How to Read a Balance Sheet Like a Seasoned Pro

Managing your own business means you’re overseeing a lot of moving parts — the people, the resources, the finances, the marketing … the list goes on.

To help with managing at least one of those aspects a little better — the financial side — it’s important to take the time to understand all of the financial documents involved with keeping your finances in line. These typically take the form of income statements, cash flow statements, and balance sheets.

When it comes time to sell your business (if that’s what you choose to do), balance sheets can provide a clear snapshot of your company’s worth, and they can inform you on whether your business can continue to fund its own growth. Vice versa, if you’re looking to acquire a business, balance sheets become a vital part of the decision-making process.

By breaking down all the components of a company’s balance sheet and understanding how to analyze the information, this article can hopefully serve as a guide for understanding how a balance sheet works, so you can prepare to acquire or sell a business.

What Is a Balance Sheet?

A balance sheet is a statement of your business’s financial position, and it involves three major parts: 1) your assets, 2) your liabilities, and 3) your equity, whether it’s the shareholders’ or the owner’s (or a mix of both).

And, you guessed it: a balance sheet got its name because the two sides of the sheet must add up to the same amount.

The equation of a balance sheet is essentially:

Assets = Liabilities + Equity (Owner’s / Shareholders’)

This can help you or a potential buyer understand who owns the company’s assets — is it other people (liabilities), or is it the business owner (equity)?

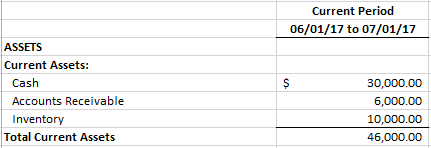

Below, you can see a visual of how a balance sheet is typically laid out, using a free balance sheet template through Excel.

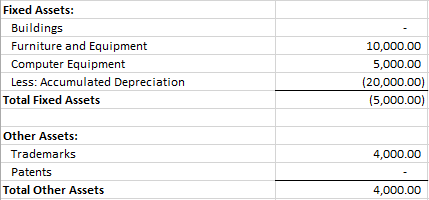

This is the first half of the (mock) balance sheet for my hypothetical Fulfillment by Amazon business, Beach Bum Accessories. I organized it by month so I can keep track of things on a pretty regular basis. Here, you can see the assets of the business. (What I “own” … I wish. Sigh.)

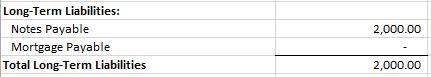

The bottom half of my balance sheet reflects what I owe others, and at the very bottom, you can see that both halves balance out!

Having a balance sheet in addition to an income statement (Profit and Loss Statement) and a cash flow statement can provide a potential buyer with a well-rounded portfolio of information about your business. These three statements work together to provide data that can help you analyze the health of your business or of someone else’s.

Income statements show how a company has performed over time by breaking down sales and expenses, and cash flow statements provide insight on the flow of money in and out of the business. In comparison, a balance sheet is a statement of financial position at a single point in time, and it’s usually taken at the end of a month or quarter; if you can view a balance sheet from the most recent month, it’s a timelier example of the business’s financial health.

You can compare balance sheets from different points in time, too, in order to see how the company has changed over the course of several months or quarters.

Balance sheets are an incredibly useful tool to keep a close eye on accounts payable and other liabilities — in other words, they’ll help prevent you from losing money due to not paying attention.

Whether you’re considering buying a business or you’re keeping track of your business’s financial wellness, it’s important to know how a balance sheet is structured, and how to analyze the data in order to make less risky decisions.

How to Read a Balance Sheet

As mentioned before, a balance sheet is made up of three major components: assets, liabilities, and equity. Each part comprises important details that all relate back to your financial status.

An asset is anything of value to your company, such as items that can be liquidated (such as inventory or equipment), accounts receivable, or cash itself. Liabilities, on the other hand, is the amount of money you owe to other people or other financial institutions — it’s part of what you need to operate. And the other part of a balance sheet is the equity of the business owner, or what is left over once the liabilities have been subtracted from the assets, also known as book value.

Assets

Assets are essentially anything of value to your company: cash, office equipment, production facility equipment, inventory, accounts receivable, and intangible items, too. For example, the assets in Beach Bum Accessories are the cash I saved up to start the business, the money that is owed to me (my accounts receivable), and the inventory that I sell on Amazon.

No matter how many assets you have, they must equal the sum of the equity plus liabilities … heck, that’s why assets take up half of the equation. They’re the means of operating a business, which is why liabilities and equity must add up to the assets; your means of supporting your business through borrowing money, or from money or value invested, need to equal the means of operation, so it’s clear where the money from your equity and liabilities is going.

On a balance sheet, assets are listed in categories based on how easily they can be liquidated (or turned into cash, sold, or consumed). It’s advised to have some of your assets as liquid as possible in the event that you need to convert something into cash quickly.

A balance sheet starts with the current assets that are the most liquid, then ends with non-current assets.

Current assets are the items that can be liquidated within a “lifespan” of a year. Typically, these are items like cash, cash equivalents, prepaid expenses, short-term investments, marketable securities, short-term obligations owed to the company (accounts receivable), inventory, and credit that a business has used to sell a product or service paid for by your client.

Non-current or fixed assets are resources that make or break the company. They’re items that can’t be easily converted into cash in an immediate sense; their “lifespan” is more than a year before being able to be liquidated. These assets include tangible assets like machinery used for production and buildings or land used for the business, as well as intangible assets like patents, copyrights, long-term investments, any intellectual property, and goodwill (the cost to purchase the business minus the fair market value).

Non-current assets often experience depreciation, and this is calculated and deducted from this particular type of asset, rather than the assets as a whole. (Experts at The Balance shed a little more light on how accumulated depreciation factors into non-current assets, in case you’re interested.)

If you have a building/property that you use for your business, it would go on an asset line item; my hypothetical business doesn’t have one listed since it’s online.

Added up on one side of the equation, assets then must balance out with …

Liabilities

On the other side of the equation are liabilities, which are the financial obligations owed to other people. These can take the form of a loan, a credit card balance, payments that are owed to suppliers, and any short-term or long-term borrowing situations.

Any and every business is going to have some sort of liabilities — there’s virtually no way to run a business without some. When added up, they represent the total cash value that a company owes others, but it’s not an issue unless the company is spending way more than its earnings.

Long-term liabilities are the types of debt or obligation that you have for longer than a year from the time of writing the balance sheet, like a mortgage.

Current liabilities or short-term liabilities, on the other hand, are items that must be paid within a year of creating the balance sheet. These are things like shorter-term loans, accounts payable (what is still owed to clients), and interest payments on a longer-term loan.

Accounts payable, which is the amount owed to suppliers for raw materials or products, is the most common and usually highest current liability. This is since many companies receive a product or a service before paying for it.

After adding up your liabilities, you’ll add that to …

Equity

The equity equals what is left over once liabilities have been subtracted from the assets.

If you’re a small business that hasn’t gone public, your equity will be made up of assets that you, the owner, have control of after you’ve paid off debt. It’s the amount you would have if you were to liquidate your assets and pay off the liabilities.

If your business is publicly traded, then the equity portion of your balance sheet will include your shareholders’ equity, which is how much ownership they have in the business once the debts have been paid. When you subtract the total liabilities from your total assets, you’ll come up with your equity, also known as the net worth. Retained earnings is the money that is left over for your business, and with a healthy cash flow, these numbers should be in the positive.

If you’re not entirely sure what is considered equity for your own business, you can always consult with a financial advisor who can break it down even more for you.

How to Analyze a Balance Sheet

Now that you understand the different components of a balance sheet, you can compile this information and use it to gain insight on your own business, or take the numbers on the balance sheet and analyze them further to understand the operational side of a business that you potentially want to purchase.

It’s time to get out the income statement and the cash flow statement, too!

First of all, though, you must make sure your most recently calculated balance sheet (whether it’s from last month, quarter, or year) is equal on both sides. If things aren’t adding up, you’ll need to go back through and determine where the misalignment is happening. Did you forget to list an asset, so your liabilities are much higher?

Using financial strength ratios will allow you to calculate and synthesize the information you’ve compiled across your various financial statements, thus being able to prove how well your business can meet certain obligations (especially for borrowing money). It also helps you keep track of performance, identify trends in your business, and implement new strategies as a result.

There are many ratios you can use to calculate your business’s financial health, but I’ll be going over three major ones to analyze when deciding to acquire a new online business.

Debt-to-Equity Ratio

A debt-to-equity ratio is important for understanding whether a business owes more than it takes for it to operate and finance its assets. It places this debt in relation to the equity, and this can help measure a company’s financial leveraging, otherwise described as the ability for a business to use debt to acquire new assets.

This financial ratio is calculated by dividing your total liabilities by your total equity, which is your assets minus your liabilities.

Debt/Equity = Total Liabilities / Equity (Total Assets – Total Liabilities)

If you have a lower debt-to-equity ratio, you’re considered a lower risk for defaulting on a loan. This is similar to the process of taking out a mortgage from a bank — if you have a large deposit relative to what you’re asking to borrow, a banking institution will lend it to you at a better interest rate.

If your ratio is high, and your levels of debt are elevated compared to your equity, then your business is considered to be “highly geared” (which is just fancy jargon for being in higher amounts of debt).

However, levels of “high debt” are relative to the industry you’re in, so before getting nervous about your ratio, consider other businesses in your sector. Items such as having less fixed assets or more goodwill can affect this ratio.

Return on Equity Ratio

A return on equity ratio indicates how well a business can generate profit from your equity. Investors often use this ratio as a key to determine whether a business is worth investing in.

You’ll need to use both your balance sheet and your income statement to calculate this ratio using the following formula:

Return on Equity = Net Income / Shareholders’ or Owner’s Equity (Assets – Liabilities)

This ratio will show how much your business is working the assets to churn out more profits, and the hope is that a business is able to earn more from the invested capital.

Working Capital and Current Ratio

Determining the working capital of a business allows you to measure the business’s ability to meet short-term obligations, and the working capital can be determined really easily:

Current Assets – Current Liabilities = Working Capital

If you don’t know your working capital, it makes it more difficult to handle issues that may arise as a surprise, such as an error in the production quality of a product, which would lead you to borrow more money to resolve the issue (and go into more debt).

The current ratio can also help you understand a business’s ability to meet short-term obligations, but the current ratio will give you a percentage instead. It shows potential buyers or investors the liquidity of your company:

Current Ratio = Current Assets / Current Liabilities

You’ll want to have a ratio greater than 1 (at the very least) in order to prove that your business is capable of satisfying the liabilities and is healthy.

Always Balance Things Out

Tools like balance sheets will help you evaluate your business’s ability to meet financial obligations, as well as figure out whether you can use credit to finance your operations, if you need to do so.

But even more importantly, when you’re looking to invest in a business, balance sheets are a vital component that a business must have in order for you to understand how their company really operates. It’s an inside look into the daily functions that you otherwise wouldn’t have access to.

By taking the time to understand the different components of a balance sheet, along with useful ratios to use when analyzing the data, you’ll be able to make a confident decision about your next business acquisition or the sale of your current business.

Photo credit: chaoss