The Top 10 Biggest E-commerce Exits: How the Owners Did It

In August 2020, TechCrunch released an article claiming the pandemic had accelerated the consumer shift to e-commerce by five years.

In their analysis of the U.S. Census Bureau News report, they stated that the retail e-commerce market value increased 31.8% from Q1 2020 to Q2 up to $211.5 billion—a 44.5% year-on-year increase. As for the total sales in commerce overall, e-commerce sales increased its share from 11.8% to 16.1% in Q2.

This market jump was maintained throughout the rest of 2020, with the quarter-on-quarter percentage change being just -1.2% and -0.9% for Q3 and Q4, respectively.

The bureau has now updated the report to include data up to Q1 2021.

As expected, with the global situation looking somewhat closer to a state of “normality,” the annual growth of online commerce was not nearly as steep as in 2020.

Having said that, 2021 got off to a good start for e-commerce, as the quarter-on-quarter sales increase was 7.7%, so it looks like we are going to see this jump in growth maintained throughout 2021 and beyond.

This market shift has been reflected in the state of the online business mergers and acquisitions (M&A) industry.

With the increase of online consumerism, there was a natural increase in e-commerce sales, and it’s this increase in e-commerce sales that grabs the attention of online business investors.

Digital assets have been growing in popularity for some time due to their high-reward nature, but never have we seen such a surge of money into the M&A market.

As a broker with the world’s largest curated online business marketplace, we’re able to collect data on every transaction that takes place.

Every year, we release this data complete with our interpretation of what it shows about the state of the industry.

If you haven’t seen it yet, download your copy of the State of the Industry Report 2021 for free.

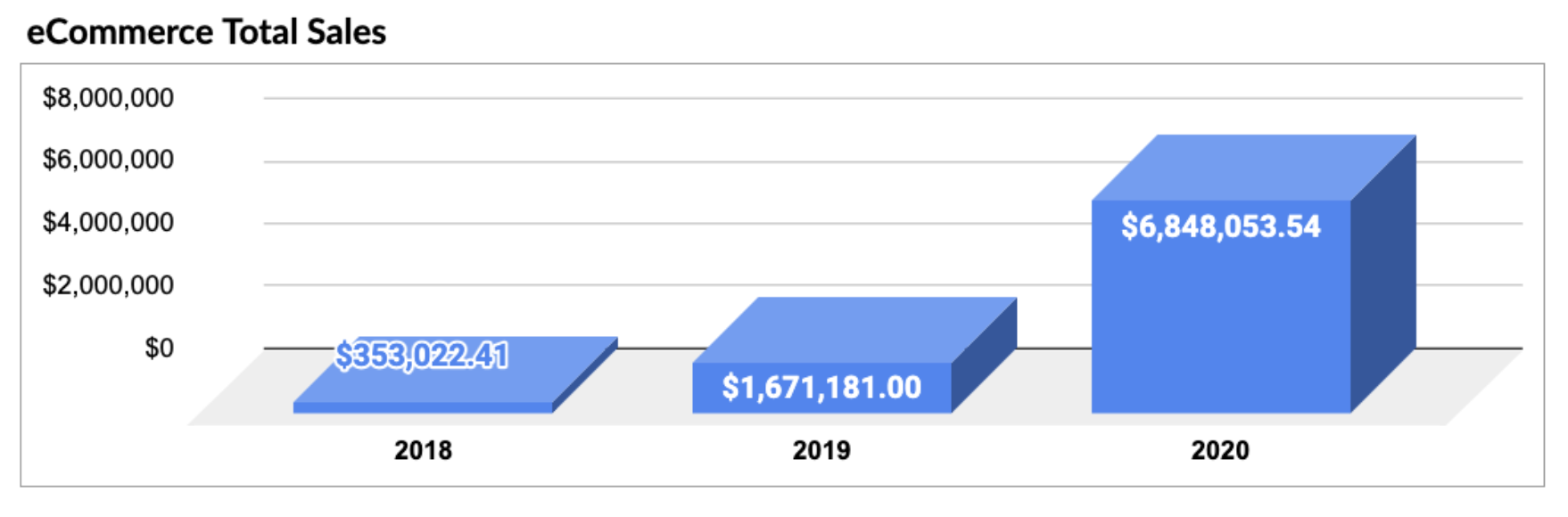

As you can see in the graph below, we sold substantially more e-commerce businesses at prices higher than any of our previous years:

If you’re looking at this table and wondering what a “multiple” is, it is a figure we calculate to determine the value of your business. If you look at the table above, for example, in 2020, e-commerce businesses were selling for 31.6x their average monthly net profit. So, if you made $5,000 a month and your business sold for a 32x multiple, you would have received $160,000 for your business.

We set a list multiple for every business we list on our marketplace. The main factors taken into consideration when deciding upon a multiple are the business model, age, earnings history, and defensibility against the market and competitors.

You can learn more about how e-commerce valuations work here. Or, if you’d like a quick way to see what value your business is, then you can find out in just a few minutes by using our free valuation tool.

As for the state of the market, we’ve never seen industry growth figures like this in our 10+ years as a broker. For the first time in history, we’re experiencing a seller’s market, and the numbers show that:

- We sold 13% more e-commerce stores in 2020 than we did in 2019, and 125% more than in 2018.

- In 2020, our sales revenue volume from e-commerce stores increased by 310% compared to 2019, and by a staggering 1,840% compared to 2018.

- Average sales price in 2020 increased by 402% compared to 2019, and 1,249% compared to 2018.

- The average sales multiple also increased by 28% compared to 2019 and 13% compared to 2018.

However, these numbers didn’t always look so good in 2020.

During Q1 2020, sales on our marketplace dipped dramatically. In fact, it was the worst quarter in our company’s history in terms of meeting our revenue goals.

This is exactly the kind of scenario that makes investors pull out and stop deploying capital. Investors can invest in challenging or easy markets, but what they don’t like is a market that is wildly unpredictable due to a catastrophic pandemic.

As the understanding of the disease and its effects on society became more apparent and expectations somewhat stabilized, investments into digital assets soared in Q2 2020. All of the dry tinder—capital that didn’t get invested in Q1—suddenly reignited the marketplace. This initial injection generated a buzz amongst sellers looking to make exits that lasted the rest of the year.

This has even continued into 2021. In April and May, we recorded record-breaking numbers of seller business submissions to our marketplace, all looking to capitalize on this seller’s market, which we’re currently experiencing.

Now that we’ve got a good taste of the state of the industry, let’s look at how, as an e-commerce owner, you can learn from the sales of e-commerce businesses to potentially make your own exit one day.

We’re going to break down the sale of the 10 largest traditional e-commerce deals we’ve ever brokered, so you can learn the anatomy of these businesses and how they work and apply the lessons to grow your own business.

The Top 10 E-commerce Business Exits

When growing a business, a lot of people believe that it’s good practice to copy what you can from businesses that are ahead of you. Every business is unique, but when collecting this data, we wanted to determine whether there were any commonalities between the top-performing businesses on our marketplace that you could learn from and potentially apply to your business.

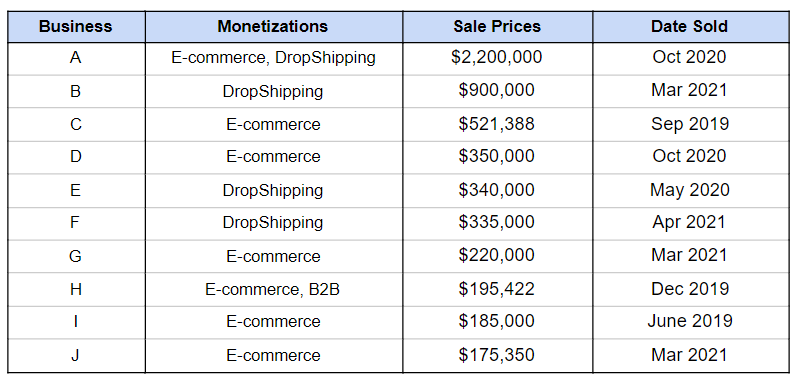

We looked at the 10 biggest e-commerce businesses we sold over the past two years. We collected data from traditional e-commerce businesses, including DropShipping, but not Amazon businesses, as they are quite different business models.

When looking at the dates these businesses were sold, we should consider the changes in the industry that have happened over the past few years.

If you refer back to the data from our State of the Industry report, you’ll notice that the average sale price rose 402% from 2019 to 2020, and the average sale multiple rose from a 23X average to a 29.5X average. The increase in investment demand would certainly have driven up the sale prices of these businesses.

It’s surprising to see DropShipping in this list, because it is difficult to make a lot of money from this type of business model; profit margins are low and competition is fierce in this space. That being said, the above table is proof that if done right, a DropShipping business can be a big money earner.

There are many areas of businesses that we can look at, so we split these areas into two categories: the business building blocks, which represent what the business is made up of and how it’s structured, and the performance metrics, which represent the numbers behind how the business performs.

We’ll start by looking at the building blocks of these 10 businesses to see how they’ve been set up for success.

Building Blocks

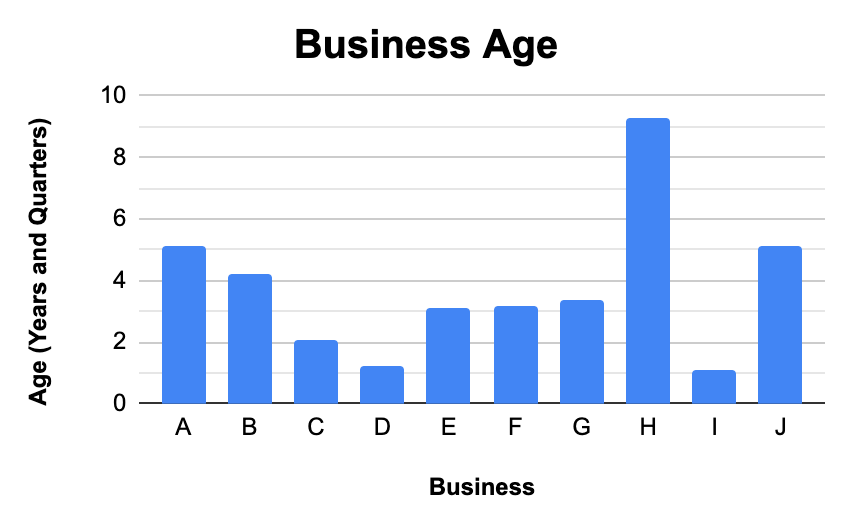

When valuing a business for sale, the first metric we usually look at is the business age. This is an important metric because a business that is well-aged has proven its longevity.

Business valuing isn’t based on one factor. Instead, we need to look at all of the many factors that dictate a business’ value to determine a viable list price—we’ll learn more on this when we dig into the data for this study.

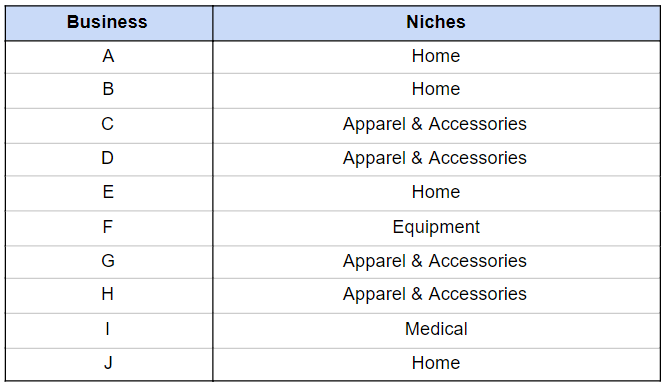

The data really started to get interesting when we looked at the niches of the businesses.

The home and apparel & accessories niches clearly take the majority, but why?

Evergreen niches are usually more desirable to buyers because, for the most part, there will always be demand for products in these niches.

Buyers don’t want to invest in the next fad diet business, especially at this business price range. They want an asset that will generate income for them in the long term, and the niche and room for product range expansion are huge parts of that factor.

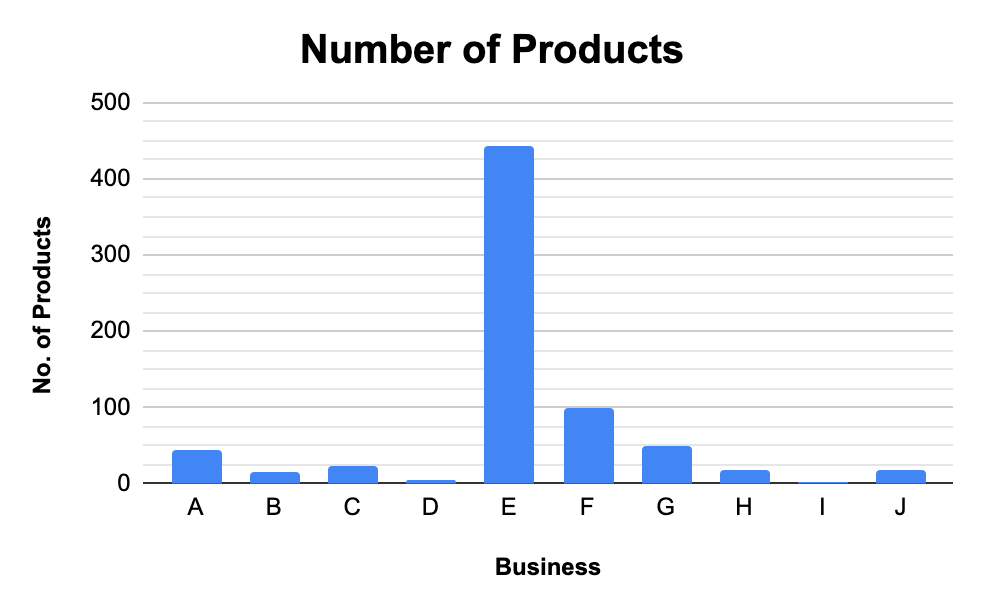

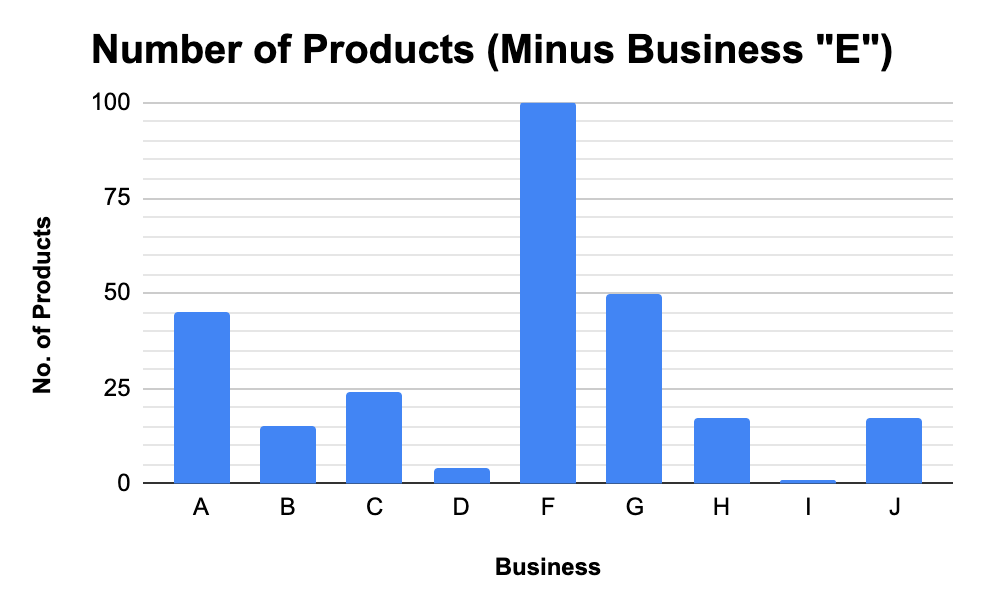

As for the number of products these businesses sold, this is what we found:

The first thing you’ll likely notice is the number of products that business E sells, which appears to be a bit of an outlier.

If we look at the data with business E removed, we can see that the difference of products being sold by these businesses is still quite high:

There are a few factors that come into play that determine how many products a business sells, including the business’ supply chain and the type of products they sell. Despite selling such a high number of products, business E was selling products that were closely related to each other within the same niche.

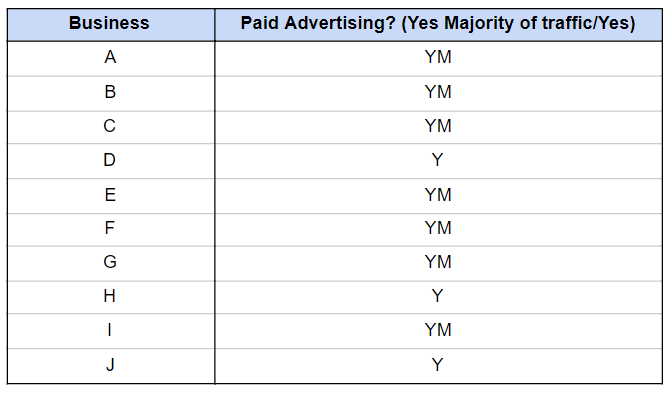

In order to sell products, you need to market them. You can carry out search engine optimization on your site, but is that enough to generate the traffic you need to make sales?

It takes a lot of time to build a site to the point where it generates substantial traffic from organic searches.

Paid advertising allows you to speed up the process. However, it does come at quite a cost, especially if you’re experimenting with ads and you have little to no experience in that area.

However, if we look at the table below, we can see that all businesses are carrying out paid advertising, and for 70% of them, paid advertising is their main source of traffic.

It certainly seems that, for these businesses at least, they believe you have to pay-to-play in the game of e-commerce.

This might be due to the amount of competition in e-commerce, or because it’s a more viable traffic generating strategy than other organic alternatives.

The fact that for 70% of businesses it was their main source of traffic shows these business owners placed heavy importance on paid ads.

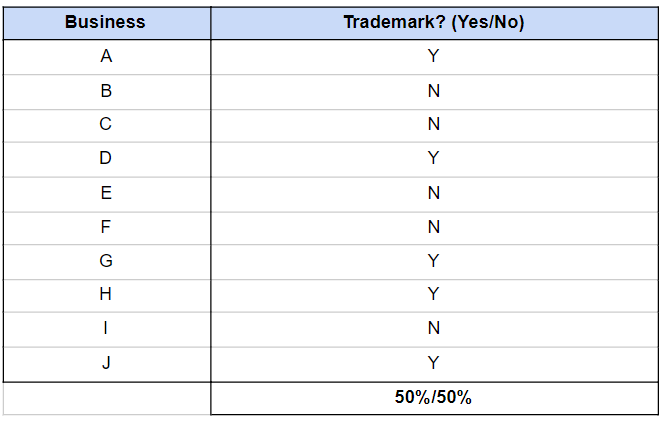

The defensibility of a business is another factor we consider when calculating its valuation. One aspect of defensibility is having a trademark to protect against copycat competitors.

To be honest, we were slightly surprised with these results, as we thought that the majority of businesses would have a trademark; however, it seems that only half did.

Acquiring a trademark isn’t the most straightforward process, especially for products that are widely available, as it’s difficult to make a “trademarkable” differentiation for your product design, functionality, or build.

Since all of these businesses are in evergreen niches, this could be why only half managed to get trademarks.

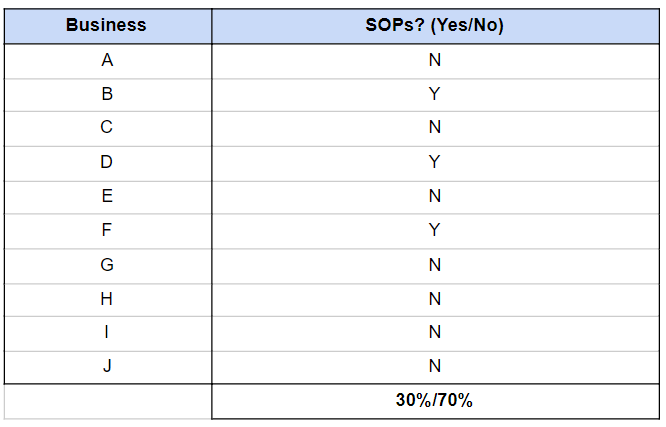

The final aspect we wanted to look at was how clean the operations of the businesses were.

To assess this on a very surface level, we looked at how many businesses had standard operating procedures (SOPs):

Again, slightly to our surprise, the majority did not.

Whether a business has SOPs or not doesn’t necessarily tell you whether the business had a good operational structure, but it could be considered an indication.

Of course, this is just one of many aspects of the business that are considered when calculating a valuation, so let’s move on to what may be the most important factors: the performance metrics.

Performance Metrics

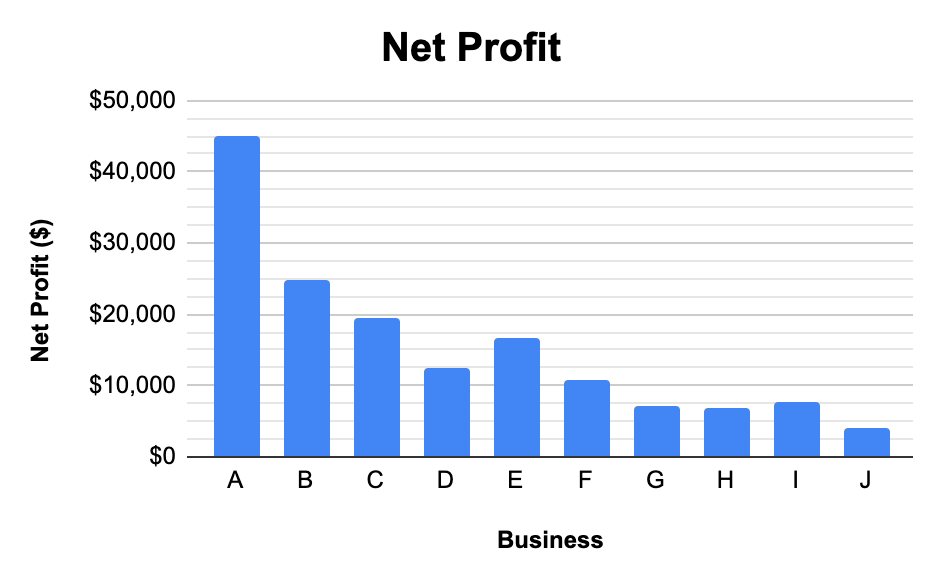

A business is judged on results. That means regardless of how it is set up, if it is generating consistent profits, then it usually has a chance of selling.

As you can see in the graph above, there is almost a direct correlation between the size of the business and its profitability.

While net profit isn’t the be-all-and-end-all, as we discovered in our study on the effects of net profit on business valuations, it certainly is one of the most important factors. The more money a business makes, the more money it can make the investor; therefore, the more the investor is willing to spend to acquire the business.

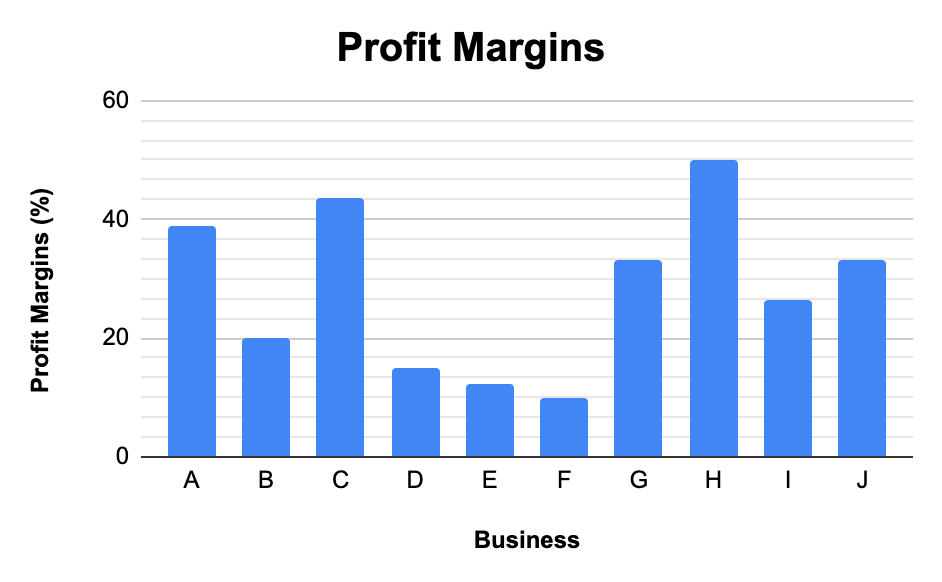

Another area wherein some buyers will look for opportunities with net profit is in the margins.

Larger margins mean that a business is doing well at keeping its costs low and its revenue high. The more money you make per dollar, the more effective your business is at making money.

Imagine having to generate $100,000 worth of revenue for $10,000 profit, compared to only having to generate $50,000 to earn that same amount of profit.

While it’s clear to see in the graph above there isn’t a close correlation between the size of the business and the margins, we should remind ourselves that a large portion of these businesses earn from the DropShipping model, which is well-known for its razor-thin margins.

Any business with profit margins on the lower side tends to have profit-boosting opportunities that a buyer could take advantage of for a quick return on their investment.

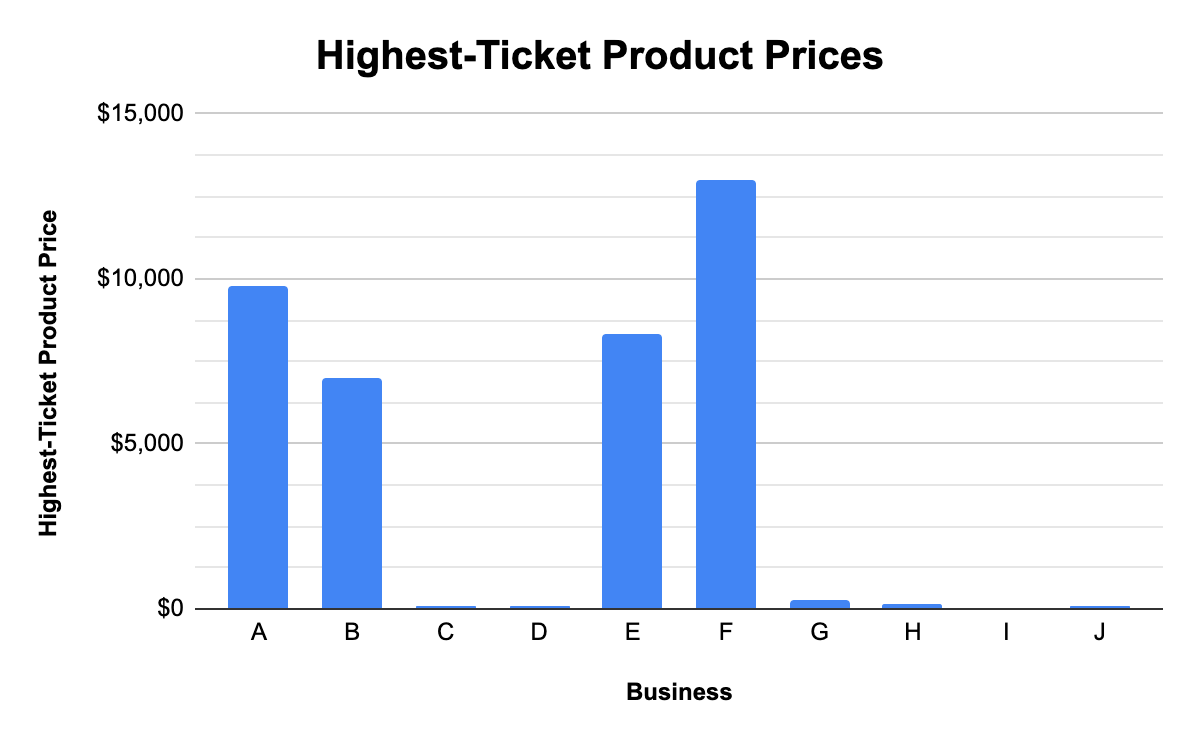

The other figures we look at when valuing a business outside of the financials are the numbers that represent the size and strength of the brand.

The main metric we look at in this area is the store traffic:

While site traffic is important, what’s more important is the quality of that traffic and how much it converts (i.e., the ratio of traffic to income). For example, business J could very well be seeing the same number of sales as business C if their site has a higher conversion rate. The most expensive product this business sells is $84.90. Compare that to businesses A and B, for which the most expensive products are $9,880 and $6,995, respectively.

It’s also important to bear in mind that some stores sell products at a wide range of prices, so they may only make a few higher-ticket product sales.

The next area we looked at was where these businesses generated their traffic.

Performance Assets

Building an audience is a big part of building a brand.

While some businesses just look for new customers, others build an audience of their customers to keep them engaged with the brand.

To link back to the traffic-income ratio, what we should also take into consideration is that some businesses that sell high-ticket products require fewer sales to make the same revenue that a business that sells lower-ticket products does. There is also the customer lifetime value (LTV) to consider: how much money is each business making per customer?

If there is no follow-up funnel set up with a business, then their customer LTV could be low; thus, the revenue they generate from the store’s traffic will reflect that.

One of the most effective ways to build that follow-up funnel and nurture your audience is to build an email list.

With an email list, you can send direct marketing to your contacts and increase their average order value and the amount of products they purchase from your business.

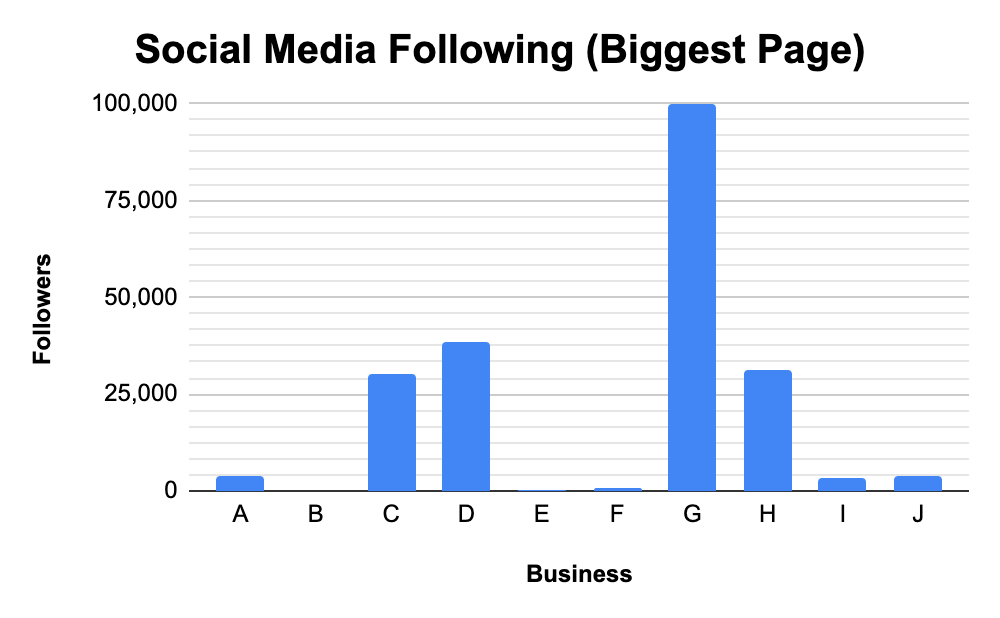

Another place you can build audiences is on social media.

You can see in the graph above that for business G, social media was a highly important marketing channel.

Using social media can be a very effective way to grow your brand. But then again, so can building an organic search presence. It all depends on your skills as a business owner and which channels you know how to use.

Some products are well-suited to social media, like business G, which sells formal shirts and accessories. It’s easy to grow a presence with influencers in that niche because influencers essentially act as models. For other products, like staplers, for example, it might be harder to find influencers with a big presence.

We’ve dived deep into the anatomy of these businesses. Now, let’s look at what the experience on our marketplace was like for each of them.

Marketplace Data

Most businesses sold at a similar price, so you’d expect them all to have a similar experience. However, online business buying and selling is an industry with many levels.

In the graph below, we can see that the time on the marketplace for business A was considerably higher than it was for the other businesses. It could be said that this was due to the fact that business A was considerably bigger. However, this is not a cut-and-dry conclusion.

Another factor that affects this is the sale multiple that the seller is asking for.

We work with our sellers to determine the most realistic and fair list multiple that we know would get the attention of buyers.

The multiple is based on all the factors we’ve discussed in this article, along with other factors that tell the story of the business.

However, what is worth comparing is the sale multiple.

You can see similar correlations between the list multiple and the sale multiple when you compare the figures business to business.

Business performance can change while it is on our marketplace, and every month we update the profit and loss statement (P&L) to get the latest net profit figures, which can lead to a valuation update if there is a significant change.

However, the biggest factor that determines the final sale multiple is negotiations. We usually need to leave some bargaining room for buyers. It’s a bit of a given that a business buyer is looking to get the best deal possible, so having that room for negotiation helps the seller get a higher multiple.

Another factor that affects the final sale multiple is the kind of deal the seller is looking for. If a seller is looking to get the maximum sale possible, they’ll happily wait a bit longer for an earnout-based offer that allows the seller to sell higher than the listing price—we’ll talk about these types of deals later on when we cover the buyers and deal structures for top-performing e-commerce businesses.

Just as the structure of each business was unique, their experience on our marketplace was also unique. With all the moving factors that come into play, every business had a very different experience in the sale process.

While it might seem like this data doesn’t draw some foregone conclusions on what makes a 7- or 6-figure business successful, there are some lessons we can take away from these businesses if we look at them individually.

Key Takeaways for E-commerce Business Owners

As you can see from the data presented, there were a few easily identifiable correlations between the sale prices of the businesses and how they were structured.

There are fundamental guidelines we like to encourage e-commerce owners to follow, but ultimately, the only metric that showed any real correlation with sale price was net profit.

There are a million ways for a business to earn money, so to say one way is right and another is wrong would usually be too much of a black-and-white point of view.

Products have their requirements and place in the markets. Niches have their own environment that is suited to particular business structures.

What we can say from this data in particular is that there is no one way to build a 6- or 7-figure business.

A lot of people may sigh at this takeaway, as we all look for laid-out pathways we can follow in many areas of our lives, but it isn’t necessarily a bad thing.

This means that the possibilities for you to build your own 6- or 7-figure business are wide open.

You can build your own brand using the skills and experience you have to do it your way.

However, looking at the businesses individually, there are some lessons we can learn. Here are our top four takeaways from the top four businesses.

Business A—There’s Power in Authority

This business was featured in the likes of Forbes, Living Cosy, Marin Magazine, and Los Angeles Magazine.

Having those authority badges on your website is invaluable in building trust in your brand. It tells your store visitors that you’re a legitimate company that sells high-quality products. Especially if you have the quality website design and product photos to match.

Building a large brand with a loyal audience is a sure fire way to build in-bound sales. For example, do you have to think about whether you want your next phone to be an iPhone? Most of us have already made that decision.

While you don’t have to be the next Apple, associating with big news outlets and niche authorities is a surefire way to build trust in your brand.

Business B—B2B is Where the Money is

The target audience for this business is bars and restaurants. They sell high-ticket products that will always be used in these venues, so there will always be demand for these products.

If you’re able to get into this kind of space where you’re selling B2B, there could be big earning potential for you, as businesses tend to make bulk orders once they have a supplier they trust.

Having a B2B relationship for a portion of your sales can really pay off for you.

Business C—It Sometimes Pays to be Cool

Building a popular and fashionable brand is no easy feat.

There are many giant brands out there like Vans and Rayban that will probably never go out of fashion. Those brands are very difficult to compete with, but you don’t need to.

The fashion industry is huge, and there is room for new brands to emerge.

This business, which is more of a fashion brand, takes advantage of modern-day social media influence in society by producing on-trend content.

It’s not easy to create a “cool” brand, but if you’re a savvy marketer, you can build a 6- or 7-figure brand and take your share of the fashion industry; the size of this business’ email list is proof of that.

Business D—Knowing Your Audience is Key

This business has a very relatable brand. It’s clear to see on their website, which features photo testimonials from customers, that the business understands their audience very well.

They also take advantage of one of the most profitable social media platforms, Pinterest, with an account that gets over 570K monthly views.

Looking at their Facebook and Instagram pages, you can see they show appreciation for their customers, encouraging customer engagement with their brand by sharing customer photos and testimonials—content that will really resonate with their audience.

The business generated the majority of its store traffic from social media, but their audience engagement doesn’t stop there.

The business also has a 15K strong email list that is monetized through email marketing. Most business owners stop once the traffic hits their site, but they’re missing out on lots of opportunities with follow-up marketing.

If we can sum up the biggest lesson from this whole study, it would be to play to your strengths.

Use what you do best to grow your business your way, and if all of the fundamentals are covered, such as high product demand, product quality, good supply chain to generate decent profits, and you have your finger on the pulse of what’s happening in the market, then it’s entirely possible to build your own path to a 6- or 7-figure business exit.

The next step on that journey is understanding the types of buyers who like to acquire businesses in this range and what types of deals take place.

Buyers and Deal Structures for Top-Performing Ecom Businesses

A common question in the online business buying and selling industry is, “Why would someone want to buy a business when they can build their own?”

To answer this question, I ask you to think about what it was like in the early days of your business. Investing a lot of time and money and not getting a lot in return.

A buyer can skip the many trials and errors it took to get your business to this point and start earning from day one.

Buyers without experience in online business are able to test the waters with an already-profitable business. Buyers with experience are able to build on their portfolio, flip your business for a profit, or use your business to grow another business.

The market is getting increasing attention from high net worth individuals, private equity firms, and family offices who are building portfolios of digital assets. Recently, we’ve had record-breaking weeks, and the pace of the market boom doesn’t seem to be slowing down.

As for the types of acquisition deals these big-money buyers are offering, at the 6- to 7-figure price ranges, they typically offer earnout deals.

An earnout is when a buyer pays a percentage of the sale price upfront, usually between 60%–70%, and the remaining amount over a period of months.

The beauty of these types of deals is that they can be performance-based. That means you are paid out based on the performance of your business. If your business continues to earn steadily as normal, then you’ll be paid out the rest of the sale price. However, if your business exceeds expectations, then you’ll be paid a performance bonus.

The motivation for the buyer is that if for some reason out of everybody’s control the business sinks, their investment is still secure.

Let’s look at an example. An e-commerce business owner has their business listed for sale with a listing price of $1,100,000.

If they would like a quick exit, they might consider offers with an 80%–90% upfront earnout with the rest of the funds paid out as a fixed amount over a 12- to 24-month period, or a full list price buyout. One earnout offer could be $900,000 upfront with the other $200,000 paid in monthly installments of no less than $10,000.

If they would like to hold on and wait for a higher value exit, they might focus their attention on offers with an earnout structure that offers the opportunity to earn more than the listing price by allowing the buyer to pay on a performance basis.

While holding on for the bigger deal, the seller might receive an offer of $800,000 upfront with an extra $700,000 to be paid out over a certain period of time, depending on the performance of the business post-sale. In this example, the offer might be for the seller to earn 33% of the business’ monthly net profit paid out on a quarterly basis.

As a broker, we manage the earnout payments to ensure the full purchase amount is paid. In a performance-based earnout, there are usually performance terms related to payments that are agreed upon by both the buyer and the seller.

Typically, the terms of these types of deals revolve around revenue as opposed to profit, as there is more responsibility on the buyer to control profits compared to their influence on revenue. If the performance earnout is based on profits, then the profits would be calculated as the seller’s discretionary earnings (SDE), so they are calculated with the same expenses the seller incurred to run the business.

Your personal situation will have an effect on the type of offer you can accept.

If selling your business quickly suits your needs, maybe you would like the capital to invest in a house or another business; in this case, an offer with as much cash upfront as possible will be better for you.

If you want to get the maximum sale price you can, then welcoming offers with deal structures that pay you over time can help you get a larger payout.

If you’d like to learn more about the type of deal structure you would expect for your business, then you can call one of our expert Business Advisors for free.

Conclusion

We’ve gone through a lot of data in this study to try and unpack 6- and 7-figure e-commerce businesses to see if there are any lessons we can learn from how these business owners were able to achieve their success.

Each business is unique and has its own place in its niche. The biggest takeaway from this study is that there isn’t one way to grow a successful business, and there isn’t one way to exit that business for a potentially life-changing sum of money.

If you’d like to learn more about what the selling process will look like for your e-commerce business, then schedule an exit-planning call with one of our expert advisors. It’s free, and we’ll walk you through the steps to get your business sold for maximum profit.