Our Data Driven Content ROI Study – What Happens After a Buyer Buys?

Content sites are loved both by people just entering our space, and as profit powerhouses by seasoned veterans.

Whether you’re new to building and running an online business or have already built an online asset in the past, you may already be familiar with building a content business or “niche site” as they are commonly referred to.

If you are not quite sure what a content business entails, we are going to pull back the curtain and lay it all out for you as we analyze the return on investment (ROI) for this business model. In just the past 3 years alone, we have sold over 425 content sites on our marketplace, with no signs of slowing down anytime soon.

So, what makes content businesses so lucrative for new and aspiring online entrepreneurs? To start, this business model, like other online business models, offers the location-independent lifestyle that most business owners seek when considering this investment opportunity.

When compared to other business models, such as Amazon FBA, e-commerce, or digital product-based business models, content sites offers fewer obligations in terms of communicating with logistic companies or, for that matter, customers.

Given that you can work from anywhere in the world by simply writing content, optimizing your website with tactics such as conversion rate optimizations (CROs) and A/B split testing various calls-to-action (CTAs), it’s no surprise most first-timers choose to build and grow an online business within this specific business model, and many veterans stick with this model when they see just how lucrative it can become.

For this data-driven study, we analyzed content businesses whose buyers have owned their assets for six months to just over two years and analyzed the ROI for these buyers. This study includes business owners who have successfully grown their investment (some tripling their monthly net income) and some that have suffered a loss (a decline of nearly 90% over time leading to this present study).

Investing in digital assets is a high risk but high reward game. There is no other asset class out there where you can double your initial investment in a year’s time like what you can do with an online business. That doesn’t mean you should invest everything you have. In fact, you should have a well-diversified investment portfolio, and only invest what you’re willing to lose when it comes to digital assets.

Still, digital asset ROIs can be aggressive when in the right hands. If you’re wondering what you need to know before buying or investing, give us a call. We’ll help you create the necessary criteria that make sense for your current budget, skills, and goals to give you the best possible chance to succeed.

If you have been following our content, you are well aware of how much we value transparency in information. It is our goal to break down this data to find the driving force behind these ROI outcomes to help you make the best decision when you decide to buy a business from us.

How the Data was Collected

First, we looked at all the content businesses that we have sold on our marketplace. These content businesses include Amazon Associates, other affiliate networks, and advertising through display ads or banners. These sites are all based on producing content as the main foundation for gaining an addressable audience, and they all fit squarely in what we call the content business model.

Obviously, we needed some time to pass after the actual acquisition of these businesses if our study was to show any real results. That is why every buyer we interviewed had to have purchased their business from us at least six months prior to being included in the study. From there, we compiled a list of buyers who purchased their asset with us up to two years past that point.

Our initial list consisted of 272 content business owners who managed and operated their business within the allotted time frame. Out of these 272, we interviewed 30 entrepreneurs over the phone to collect data and hear their story of what happened after the acquisition was completed.

The Data We Collected

- Whether or not they were a first-time buyer

- Their niche

- Their current status (if the business had grown, remained the same, or declined)

- % their asset had grown or declined

- Their #1 strategy for growing the business at the time of purchase

- Any major changes made after the acquisition

- Their biggest traffic challenge

- Future traffic goals

- What they were looking for prior to making the purchase

- What they wanted to avoid in terms of acquiring the asset

- Their ultimate goal in purchasing the business

From these 30 responses, while collecting this data during Q4 of 2019, 14 assets had grown in monthly net income, 11 had declined, and 5 remained the same from the time these buyers acquired their content site.

This means 47% of all buyers in our study saw an increase in their net profits, 36% experienced a decrease, and 17% encountered no growth or decline after their acquisition.

Of the respondents, 36% were first-time buyers having never owned or operated an online business prior to this acquisition. The majority, however, had previously owned and operated two or more online businesses before acquiring their content sites.

There’s a lot more to the story than what is shown in the above chart, so let’s carry on.

Now that we know what the ROI was for these 30 businesses, let’s look into what these buyers actually did that caused their site’s revenue to grow or decrease, and identify the key performance operations that these businesses are utilizing to see what works.

To start, it’s always interesting to see what niches have been growing, however, it is important to note that a site’s niche may or may not be responsible for its success or failure. The figure below shows the spread of niches for various sites within our study that had grown. Keep in mind that these are “parent” niches, as we can’t reveal the actual niches because of client confidentiality.

Niches for content sites that have grown or remained the same:

Remember, based on a total of 30 responses, 63% of these content sites have grown or remained steady in monthly net income for 6-24 months since they were purchased.

Looking at this data, we can see that the largest contributing niche for the ‘sites that have grown or stayed the same’ data is the ‘home’ niche based on these responses alone.

This niche covers a wide array of content and products, so it is no surprise to see it as a common selection for business owners. After all, the home niche is filled with juicy keywords and plenty of opportunities to gain large traffic numbers and further monetize your content.

However, as we dig deeper into the niche selection for those businesses that have declined, we start to see some overlap in the data.

Niches for content sites that have declined in net income:

As we can see, while the “home” niche covers a wide range of topics and potential content subjects, that doesn’t make it the perfect niche. The “home” niche also leads the declined category with a greater number of sites than it had in the growth category. This provides evidence of something we often say on this blog: the niche doesn’t matter nearly as much as marketers and business owners believe. A while back, we did a study on the anatomy of a six-figure content site and found much of the same, that the niche wasn’t a huge factor at all in the success of the business.

What we can also gather from this data on niche selection is that the same niches that declined in monthly net revenue for some business owners have grown for others.

With no stand-out indicator as to which niches perform better, we need to consider what these business owners have been doing since they acquired these assets.

To get a better understanding of what your barrier for entry is into this business model, and to understand the full spectrum of what these sites will require in terms of start-up capital, let’s take a look at what your initial investment may look like when you first get started.

Based on the data for content sites we sold in 2019 (which you can see below), we know the average sales price for this business model was about $99K, and the average time on our marketplace was about 31 days (You can see a lot more data in our industry report).

As you can see from the above figure, the average sales price has grown a significant amount in the last year, just for the content sites we sold on our marketplace.

So, let’s go a step further to uncover what these business owners were optimizing on the backend of these assets, in order to get a better picture of what offers the best possible outcome in terms of ROI when entering this investment pool.

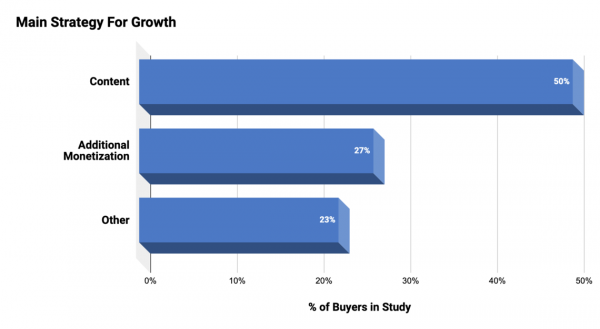

What Buyers Indicate as their Main Strategy for Growth

After receiving 30 individual responses in this study, the primary focus when speaking in terms of the number one strategy most buyers used to grow their asset, 50% indicated that growing, improving, or updating old content would be their target approach.

This should come as no surprise, as the majority of content site owners will often tell you the importance of providing the best quality content possible within your niche, to ultimately become an authority leader, rather than a casual blogger.

Our data also indicates that 27% of these buyers saw an opportunity to grow the asset by changing, improving, or adding another monetization to the business’ revenue stream.

This is something we consistently suggest as a reliable means to grow your business. Adding a monetization offers not only an additional income source, it also mitigates the risk of relying solely on one revenue stream.

The 23% of buyers in our study that were not concerned with improving the asset’s monetization or upgrading the quality of their content saw an opportunity to improve operations by including CRO, utilizing the asset’s large email list, changing ad networks, and updating the user experience (UX) and frontend of their site.

Now that we have the general consensus on improving these content websites according to the buyers, let’s dive in and see what changes they actually made to their business, and how these modifications affected the outcome of these businesses in terms of their overall ROI.

What Changes Were Made to Grow the Business?

If you are just starting your digital journey or looking for key ways to improve your business, then this section is for you.

As mentioned earlier, the primary focus when building or optimizing any content business is making sure the quality of the content on your site is evergreen (not a temporary trend).

Also, keep in mind that it is important to produce content that keeps your readers engaged.

The more you make your readers feel like they are a part of the conversation, the more likely you will gain their trust. In turn, this trust will lead to new or repeat customers that will click your affiliate link or display ad, or sign up for your newsletter to get notified every time you publish new content.

Most online entrepreneurs are constantly searching for ways to improve and grow their assets by hiring service providers, virtual assistants (VAs), and subscription-based software to streamline business operations, so let’s start with what works.

The following list contains what the business owners of these content sites have done in terms of changes to their site. Later, we will discuss how much their net monthly revenue increased as a direct result of these changes.

When it comes to content sites, it is obvious that no one size fits all in terms of what you can optimize to get the best possible ROI.

While adding content and backlinks was a large factor in terms of growing these businesses, this same operation was also performed on sites that had declined in monthly net revenue.

What may have worked for one business in a specific niche may not have worked as well for another. Based on the responses, we can see that testing and optimizing all aspects of the business outside of the content alone will usually offer the best chance at achieving a positive outcome from your investment.

This is also evident when it comes to adding content and backlinks to your business, as the source and quality of these additions can vary drastically among the different niches and resources.

Undiscovered Opportunities with Ad Placement

When it comes to content sites, the majority of your ad blocks will be displayed along the sidebar or at the top of the website. This offers room for improvement, as most business owners choose to set these ads and forget them, never testing their true potential by playing around with their placement or size.

One business within the entertainment niche that participated in our study did just that. By simply improving the ad placement on their site, they grew their revenue from making just over $1,000 a month in net profit. That is a 50% improvement just by testing the ad block placements.

The buyer purchased the asset for $40K, and after updating the ad placement and improving the page load times, they increased their monthly net revenue by over 50%. This will offer a full return on their investment in just 24 months time; even less if the buyer chooses to sell the business as it’ll now have a higher multiple than it was sold for, plus more net profit improving its monthly average.

Due to the fact that this business only generates revenue from these display ads when a viewer clicks on the ad itself, they were constantly playing with where they should be displaying these ads on their site, the size of the ads, and even the page load times which also affect the conversion rates for these ads.

As your content site grows and gains traction within your space, advertisers will also take notice of the opportunities your business provides with unused space, for which they might offer a much larger commission, depending on the traffic your website receives.

This is something that any and every content site that uses display ads as a means to generate revenue should constantly be doing: split testing and optimizing to gain the best possible outcome in terms of their conversion rates.

The best thing about this action is that it is not incredibly time intensive to do these kinds of tests on your site. Most of these tests can be carried out and finished within the first month of owning the asset.

Sending Your Traffic the Right Content, at the Right Time

If you haven’t already discovered the importance of creating buyer personas for your target audience, this is something that you must include in your marketing strategy to maximize the engagement you receive from your viewers.

An Amazon Associates, advertising, and affiliate business in the culinary niche saw a great opportunity to optimize their email sequence with offers from new affiliate networks.

The business was generating $2,500 per month in net profit when they first purchased the asset back in October 2018. The site was receiving steady traffic numbers from Pinterest and other social media platforms, but was lacking in terms of sending their audience newly published content tailored to where they were within their specific buyer journey.

After producing a detailed buyer persona chart for their content strategy, they were able to send articles geared towards their viewers interests based on their engagement with past guides and culinary product reviews.

These improvements led to a 10% increase in monthly net profit, and also diversified the revenue streams this asset was producing by forming an additional monetization through this email sequence alone.

Now, while a 10% increase might not seem like much of an ROI in this particular case, this improvement is actually quite scalable in terms of having the proper content strategy moving forward with any new subscriber that enters the funnel.

Literally every new subscriber the business gains, which are subscribers they were going to gain in their traffics buyer journey anyways, will now go through a far more optimized funnel. It is a classic conversion rate optimization play applied to email funnels.

Knowing where your viewers are in their buyer journey is important in terms of what specific content you can target them through automated email campaigns.

Sending a product offer or an upsell to a viewer who is still in the research or awareness phase in their overall buyer’s journey is not always the best approach in terms of gaining a conversion.

Optimizing the sequence in which you send the right content, to the right person, at the right time, is the most important improvement you can make when it comes to getting a return on the investment that you spent to get that viewer into your marketing funnel in the first place.

The Power of Utilizing VAs

If you’ve got a “do it yourself” mentality when it comes to managing and optimizing your business, welcome to the club with the rest of today’s online entrepreneurs.

One stand out improvement that differentiates a business that is able to scale and one that will ultimately become stagnant, is whether or not that business owner has hired or managed to implement a quality team of VAs to help with those “not so important” daily operations of the business.

Utilizing one or even a team of VAs will not only pay for itself in the long run, but also offers you the freedom to focus on more important tasks in terms of scaling the business further.

For one of the buyers who participated in our study, this offered a huge opportunity to focus on other ways to improve the overall traffic and revenue streams they otherwise never would have had the time to work on.

The buyer of this Advertising and Amazon Associates business within the culinary niche knew that by hiring a team of VAs, they could focus on growing the asset further without an increase to their own sweat equity in doing so.

The business was generating $911 on average per month in net profits at the time of purchase, and after building a team of VAs to help with the nuance of daily tasks that it was required to maintain, they were able to increase their net profit by 10%.

Improvements such as this, coupled with the fact they were able to utilize the services of SurferSEO to improve their search engine optimization (SEO) rankings for their content and grow their traffic even further, gave this buyer the opportunity to remove themselves from the business and truly scale the asset in a timely fashion (less than a year and a half to be exact).

Removing yourself from certain operations of the business in general, offers you the opportunity to focus on other key adjustments you may have not noticed were otherwise lacking.

Diversification Leads to Preservation

The 54% of sites in our study that grew, did so by improving their conversions or adding an additional monetization.

This is often overlooked when buyers perform their due diligence on any given content site, as they often consider content and backlinks their primary focus. They’re often thinking about traffic rather than revenue as the priority, which is the wrong way to go about it. Adding or improving an additional revenue stream is far more important in terms of increasing your chances at gaining a profitable ROI.

For example, let’s look at an Amazon Associates business in the sports niche that decided the best way to diversify their income stream would be to add an Amazon FBA component to their asset.

At the start, the business generated a decent amount of traffic and revenue from their affiliate links, but later realized that by writing articles and expanding by offering their own FBA products, they could grow their business even more.

When the buyer first purchased the asset in October 2017 for $96,000, the business was generating an average monthly net profit of $3,900, and after adding the FBA products and publishing new content related to these new items, they doubled their monthly net profits in less than two years from acquiring the business.

In this case, the buyer of this Amazon Associates site turned FBA business in the sports niche was able to gain a full return on their investment in just 12 months’ time.

Other businesses have also grown from expanding outside of their normal monetization categories. For instance, an Amazon Associates business in the home niche also doubled their monthly net profit by expanding their affiliate offers outside of Amazon.

This not only gave the business a diversified revenue source, but also gave the viewers and traffic more options outside of what they may have already seen from a similar business or website during their research phase.

Another benefit to expanding your offers outside of Amazon not only stems from offering your traffic more options in terms of additional products, but oftentimes you will receive a larger commission from these smaller affiliate networks compared to what Amazon offers for their massive associates program.

Lastly, a stand out business that grew their monthly net revenue by over $1,000 dollars per month in the technology niche did so by switching their affiliate network and display ad networks all together while remaining relevant in terms of these ads based on their traffic’s interests. At the time of acquiring the business, it was generating $1,800 in net profit, and the buyer purchased the site for $49,000 back in January 2018.

After switching from the Shareasale, Aliexpress, Ebay and Amazon’s affiliate networks, they saw a huge gain in commission when their traffic eventually made a purchase. The buyer ran targeted Google and Facebook ads which helped increase profitability and went directly to manufacturers to sell banner and ad space on their home page.

By migrating away from Google and Amazon as much as possible, they were able to increase their commissions and lower their margins which contributed to the business now generating close to $3,000 per month in net profit after these improvements were made.

Based on these adjustments, the buyer was able to accrue a full return on their investment in 17 months’ time, with everything after being pure profit.

They also hired a programmer to do some minor user interface (UI), and UX updates to the webpage, which leads us into our next key improvement to optimizing your content site for growth.

What is CRO, and Why is it Important?

Constantly testing specific features and the layout for your CTAs on your site is very important when it comes to getting the most value from the traffic on your page. CRO can be one of the most beneficial improvements made to any business within this model, as this will often times grow your revenue with little effort in a relatively short amount of time.

Examples include testing which email title copy receives the most engagement, the location of display ads that are receiving the most clicks, and optimizing which color in your newsletter and opt-in forms gain the most conversions.

By performing these tests, you can produce a mental mindmap of what your site should look like in order to gain the most value from your audience by performing these simple adjustments and constantly testing different variances.

The lack of performing simple CRO on a site is something that many buyers will look for while performing their due diligence on a potential business acquisition, as it offers some of the most lucrative opportunities to improve any businesses net income in the shortest amount of time.

Two businesses within our study were able to capitalize on simple CRO improvements after acquiring their content site in a relatively short time frame.

For one business owner, improving the site with simple CRO tactics led to tripling the monthly net profit. He had taken this asset, which at the time was generating $4,200 per month on average in net profits, and grew the monthly net income to just over $12,000 in less than one year after the acquisition.

This first time buyer who purchased this Amazon Associates business for $157,000 back in February 2019 in the equipment niche, noticed an opportunity to gain a timely ROI from the asset by improving the CRO and running simple split testing to gain the most conversions from their traffic.

This was something the buyer was looking for in a business right from the start.

The low hanging fruit this asset offered by updating the content, backlinks, and CRO alone was enough to make this investment a no brainer, and an easy win for this particular buyer.

Another business owner who acquired an Amazon Associates business from us in the sports niche gained a 30% increase in monthly net profits, prior to putting the asset back on our marketplace as a seller.

He purchased the business on our marketplace for $50,000 back in 2017, and after performing a few simple CRO improvements, a front end theme update, and publishing new content on a consistent basis, he sold the business back on our marketplace for $85,000 one year later.

If we break down the increase in revenue at 30%, and the ROI received from the sale of the business one year later, this buyer was able to profit just over $42,000 in just a year’s time.

This data shows the potential that CRO offers when making improvements to gain the most from your content site acquisition. If you’re looking to buy a content site, then CRO should be a top priority for you post-sale if you want to speed up the timeline to get your initial investment back.

Most buyers consider simply improving the content when they acquire one of these businesses. While that should be part of your goal, it is clear that if you want to capitalize on an aggressive ROI, then you’ll need to do more than simply update content or disavow a few backlinks if you want to make the most of your investment.

With all of the data we’ve collected, one thing that has stood out so far is that most content sites whose monthly net revenues grew are performing improvements outside of adding content and new backlinks alone.

It is, in fact, the opportunity to grow and scale the business outside the addition of new content or the improvement of the site’s backlink profile that piques the interest of potential buyers in today’s content site market.

Now that we have discussed the other ways to grow your content sites monthly net revenue, aside from content and backlink improvement, let’s consider what played a pivotal role in the decline of these content sites within our study.

Google Updates: A Content Sites Kryptonite

Ask any niche site or content business owner what the number one risk factor is to their businesses growth potential, and usually the first thing that comes to mind are the dreaded Google algorithm updates.

This is something that even business owners growing their monthly net income mention as a reason why their business had not scaled as much as they had hoped for.

The uncertainty behind these updates and the key attributes they target in terms of what is acceptable in Google’s eyes and what is not, is often frustrating for content site owners and SEOs alike.

While some claim to have a detailed plan of execution to remain positive in the eyes of these updates, they too will fall short to the uncertainty of what Google deems fair game. One algorithm update can be the difference between massive growth, and shocking decline if all the business’ traffic is SEO based.

You only have to look at the 43% of business owners in our study who indicated that their existing traffic numbers were directly affected by one Google update or another, to understand that the Google algorithm can both give and take from your website’s earnings.

Furthermore, of the 11 content sites that have declined since their owner acquired them, 54% of these buyers identified Google updates as a primary factor for the businesses inability to gain additional traffic.

What 36% of these Content Site Owners did that Made their Business Decline

As mentioned before, we won’t go into the subject of adding or revising the content found on these sites or the backlinks associated with the businesses. However, we will take a look at other factors that may have led to the decline of these assets.

Something that stood out for content sites that declined in revenue was not what these business owners had done, but rather, what they hadn’t done to improve or maintain the site.

63% of the content sites that decreased in revenue, focused only on content and backlinks, or did nothing to the site at all.

Just a few years ago, you could see plenty of online gurus discussing how to build and grow a content site by simply producing the best quality content possible.

Is this no longer true? Was it ever true?

While content and backlinks are still very important, and yes, you should still be publishing consistent high quality content as much as possible, this is far from where the work stops in terms of growing and scaling within this business model.

As more online entrepreneurs are entering this space, it is essential you protect your investment by diversifying your revenue streams, and set up the proper safety nets required in case something doesn’t pan out the way you envisioned it to prior to making the acquisition.

Content and backlinks aside, what other changes were made to these assets whose monthly net income had declined since their buyers acquired them?

Even though some of the initiatives that were made to the businesses that declined may have also been implemented to those whose monthly profits grew (for example: updating the theme of the site), these changes were coupled with improvements to the content or backlink profile updates alone with no other features being optimized.

Let’s dig into each of the changes made to these businesses that experienced a decline to get a better understanding of what you should avoid when scaling your content site.

The Color of the Hat is What Google is Looking at

While we could go on a rampant discussion pertaining to the differences between white, grey, and black hat PBN link building techniques alone (see more here if interested in the rewards and risks of using PBN links), we will keep it short by focusing on the subject at hand: ROI for content sites.

We will however, mention that as with most things in life that are not entirely by the book or in accordance with the rules set by the referees (in this case Google), there will be an associated risk and consequence from stepping outside the boundaries.

This was the case for one of our buyers who decided to utilize an SEO service provider to build grey hat backlinks to their site in hopes of gaining more traffic, and in turn more revenue in a reduced time frame.

Now, we are not saying that using PBN links are not to be trusted when building or growing your content site by any means. In fact, a business that had grown by 30% in net profits, which we mentioned earlier in the sports niche, used PBNs to grow their backlink profile as well, but the key difference here is they also performed updates to their CTAs among other changes mentioned earlier.

This however, was not the case for the buyer of an outdoors niche site when using grey hat links from this particular SEO agency.

After purchasing the site for $235,000 back in 2017, the business, which was generating an average of $8,000 per month in net profit, dropped by nearly 80% after implementing these grey hat links from this particular SEO service, coupled with minor changes to the logo and theme of the site.

Again, we are not saying that by using PBN links for your websites profile that you will experience the same results (as evident from the business which grew by 30% utilizing PBN links on their site), but when this is the only strategy you have included for the improvements being made to the overall structure of your site, you’re leaving a lot of money on the table and potentially introducing new risks to the site.

Changing Ad Networks and the Theme on Your Site Could be Negative

Not all ad networks and themes are the same.

This is apparent when we take a step back and look at the full 30,000 foot view of any business within the content site space today.

Major changes to the look and feel of your site could have a negative affect on how your existing traffic perceives the site and the brand feel that was painted in their mind prior to these cosmetic alterations.

For one of the buyers in our study whose business had declined after switching ad networks, this was made apparent when their monthly net profits declined by nearly 30%…

The buyer, who purchased the aged site, created in 2001 which is ancient in internet time, decided to try their luck in moving away from Adsense altogether, which may have not been the best decision at the time.

After having gained years of data and click through rate (CTR) metrics on Google’s end, the ads were geared to the best of their ability to be tailored to the sites traffic and buyer intent, which was ultimately a benefit to not only the business owner, but to Google as well.

Switching to a new ad network and ultimately “cleaning the slate” in terms of data used to display the most relevant ads for the sites audience, ultimately may have been the biggest contributing factor to why the revenue declined from its previous state.

Change can be a good thing, however, when you change the complete look and feel from what your loyal audience is used to experiencing from your website or brand, this can ultimately have a negative impact to the overall performance in generating revenue as seen here.

Focusing on Content Alone is Not Enough

If you are the type of person who thinks that simply adding new content to your business is all that it takes to scale your business in terms of traffic and revenue, you may want to reconsider this approach.

Based on the data we collected in this study, adding new content or improving your backlink profile by means of manual outreach or removing broken backlinks is no longer all it takes to grow your asset.

As mentioned above, 63% of the businesses that declined in this study experienced this drop in monthly net profits from performing this operation alone, which leads us to believe that there is far more work required to truly get the ROI most buyers are expecting from their newly acquired investment.

One buyer, for example, who purchased an Amazon Associates business from our marketplace in 2017, saw an immediate decline in revenue on the first day of the migration period due to a change in the commission structure Amazon was offering for their associates program.

The listing price for the business at the time this buyer was performing their due diligence on the asset was originally $20,900 for this apparel & accessories business in the sports niche, which was generating $746 on average per month with a listing multiple of 28x.

On the first day of the migration period, Amazon decided to change their commission structure completely. This resulted in a decline of nearly 30% of the net profit the business was generating after factoring in the new commission Amazon calculated.

Based on the fact that our migration process gives all of our buyers the option of performing a full reversal of the deal if profits drop significantly at no fault of the new owner, we extended this offer to the buyer.

After considering the new sales price of $15,461, and a sales multiple of 21x, the buyer decided they would still continue on with the acquisition of this business considering the reconditioning we acknowledged with this new commission structure Amazon had implemented.

In the words of this particular buyer:

“This was kind of frustrating from the buying experience, but it was also really helpful that Empire Flippers was mediating that. They were able to adjust the price and get the seller to agree to the new value of the business based on the new commission structure Amazon changed. So that was a pretty helpful thing that the Empire Flippers team helped manage and mediate.”

While this particular case is not something most buyers would like to experience for their first time purchasing an online business, we offer a safety net for these case by case situations to not only make sure the buyer is 100% satisfied with an agreed-upon purchase price, but also to make sure the buyer is getting a fair deal in the small chance that something should go astray during the migration period at no fault of their own.

This is something you will not be protected against if this was a private deal the buyer and seller were performing – and protection for both buyer and seller is something we’re fanatical about.

Despite these changes to the deal structure, and considering the reevaluation of the asset after these unforeseen circumstances had stemmed from this Amazon commission structure update, the buyer only focused on adding new content seldom after the acquisition.

Coupled with a loss of interest on the buyer’s side within the niche as a whole, and their content having been stolen and used on other sites within their niches market, the business slowly declined by nearly 70% after owning the asset for just 6 months.

In this example, if we take away the Amazon commission structure element of the business, we still see a cause and effect created from the buyer only posting content periodically, and no other improvements to the business at all, which leads us into our next topic of discussion.

Why One Business Declined 90% from Doing Nothing to the Site

While adding quality content on a consistent basis is still important in terms of staying relevant within your target audience’s interests, not having diversified revenue streams is also a missed opportunity in creating a revenue safety net for your business.

The buyer of this business in the lifestyle niche had many opportunities to do just that, but ultimately decided not to venture outside of what the business was already utilizing in terms of content for its viewers.

Acquiring the business back in July 2017 for $25,000, the business was generating $1,000 per month in net profits already having multiple monetizations included within the business structure.

Where this first time buyer failed in terms of scaling and growing the business was when they left the site alone in hopes that their revenue would remain steady.

This is usually the last thing you should consider, since new content will ultimately target new keywords you might not have been ranking for prior to publishing these new articles.

Soon after the acquisition of the asset, a Google update had hit their site quite hard leading to a decline in traffic, and based on no other new articles being published to offset these penalties, led to a drastic drop in revenue as a result.

After the buyer had already started to experience a decline in traffic and revenue, they finally decided to start publishing new content to the site, yet failed to see other opportunities available to them.

From reaching out to influencers for the affiliate offers on the site, to growing the info product line within the niche, this business had ultimately lost the opportunity to reach its full potential from the lack of any additional improvements to the structure of the business on the buyer’s part.

Focusing on content alone and not taking advantage of growth factors such as the addition of a monetization, performing CRO, or improving the assets of an existing monetization can have a direct effect on the success or failure of your newly acquired business.

So, what exactly does the content site market offer in terms of ROI?

Our Conclusion

This business model is different in terms of required sweat equity when compared to models such as Amazon FBA or e-commerce businesses which are geared towards logistics, customer service, and protecting the brand’s reputation offering the best quality product within their niche.

For niche sites, on the other hand, the product you are selling is in fact the content on your site.

The opportunity to gain a timely ROI stems from diversifying your income streams, targeting new keywords with content produced on a consistent basis with quality in mind, and constantly testing your conversions to be optimized for profit growth.

While 40% of the buyers in our study set out to add a content site to their portfolio of businesses, 50% of these buyers set out to create a side income alongside their 9-5 or replaced their main income altogether. The last 10% was determined to acquire the site and flip it for a profit shortly after their acquisition, which gave these buyers the persona we often refer to as Flipper Freds (more on our buyer personas here).

Content sites, on the whole, are not a simple fire- and- forget business: you get out of it what you put into it.

This business model is still one of the easiest to get started with in terms of the knowledge required to pick one up and start running with but is at the same time imperative to realize that these assets are not self-sustaining by any means.

The most successful content site owners will have the mindset of knowing that the end goal shouldn’t be to simply produce content and build a white hat backlink profile, rather, it should be to become an authority site of information within their given niche or market, and to diversify its revenue streams as much as possible.

Optimizing your traffic sources by running targeted ads on your social media platforms, utilizing lead generation services, and improving your keyword research prior to publishing new content will help you gain higher-quality traffic to your site.

Improving ad placement, optimizing your email sequence in which you send the right content to your addressable audience, and performing CRO on key actions you want your traffic to perform while on your site, will strengthen your earnings throughout the lifecycle of this traffic.

Diversifying your income streams by adding unique affiliate networks, relevant advertisers, and tangible items if related to the content of your site, and info products and guides to help gain email opt-ins will help scale your business even further.

And lastly, building a team of VAs to allow you the opportunity to step away from performing the time-intensive operations required of the business, such as writing the content and performing the manual backlink outreach needed to gain quality backlinks, will produce a turning point to fundamentally scale your business to the level in which anything is possible.

Not quite sure which niche or business model is right for you? Set up a buyer criteria call with one of our business analysts today, and we can help you determine which business model fits your needs.

Already have a content site and not sure if now is the best time to sell? Set up an exit planning call and our team will help you get the best possible ROI from your exit.