it allows us to move people deeper into our marketing funnel, and even helps them cross the finish line when they’re in our sales funnel by having our sales team point good prospects to relevant content.

Over the years, we’ve published dozens of high-quality content pieces. We have everything from how-tos, case studies, and even white papers where we analyzed in-house data to see where the markets are going, such as in this one we did for Amazon FBA recently.

That being said, let’s take a look at our most viewed pages, marketplace listings, and pieces of content we published in Q4 and throughout 2017.

Top Content in Q4

Here are our Top 3 Most Visited Pages on Empire Flippers:

Here are our Top 3 Most Viewed Listings:

- Listing 43837 (PENDING!)

- Listing 40999

- Listing 40162

Here are our Top 3 Most Viewed Pieces of Content:

- 11 Most Popular Online Business Models

- How to Start an FBA Business

- A Little Known Method for Removing Negative Reviews on Amazon FBA Listings

Top Annual Content in 2017

Here are our Top 3 Most Visited Pages on Empire Flippers:

Here are our Top 3 Most Viewed Listings:

- Listing 40612 (SOLD!)

- Listing 40926

- Listing 40795

Here are our Top 3 Most Viewed Pieces of Content:

- 11 Most Popular Online Business Models

- Debate: Dropshipping vs. Amazon FBA

- A Little Known Method for Removing Negative Reviews from Amazon FBA Listings

Podcast Downloads

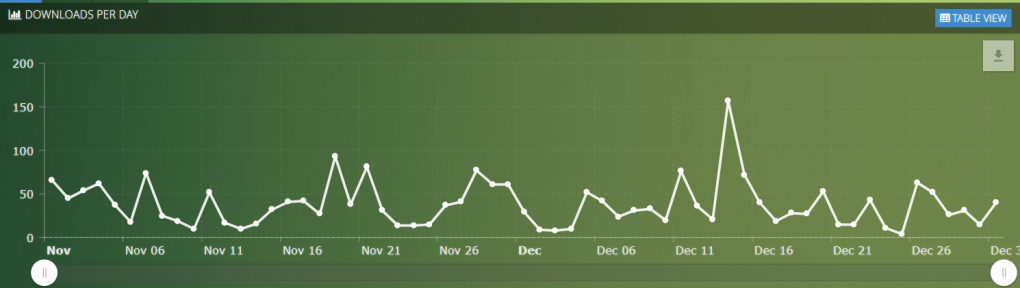

People love our podcasts, and it remains a strong content arm for us. Alas, in Q4, we did see quite a significant dip in downloads as we once again didn’t publish that many podcasts from our Empire Flippers Show and Web Equity Show.

Sadly, our Digital Journey Podcast will be discontinued as well due to an unfortunate passing of our co-host Rob Fortney (more on that below).

In 2018, we are planning on doing more podcasts for the Empire Flipper Show and to also start Season 4 of The Web Equity Show. We’re pretty excited about the latter because we will be talking specifically about buying and selling 7-figure sites and putting together investment funds and portfolios with operators in place.

Here are the various download charts from our podcast shows:

The Empire Flippers Podcast

9,840 downloads

The Web Equity Show

2,312 downloads

The Digital Journey Show

5,285 downloads

Email and Contacts

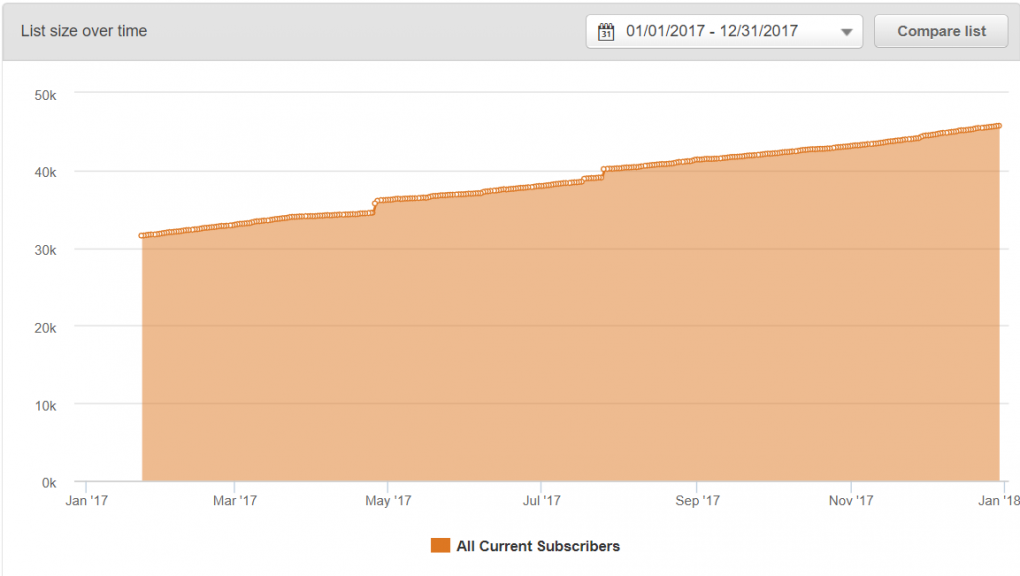

Email is one of our primary marketing channels, and with 46,764 active subscribers, we have a small army to whom we can promote our new business listings, content, and ideas.

They often say the money is in the list, and that old marketing mantra is 100 percent accurate.

In 2017, we revamped a few of our marketing funnels and started segmenting our lists on a more granular level than ever before. We also used Hubspot to start creating multiple different lead buckets represented by where the leads first came into our funnels (i.e., blogs, marketplace, podcasts, etc.).

Our goal here is to have our new sales team of Business Analysts call up these leads and see if we can’t convert even more people to our tried and true process. In addition, many of our email funnels are now helping sellers learn how they can become buyers. We found that often the best time to buy an online business is right after you sell one, since that is when you are the most liquid and have the strongest negotiation options open to you for creating a great deal structure.

Here is a graph showing our 46,764 current email subscribers and email growth overall during 2017.

We’ve segmented our lists into two major categories and from there have added subcategories based off where that lead is in our sales cycle. Whether they’re just starting the process of looking at our marketplace, have actually made a deposit, or have successfully bought a business, all three of these are the subcategories for people who are primarily interested in buying. On the selling side, we have subcategories for people who have just filled out our valuation tool, submitted their online business for sale, and have just sold their business with us.

If you would like to get relevant content regardless of where you are in your personal journey, you can select one of the two options below to get started.

Which One Are You Interested In?

Click Here to share your buying interests.

Click Here to share your selling interests.

Customer Experience

In 2017, we revamped our customer service operation in a significant way. Before 2017, our customer service team did everything, which caused a ton of issues in being able to communicate effectively with our clients.

We’ve since solved this problem by dividing our operations staff into three departments:

- Vetting

- Customer Service

- Migrations

Since April, we have had a dedicated staff in each of these departments that handle just their specific area of operations. This change was a huge help in achieving higher customer satisfaction and getting more deals done.

One thing we did see in Q4 was another critical point of failure in our operations. When our vetting supervisor left his role with us to pursue other opportunities, we realized that having just ONE vetting specialist was a big mistake. With only one vetting person, if they get sick or quit, or just want to take a vacation, then our entire system starts to break down. Our operations manager, Andy Allaway, had to do double time in handling both vettings and customer service, which at our current size is just way too much for one person to handle effectively.

Luckily, we got through this hard patch.

We realized this mistake, and it is a reason why in Q4 we put out a job application looking to hire vetting specialists specifically. Now in Q1, we have four new vetting specialists in training; this addition to our team will make the operations side of our business a lot smoother here on out.

Zendesk Support

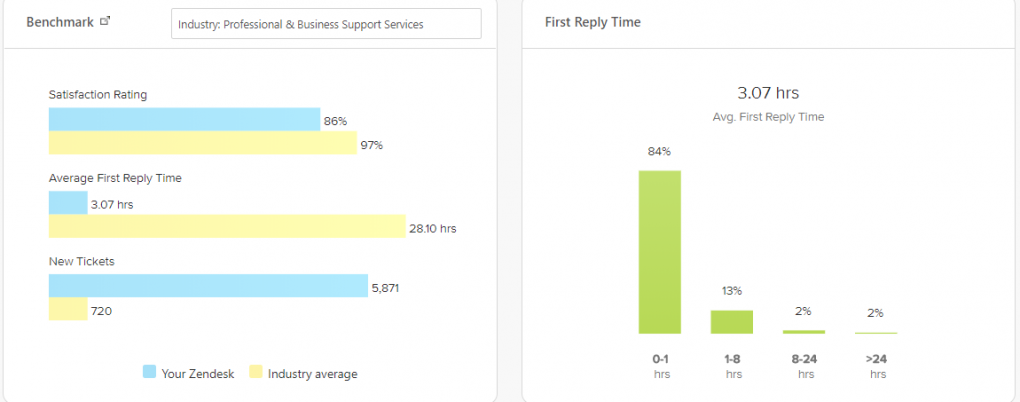

Here are our numbers for Q4 2017:

We saw our average first reply time fall by over an hour compared to Q3 numbers, despite the added pressure we had with our vetting supervisor resigning. This is great evidence suggesting that the new systems we’ve put into place can handle any temporary stress added to the system (whether from a larger influx of people reaching out to us or while we fill temporary vacancies with new employees).

Sadly, our satisfaction rating did drop from 90 percent to 86 percent in Q4. Most of that decrease can be attributed to our focus on getting vettings through in Q4 and interviewing new employees to fill the vetting role starting in 2018, leaving us less time to handle customer service as a whole.

Customer Feedback:

Q4 2017: 5,871 new tickets, 5,388 solved tickets, 277 good ratings, 45 bad ratings.

Customer feedback remains an important factor we take into consideration when it comes to how we can improve our business. In Q4, we received 277 good ratings compared to our 360 ratings last quarter. While this dip is unfortunate, it is still far above the mark of where we were in Q2 where we had just 128 good ratings.

Q4 and Q3 had a similar number of new ticket requests, with Q4 being slightly lower.

Here are a couple of screenshots of the feedback people gave us:

As you can see, a lot of the negative feedback consisted of our customers feeling like we didn’t communicate enough with them. Yet many of our good feedback comments praised our communications. We want all of our customers to feel like they have our attention, so we’re working on improving.

For us, this is a staffing issue more so than a process issue at this point. When we have enough staff to cover all the bases, our satisfaction score should go up. Now in Q1, with eight new hires, we think we’re going to see a lot less of this kind of negative feedback in 2018.

What Happened in Q4 2017?

A lot of stuff went down in Q4 2017!

In 2017, we saw ourselves become THE leader when it comes to selling Amazon FBA businesses. We also started rocking conferences and looked towards the future as we scaled up our operations in a BIG way.

Conferences were especially heavy in Q4, as it seems that is truly the “conference season.” We try to spread out our conference attendance over the year, but most of the big ones just seem to happen in the October to December time periods.

We were missing the boat on a major marketing channel in 2016 by not having a presence at these conferences. In 2017, having attended conferences around the world, we have seen much more interest in us as a serious contender in the brokerage space. In fact, multiple attendees told me personally that they didn’t realize Empire Flippers was so big when we came to these conferences.

One attendee happened to see us at THREE of these conferences back to back (he flew to Bangkok for DCBKK, then Las Vegas for Rhodium Weekend, and back to Thailand to attend the SEO Conference in Chiang Mai, hanging out with an Empire Flippers employee at every conference!).

Our team rose to the challenge though, and we flew across the world to various exotic locales to educate people about our business.

Scaling Our Vetting and Sales Team for 2018

In Q4 we listed two new hiring posts, one for our vetting team and one for our sales team.

Even though we have the MOST dealflow of any brokerage, we realized that vetting was a gigantic bottleneck for us. In the past, we always had just one person to do all the vetting. This fact caused a lot of stress on our systems, processes, and the vetting specialist.

We decided to bring on four new vetting specialists, not just to build in redundancy in case someone leaves us, but to also speed up the amount of listings we publish on our marketplace. We still have quite the backlog of online businesses going through our vetting process, but with our new specialists, we expect to see this backlog decrease significantly.

With these new hires, we should be announcing even more new businesses and opportunities on a regular basis for our audience. This growth will cement us as the leader when it comes to deal flow for high-end, profitable online businesses.

We also have an issue where we have too many leads for our sales team to call… which is a pretty great problem to have.

Our Business Advisors have been very busy setting up conference calls, helping sellers and buyers negotiate deals, and guiding new buyers to the perfect listing. This workflow means they haven’t been able to call several thousand leads that the marketing team has generated over the last few months. We see ourselves missing out on a big opportunity, which is why we hired four new Business Analysts who will act as junior salespeople for our team.

These Business Analysts will help close that gap so we can call every lead that comes through our marketing funnels; they will lead us to closing even more deals (and larger deals) in 2018.

If hiring eight new people didn’t already suggest we’re the biggest team in the industry, we are actually hiring for a NEW position in 2018. Along with scaling our sales and operations teams, we want to start seriously growing our marketing department as well.

That means we’re hiring a content marketing specialist that will be helping us continue to grow and be seen as the thought leaders when it comes to buying, selling, and investing in online businesses.

Know someone that fits the bill? Check out the hiring post here!

Medellin, Colombia Meet Up!

In November, we hosted our first ever Empire Flippers Meet Up in Medellin.

These Meet Ups are something we used to do three times a year. Since the rapid growth of our team though, we have reduced this number to just two Meet Ups per year. During every Meet Up, we get our management and staff together in an exotic locale to work hard, play hard, and connect with each other for anywhere between two weeks to a month.

The weather in Colombia was beautiful compared to the often scorching temperatures of Southeast Asia (something a lot of our team found super refreshing). It was great to get our growing team together to hash out plans for the future.

We had a two-day session going over our goals extensively and our plans for 2018. A big portion of those plans is doubling down on sponsoring and speaking at entrepreneurship conferences around the world. In 2018, we are looking to grow our presence at both ecommerce and SAAS conferences.

In addition to all the business talk, some of our guys enjoyed the Medellin countryside as they paraglided across the skies.

We Attended 5 Conferences in Q4 2017!

Chiang Mai SEO Conference 2017

In 2016 we sponsored Matt Diggity’s SEO Conference, and so we wanted to do it again because it was a great group of the “who’s who” in SEO. We love connecting with these influencers. Of course, we told Matt we would gladly sponsor his event again.

In typical Diggity fashion, Matt scaled up the conference from just 20 people to right around 500 attendees. 500 SEOs descended on Chiang Mai to talk SERPs, backlinking strategies, monetization, and more.

We even got in on the action with two separate talks at the event.

I had the chance to speak at a lead-up event where I went into detail about what it looks like selling a six-figure affiliate business. Then Justin and I did a whirlwind talk on the main stage, where we told people what kind of bases they should cover if they’re seriously looking to sell.

One thing that was surprising to us was just how few people thought they could sell sites that had PBN links on it. While PBNs do add risk, there are definitely a multitude of buyers out there that are totally okay with buying an asset that has PBN links attached to them.

You can check out my Food4Thought presentation below:

Every year, we sponsor DCBKK. DCBKK is made up of location independent entrepreneurs, freelancers, and remote workers that meet every year in Bangkok to network and learn more about online business, and to connect with other members of the Dynamite Circle. We had members from our operations, marketing, and sales teams all representing the Empire Flippers brand, passing out EF swag, and helping get valuations on the businesses they’ve built.

We love everything the DC has done for the community, and we love helping its members continue to grow both personally and professionally.

Now we are looking to hire people directly from the DC to come work for us, using their new Dynamite Circle Job Board to promote our content marketing specialist position.

Rhodium Weekend 2017

Every year in Las Vegas, there is an event called Rhodium Weekend. When it comes to buying and selling online businesses, this is about the only event that caters to that topic specifically. It was started by Christopher Yates and the team over at Centurica, and it is a great opportunity to network with both investors and entrepreneurs.

We hosted a party in true Empire Flippers style for everyone as part of being a sponsor for the event. It was a blast to meet all the attendees, hand out some business cards, and talk shop with people who are actively in our space.

Dropship Lifestyle Mastermind Retreat 2017

We’ve been long-time friends with the team over at Dropship Lifestyle. So when they announced their retreat in Costa Rica, it was a no-brainer for us to go. We sponsored the event, and our Business Advisor James Howitt gave a speech to the crowd on preparing a dropshipping business for sale.

Affiliate World Asia 2017

This was the last conference for 2017, and it took place in December in Bangkok. While we participated at this conference only as attendees, we were able to meet up with some of the speakers and other organizers for a nice dinner. Because of this connection, I think it is safe to say we will be sponsoring, or at least attending, other Affiliate World conferences in the future.

If you are looking to really take your affiliate marketing to the next level, then Affiliate World Asia is definitely the conference for you. You’ll find dozens of sponsors at their booths who are owners of various affiliate networks, ad technologies, and marketing platforms.

When it comes to affiliate marketing, dropshipping, and ecommerce, this one was definitely the highest level conference we attended all year, both from the skill sets of the other attendees and the experience the speakers had in the industry.

A Focus on Financing

Throughout 2017, we started networking with more SBA (Small Business Administration) lenders and organizations known as “Family Offices.” Our goal is to set up a network of potential financiers for buyers on our marketplace. Ultimately, we would like this rolodex of financial institutions to look at the businesses we’ve vetted on our marketplace and pre-qualify the businesses before they go live. It might not be possible for every business, since these loans take anywhere from 45-90 days for approval and most of our small businesses move faster than that, but it’s worth pursuing as an option for larger, more complex businesses.

Pre-qualifying a business for financing will reduce a lot of earn-out scenarios, and that will allow our sellers to get 100 percent of their sales price upfront, but it can still provide good leverage for buyers who seek some kind of financed deal structure.

Right now, it is pretty early days on this front for us. We’ve had a few calls with banks and private lenders that make us hopeful we can find some good financing solutions for our clients. The tricky part is that any business that is worth less than the $2 million mark is often more effort than reward for these lenders, so it just doesn’t make sense for them.

Luckily in 2018, the SBA program in the U.S. has started to grow more interest in lending to online businesses. As time goes on, we hope to see more lenders like SBA cropping up.

Commission Structure Change (Big News!)

One of the BIGGEST things that came out of our Medellin Meetup was a new commission structure. For years, we’ve been hardlined 15 percent commission regardless of the size of the business. A few of our clients have pressured us on this front in the past, but we stuck hard and fast to the 15 percent brokerage fee.

We think 15 percent is a fair deal when you compare the manpower we bring to market, vet, negotiate, and migrate the businesses we sell on our marketplace.

However, that is changing a bit now that we are seeing 7-figure businesses and higher being listed on our marketplace. We realize that 15 percent is a BIG ask to make of someone selling a business that is over a million dollars.

That is why we have rolled out a brand new commission structure, which we put into effect in the middle of Q4.

Range of Commissions Based Off Business Valuation Price:

We believe these new commission ranges are going to make us far more attractive to 7-figure sellers. We already have the biggest, most process-drive team in the industry, and now we will have some of the most attractive fee rates for our sellers without sacrificing any of the value they get by going through the Empire Flippers marketplace.

The Ending of the Digital Journey Podcast

As I mentioned in the podcast section above, the Digital Journey will no longer be published because of a tragic event that happened in Q1 2018, where one of our co-hosts passed away in a motorbike accident in Chiang Mai. Rob Fortney was a big part of the Digital Journey Podcast, and his far-too-soon passing was something that hit all of us like a sack of bricks.

For those of you in the Digital Nomad space, especially in the Chiang Mai area, you may have heard of Rob Fortney. He did weekly meetups teaching people for free how to create Amazon FBA businesses and live anywhere they want in the world. He lived his life to the fullest and was a walking, talking personal development book. He gave a lot to the community, and it is super sad to see his passing.

There will be one more episode of the podcast done as a tribute and sign-off to Rob. That episode will likely be live by the time of this report being published.

Nick Nimmin will continue on with helping Empire Flippers grow our YouTube channel, which is something we want to do in a big way in 2018.

He created a tribute video to Rob that was featured during the Nomad Summit conference. The video was both moving and inspiring.

You can watch the video here:

Looking Forward in 2018

That wraps up what happened in Q4 2017 and in 2017 as a whole. Now, we’re well into Q1, working hard to meet our 2018 goals!

We have some new projects lined up, a team that is scaling, and a building reputation that will continue to make us the thought leaders when it comes to buying, selling, and investing in online businesses.

We have ambitious goals to hit: we want to more than double our revenue in 2018 to $40 million.

Stay tuned for our next report to see how we’re doing with hitting that target!

Hopefully, this report served to inspire you in your business. We’re looking forward to 2018 being our most profitable year yet. If you keep working hard, we’re sure that this year will also be YOUR most profitable year yet too!

Discussion

I like the article

Gentlemen,

I’m sure you have your reasons for posting your business numbers publicly, but for me personally, it does not have a positive effect. BUT, what would really make a huge different to me (as a prospective investor who has not taken the leap yet) is to see you follow up with sites that you have sold to people, and do an interview with them on how they are doing 1 year after the purchase. Now THAT would bring huge credibility to you, and truly provide a benefit to those of us on the fence. That is transparency that actually matters to your me.

By posting all your business numbers for us to see…it only verifies that YOU have been successful in brokering a deal (or many deals). It just proves that you have a strong sales team. It does not validate that these deals we’re legit, and that any of these sites survived a year later, and are still making money. What REALLY matters to us, is that sites are stable, strong, and if we put the work into them, they last long enough to return our investment, and make us some more money.

We want to know that you are doing a good job vetting deals, and that can only be verified by interviewing your buyers a year later or so. Think about Shark Tank, they do this very thing…they know it matters…it matters that we see the end results a year later, that’s what REALLY inspires people on the fence to get off and do a deal.

So if you truly want to be transparent in a way that actually helps prospective buyers/investors, then please consider a follow up program with sites that have been brokered by you. It would help us, and explode your sales. Isn’t that what you want?

Thank you for your time.

Hey Ken!

I’m sorry to hear our quarterly reports don’t inspire you, but I get it. These reports do inspire others so we keep doing it. If we don’t publish these, people are wondering what is happening with us 🙂

As far as buyer case studies goes, this is something we are working on to produce bunch more in 2018. We actually do have several buyer case studies sprinkled throughout our different content channels. They CAN be hard to find though. That is something we are also looking to change soon as we reorganize how our blog is laid out!

Here are a couple of entrepreneurs who have bought and succeeded with deals brokered on our marketplace:

https://www.youtube.com/watch?v=wi3Najg8sAU

https://www.youtube.com/watch?v=M7LRjHwrrDM