How to Find Investment Opportunities in Online Business

Not all investments are built the same.

What might be a good investment for someone else, might not be a good investment for you.

Being at the forefront of online business means we’ve seen all kinds of deals across the years. And whether it’s content sites, Amazon FBA businesses, or e-commerce stores, what’s important is finding the right types of investments for you.

Starting with your end goal in mind and performing an audit of your own skills will set you up to find highly profitable investments in online business. But first, we’ll begin by discussing why we’re seeing more and more investors buy up online businesses as desirable investment opportunities.

Why Should You Invest in an Online Business?

Online businesses have become a desirable investment for a range of investor types. There’s a reason why we’re seeing a year on year increase in the total sales figures of online businesses on our marketplace. And this isn’t just a small increase—between 2017 and 2019, there was a 179% increase in total sales, and in 2019 alone, there was a total sale value of over $50M for online businesses.

This upward trend and our first-hand experience tell us that investors are now heavily focusing on online assets. This begs the question: what is it that makes an online business such an appealing asset?

As a prospective investor, it’s natural that you would want to compare online business to other investment opportunities. Currently, many people are leaning towards online, since the remote aspect and lower overheads are becoming progressively more attractive, particularly since the onset of the COVID-19 pandemic.

When you choose to work with digital assets rather than brick-and-mortar investments such as real estate, you gain the ability to work from anywhere in the world. Online business is truly global, allowing you to manage your investments with nothing but your laptop. This makes online options highly accessible, it’s possible to acquire a small business for considerably less than real estate investment, with a greater return. Which is part of the reason why we’re seeing many real estate investors turn towards online business investments too.

Outsourcing to a team also becomes easier; investors can (and do) hire internationally, choosing to outsource to high-quality workers in countries where average wages are lower.

These lifestyle improvements will be enticing to many, but let’s not forget that investments are, by definition, supposed to grow your wealth. Online business is not a fixed income investment that’s capped on a low-interest rate like bonds. Nor are they a startup that’s crowdfunding or looking for angel investors.

Instead, it’s a chance to become the business owner of a highly scalable business model that has a very high return on investment. It even has the ability to outperform the stock market. Some investors have been able to double their monthly net profits shortly after acquiring the asset and seen a return on investment in just 12 months.

Of course, investments of this type do involve more risk. No high return investment is without increased risk, but understanding how to find good investment opportunities can help to minimize this risk.

There are few other investment opportunities that offer the flexibility and potential high gains of online businesses. The idea of making a short-term return on this kind of investment brings a whole new meaning to compounding. While it’s possible to sit on a single investment and continue to profit, you can also reinvest and grow your very own investment portfolio, diversifying the potential risk and reward even further.

The key to unlocking this potential is finding investment opportunities that match your desired outcomes and skill set.

Establishing Your Target Asset

For two successive years, we’ve sold almost 250 online businesses and listed more than that annually. In this highly dynamic and active market, you need to have a system for finding investment opportunities that allows you to work quickly and efficiently in finding appropriate acquisition targets.

The idea of having too much choice is a relatively new one for the online business space. To manage this, you need to establish what your end goals are and a process to get you there. This cuts out the time spent wading through unsuitable investments.

Understanding how to reverse engineer your desires and perform a skill audit are valuable tactics that will put you ahead of the majority of other investors, allowing you to not only acquire businesses quicker but even identify value in businesses no other buyer wants.

Reverse Engineering Your Investing Goals

Reverse engineering is the process of starting with an end product and working out how to get there. You can use this approach to tailor investment opportunities to the goals you have as an investor.

There are two main pillars of why people choose investments: lifestyle and finances. Before you even begin looking for assets, we need to establish what kind of investor you are. Sure, everyone wants to maximize their earning potential, but try to start from a perspective where money is not the only goal.

What matters most to you?

Maybe you want an investment to replace your current income and allow you to quit the daily commute. Or maybe you want to become your own boss and travel the world while you work.

Whatever your goals are, start at the top with the most important and work your way back, dividing the bigger goals into smaller sub-goals. It really helps to write this down—when things stay in your head, they never seem to make it from dream to reality. This process will point you toward the kind of investment asset you need to be looking for.

Your investment goals could look like any one of these:

- “I want to stop working so many hours at my office job and spend more time with my family. I want to be able to take my children to school and work when it’s best for me. Money isn’t a big motivator, but I still need to replace my current income.”

- “I have the capital to go out and buy an asset that can help to fund my retirement, potentially even allow me to take early retirement. I’m happy with a steady return but I’d like to have some help to run things so I could continue to work my regular job.”

- “I want to make as much money as possible, and I’m willing to take more of a risk to get there. My motivator is money, so I’m also willing to put more hours in to get more out. The idea of working for myself is very appealing to me, and I don’t want there to be a limit on how much I can earn like there is when you work for someone else.”

Regardless of why you want to invest, it’s important to establish the reasons to guide your next steps. This applies whether your goals are purely financial, lifestyle-based, or a mixture of the two. Another reason why online business is so popular is because of its diversity; it caters to a very wide variety of goals. So no matter what motivates you, you’re very likely to find something that matches your investment needs in online business.

As an example, if you want to have more spare time, you need to look for assets that can be run hands-off. If you’re more interested in building your wealth quickly, you might want to go after an asset with problems that you can fix, leading to big profit wins. Finding out all of this information is possible when using our marketplace, but more on this later.

See how this process is already pointing you toward tailored investment opportunities?

After performing this initial task, you can use what you uncover as your roadmap for success. Next, we recommend doing a skill audit, which is the process that’s going to coordinate these goals to your skillset.

How to Perform a Skill Audit

A skill audit is the process of finding out all your strengths and weaknesses when it comes to owning a business.

This will help you create a checklist to find online businesses that match the goals you’ve outlined in the steps above.

To begin, grab a piece of paper, or open a document, and write down all of your strengths when it comes to business. Creating and managing teams, logistics, advertising, it doesn’t matter what it is but get it down on paper. Place the skills in order of what you are best at and what would make you the most money.

Next, repeat the same process for your weaknesses. This could include things you’ve never done before but want to learn. Again, order them in terms of importance; what would make you the most money if you knew how to do it?

The next stage is to look at the list of weaknesses and decide whether to learn or to outsource.

If you feel you need to learn a skill to achieve your goals, then set aside some time for yourself to go through a course or some YouTube videos. Joining online communities can also be a good place to learn from people who have been in through the same learning process.

Your other option is to outsource the skills to someone else. Sites like Upwork are a great resource if you want to quickly connect with freelancers. For some skills, you might be better off working with agencies to help you get results.

Which skills you need to learn or outsource will depend on the goals you outlined earlier. For example, if you want to find quick fixes for businesses to speed up the return on investment and flip the asset for profit, knowing about paid ads would be a valuable skill to have. If you don’t have any experience in this field, learning or finding someone who does is the next step for you.

Use the skill audit to become more aware of your strengths. You can look to acquire assets lacking in these areas and scale them up to be even more profitable. This opens the door to you investing in assets that you may never have considered otherwise.

How to Find Investment Opportunities

With your goals established, it’s time for the fun part of leveraging the skill audit to find the best investment opportunities for you.

We’ll run through some examples with you on how you can use our marketplace to find these highly targeted investments. Working with a registered broker, like Empire Flippers, will help to do some of the heavy lifting for you by tailoring opportunities to your minimum investment. However, you should perform your own due diligence on each investment opportunity.

You’ll need to register for a free account to get the most out of the marketplace.

Quick Return Investments

If your priority is chasing profit and earning back your return on investment as quickly as possible, then you’re going to have to take more risks.

One way that we see buyers try to hit high-income goals is to go after businesses that have encountered penalties or problems. Perhaps there has been a Google penalty on an affiliate site or the current owner of an e-commerce store has mismanaged the supply chain and the business experienced ongoing stock-outs.

Let’s consider an example. Looking at the listing description of the business below, it seems that cash flow and inventory management have been an issue. Acquiring an asset that’s experienced stock-outs usually means the net profit has taken a hit, but the upside to this is the valuation will be lower.

This might put some buyers off, but for the sake of this example, let’s say you’ve completed your skill audit and know that your strength lies in logistics. This leaves you confident that you can manage the cash flow better than the present owners, and you know you’ll be able to negotiate to find better suppliers with more accurate lead times.

These improvements would allow the business to start earning more consistently. This means that your net profit is going to be higher, and in turn, the valuation will increase, so you could sell for a profit further down the road.

Another tactic we see astute investors use is to buy a content site that’s been hit with a Google penalty.

Sites like this are normally available at knockdown prices and are something that many buyers might stay away from. But you know that it’s possible to outsource to a third party service that specializes in fixing Google penalties. So you go ahead with the purchase, turn around the fortunes of the traffic, and suddenly the revenue starts flowing back in.

These tricks of the trade can be combined with the information gathered from your skill audit to help you identify and pursue successful investments that many others would overlook.

Hands-Off Lifestyle Investments

If you come from the 9-5 lifestyle, you’re used to working 40 hour work weeks, which is more like 45 hours if you factor in an hour of unpaid travel time a day.

In this case, finding an investment that allows you to take back some of your workweek and work on your own terms will likely suit you best.

To do this on our marketplace, you can filter by “hours worked” to ensure you’re only seeing businesses that require less work time. You might be surprised to find that a successful online business can be run with a few hours of work per week.

The seller of this affiliate business is only spending around three hours of work a week to manage things. It’s important to note what type of work and skills are required. You will want to make sure that they match up to your strengths or acquirable skills or that you could outsource them.

If you don’t have a lot of time to put into the business it’s probably better you look for an asset that has more stable earnings.

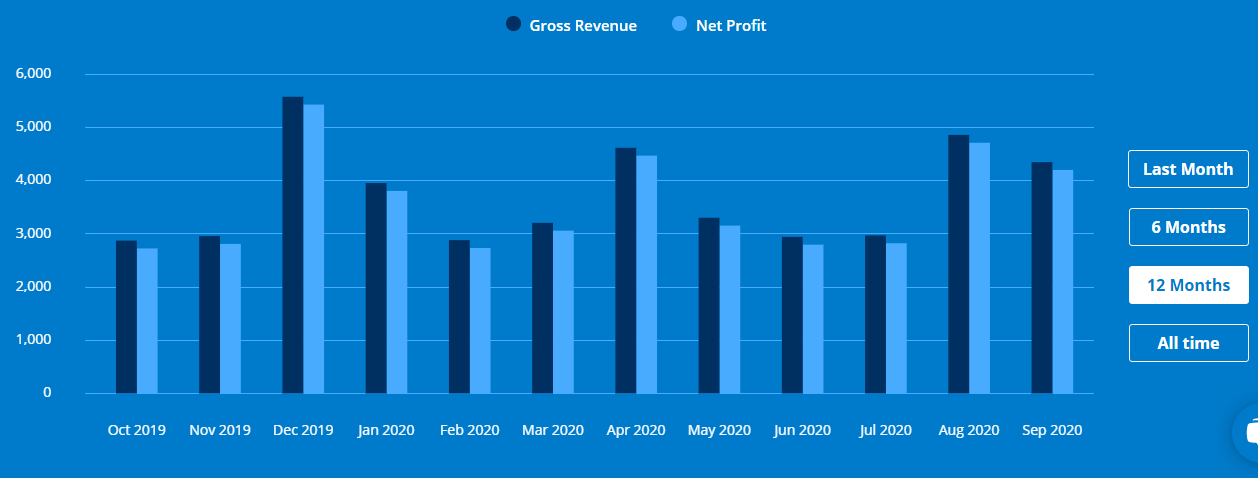

Each listing comes with a traffic and earnings graph, like the one above, that’s split into gross revenue and net profit. This makes it easy to see the business’s current trajectory.

We would never tell you that an online business is a risk-free investment—as with any high-yield investment, there is volatility. While the business might only require one hour of work per week currently, if you want to nurture it, you have to be willing to put the work in when it’s needed.

But by acquiring a business with stable earnings and a low amount of work at the time of purchase, you’re giving yourself solid foundations to build off. With an online business, it’s absolutely possible to earn a considerable amount of money from a few hours of work per week.

For a truly passive investment, consider investing in online businesses by buying fractional shares. You can do this through Webstreet.

They allow you to invest in cash-flowing online businesses that are run by professional portfolio managers. You get all of the benefits of investing in this growing asset class, without needing the time or skills required to actually run the business yourself.

High-Performance Assets

You’re an investor with access to a large amount of capital—this opens up the possibility to find high-performing investment opportunities that will bring large net profit sums each month and are run by a team of people.

This seven-figure affiliate business comes with a team of five people.

Even though the seller said they were spending 15 hours of work on the business per week, their work was mainly overseeing the team.

The return on investment for online businesses is why we’re seeing more and more high net worth individuals and private investment firms purchase businesses of this kind. Using your investment goals and skill audit in conjunction with the marketplace features allows you to efficiently outline investment opportunities so you’re not wasting time on unsuitable opportunities.

Leveraging Paid Ads

If you know the ins and outs of paid advertising or are willing to hire someone who does, then you’ll have a powerful tool to leverage.

It’s common for e-commerce stores to use some form of paid ads to drive traffic to their storefront. Online businesses are often created by people as a side hustle that later grows into a profit-making machine. A business may depend on paid ads, but that doesn’t mean its owner is a paid ads expert.

If you can identify businesses that aren’t optimizing ads as well as they could be, then this could be a great way to boost net profit.

The above business is an e-commerce store that is making five-figures a month in average net profit. This is already a successful business in most people’s eyes, but you know the importance of paid advertising for e-commerce.

The listing description mentions that the seller uses a contractor for Facebook ads, but there’s no use of Google ads. We also try to include a seller interview with listings to allow you to hear the seller talk about their business in more detail. During the interview, the seller mentions how the contractor is actually a buddy of theirs from college who doesn’t have much experience with paid ads.

This bit of information could be very valuable to you. Taking this business that already has a customer base and working on the ads could make it an even more profitable investment than it already is.

The Business is Too Time-Intensive

Many buyers are put off by a business that requires a high level of work to maintain the asset. The reason many people buy online businesses is to work fewer hours a week, but that doesn’t mean a business with high time requirements is a bad one. Financially, it may be a great business.

If your skills are in building and managing teams, then this could be a good investment opportunity for you. You know that you can hire the right people and build systems to really focus the efforts on growth. Doing this will not only free up your time but also make the asset more desirable if you want to put it back on the market down the line.

Investing in an Online Business

Thanks to the diversity in the types of online businesses available, there are many different ways you can invest. The above examples have just scraped the surface—there are many more ways to find profitable investment opportunities in online business.

The basis of finding these investments is all based on the simple process of reverse engineering your goals and performing a skill audit. Reverse engineering will show you what type of asset you need to be purchasing. The skill audit will outline all the skills that you already have to get you to your goal and identify what else you need to learn or outsource.

Combining these two tasks is a powerful tool for an investor to find assets that are specifically tailored to them. It also allows you to spot opportunities where you never would have before and go after businesses that no other investors want, knowing you can turn them into profit-making machines.

Once you start looking at online business as an investment, you’ll wonder why you’ve waited for so long to get started. To make use of these newly found investment skills, head over to our marketplace to start searching through the listings. If you’re looking for something specific, set-up a call with one of our business analysts who will help you find the right investment for you.