What is MRR and How Do You Increase It?

Monthly recurring revenue, or MRR, is the golden goose of online business.

Every functioning online business is generating revenue, but not many generate recurring revenue, as most don’t offer a subscription-based service.

MRR is when your business has a number of enrolled customers paying for your service every month. This is a better business model in terms of making revenue than in other business models where customers pay when they want the product or service, so the revenue figures are less consistent and reliable.

It is a bit more complicated to calculate your earnings, however, as there are quite a few metrics to track to ensure your MRR is turning profits.

The Types of MRR You Should Be Tracking

Ok, grab a pen and paper and make a note of these. You want to know what they are and how they relate to your business finances because if you don’t, you can be making a loss and not even know it.

Churn MRR

Let’s start with the outgoings.

Churn MRR is a measure of how much revenue you lose each month due to customers canceling their subscriptions.

You can define the MRR churn rate metric as an absolute dollar amount or as a percentage, which is more useful and much more actionable to track over time. It’s important to know your churn rate because a high customer drop-off rate indicates that there is something wrong with your service or the audience you’re targeting, and it’s costing your business money.

New Customer Acquisition MRR

This is the portion of your total MRR that is generated by new customers. This is a crucial metric to keep an eye on when running paid ad campaigns if you want to know if they are profitable.

Tracking your new customer acquisition MRR can save you a lot of the money you would have lost experimenting with paid advertising.

Expansion or Upgrade MRR

This is revenue generated from service upgrades that customers sign up to. The total amount will largely depend on your pricing model and how much or how well you’re selling your service upgrades. Selling upgrades will help increase your average customer LTV.

Reactivation MRR

This is revenue generated from customers signing back up to your service after having churned.

You’d think this is a positive metric, but if you have high churn and reactivation rates, then you may have a problem with customer retention you need to look into. Maybe it’s because of the types of customers you’re targeting, or maybe it’s just the nature of your service, or maybe you’re not marketing your service well enough to current customers.

Contraction MRR

Similar to churn MRR, contraction MRR is revenue you lose through customers but from downgrades in your service, not cancellations. High contraction MRR indicates that you may need to rethink your pricing model, how you market your service, or what audience you’re targeting.

Net New MRR

This is probably the most important metric. This figure tells you how much recurring revenue you’re gaining or losing each month after you’ve considered the recurring revenue you’re losing. It accounts for new revenue you bring in each month through upgrades and through new customers and the revenue you lose through churn.

You can calculate your net new MRR using the following formula:

Why You Need to Know All About Your MRR

Tracking your SaaS metrics is crucial to maintaining and growing a profitable SaaS business. If you’re only looking at one or two metrics like your revenue and losses, then you won’t be able to see the leaks in your finances that slowly deflate your business like a small puncture in a tire.

You could even be experiencing rapid growth with a ton of new customers signing up every month, but if you’re spending too much to acquire those customers, you’ll end up losing money and your business will eventually crash.

Here are the main reasons why tracking your MRR is important.

Measuring growth

Tracking MRR allows you to see if you’re hitting your financial and performance goals. If you want more customers like your highest-value customers, then knowing their life cycles through your MRR figures helps you understand how they operate, helping you target more people like them.

Knowing your MRR and getting clear on your finances allows you to distribute your profits to growth areas, like hiring an expert media buyer or business development pro that initially might be outside of your startup’s core efforts but have the potential to scale your business.

You’ll discover your average customer lifetime value (LTV)

Knowing your customer LTV helps you in a lot of ways, but mainly for your marketing efforts and business health. When you dig into and calculate your MRR figures, you discover your customer LTV.

In the startup phase, this will help you a lot to figure out your ideal pricing range. When you’re more established, you’ll have more customer data to go off of, and you can optimize your pricing to grow your profits.

Financial forecasting

The number one rule in business, as said by Warren Buffet, is to make profits.

Forecasting your finances is a pivotal part of keeping a business profitable, as it lets you make calculated predictions of where your business is heading. This is a lot easier for SaaS and subscription businesses that generate MRR, as their income is a lot more predictable. So there’s no excuses!

What Percentage of Your MRR Comes From a Single Plan?

We’ve discussed how to calculate your total MRR using the metrics above; now it’s time to look at your MRR by subscription plan.

Understanding your pricing models is crucial here. You want to know where the majority of your revenue is coming from. If you find out 70-90% of your customers are on the lowest plan, you may have discovered a problem if that plan only makes up 10-20% of your total MRR.

If customers aren’t upgrading to a more profitable plan, you may have an overloaded customer support team or even a customer management problem.

The Formula for Calculating MRR for Your SaaS Startup

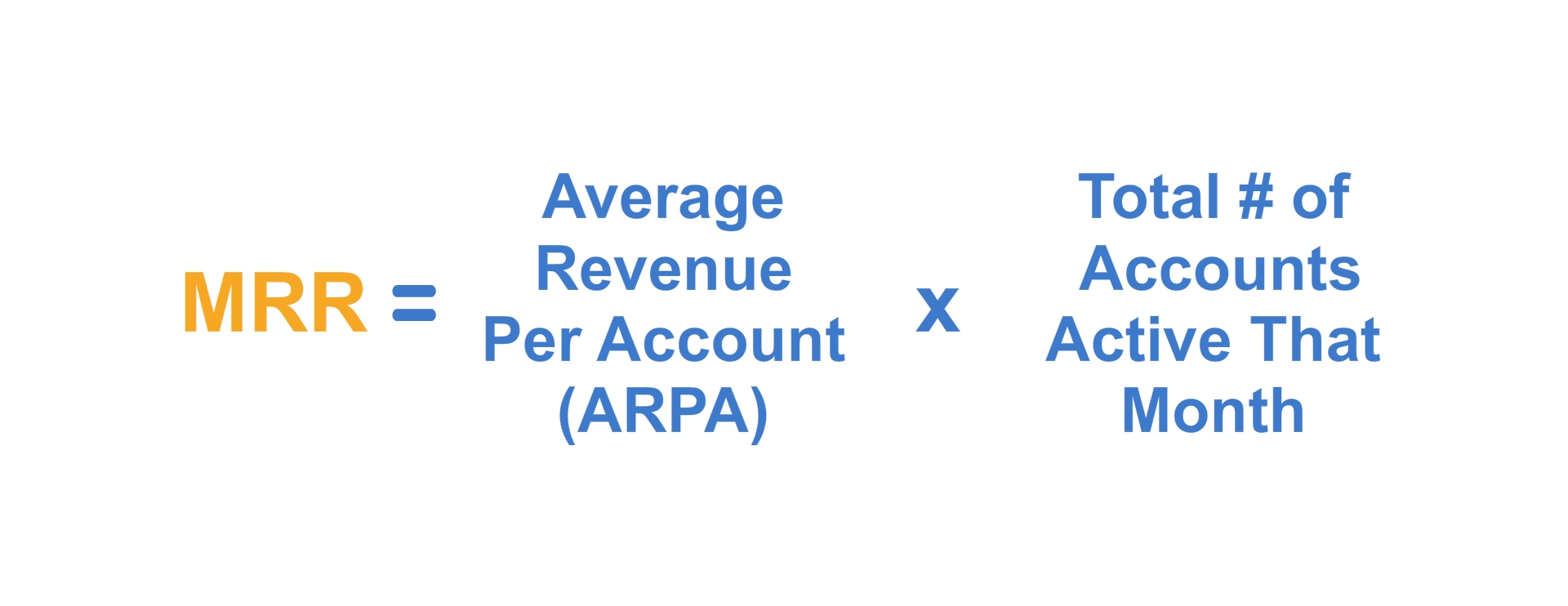

You can use the metrics we’ve shared above and go granular with your MRR calculations or, if you want a quick way to calculate your MRR, you can use this formula to get a base figure:

This isn’t the most accurate way to calculate your MRR, however, so at some point you should take the time to do a thorough calculation.

When you do, try to avoid these 5 common mistakes:

1. Including one-off payments in calculations

You wouldn’t include a one-off payment in your calculations because it isn’t recurring revenue. If you have customers who make sporadic payments, then you should calculate that income separately.

2. Calculating Sporadic Subscriptions in Full Monthly

If a customer pays for a quarterly or annual subscription, this should be calculated by how much they would pay each month, not how much they actually pay each quarter or year.

3. Forgetting discounts

If you discount your service in marketing, then you need to account for that in your MRR calculations. It’s easy to miss this one.

4. Including Delinquent Fees in Losses

Transactional and delinquent fees should be put in their own category, as sometimes you can recover these fees and they’re not consistent each month.

5. Including non-customers in calculations

If you offer a freemium model or a free trial, then you shouldn’t be including customers who aren’t paying you in the expectation that they will be a customer. If they’re not a paying customer, don’t include them.

How to Scale MRR

Now that you’ve got your MRR finances figured out, it’s time to scale and optimize for higher profits.

Quarterly Goal Setting

It’s time to set goals to improve your MRR. This is best done quarterly as it gives everyone on your team enough time to achieve the goals, without being so long that the goals get forgotten or neglected. You want each of your team members to have their own goals so they all contribute to the overall goal of increasing the business’ MRR.

Focus on Customer Acquisition vs Growth

Reducing churn is important, but not as important as most SaaS owners think it is. Don’t forget to be bringing in new customers or your business will struggle from being reliant on retaining your current customers.

Charge More for Your Service

Many founders are not the best at pricing and actually far undercharge what their market is paying. If your service is selling too quickly, you may be charging too little for it; a little friction is sometimes a good thing.

It’s a very simple change that can lead to huge wins with MRR. Charge by the seat or use metered pricing based on how much the customer uses your service (make sure to test this, as it could lead to lower MRR).

Why Unlimited Plans Limit You

Having an unlimited plan puts a cap on your potential revenue per customer.

They might be willing to spend more for the advanced features of your service, but you’ll never know that with an unlimited service plan. Remember, a key factor in the MRR calculation is Upgrade MRR; if you can’t upgrade customers, then your overall MRR is limited.

Increase Upgrade MRR

There’s two ways to approach this. One is to better market your current service upgrades, and the other is to create features in your software that customers would be willing to pay for. How do you find out features to add? Survey your customers.

When your Upgrade MRR is growing faster than your Contraction MRR and your Churn MRR, you see dramatic improvements to your overall MRR.

Focus on Monthly Plans Over Annual Ones

Annual subscriptions are good for startup SaaS businesses while they get off the ground, as they give the owner time to develop the service and business structure.

However, it’s not a good long-term play. Annual recurring revenue (ARR) is less reliable than MRR, as it makes the business reliant on the whole year’s income in one transaction.

Conversion Rate Optimization

Just a 4-8% increase in conversions on your website can lead to a huge increase in MRR as the income you generate from the new customers’ compounds – just consider your customer LTV to see what we mean.

Software services are difficult to explain to prospective customers, so you want to make sure your site copy is crystal clear, because that is likely the number one thing limiting your site conversions.

You can also conduct some user tests on your site through a service like Usertesting.com – this is where site testers navigate through your site and give you feedback on its navigability and user experience. VWO is another tool you can use to help you with your site’s conversions.

Leverage SEO and Guest Posting

One of the best ways to educate your audience about your service is to create content around it, as doing so not only improves your chances of gaining new customers, it also increases your site’s search ranking, and you start to establish yourself as an authority in the niche. Offer to do guest posts for un-competing sites in your niche and get your name known.

Retargeting

A common sales mantra is “There’s finance in the follow up”.

On average, it takes 8-12 contacts with a lead to make a sale. It’s not as simple as presenting your service and they buy or don’t buy.

Same goes for marketing. You need to be following up with your leads through Google GDN, Facebook, email, or whatever marketing medium is working for your business. You’ll make a ton more sales than you would always going for cold audiences.

Paid Media to Cold Audiences

After setting up your retargeting campaigns, you can focus on cold audience outreach. It’ll be costly, and you’ll have to do a lot of experimentation, but if you focus on giving value to your audiences and keep consistent with your outreach, then it can pay off for you in a big way.

How to Cash Out From Your MRR-Infused SaaS

Everything we’ve discussed in this article not only helps you make more money from your Saas, it helps you create a more solid business and a more investable asset.

When you have a strong SaaS business with all the finances optimized for maximum profits, and you have scaling programs in place, then you have an absolute goldmine.

Buyers everywhere drool over SaaS businesses because they offer recurring, and most of the time, passive revenue.

You can go to venture capitalists (VCs) to sell your SaaS business, but they only arrange the deal. With Empire Flippers, we help you prepare your business for sale, market your business for you, help you negotiate with buyers, collect your funds from the buyer for you, and migrate your business to the buyer. You just list it for sale and collect the money when you sell.

Interested in seeing what your SaaS business could sell for? Try our free Valuation Tool to find out.