A Data-Driven Analysis of Six-Figure FBA Businesses

Minutes may become hours, hours become days, and days become months before you can answer the question, “How do I create more income while working flexible hours?”

A lot of people consider starting an Amazon FBA (Fulfilled by Amazon) business. You might even have started one recently to explore this business opportunity as a side project or to expand your business with a new sales channel.

Becoming an Amazon seller is a great way to become your own boss and sell private label products through an e-commerce route. It’s arguably a better marketplace than eBay in which to set up a store if you plan to sell new goods.

Building an FBA business is also a great way to create a profitable asset that can scale to a six- or even seven-figure value.

But how do you reach that point? What does it look like to build an Amazon FBA business that someone will buy for $500,000?

Instead of giving you a guide on how to grow your FBA business, we thought it would be more helpful to show what a scaled-up, six-figure FBA business looks like from the inside. Although we can’t reveal the URLs to specific Amazon storefronts or brand names, this in-depth look at the average six-figure FBA business gives a general baseline small businesses can aim for when scaling up.

Just as we looked at the anatomy of a six-figure affiliate business, here we’ll continue our series analyzing six-figure businesses with a deep dive into our data of six-figure FBA businesses sold over the past few years on our marketplace. We’ll also give you some actionable insights to help you scale your business to the same heights.

How the Data was Collected

We analyzed data from January 1, 2018 to August 25, 2020.

During this time, 103 businesses were sold on our marketplace, totaling $29,950,020.37 in sales.

*Please note that for all future Amazon FBA businesses that sell in the EU, Empire Flippers will only do account transfers going forward. Listing transfers won’t be an option anymore.

As you can see from the infographic above, most of the six-figure FBA businesses were monetized only through FBA.

We collected internal information on the following metrics:

- Trademark

- SKUs

- List price

- Sales price

- Days on our marketplace

- Sales multiple

Empire Flippers’ intense vetting process ensures only quality online businesses make it to our marketplace. This also means there’s a wealth of information on our ticketing platform, from which we drew this internal information (after many cups of coffees and barrels of midnight oil burned).

From here, we’ll look at general trends and what these valuable assets have in common.

List Prices, Sales Prices, and Actual Sales Multiples that FBA Sellers are Getting

If you’re new to the online business world, a lot of business broker terminology might seem like another language to you. We’ll break down what our valuation process looks like to give you an idea of how to determine an online business’s worth.

The list price is the price at which a business is listed for sale when it first goes live on our marketplace. Our vetting team factors in many details of each business to arrive at this number. The sales price is how much a buyer paid a seller to gain ownership of that business. The multiple is how much you multiply the average monthly net profit.

Our valuation formula is as follows:

Valuation = Average Monthly Net Profit X Multiple

Usually, the average monthly net profit is calculated based on data gathered over 12 months. This can change depending on a seller’s request or if a business experiences more growth during certain months. The multiple range anywhere from 20 to 60 and depends on a wide variety of factors, such as traffic, earnings, and how many SKUs you have.

A quick way to see how valuations work is by trying our free valuation tool. After you input some information, it gives you a rough estimate of your business’s worth based on data we have gathered through brokering more than 1,100 deals.

List Price vs. Sales Price

Let’s talk about how much money is needed to acquire a six-figure FBA business and how much capital FBA sellers receive from a sale.

The average listing price on our marketplace was $334,968 at a multiple of 28, while the average sales price was $290,776.90 at a multiple of 25. This means that FBA businesses in this price range sold for 87% of their listing price and that buyers had some wiggle room to negotiate.

Did monetization make a difference?

We found that single-monetization FBA businesses were listed 17% higher at $308,815.54 on average, compared to $263,634.95 for FBA businesses with mixed monetizations. Sales prices showed the same trend: FBA-only businesses sold for 26% more at $274,770.05 on average, and mixed-monetization FBA businesses for $218,595.83.

Far more FBA-only businesses were listed, so this finding should be taken with a grain of salt. A listing with four monetizations sold for $952,000, which would have seriously skewed the data and was duly omitted.

However, selling through other monetization methods minimizes risk in case your main income stream suffers a drop in revenue.

Minimizing risk by diversifying revenue streams can be especially important when selling on Amazon as their terms and conditions can change overnight.

If you depend on organic traffic to your Amazon product listings via Amazon Search Engine Optimization (SEO), a change in Amazon’s search engine algorithms could mean a decrease in sales. A change in fee structure could also result in lower profit margins. Wherever possible, we recommend diversifying monetization methods in case these events affect your Amazon store.

How Long Does It Take to Sell a Six-Figure FBA business?

Good things come to those who wait.

This saying is especially relevant to selling a six-figure FBA business. It takes an average of 76 days to complete a deal, three times as long as it takes to sell an affiliate site (27.52 days). The original average was 87 days, but we had a few outliers that skewed the data so these were removed to give a more accurate picture.

Buyers also take their time to complete their due diligence. On top of checking what niche there is, they’ll consider how many SKUs the business has, how long inventory has been in the FBA warehouse, and why any stock shortages occurred, among other factors.

In addition to the due diligence process, migrations of FBA businesses can take much longer as Amazon needs to be informed through the proper channels that ownership of the Amazon Seller Central account or the Amazon listings is being transferred. If they aren’t aware that the brand is changing hands, their anti-fraud system will be tripped and they could temporarily ban the account, which would delay the transfer by weeks or even months.

Value-added tax (VAT) should also be considered. European businesses are subject to paying VAT if their sales are over a certain amount. Amazon sellers must let the broker know if their revenue meets this threshold, and in which marketplaces, so the buyer can apply for VAT accordingly.

VAT can get pretty complicated, so we’ve broken down what VAT is to help you figure out whether you need to register for VAT.

What is the Niche?

When we looked into our data, we found that niche doesn’t play a big role in the success of a business.

However, certain niches were far and away more popular in which to start a business.

The common trend among all the niches is that you can achieve success if you create a winning product that solves the customer’s problem in any category.

Dissecting the Anatomy of a Six-Figure FBA Business

It’s time to open the door and have a look at what a six-figure FBA business looks like from the inside. Out of the 103 businesses we sold, we were able to gather the following information from 41 businesses.

It takes time to build a great e-commerce business, which is no surprise that the average age of six-figure FBA businesses was 3 years and 2 months. As we covered in a previous data study, we found that online businesses become more valuable with age. As you’re trying to establish your procedures and logistics, it can take over six months before you see your first profitable month.

Once your FBA business is scaled up to a six-figure value, you’ll earn a five-figure income as profit. The average profit margin was 25.13%. To put this into context, the average monthly revenue was $52,696, and the average monthly net profit $11,453. E-commerce businesses naturally have lots of expenses as you’ll need to pay Amazon for their fulfillment services on top of production and logistics costs.

One expense that’s universal to most FBA businesses is the advertising spend. Only two businesses chose not to spend any money on paid advertising. Of the 39 businesses that did, the average ad spend was $1,529.05 each month and had a 34% increase in sales price compared to the two businesses that relied on organic reach. 87% of businesses only opted to use Amazon pay-per-click (PPC) advertising.

Amazon is a powerful organic search engine but paying for ad space can boost your revenue as it gives you the advantage of being seen. If you want to take advantage of organic search as your main traffic driver, you could start a blog and create content that provides a lot of value to your customers through how-to guides and product reviews. You can even monetize the blog as an additional source of income while establishing yourself as an authority in the niche.

Without stock to fulfill sales, it’s not that useful to drive traffic to your product listing pages. On average, FBA businesses kept $85,560.72 worth of inventory in FBA warehouses. A downtime of even a few days can lead to a significant loss of revenue as customers will usually order products that are immediately available if their ratings are similar.

So we’ve just covered some of the overall factors that make up a six-figure FBA business. Let’s take a deeper look into the differentiating factors: the product and the branding.

The Cornerstone: Creating a Winning Product

It would have been awesome to share the product ratings and numbers of reviews of sold businesses, but we had some trouble gathering that since those numbers would have been updated by now. So we did the next best thing and analyzed the six-figure FBA businesses that were currently for sale on our marketplace.

With that said, the importance of a highly-rated product can’t be said enough. Even if a store sold only one product, you’d probably check that product out if it came highly recommended.

The average customer rating for Amazon products was 4.5 out of five stars. A high customer rating can be a solid trust signal when it’s backed by dozens or hundreds of positive reviews.

That said, it’s good to offer customers the choice of a variety of products. Six-figure Amazon FBA businesses had 36 SKUs on average. However, one outlier had over 1,500 SKUs. After omitting this business and running the numbers again, the average dropped significantly to only 21 SKUs per business.

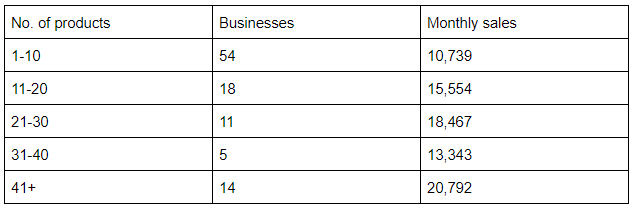

FBA businesses in this price range tend to keep their product range quite narrow, as shown in the pie chart. But would more products mean more sales?

On average, 23,787 sales were made on a monthly basis. If we break these numbers down according to product range, we see the general trend that the more SKUs are available, the more products are sold.

When an FBA business has scaled to a six-figure value, the seller has a pretty good idea of its unique selling point and how they can help their target customers with their pain points. This makes it easier to add new products to the range.

You can also aim to earn the Amazon Choice label for your product to help it stand out among similar products in its category. The secret sauce to getting this coveted recommendation for your product is a combination of a high bestseller ranking, a low return rate, high customer ratings, and quick delivery.

All FBA sellers are entitled to sell through Amazon Prime, which is a big win thanks to the next-day delivery. To stand a better chance of getting Amazon Choice, make sure you put your copywriting hat on and write product descriptions that concisely describe the benefits of your products.

All Amazon sellers should also learn about the Buy Box. This is a widget on the far right of product listings that gives you the chance to promote your products, even on someone else’s listings. Check out Jungle Scout’s article detailing how to win the Buy Box.

The Branding of Six-Figure FBA Businesses

A strong brand means customers will associate your store with great customer service, a high-quality product, and a company that is truly passionate about helping its customers.

How do we measure an Amazon FBA’s brand score?

There isn’t a single metric that captures this idea, but you can take many defensive actions to differentiate your brand from competitors and make it harder for others to copy your store. We compare these online business defensibility actions to building a moat around a castle.

Many of the six-figure FBA businesses sold on our marketplace took similar steps to each other to create a bigger moat around their “castles,” which made them lucrative assets.

One sign of a deep moat is a high store rating.

When you last went on Amazon to find a specific product to buy, you probably checked the store rating as well as the product rating to make sure the seller was reputable. It’s no surprise, then, that the average six-figure FBA business’s store rating was 4.4 out of 5.

Another way of showing potential buyers that customers enjoy your products and gain a real advantage over your competitors on Amazon is to get a high Amazon Best Sellers Ranking (BSR). This ranking is calculated based on your historical sales, the performance of your products against competitors, and repricing.

BSR is a good indicator of how many sales a product has made. Improving your BSR is a gradual process, so even if your product sells twice as much within an hour as a product that ranks twice as high, it’ll jump only a few rungs up the BSR ladder.

However, getting a high BSR rating for your top-selling product isn’t a deal breaker if you’re trying to scale your FBA business to a six-figure value, since the average BSR was 39,744. The results were wildly varied with the highest BSR at 12 in the entire niche category, and the lowest was 217,901.

A trademark is a legal way to stop fraudsters from ripping off your products. Of the businesses we reviewed, 82 had a trademark, which protects them against copyright infringement and is another stamp of trust for their customers. It’s worth noting that trademarked businesses sold for $305,841 on average compared to $238,657 for non-trademarked businesses.

You can establish further trust by applying for the Amazon Brand Registry 2.0 program. This proves to Amazon and to customers that you own the products you sell on your FBA storefront. Being part of this program further protects your brand from copycats on Amazon.

83% of businesses sold on our marketplace that were on the Amazon Brand Registry had an average sale price of $292,751.46. This is only a 1.2% increase over the average sale price of the 18 businesses not on the Amazon Brand Registry ($289,273.87), but it’s still recommended to apply to the program to increase your brand’s trustworthiness.

Creating your own website is another great way to establish yourself as an authority in your niche and as a successful Amazon seller. You can address many issues caused by your customers’ pain points in helpful articles with how-to guides and product reviews.

Plenty of platforms can help you start a blog from scratch without any coding knowledge. WordPress is the most popular blogging platform and provides templates to get you started.

You can also diversify your revenue source by starting an email list. By creating an email marketing funnel, you can promote products and articles.

Although the business owner’s workload isn’t part of the brand score, buyers pay attention to how many hours are needed to maintain the business. Of the FBA businesses sold on our marketplace, 85% required fewer than 10 hours of work per week, meaning that many of their operations and procedures were automated. Entrepreneurs want to invest in an asset that they can work to improve rather than buy a full-time job. The more processes you can automate or delegate to staff or freelancers, the more time you’ll have to focus on growing your FBA business.

Common Questions When Selling a Six-Figure Amazon FBA Business

We’ve covered a lot of ground concerning the average sale price of a profitable six-figure FBA business on our marketplace. We thought it would be helpful to include buyers’ most common questions, so sellers can address them early.

We identified concerns that cropped up repeatedly throughout the individual listings and included a few tips, so you can level up your FBA business and increase its value. You can prepare your FBA business by addressing these concerns ahead of time, setting yourself up for success.

What is the Return Rate on the Products?

Buyers will be worried by a high return rate because it indicates that the products are low quality or don’t solve the customer’s problem as intended.

A 10% return rate is normal for most FBA businesses, but the lower yours is, the better.

Even if your return rate is low, let potential buyers know what reasons customers gave for their returns, what negative reviews centered on, and what you did to keep the likelihood of returns as low as possible. This might mean updating product descriptions if customers felt the product didn’t match up with the information given on the product page or increasing the packaging size for more protection.

Do you have Pictures of the Products?

This question came up pretty often.

Buyers often ask this question if they feel the images on your product listing pages don’t provide a good reflection of the product.

If the business has social media accounts, the images uploaded there can become your portfolio. You can experiment by uploading different pictures of models using your products to give buyers a better idea of how they look and who the target audience is. Consider partnering with influencers to promote your product, especially if they represent your target audience (e.g. teens, young adults).

How Many Products are Shipped to Foreign Markets?

Selling on Amazon marketplaces outside the US can be a great way to diversify your income sources.

Buyers often ask whether products are currently being shipped to foreign markets because it’s a potential opportunity for the business to expand by growing the business’s presence and sales abroad. You can leverage Amazon’s fulfillment centers to help you fulfill customer orders no matter where you sell.

This question is also important for tax considerations; buyers will want to know if they should prepare to apply for VAT when selling in Europe.

Can you Provide a Breakdown of the Expenses?

A typical six-figure Amazon FBA business will have a lot of expenses, including FBA fees, freight forwarding, shipping costs, and product manufacturing. Serious buyers will want to know where the expenses lie to see if it’s possible to reduce overhead costs.

A clear profit and loss (P&L) statement is a great way to show these expenses, and creating one before putting your business up for sale can save you a lot of time. We can help you create one if you have compiled your finances over the past few years. Preparing a P&L statement early helps deals go smoothly.

I saw a Decline in Sales/Profit Over ___ Period of Time—Why?

Naturally, buyers will wonder why sales are lower at certain times. Your business might be seasonal and enjoy peak periods at Christmas or other festival times. It could also be because of a change in logistics or supplier.

To help answer this question, I recommend that all sellers record a short Real Money Real Business (RMRB) seller interview with us. RMRB interviews are great for additional exposure and take just 30 minutes of your time. You get a chance to explain certain aspects of your business in more detail, and buyers learn more about you as an Amazon seller.

Interviews recorded by 60 of the six-figure FBA businesses were watched by an average of 48 people. These interviews answer common questions and put sellers in front of buyers who might not have looked any further into their listings.

What’s your ACoS for PPC Campaigns?

Advertising Cost of Sale (ACoS) is an important metric, and buyers will be wary if you’re spending too much on pay-per-click (PPC) campaigns.

The average ACoS is 30%, but there isn’t a golden standard. If your marketing strategy is about increasing brand awareness and increasing sales as much as possible, your ACoS might be much higher for the moment

Explain the rationale for your ACoS and marketing campaign strategies. This helps to set a buyer’s expectations for when they acquire your business.

What are the Top Keywords the Store Ranks for?

This question might catch you by surprise because many Amazon sellers don’t pay enough attention to SEO on their product listing pages or storefront. Having your products appear among the first few results in Amazon’s search engine is a big attraction to buyers because it increases the likelihood that people will buy your product.

Use your Amazon Seller Central account to help you optimize your store’s SEO and stay on top of which keywords your storefront ranks for.

Have you Tried Selling Outside of Amazon?

Products in certain niches may have the potential to sell well on other platforms, such as Shopify or Walmart. Buyers ask this question to see what results if you did try to expand the business outside of your primary marketplace.

If you did and it failed, it’s useful for a potential buyer to know why.

What’s the Relationship with the Manufacturer Like?

Buyers will be cautious about every aspect of their new asset, especially the seller’s relationship with the current manufacturers. If your relationship with the manufacturer is good, the transition of ownership will be easier. Let interested buyers know what communication with the manufacturer is like and how frequently you talk with the suppliers.

However, even if communication is not perfect, I advise buyers to not make wholesale changes to the procedures currently in place between the business and the suppliers. The trust established between the business and the supplier is built on the current workflow and shared understanding of how business is done. Making big changes too soon can sour this relationship and make suppliers distrust the new owner.

How Much Extra Stock is Needed for Special Deals (e.g. Prime Day, Black Friday, etc)

If your products are particularly popular during events, or your business thrives by participating in these flash sales, buyers will want to know how they should prepare to get the most out of these peak periods.

Do you have Ideas for New Products to Sell in the Current Market?

Buyers want to know how they can scale an asset. Creating more winning products to expand the product range is one way to scale an FBA business.

It’s useful to do some product research on Helium 10 or Jungle Scout when thinking of adding new products. Even if you haven’t made any steps towards manufacturing new SKUs, you could suggest these product ideas to the buyer and explain why you think they’d sell well under your brand in the current market. A buyer will be more interested in acquiring your business if they see different ways to expand it.

Who are your Competitors?

No niches or markets have zero competition. Buyers can compare your brand to the competition and perform a competitor analysis to see how much share of the market your FBA business has and how much more they could claim if they took over as owner.

What’s your Average Order Size?

Planning to take over an FBA business means knowing every detail of its operations.

This statistic is often overlooked; you’ve probably automated your orders and invoice processes to let your suppliers know how much you want to order. Knowing the average order size is important, though, as it could help a buyer work out how much capital is needed to keep the business running and how to lower expenses.

Are There Standard Operating Procedures (SOPs)?

Every FBA business will be run slightly differently to another despite being built around the same business model.

Even experienced e-commerce entrepreneurs will want to know about your SOPs.

Clear documentation allows a new owner to step in and easily continue running the business just as it was by the previous owner. This is why SOPs are the cornerstone of creating a turnkey solution.

A lot of technology exists that can help you create SOPs simply. You could make screen recordings or written guides for the buyer, or hold several tutorials over video and voice communications.

It’s important to have some sort of recorded documentation of SOPs in either written or video format, so the buyer can refer to it like a manual after the acquisition is complete.

Are you Willing to Release the Email Associated with that Business?

When you started your business, you probably used an email that you also frequently used for other purposes to keep your notifications in one place. This can become a bit awkward when a buyer wants the email associated with the seller account to come with the sale, especially if the account contains personal information as well.

A small but useful tip is to create a separate email account associated solely with your FBA business to avoid the above situation and so it can be handed over without issue.

Do you have Dedicated Tax Returns and Bookkeeping?

Many entrepreneurs’ dream is to create and run a business that requires as little input as possible. Accounting and bookkeeping take up time that could be spent expanding your business or otherwise improving it.

You can outsource bookkeeping duties to freelance accountants, lowering the number of hours you need to work on the business while providing a dedicated tax returns service to keep your financial records up to date.

Why did this Item go out of Stock?

Managing inventory is one of the trickier parts of running an Amazon FBA business. Buyers may be concerned about whether an item went out of stock because you were unable to keep up with demand or there were issues with the supplier.

We definitely recommend being honest about why an item went out of stock. The reason might not be a deal-breaker for an interested buyer, and it gives you an opportunity to address how you avoided running into the same situation in the future.

Are you 100% Owner?

People have varying opinions on partnerships. Some people prefer to go solo while others appreciate partnering with others who have different skill sets and backgrounds to take the business further.

If your business is joint-owned, let buyers know whether your partners will be continuing with the business and in what capacity. Most business partners tend to leave an FBA business after it is sold, but if a partner wants to contribute to the business under a new owner, find out how they can continue to help.

Do you have any inventory older than six months?

Stock that hasn’t shifted for longer than six months can be of great concern to buyers.

Having some backup stock for returns and exchanges is good practice, but it’s unusual to have inventory in FBA warehouses for that long.

Buyers will also be wary of paying the FBA long-term storage fees. Check your inventory before putting your business up for sale, and reconsider whether stock that’s older than six months needs to continue sitting in FBA warehouses.

Conclusion

This study shows that effective planning and excellent documentation make all the difference when creating a highly profitable FBA business.

E-commerce businesses have many moving parts, which is why clear SOPs and workflows are essential.

As indicated by all the different aspects we covered above, there is always room to scale.

The foundation of a scalable FBA business is a strong and reputable brand. Creating a deep moat around your business will help you keep pace or even outgrow the competition in your niche. Establishing trust among new and returning customers makes it easier to expand your business by creating new products or selling on different marketplaces.

It’s important to address the concerns in the FAQ section of this article to put your business in a position that will allow it to expand, even if you can’t personally scale it to the next level. There are many interested buyers who do have the capital to take a profitable FBA business to the next level.

We’re market leaders when it comes to helping FBA business owners sell their assets.

When you sell on Empire Flippers, you receive world-class help with the migrations process. We’re the only online business broker to help you navigate this tricky part of selling a business, where missing information or poor communications can delay a deal by weeks or even months.

Try our valuation tool to see how much your FBA business is worth based on hundreds of FBA deals completed on our marketplace and machine learning.

If you want to take a step toward selling, go ahead and book a call with our team of business analysts to get help preparing your P&L statement.

![[DRAFT 3] A Data Driven Analysis of Six-Figure Amazon FBA Businesses](https://d1u4v6449fgzem.cloudfront.net/wp-content/uploads/2020/09/23142935/A-Data-Driven-Analysis-of-Six-Figure-Amazon-FBA-Businesses.jpg)