What is the Return on Investment for Buying an Amazon FBA Business?

Have you ever thought to yourself, “I wonder if the Amazon FBA business model is a profitable investment”? Whether you are on the buy side or the build side of Amazon FBA, the opportunity to scale this business model to a high-yielding powerhouse constantly entices.

Having sold more than 145 FBA businesses in the past two years alone (to see last year’s stats check out our 2020 trends report), we have gained invaluable insights on the ROI potential for this business model.

We’ve spent time interviewing 31 different Amazon FBA investors to get their insights into what happened AFTER they purchased the business. We did this all in an effort to create another ROI study like we did with content sites a while back, so you can make a more informed decision as a buyer.

As we have always valued transparency with all of the data we collect, we want to share exciting information showing exactly what business owners have done to grow their assets over the past two years.

Before we dive into how these successful FBA owners grew their net profits (and yes, we are excited to discuss with you as well), let’s ask one question:

What Makes an Amazon FBA Business Worth Buying?

People often ask us, “If there are so many online courses available on the market today teaching people how to build these types of businesses, why would anyone bother investing a large amount of money in purchasing one?”

Most people don’t know of business owners who became instantly successful after finishing just one course on Amazon FBA.

Many will spend thousands of dollars and priceless time on training that could have been better spent on product development or inventory start-up costs. While FBA courses are great for introducing you to the world of FBA and e-commerce, they often fail to provide anything beyond a general understanding of how it all works.

Yes, some courses out there today can flatten the learning curve when getting started with Amazon FBA, but students will soon realize just how hard it has become to enter this space considering the competition that’s out there.

Courses seldom mention that this business model requires a great deal of effort, a decent amount of startup capital, and the experience of unprofitable mistakes on the way to finding something that clicks.

After you factor the time and effort necessary to perform product research, contact suppliers, optimize logistics, build and market your brand, as well as a whole list of other necessary operations prior to launching your first product, it’s safe to say the number of overnight successes in this business model is none.

This might all sound like a lot of effort just to get into building an Amazon FBA business on your own, but there is an easier way to capitalize on the great opportunity this model provides.

Buying an Amazon FBA business that already has cash flow, an established brand, a line of products, and has the systems needed to ensure that inventory gets from your suppliers to your customers. That means the hard work has already been done for you, allowing you to skip the risk and uncertainty of investing in a product that might or might not be a success. You also get the opportunity to scale an established business that’s generating revenue.

It is not only our goal to reveal the real numbers of real businesses that were acquired on our marketplace, but to also give you insight into what these business owners improved on the back end to maximize their investment.

That is exactly why we created this data-driven study of 31 buyers that acquired different Amazon FBA businesses off our marketplace to see what happened after the acquisition.

The data-driven study consists of Amazon FBA businesses with buyers who owned their assets for anywhere from six months to just over two years. We interviewed these buyers to determine if they did, in fact, hit an ROI or not on the investment. These interviews also showed us buyers who grew their investment, some gaining all their initial capital back within a year, and those who suffered losses, some as much as a 50% decline in their average monthly net profit.

We will never tell you that buying an online business isn’t risky, and so we wanted to show the losses as much as the gains to help you make a better decision according to your risk tolerance.

Investing in any digital asset in today’s market is a high-risk/high-reward pursuit. However, no other venture offers the real opportunity to double or triple startup capital when it comes to long- or short-term investing. It is very realistic to be able to double a digital asset’s value within a year or two of ownership despite the risks. If you were to try and do the same thing in say real estate or stocks, you’d have to exponentially increase the level of risk in comparison to digital assets to achieve the same kind of return.

There is inherent risk when starting an Amazon FBA business from scratch such as launching an unprofitable product, but most of that risk can be mitigated by acquiring an asset that is already generating a steady income.

Not only do you gain an asset proven to be financially successful, but you also gain the previous owner’s data and knowledge, explaining what has worked and what hasn’t based on their experience of growing the business from the very start.

As most of the work required to build a successful FBA business is front-loaded, tapering off into a more hands-off income stream after the business is established, it is easy to see why many entrepreneurs and investors choose to buy instead of build.

At this point, you might be thinking to yourself, “Okay, so if buying an Amazon FBA business is a way around long startup times and selling uncertainties, how long will it take to make my initial investment back?”

That is exactly what we want to show you with this data study.

Whether you’re new to Amazon FBA, a seasoned pro of the e-commerce space, or somewhere in between, it is our goal to offer you a better understanding on how to improve your asset based on what has worked and hasn’t worked, for others.

What Data did we Collect from These Amazon FBA Buyers?

Similar to our data-driven content site ROI study, we gathered all of the Amazon FBA monetized assets acquired on our marketplace and compiled them into a sheet. After doing so, we realized that reaching out to Amazon FBA owners who had only been operating their businesses for a few months wouldn’t give us the best perspective on the true potential for this business model.

So, we decided to include business owners who owned their assets for anywhere from six months to two years at the time this study was conducted.

After restricting our full list of FBA sales to meet this requirement, we were left with 145 buyers. We then reached out to see if they would be open to being a part of our study and received 31 interested responses.

These reports mentioned above are important for not only new entrepreneurs to the space, but also current FBA owners to gauge current market trends within the coming months.

The Data We Collected

We asked our 31 participating buyers:

- Whether or not they were first-time buyers;

- What they were looking for prior to making their purchase;

- What they wanted to avoid in terms of asset details;

- What their desired niche was;

- What their current status was (whether their business had grown, stayed consistent, or declined);

- How much their asset had grown or declined (as a percentage);

- What their top strategy was for growing the business at the time of purchase;

- If they made any major changes made after the acquisition;

- What their biggest traffic challenge was;

- What their future traffic goals were; and

- What their ultimate goal was for purchasing their asset.

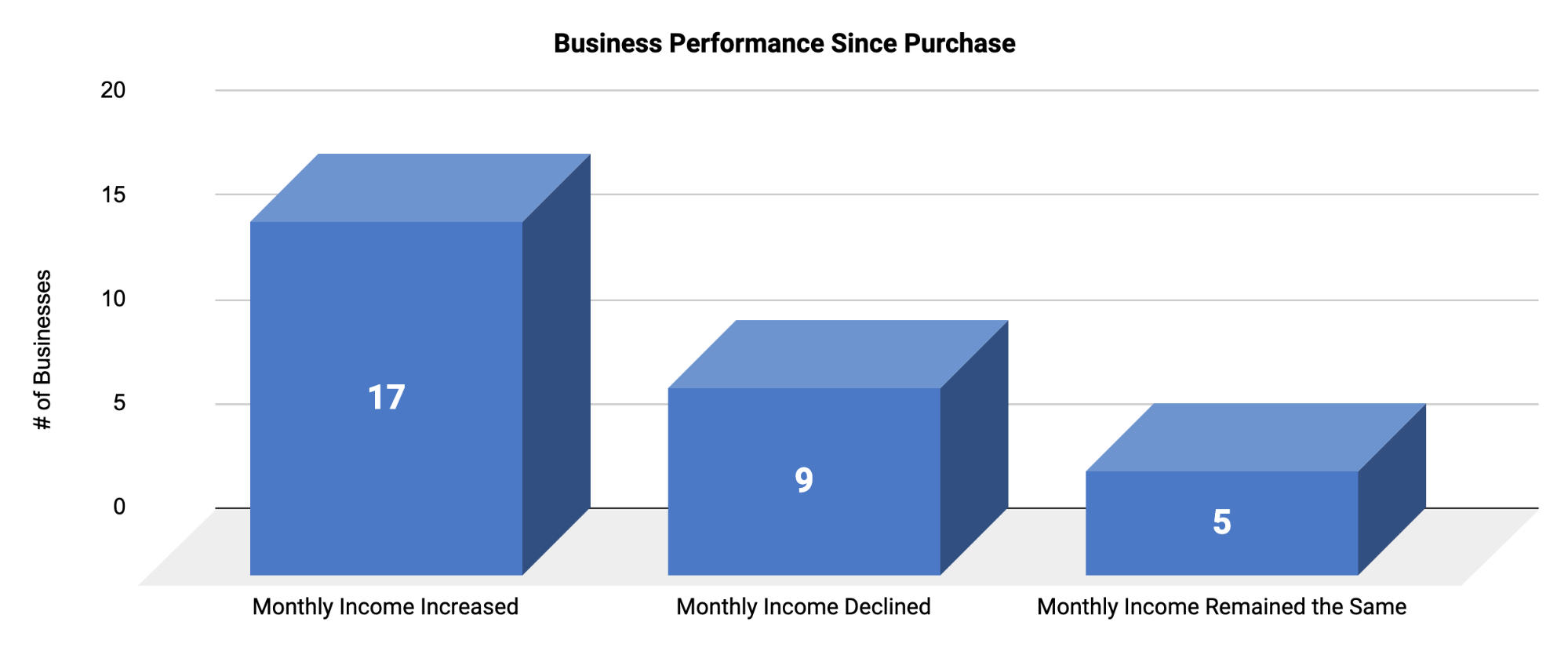

Of the 31 data-driven interviews we collected during the last half of Q1 in 2020, 17 buyers (55%) reported monthly net income growth, 9 (29%) suffered declines, and the remaining 5 (16%) maintained a steady income from acquisition.

These might not seem like captivating percentages that make you want to drop everything you’re doing, call up your bank, and have them prepare for a 6-figure wire transfer within the coming weeks, so let’s sharpen our focus a bit.

According to our study, 71% of the surveyed Amazon FBA businesses grew or maintained their net profits.

Compared to our last content site ROI data study where 64% of respondents either saw an increase in earnings or earnings remain at a steady level. It’s easy to see a slight advantage towards Amazon FBA. Even factoring out the one additional participant within our FBA study over the content study, shows more businesses have grown compared to the content site ROI study.

The reason behind this might be the initial requirements for scaling these business models.

While Amazon FBA is known for having large startup costs (such as inventory and logistics) compared to content sites, content sites require a great deal of sweat equity as well as time to start ranking in Google (their usual traffic play). Since this is not a discussion about which kind of monetization is better, they all offer huge potential for those treating the businesses as a real business, let’s ask something else.

If content sites require large amounts of time for ranking and Amazon FBA businesses require large amounts of startup capital, are first-time buyers bothering to purchase already established businesses over starting one from scratch?

Yes, they are.

Of the Amazon FBA study’s respondents, 42% were first-time buyers.

The rest were portfolio or repeat buyers looking to gain another source of income requiring minimal maintenance as part of their criteria when performing their due diligence.

So What Exactly Do Amazon FBA Buyers Look For?

Based on our survey data, 48% of buyers were most interested in seeing steady growth in traffic and revenue. Another 23% said acquiring an asset with room to grow and without full optimization drove them, while 13% indicated they sought an investment selling a specific product or selling within a specific niche. Only 6% said they were mostly concerned about the quality of the product. The last 10% stated the business’ prices and profit margins were their primary concern, and ironically the participants with this criteria saw their acquisitions decrease in monthly net profit.

This simple fact might say something about those who take too narrow a view of the businesses they purchase. That’s a subject for another time though.

What do FBA Buyers Want to Avoid When Looking for an Asset?

Just under half of our respondents (43%) claimed the biggest risk they wanted to avoid while searching our marketplace for a business acquisition was large shifts in traffic and revenue.

Buyers also mentioned (19%) that they’d rather not choose businesses with no room for growth, easily copied products, or requiring too much time and effort to maintain on the backend.

Now let’s dive deeper to see what these 31 business owners actually did after acquisition. We will also go over the key performance indicators these buyers implemented to see what really worked.

As with our last data study, discussing which niches have been performing well over the past two years is still interesting. As we often mention within our content, niche selection does not always make the difference in whether a business will be a success or not, however, this information is still interesting to see nonetheless.

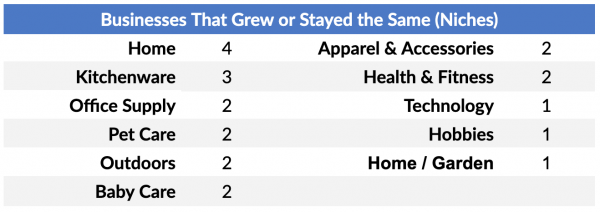

We have provided a figure showing the span of various niches within this study that showed net profit growth. That being said, these are “parent” niches; we won’t reveal any actual niches to maintain client confidentiality.

Amazon FBA Niches that Grew or Maintained Net Profits:

As the figure above shows, petcare, technology, hobby, and the office supply niches all provided great niche opportunities for buyers over the past two and a half years.

That doesn’t mean you should only focus here when deciding on the specific niche you will use to enter the space, but it does give an idea of what evergreen niches exist in the Amazon FBA space.

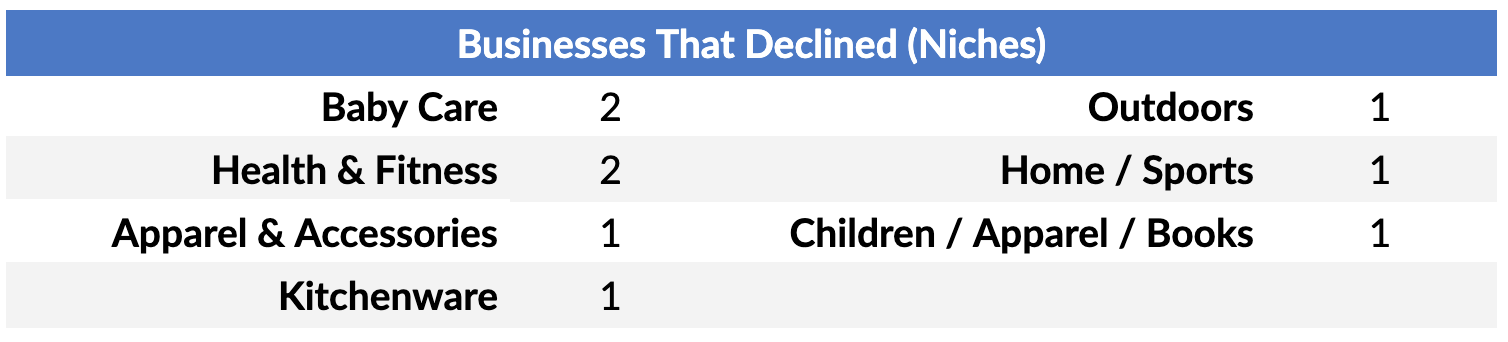

As you’ll see below, many of these niches are repeated, which goes back to what we normally say – the niche of the business usually isn’t an important factor on whether the business is going to grow or decline.

Niches for FBA Businesses that Lost Net Income:

With no real evidence on what the perfect niche is or has been for Amazon FBA owners over the past few years, let’s consider what these buyers did after acquiring their assets to get a more detailed picture of how they each differed.

For a better understanding of what the Amazon FBA business model requires in terms of start-up capital and initial sweat equity investment, let’s take a look at what the average investor usually spends on acquiring an FBA business from our marketplace.

Based on our 2019 data pulled from our industry report here, we sold 62 Amazon FBA businesses with an average sales multiple of 26.2x. For the businesses within this survey, the average sales price was $453,119.

This does not include any upfront inventory costs, which are up to the buyer to cover on top of the acquisition price. Typically, the seller will sell off the inventory to the new owner at cost.

So what did these buyers actually do after acquiring? Let’s find out.

The Primary FBA Growth Opportunities:

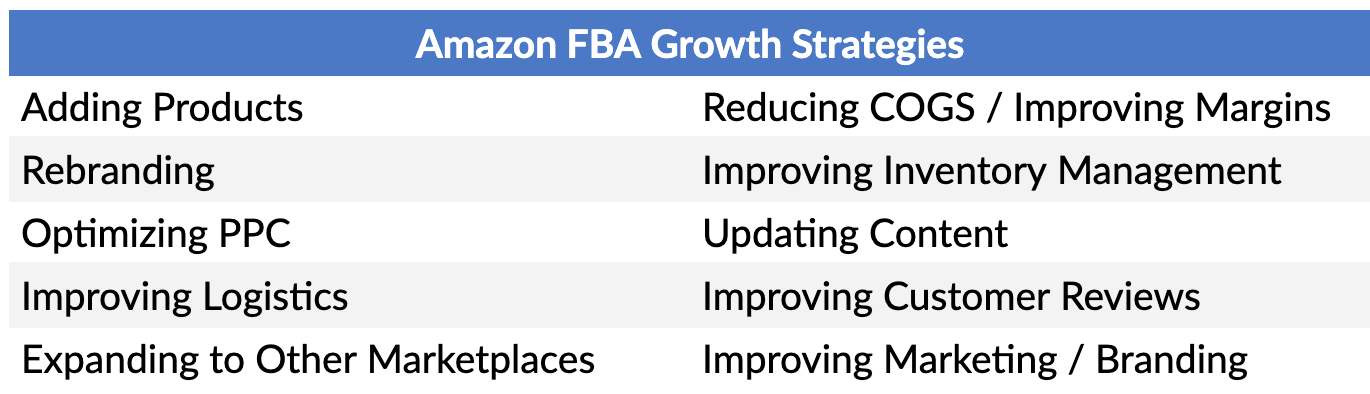

A few of our respondents stand out as growth opportunity buyers who made their discoveries during their due diligence process. The primary growth strategy among our FBA buyers (52%) was adding new products. Another 32% saw an opportunity to scale their business by improving logistics and inventory management, whether by investing in larger inventory to avoid constant stock outages a current owner was having issues with or by switching from storing all inventory assets with Amazon alone to a lower-cost 3PL storage service.

The remaining 16% of surveyed buyers saw an opportunity for the asset from scaling and optimizing PPC ad campaigns that were already running.

What FBA Buyers Changed to Grow Their Net Income

The primary focus for a majority of Amazon FBA buyers tends to be launching new products or adding variations to existing SKUs. However, closer examination revealed those were not the only growth tactics used, especially since adding new products led to one buyer seeing monthly net profits fall.

The figure below contains all key improvements and changes made on the backend to improve ROI.

Some of these specific changes after acquisition can make you wonder why previous owners didn’t make obvious improvements.

Keep in mind that while one type of improvement may have worked for a specific business within a given niche or marketplace, it might not always work out in an owner’s favor.

We often promote a “more is better” approach in terms of improving your asset, and this is also true when it comes to these outstanding performance improvements. While not all of the changes mentioned here will work for every single FBA business, experimenting with these improvements in your own business model can lead to significant upticks in bottom-line net profit.

Adding to Your Product Line

With a business model that relies on physical products as the main revenue-driving source, it’s easy to see why this change leads to direct growth improvement for some of the FBA businesses within this study.

As traffic and customers become accustomed to seeing the same product line, a great opportunity emerges to capture more revenue as existing customers see new products to buy from the brand. The thought process goes, “If my other products have been doing so great, then I should launch more of these types of products to improve my sales.”

Still, this isn’t a 100% surefire way to increase your net profit.

Adding new items to your business requires caution as no sale is guaranteed until the order has been placed and the customer is happy with their purchase. Ask any successful Amazon FBA owner today if they have ever invested a large amount of capital into a new product or variation of an existing SKU only to endure a loss.

More often than not, you will get a mournful “yes.“

Adding new products though can be a powerful strategy when done right. One buyer in the outdoors niche was able to increase their monthly net profits by 10% thanks to a new product launch, adding an extra $900 for an average of $9,000 per month after purchasing their asset for $211,000. The increase here will, as they often do, pay even more dividends as the buyer continues to scale the asset.

A key benefit to purchasing an established FBA business is that the work required to launch new products is decreased due to there already being proven systems in place for other products. Even so, approach such changes to your business with caution and a detailed plan of execution.

There is nothing more frustrating for an e-commerce business owner than investing substantial capital into a new product only to discover a non-existent demand for that product.

Opportunities within Other Marketplaces for Your Products

While your product line of snow trekking boots might be doing great as far as Alaskan sales are concerned, it might not be thriving in California. The same goes for expanding and advertising product listings into other marketplaces.

One Amazon FBA buyer selling in the baby care niche increased their monthly net profits by 5% by diversifying their marketplace strategy. The business, which was acquired back in September 2017 for $115,000, was generating an average of $5,200 per month and, due in part to expanding within other marketplaces (such as Europe and Australia), increased to an average $5,500 per month with a relatively simple marketplace expansion where Amazon is still doing the heavy lifting of actually fulfilling the products.

Not a bad increase considering little effort was needed to make this improvement.

Expanding into other marketplaces offers a huge competitive advantage as it allows you to tap into entirely new audiences with a product that has been proven to work in your current market.

There’s Gold in those Ad Campaigns

When we talk with Amazon FBA business sellers about their primary reason for listing their business for sale on our marketplace, they usually respond that they no longer have time to focus on their asset as much as they would like.

Then why would sellers state it only takes three hours per week to maintain the business?

As mentioned earlier, this business model usually requires more effort to start, but once things have been optimized on the back end, the hands-off nature will often lead to most entrepreneurs pursuing their next challenge.

Most business owners in our space operate multiple business ventures that can draw their primary focus away from scaling a given asset further. That is exactly what the surveyed buyer of an FBA business in the health and fitness niche saw as their opportunity to increase monthly net profits by more than 30%.

The buyer, who purchased this business in April 2019 for $952,000, knew that a lack of focus on the seller’s part could lead to a profitable increase once the PPC ad campaigns, abandoned by the seller, were optimized.

Most FBA business owners will see the value in running PPC ads for the launch of a new product, but will then drop them once product sales dip after that initial ad campaign.

Generating ad campaigns for the entire product line with data that existed from previous campaigns meant that the buyer not only grew the business to its current new average of $65,000 per month in net profit, but that the buyer was also able to make the change with little to no effort by simply optimizing pre-existing ad campaigns.

How Rebranding and Acquiring a Trademark can Help Your Business Grow

When it comes to selling products on the Amazon platform, it is important to remember that you are not the only one out there looking to make a sale.

Competitors will enter your space, sooner or later, to offer a similar product, commonly referred to as a “me too” product, at a lower price point.

This can happen in any niche, but there is a way to avoid this undercutting: obtaining a trademark and building your brand following. Separating yourself from your niche imitators creates a stronger barrier to entry for competitors looking to take advantage of the hard work and effort you’ve put into growing your brand.

For one FBA buyer in the pet care niche, having an established trademarked brand with a unique (and difficult to replicate) product meant that another form of optimizing the brand awareness was in order.

The buyer was part of a private investor fund and knew the best opportunity to scale the business would be performing a complete branding overhaul. The brand got updated colors, design, packaging, and labeling as part of its fresh look along with a new product launch within the same sub-niche. As a result, the business skyrocketed beyond all expectations.

This Amazon FBA business was purchased back in 2018 for $1,450,000. The buyer grew their average monthly net profit from $56,000 to over $280,000.

That’s a growth rate of well over 5x with a gaining a full-ROI in less than a year.

While this might sound too good to be true, when we reached out to the private fund to be a part of this study, they sent over the P&L for last year and our jaws hit the floor. It is insane to think that an Amazon FBA business, especially one with this price point and size, could earn back the entirety of its initial sales price in less than 12 months.

Yet, here is a prime example of how an established brand and trademarked products can enable the scaling your business to its full potential.

And, it is an example of it is often so much easier to scale a business already making money than trying to build a business from scratch.

Why Customer Reviews Matter

One key metric for some buyers that would make or break moving forward with an offer is the quality of customer product reviews.

The importance of social proof continues to be valued as buyers convert window shoppers into paying customers, with the customer reviews carrying more weight than ever in buying decisions.

These product reviews will often play a huge role in whether inventory will continue to produce revenue for a business or lead to its demise.

This was exactly what a buyer of an FBA business in the office supply niche recognized.

The buyer purchased their asset from our marketplace back in September 2018 for $60,000, knowing that improving customer product reviews would push the business to perform better than the previous owner had experienced.

You cannot please every customer or prevent every negative remark made by a displeased customer. However, what you can control is the quality of your products the manufacturer is producing and afterward by performing manual inspections before goods are then shipped to your customers. This will protect your brand name while improving quality control, preventing unforeseen issues such as above-average returns and below-average reviews.

This buyer improved their review scores on Amazon, lowered their return rates, and improved their customer retention numbers to grow their monthly net profits from an average $2,500 to a staggering $12,000 per month.

Exponential growth opportunities are available to those who focus on providing the best quality experience for their customers, proving the importance of treating customer reviews as an asset when deciding to invest in Amazon FBA assets.

The Importance of Amazon FBA Content Quality

Have you ever walked around your favorite shopping center and seen storefronts with mannequins and product display layouts trying to entice you to buy something before you even set foot in the store?

That is exactly what your listing page content aims to do.

Before you can get a window shopper (online shopping pun intended) into your buying funnel and direct them to the checkout, you will need to pull them in with product presentation on the listing pages.

For some, how you present your products on the listing pages is a direct representation of your company’s brand, quality, and sense of professionalism.

A surveyed buyer of a technology-based FBA business capitalized on this when deciding how to obtain a fast return on their capital. Stepping in as the new owner of a business producing roughly $3,200 in average net profit, the buyer optimized all listing-related content, including enhancing product photos, updating listing copy, and building out a fully optimized Shopify storefront site in addition to all the Amazon page work.

After making these adjustments to the acquired asset, the buyer grew the business by 15% to produce an average of just over $3,600 in average monthly net profit. Considering that all improvements were outsourced, the buyer also demonstrates the importance of providing the best quality customer-facing content.

As Amazon FBA businesses sell your products on their platform, you have little choice about what gets shown to their traffic on the site design wise.

One thing you can control, however, is how products are displayed to customers. Using quality pictures and listing copy should not be overlooked. Small, often easy changes here can lead to big wins.

How Optimizing Logistics Can Help You Scale Your Asset

It doesn’t matter how great a product you offer, how perfect your photos look, or how much money you spend on advertising if your supply chain is constantly experiencing issues getting products to customers intact and on time.

Your logistics supply chain has significant influence over whether your FBA business succeeds or is left without products.

A buyer discovered an opportunity to avoid the latter while performing due diligence on a home niche business back in July 2018. The asset, which had been generating just over $3,000 per month in net profit, had a few red flags, most notably a few substantial drops in traffic and revenue.

There could be any number of reasons for such activity when it comes to selling a multitude of products on Amazon’s platform, such as seasonal products. However, the buyer also noticed that the business wasn’t only selling seasonal products.

“The previous owner kept running out of stock, and I’m not sure what his strategy was or what or if he just had financial issues of keeping things in stock. One of the first things I did was I boosted the inventory to about three or four months worth of each item. That made a huge difference so that when we had good months, we weren’t running out of stock and having to expedite and pay extra for not only paying the manufacturer to expedite, but also paying the extra freight to do it.”

-Buyer of this home niche FBA business

A deeper dive revealed that the sudden drops were caused by a stock out issue with the business’s number one selling product. Seizing the moment, the buyer acquired the business for $60,000, knowing that if they could keep a ready stock of inventory on hand, improve margins by shipping inventory from air to freight, and removing poor-performing SKUs while replacing them with a new and improved product line, they could easily increase their profit.

The buyer couldn’t have been any more on target. Monthly net revenue ballooned 4x to over $15,000 per month, recouping the acquisition cost in just six months.

We are not saying that this happens for everyone, but with a little effort on the backend of your FBA business, implementing key improvements made by those who have successfully acquired and grew their assets within this model can give you that extra boost you need.

All the changes above can lead to significant increases in your net profit, and the fact all these buyers did see an increase makes them worthwhile to explore for your FBA business.

But…

What about all the buyers we had that saw a decline in the FBA business they bought?

A short caveat before we dive into the not-so-fun stuff.

While we wish that every online asset we list for sale on our marketplace could live up to just a few of the businesses mentioned above, we cannot guarantee success. It is on the buyer to properly perform rigorous due diligence and ensure any given asset is truly worth investing both time and capital into. At the end of the day, it comes down to your risk tolerance.

As with any business, inherent risk is always present.

Why 29% of These FBA Businesses Lost Profit

You will see many of the same things that were opportunities for growth in the previous section, as the harbinger of decline in this section.

It shows that every move you make in business can be a double-edged sword.

Much of the success that came from above is the “how” the changes were executed and implemented.

Something that stood out to us while conducting this study was that some declines were due to back end issues with Amazon instead of the fault of buyer error. Amazon typically does a good job, but that does not mean they are immune to mistakes. The control Amazon has over your business is the exact reason why we often call Amazon the actual critical point of failure for Amazon FBA businesses. If Amazon changed their terms, changed their FBA program in any way, you really have no control over what might happen to your business, thus it is a central risk for FBA acquisition.

Let’s dig into each of the changes to give you a better understanding of what you should avoid when scaling your Amazon FBA business.

How Expanding your Product Line can Hurt your Business

Before launching a new product on your Seller Central account or even acquiring inventory for that product, make sure that you have performed proper product research based on analytical data. The quality of your new product should also be worthy of your brand name.

Most FBA owners ship a few test products to their personal residence to perform a thorough quality control inspection before launch. This offers a fail safe prior to making the final call on a product, preventing over 1,000 units shipping to your fulfillment center with poor spelling or incorrect specifications. These quality checks can also improve the chances of success for variations to an existing product.

And these quality checks can prevent you from shipping a looming disaster for your revenue to the warehouses.

How Much is Too Much when Paying for Amazon PPC?

Most Amazon FBA owners only use PPC ads when they launch new products, though some (such as the health and fitness FBA asset that grew by 30%) do so consistently. However, constantly running these ads for product traffic usually comes at a cost that outstrips profit.

As competitors enter your market and begin competing for the same keywords you are targeting, your ad prices will rise, making PPC campaigns less feasible. Hence, the preferred solution of utilizing Amazon PPC ad campaigns is to promote product launches and stop using them after products begin to rank on Amazon’s platform organically.

If you don’t monitor these ads closely with a watchful eye, it can lead to a steady or even sharp decrease in overall earnings.

When Your Logistics Supply Chain Fails, You Fail

Businesses that experienced stock-outs are going to be businesses that earn a few wounds to their revenue.

This can happen for a myriad of reasons. One reason this happens to many Amazon FBA owners is that they simply don’t want to pay the often costly fees associated with Amazon’s warehouses.

There are solutions to this problem, namely using a 3PL service provider.

Those who don’t have any extra steps (such as specialized packaging, inserts, or any other form of branding or marketing included with shipments) might not think that utilizing a 3PL service would be of any benefit. Sure, you could ship your inventory directly from the supplier to Amazon’s fulfillment center, but that would mean having to perform quality checks on your own.

One benefit of using a 3PL service is the opportunity to lower your overall storage costs and diversify the risk of having all your inventory in one place. These service providers will also usually perform any special packaging requirements your business might have, supporting sellers who might not be living in the same country their products ship to or from.

Setting up a 3PL provider or simply spreading out the risk of centralized inventory storage will not only help mitigate large profit losses stemming from stock outs, but also grant peace of mind regarding quality in addition to getting around high fees from Amazon’s warehouse.

Change is a Given

Our recent content site ROI study found out that making little to no improvements to an asset can have a negative effect on the business from a maintenance perspective. The Amazon FBA business model is not much different in that regard.

When investing in a digital asset, no matter what the monetization or niche, you will usually get out what you put in. Simply maintaining a product line will rarely turn out in your favor, if ever.

When you immerse yourself in the customer experience, read their comments and reviews, and gauge those reactions against the products you offer, you gain valuable information on your customers’ pain points. Using that information and making adjustments based on it (such as expanding products and offering innovative upgrades) allows you to limit the reasons a loyal customer might jump on the next me-too product,

Taking the Amazon FBA business model into your own hands and giving it everything it needs provides you the best chance at gaining the ROI you would expect for all your efforts.

Other Challenges All 31 FBA Businesses Encountered

A handful of common improvements were made to practically all businesses, whether they grew or declined, and some challenges were interrelated as well.

Of the responses we collected, 35% said their biggest traffic challenge stemmed from growth in competition while 25% reported having no problems gaining traffic at all. Another 16% mentioned having issues with their logistics and supply chains killing inventory availability, and 24% said they had suffered from other issues that caused average traffic numbers to fall.

Other issues these buyers encountered were scaling their marketing strategies, enduring drastic drops in review scores, optimizing and managing split marketplaces, and gaining rank for their target organic keywords.

So What Exactly Does the Future Hold for These FBA Owners?

The Amazon FBA business model offers a great platform where a large portion of customers are already shopping as well as a solid base to work from while adding other revenue streams.

Future goals the buyers responded with included plans to expand and improve product lines (22.5%), maintain their assets (22.5%), expand into other global marketplaces (19.3%), work to improve logistics and supply chains (13%), optimize PPC campaigns to obtain the best possible ROI (13%), and pursue retail expansion (10%).

Regarding the ultimate goals behind acquiring their assets, 61% of our surveyed owners said they wanted to build or add this asset to their portfolio, 29% wanted to generate a side income while still affording time with their families or the ability to continue working their 9 to 5 job, and 10% stated they wanted this asset to replace their main income altogether.

Whatever your goal happens to be while pursuing the countless opportunities the Amazon FBA business model has to offer, we hope you have been able to gain some valuable insight on how you can optimize your very own FBA business .

If all this talk about gaining a 5x return on a newly acquired Amazon FBA business sounds like an opportunity too good to pass up, schedule a call with one of our business analysts today.

By setting up a criteria call with one of our business analysts, who constantly review new FBA businesses every week, we can pair you with something that meets your requirements according to your individual investment goals.

Already have an Amazon FBA business and not sure if now is the best time to sell? Set up an exit planning call and our team will help you get the best possible ROI from your exit.