Our Monthly Report – March 2015

It’s amazing how quickly business can turn around.

After last month and what we would consider our worst in business to date, we ended up having our best month ever in March.

In total, we closed $513,853.71 worth of business through both our brokerage and investor program.

We’ll get into all the dirty details below, but I have to say we’re ecstatic with how things turned out and the credit really goes to our team in getting this done. They worked their butts off to help sellers get their sites listed, help depositors find the right sites, and help get the deals closed.

As always, our goal is to share with you our successes and failures in the hopes that they help you build and grow your own profitable business.

We’ll cover everything in depth but first, let’s take a look at the overall numbers.

Executive Summary – March 2015

Our huge boost in sales is what really made this month, but I’m also happy to note that we’ve begun our new investor program and have landed our first private investment.

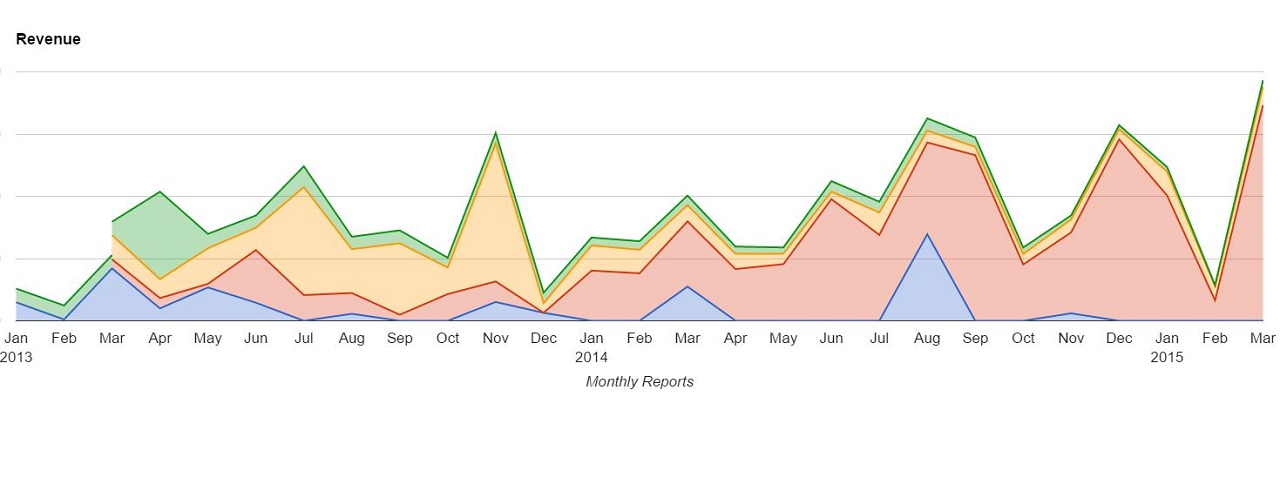

Here’s a look at all of our revenue streams over time:

March 2015

Business Data:

- Employees: 8

- Apprentice: 1

- Contractors: 3

- Contact Records: 28,854 (+1,121 from previous month)

- Email Subscribers: 18,727 (+821)

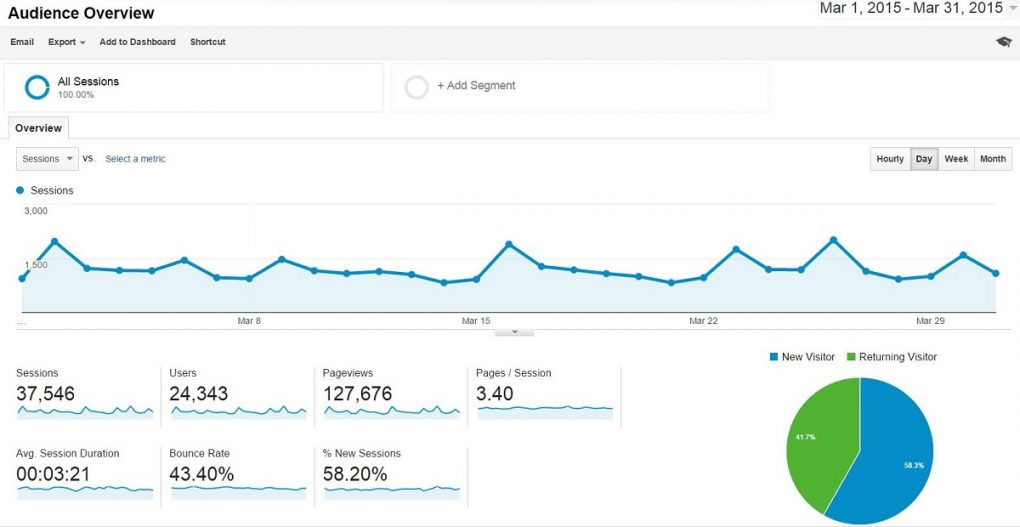

- Site Visits: 37,546 (+3,350)

Earnings:

- Brokered Site Sales: $388,853.71 (+$358,651.51)

- Brokered Site Earnings: $51,988.46 (+$47,053.49)

- Listing Fees: $4,449.00 (+$1,091.00) 14 new, 3 returning

- Investor Program Raised: $125,000.00

- Investor Program Commissions: $0.00

- Investor Program Monthly Earnings: $0.00

- Investor Program Revenue: $0.00

- Our Sites Sold: $0.00 ($0.00)

- Outsourcing: $0.00 (-$1,000.00)

- Additional Revenue: $1,544.63 = ($531.39 Amazon) ($217.96 Affiliates) ($44.65 eBook Sales) ($150.63 Tshirt Sales) ($600.00 Other)

TOTAL Revenue: $57,982.09 (+$48,404.79)

Revenue Breakdown

Now that we’ve looked at the overall numbers, let’s break down each revenue stream and dig into the details.

Brokered Site Revenue

Here’s a look at our all-time brokered site revenue:

And our month-by-month breakdown:

We ended up brokering 23 transaction with our largest at $76K and the smallest at $4.5K. This added up to a total of $388,853.71 in brokered site sales (our best month to date) and brought in nearly $52K in revenue for the company.

We’d been building up inventory in the $10K – $100K range over the last couple of months, so it was nice to finally find the right buyers for those sites and move them along.

After a dismal February, Joe and I put our heads together on what we thought might be the best way to promote sales and finish the quarter strong. We ended up clearing our schedules for two weeks and opened up the floodgates to talk to prospective buyers and answer questions about sites they were looking to purchase, how to grow their purchased sites, etc.

This ended up having a fairly dramatic and tangible impact to our sales and bottom line. (More on that later)

While this was our best month ever, we weren’t able to close all of the deals that were going through in March and quite a few of them have trickled over to April. We’re expecting another strong month leading us into Q2.

It’s interesting to note that a mere 2 years ago our “normal” sales were in the 4-figures, while our “reach” listings were mid-high 5-figures. Today, we’re closing 5 to low-6 figures sites on a consistent basis and our “reach” deals are in the mid six-figures.

We realized that there was more value in pushing ourselves out of what we were comfortable with and moving up the value chain. By learning how to do deals we weren’t as comfortable with, we opened ourselves up to a new market, new customers, and new opportunities.

Website Listing Fees

We had another solid month for new listings in March, bringing in a total of $4,449.00.

- 14 First-time listings @ $4,158.00

- 3 Repeat listings @ $291.00

After clearing quite a bit of our inventory in the $10K – $100K range, it will be important over the next couple of weeks and months to keep the flow of new listings and sellers coming in. We’ve been expanding some of our paid channels and content marketing strategies to improve dealflow so that we can keep up with demand.

By far, our best source of new listings is word-of-mouth. The more our sellers get the word out about how they listed and sold with Empire Flippers, the more new sellers we’re able to bring into our ecosystem.

Investor Program

After months of discussion and delays we finally (privately) launched our investor program and moved forward with an investment of $125,000. We ended up having dozens of discussions with potential investors which really helped to shape the direction of the program.

Ultimately, this first investor is keen to get involved in owning a portfolio of website investments, but simply doesn’t have the time or skills to run them. Combining his capital with our skills and team should prove to be an interesting combination.

While we’ve received the cash from the investor, we haven’t actually deployed the cash yet in purchasing the sites. The plan is to take it slow and to find a great mix of sites to add to the portfolio through April/May. There’s no rush on the investor’s end, so we’re comfortable taking our time here to find the right sites.

It’s funny – we’re feeling the pain of some of our website buyers. We’re looking to follow the Lifestyle Larry approach we laid out in a recent podcast. While we have some inventory, finding the RIGHT site at the RIGHT price point in the RIGHT niche isn’t quite as easy as it sounds. The best way to solve that problem is to have more sites for sale – something that we’re definitely working on.

Additional Revenue

Most of the earnings here are from Amazon affiliate income, Long Tail Pro sales, eCommerce sales, and earnings that carried over from February.

We expect this to grow a bit over the next few months as we hold some sites temporarily, but it shouldn’t be a major driver of revenue for us in the near future.

Traffic And Audience

Here’s a peek at our blog traffic, podcast downloads, and email list for March, 2015.

Blog Traffic & Analytics

We’ve seen month over month growth on the blog and brought in a total of 37,546 visits in March – 10% more than we received in February.

I’ve thought about why this might be quite a lot and the best answer I can come up with is attributing it to our redesign. We seem to have a much more “sticky” factor for those who are new to our brand and are keeping them around longer.

Here’s a look at our channel traffic and deposits for the month:

More than half of our depositors came from direct traffic and those familiar with our brand, but it’s good to see our organic traffic also brought in 30% of our depositors for the month.

I’m happy with our organic traffic and positioning in the SERPs, but considering we haven’t done much onsite SEO work, I think there’s a big opportunity there. We recently hired Chris and Nico over at Pagespeed.io to help us with our onsite optimization. I’m not expecting immediate returns here, though – we’re probably 4-6 months out from seeing how these changes play out.

Here’s our referral traffic for March:

Facebook and Reddit dominate the referral traffic, but I was happy to see our paid, niche-specific traffic from sites like BizBuySell and BizQuest sending some visits as well.

Our top content in March:

The majority of our traffic definitely hit the Marketplace with a fair amount also to the Valuation Tool and How It Works pages.

Podcast Downloads

We kept up with the podcast in March and saw a significant bump – up to 18,545 downloads compared to 12,783 the previous month.

It helps that we published a show every week in March. I actually think we published some of our best podcasts in March. If you’re new to the show, I’d recommend:

Lifestyle Larry Guide To Job Replacement Income – Joe and I dig through the details on the types of sites a “Lifestyle Larry’ might want to include in his portfolio. One of our best topical shows to date.

10 Proven Tactics For Growing Purchased Websites – We cover each of the different tactics you can use to expand your sites in detail.

Dan Pena On Creating $50B In Value – (NSFW) A No-BS approach to building a real empire, Dan covers his path to creating a 9-figure company and 11-figures in value through his network.

Emails & Contacts

We ended the month with 28,854 total contacts – up 1,121 from the previous month.

We ended March with 18,727 active email subscribers.

We’ve narrowed down our email list segments to: buyers, sellers, investors (a much smaller segment). All have informational emails relevant to the segment, but I’m wondering if it wouldn’t make sense to break them down by interests even further at some point.

Customer Experience

We strongly believe that our customer experience helps set us apart from our competitors and that’s one of the reasons we measure our success (or failure) in this area every month. Keep in mind that the majority of our feedback and comments are overwhelmingly positive, but I’m highlighting the positive and negative equally for clarity.

Here is some of the behind-the-scenes feedback we’re getting from our customers.

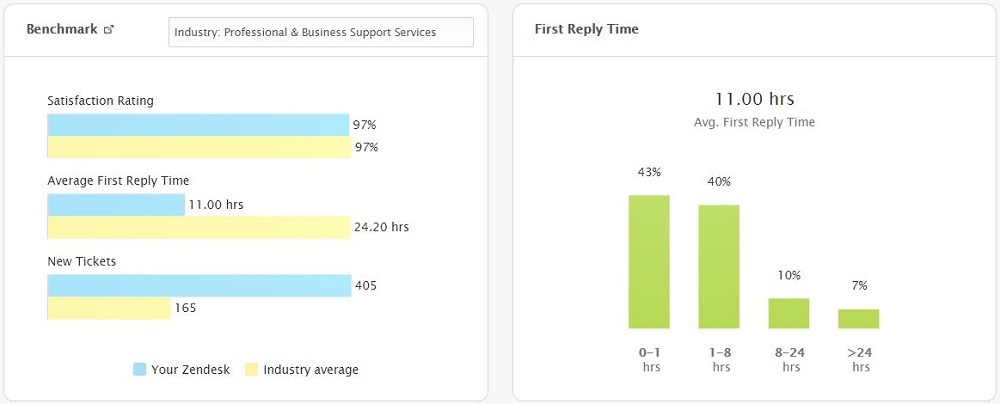

Zendesk Support

With fairly poor numbers in February, we made a point to focus on our team and the support we were delivering to our customers.

This definitely paid off – we were able to slightly improve the satisfaction rating, but also cut our first reply time by more than half.

Here’s a look at March’s numbers:

Compared to February’s numbers:

This is great considering we had 719 new tickets in March compared to 405 in February.

Our team is currently keeping up on all of the tickets/work and, with the addition of Andrew as our new Account Manager, we’re hoping to push those numbers down even further.

We’re back to 2-4 weeks from seller submission to listing, but we’re hoping we can get that down to less than two weeks within the next month or two.

We’ll have the whole team together from May 13 – June 13 in Davao City, Philippines and we’ll be using that time to clean up our support processes and introduce our new Account Manager to the team.

Customer Feedback

Out of a total of 719 new tickets, we had 128 marked as good/satisfied and 3 marked as bad/unsatisfied.

Here’s a comment from a happy buyer:

I liked his suggestion of putting together a “new site buyer” content package. I agree it would help to add confidence and help the buyer down the right track to growth.

Here’s feedback from a happy seller:

This site is currently still listed, but I’m confident he’ll have a buyer for the site soon.

We didn’t get direct feedback from the bad/unsatisfied tickets as they didn’t leave any comments, but they were around one of the following situations:

- Wanting information without paying a deposit

- Not wanting to pay a listing fee to submit the site

- Having their site declined in the vetting process

Whenever we get bad or negative feedback, we ask ourselves a question:

Was this unintended consequence or are things working as intended?

In the case of someone not wanting to pay a deposit, listing fee, or getting denied in the vetting process, we chalk that up to “working as intended”. While we might have done better about explaining the value/reasoning, it’s not something we’d really like to change.

If not working as intended, usually one of two things happened:

- We screwed up

- There’s a hole in our process

In the case that we screwed up and someone on our team was not following the proper procedure, we use that as a training opportunity to make sure that person (and everyone else) is up to speed.

Where there’s a hole in our process, we usually wait for several pieces of bad feedback before making any changes. If the situation is extremely rare it may just not be worth the time/hassle to change the process. Once we have a few examples of where the process got in the way of good business, we’ll usually address and correct.

This definitely isn’t perfect, but it helps us sort out the things that we do want to fix/change from the ones we don’t and it also let’s us know whether it’s a personnel or process issue. (And allows us to address it)

What Happened In March 2015?

Last month I covered some of the reasons for our bad month and I wanted to take a look at what we did differently in March to compare. Some of the reasons for the disparity were out of our control, so I wanted to specifically cover the things we deliberately worked on.

1. We had an excellent amount of inventory.

As carry-over from a bad February, we started the month of March off with a good amount of inventory for buyers to review.

This makes sense – if you’re looking to buy an AdSense site in the $20K – $40K range and we don’t have any available, it’s less likely we’ll be able to do business. (At least right away) If, however, we had 8-10 available and a wide variety of industries, there’s a much better chance we’ll be able to find you a site that you’ll like.

This is the case for most eCommerce companies in the early stages which is why so many of them funnel their profits back into inventory.

That’s one of the reasons we’re constantly on the lookout for new sellers and sites for sale. If we can keep a nice selection of inventory, we’re more likely to find the buyer the site that’s right for them.

2. Our support team improved significantly from the previous month.

It’s not a coincidence that significant improvements in our customer service numbers coincided with a significant improvement in the number of websites sold.

The better we are at:

- Swiftly responding to customer inquiries

- Directly answering their specific questions

- Communicating our value

the more deals we’re bound to do.

We view this as an iterative process that continues to improve value for our customers and provides us with a competitive advantage. In talking to our customers we found that flaky brokers seemed to be an industry norm – something we’re looking to change.

3. We cleared our schedules and talked to more than 100 potential customers.

After a bad month in February, Joe and I sat down to discuss what we could do directly to improve our numbers for March. While there were a few deals in the works, we found an opportunity at the top of the sales funnel to drive more potential buyers.

While Mike was working with both buyers and sellers towards the end of the deal, Joe and I dropped everything else and sent an email out to a few thousand potential buyers inviting them to schedule a call with either/both of us. Over the course of two weeks, we spoke to more than 80 potential buyers, with a couple dozen more in the following two weeks.

Some things are just more easily asked/answered over the phone than by email and this gave us an excellent opportunity to answer questions, clear up misunderstandings, and help buyers figure out which sites might be best for them.

This definitely falls under “doing things that don’t scale” and the feedback was incredible. Here are just a few of the things we learned about these potential buyers:

A) Our buyer profiles are pretty accurate – While some buyers self-identified with the profiles, others fit one or more to a tee. This was incredibly helpful in guiding them towards the right sites for their particular situation.

B) There’s a huge need for more education in our industry – Both in terms of explaining our process and also covering things like risk management, due diligence, and expanding and growing purchased sites.

C) Our podcast is incredibly valuable – More than half of those we spoke to had listened to one (or even all) of our podcast episodes. Conversations with regular listeners were incredibly easy as it felt like we were already on the same page.

D) Our investor program is a step in the right direction – There are plenty of people out there with more money than time who simply don’t have the time to run/manage a portfolio of sites, but still want to get involved from an investment perspective. This is definitely solving a problem. The potential customers for this included: partners who would like to pool their money on a portfolio, an offline real estate investor who own 15+ properties and is looking to diversify online, and an Ex-VC attorney looking for a niche investment with great potential returns.

Aside from the revenue, March was a really productive month in terms of better understanding our customers, our market, and preparing for what we believe will be significant growth in the buying and selling of websites and online businesses.

I think we’ve done a good job in terms of setting up processes and hiring the right people, but we need to take a more data-driven approach to our strategy for growth. We’d be happy to ride the tide, of course, but I think there’s still a ton of opportunity we’re missing out on when it comes to better understanding customer acquisition costs, lifetime value, and meeting the needs of the market.

That’s it for this month’s report – thank you for checking it out! Please feel free to share if you think others might find it useful too:

“New – Monthly Business Report for March 2015 from the @empireflippers!” – Tweet This!

So how did your month turn out? Any thoughts or comments you’d like to share? We’d love to hear from you!

Discussion

Nice rebound guys! Remind us why biz feel so much the month prior?

How much time do you guys spend managing employees/contractors? Right now, everything is managed by me and it is easy. Do you think it’s worth scaling up and dealing with more people if revenue is pretty healthy already?

I’m making more than I need or use, so I’m thinking what’s the point? I’m curious to know what your ultimate business/income goals are? Also, what type of assets have you accumulated during your time running the business e.g. property, investment portfolios, etc.

Thanks!

Sam

Hey guys. Just a question. If while vetting a site, you find that the site is poorly optimized, is it an option for you to buy it, optimize it and then flip it? or will it be a bad move for your brand.

That’s a really, really good question, Alex.

Up until now it hasn’t been much of a problem. We saw some sites we thought had opportunity there for us, but we never acted on it.

With the investor program, this could become more of an issue as we’re actively involved. As it stands – we do NOT get first dibs on sites before they’re publicly available for everyone. All sites get listed publicly and THEN we can take a look at picking them up for the investor program.

Here’s how we think about it – as long as we’re operating with transparency, we’ll be fine. For now, this is a much smaller deal for us and as long as we’re fair and upfront with both sides, we think everything will be OK. If/when this expands we’ll have more complicated “conflict of interest” problems we need to mitigate though, for sure.

Making sure ALL vetted listings go public is our first step. In the future…I don’t know. Chinese wall? Separate companies? That’s what we’re looking at. Either way, we’ll be walking through it on the blog/podcast for all to see and comment. 🙂

Hey guys, great month and glad your pivot to focusing exclusively on selling websites has paid off! Great focus!

Thanks, Johnny!

Yeah – a bit of a gamble when we did it, but we’re finally able to look at it and call it a “win”, I think.

All of a sudden that month by month marketplace revenue chart looks amazing!

I’ll be following the investor program progress. Looks to me like a complete win-win for EF and investors. Nice innovation.

Keep up the good work, look forward to flipping more sites with you guys!

Thanks, Greg!

Yeah, pretty happy with that big bump up and to the right. 🙂

Actually, when you look at our topline revenue that includes the outsourcing company, we’ve been on a downward decline. That doesn’t tell the whole story, though, as our margins were much smaller with the outsourcing company, heh.

Excited about the long-term prospects of the investor program, for sure.

Looking good, guys. delighted to see that February wasn’t a sign of the future. GREAT to see progress being made on the Investor Program. You know we have talked about this before. (note: I think you have the phrase reversed here …

” There are plenty of people out there with more time than money ” …

seems that the main investor candidate would have more money then time, diba?).

I mean if you have the time, build it yourself. But if you have money sitting around not earning much, put it to work in a matter of weeks rather than months or years.

One of the reasons I’m “bullish” on the whole investment idea is the ideal “fit” it makes with many retirees … especially retirees like me who want to live overseas for pleasure and economy.

Look at the difference between buying something like a single life annuity for $200,000 which will yield perhaps $400 a month versus buying $200,000 worth of proven website(s) which will gross ~ $20k per month and net at least ~$10k a month after overhead and profit share is taken out.

Personally I could live pretty darn good in Davao for $10k a month, and at the final day of reckoning the investor would have an estate to pass on as well.

A fellow can live prety well in the Philippines on $10k per month

Hey, Dave!

Thanks for catching our mistake – fixed it!

TOTALLY agree that there’s an opportunity for retiree investors here. Especially when you look at the baby boomers who are selling their B&M businesses, but still looking for investments that cash flow….

It IS risky, though, so I’d hate for a retiree to dump their life savings into something like that and have it go bust. Would have to keep it to a percentage of their overall portfolio, IMO.

Happy to see that March went so well for you guys – especially after the dismal February. I’m also glad to have bought two sites through Empire Flippers after having sold probably a dozen through you over the last couple of years. I may pick up another one in April if I can find a good fit!

Thanks, Gunnar!

Yeah, it was a nice comeback after a horrible Feb. Happy to continue to do business with you, man. 🙂