What is LTV SaaS? – Definition, Formulas, and Uses

LTV stands for lifetime value. The lifetime value of your customers, that is.

This value is determined by how much revenue the customer brings to your business. Their lifetime is a measure of how long they are a customer before they churn.

Understanding this metric can be pivotal to the survival of your SaaS, as financials are the lifeblood of business.

LTV is a metric that is used for all business types, online and offline, but for SaaS, it’s particularly unique.

SaaS customers pay a subscription, which is great because as a business owner you receive recurring revenue as a result, making your income more predictable.

This relates to LTV, in that you also need to consider another metric: churn.

This is when customers leave your service.

We’ll talk more about the specific metrics involved in calculating LTV in a moment, but it’s important to know that your churn rate, the rate at which customers leave you, and how customers churn has an impact on your customer LTV.

SaaS businesses experience customer churn in different ways.

Some see high churn rates for the first month of customers signing up, but after the first month, the rates drop significantly.

Some have a high number of customers churning annually, so the month-to-month churn rate is low.

Some have a steady churn rate, while others have an increasing churn rate.

You should understand what your customer’s churn looks like, not just for calculating LTV, but for identifying potential problems with your service.

For example, if you experience a high churn rate in the first month of customers signing up, you should look into what’s causing that. It could be that your software doesn’t deliver the level of service customers expect. Or it could simply be because you aren’t following up with customers to encourage them to continue their subscription.

Now that we’ve had a taste of the metrics that go into calculating LTV, let’s dive deeper into how you can calculate your customer LTV.

LTV Formulas and How To Use Them

Before we get into the formulas, it’s important to know the metrics that go into them.

- Customer churn rate = the rate at which customers leave your service. Calculated annually or monthly.

- Revenue churn rate = the percentage of your total monthly or annual revenue that is lost through customer churn.

- ARPA = average revenue per account. We use this metric instead of the average revenue per customer, as customers may be able to have more than one account.

- Gross margin = the percentage of total sales revenue after business costs are deducted.

- Average customer lifespan = how long a customer stays with your service before churning.

To calculate your average customer lifespan, you divide 1 by your churn rate as a percentage.

Here’s some examples to help you understand how the formula works for a monthly calculation and an annual calculation.

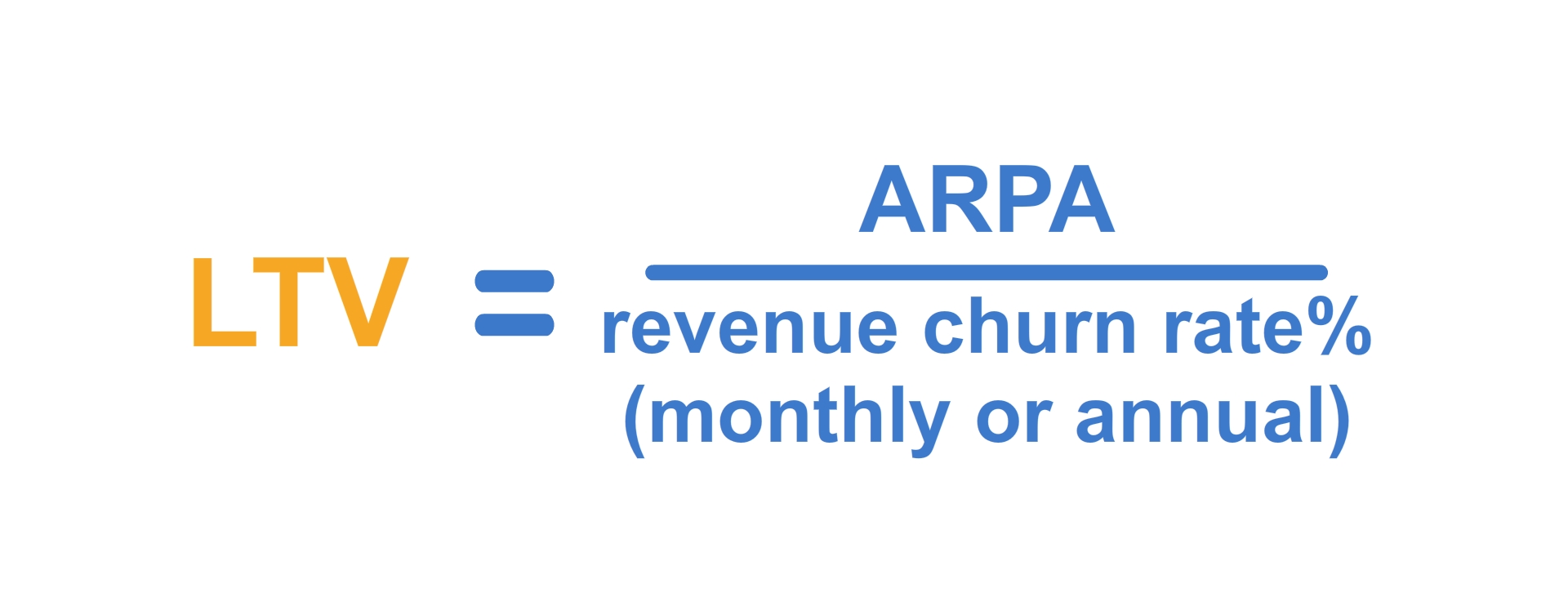

Basic LTV Formula

This formula will give you an idea of what your customer LTV is. It’s not comprehensive and there are other factors that affect this value, but if you’re just looking for a rough figure then this formula will help.

Note: If the ARPA is a monthly figure, then the revenue churn rate should be as well.

We use revenue churn here instead of customer churn because customer churn doesn’t account for the amount of revenue you lose through churn.

For example, you could lose 10 customers paying $10/month and lose one customer paying $100/month.

A limitation of this formula is that it doesn’t take into account your gross margins.

You could have a low revenue churn, but if you’re not taking a lot of that revenue home (i.e. you also have a low gross margin percentage), overall, the LTV of your customers will actually be lower.

Here’s how to account for your gross margin’s effects on your customer LTV.

Advanced LTV Formula

To get your gross margin percentage, you need to divide your gross profits by your revenue.

Say your gross profits are $10,000 and your revenue is $25,000, your gross margin will be 40%.

You’ll notice we used the same figures in the basic formula example. Can you see the difference between the two LTVs?

This is why it’s important to use the right formula to be as accurate as possible with your finances.

How to Not Let Customer Churn Patterns Affect Your Calculations

To account for your customer churn pattern, you should calculate your LTV for each of your customer segments. Your customers will have different LTVs based on whether they use your service consistently or sporadically, their demographics, among other factors.

For example, if you have customers who are contractors, they may churn at a higher rate, as they may only use your software sporadically throughout the year. Therefore, they might close their account and reopen it when they need it.

This customer would have a much different LTV to one who uses your service consistently for years.

This is why it’s also important to separate your customers into annual and monthly subscribers so you can get a more accurate LTV figure for each customer type.

Use Cases for LTV Formulas

A lot of SaaS owners struggle with pricing their services. After all, what do you base your pricing on?

The first factor to consider when setting your pricing is profit.

This is number one in business because if you don’t have your finances in order, you could be heading into the red without even knowing it.

Knowing all the metrics that go into the calculation of your customer LTV helps you get to grips with the cash flow in your business. Once you understand how much profit you make on each customer based on your current pricing model, then you can make decisions on how to increase your revenue, reduce your margins, or both.

When starting campaigns to increase your revenue, your customer LTV tells you what customer acquisition costs (CACs) you should be aiming for. This refers to how much you spend on acquiring a new customer.

If your CACs get too close to your customer LTV, then your marketing campaigns will become unprofitable (or minimally profitable) and not worth your time.

An Extra Use Case For LTV Formulas

When you have a SaaS business that is generating regular profit and has all its finances in order, you don’t just have a stable business. You have an investable asset.

Online business buyers find SaaS businesses highly desirable because, as a business model, they are built around recurring revenue.

When preparing your SaaS business for sale, it helps you get an accurate valuation figure if you have all your financials together.

Having a high customer LTV is leverage for you to increase the valuation of your SaaS business and sell it for a higher multiple.

Conclusion

Knowing the important SaaS metrics inside and out is crucial for a SaaS business, as there are so many moving parts. You can learn more about some of the other performance metrics you should be tracking in this article on the top 10 SaaS metrics to track.

Once you’ve used the formulas in this article to calculate your LTV, head over to our Valuation Tool to see what your SaaS business could be worth.