Amazon FBA State of the Industry Report 2022

The Amazon FBA business model continues to grow in popularity as an asset. The increase in capital flow from big investors and the development of an Amazon aggregator market are helping the online business mergers and acquisitions (M&A) industry thrive.

There’s a lot going on in the space, so we decided to boil it down to the numbers.

We’re continually gathering data on all the transactions that occur on our marketplace. In fact, we’re the only brokerage able to collect this data, making this report the only one of its kind in the industry.

This report is designed for both buyers and sellers of Amazon FBA businesses to understand the current state of the FBA M&A industry, so you can make informed decisions on your acquisition or the sale of your FBA business.

Let’s dive in.

Note: To offer better takeaways in this report, we’ve filtered out any renegotiated deals when calculating averages for some data, such as multiples and prices. You may also notice minor differences in data from previous reports because of updates like renegotiations or reversals.

Amazon FBA Data and Trends

Check out our visual report to see all of the Amazon trends in one place. It breaks down the past few years of the industry, revealing data like average twelve-month trailing multiple by year and pricing tier.

Amazon FBA Sales and Volume

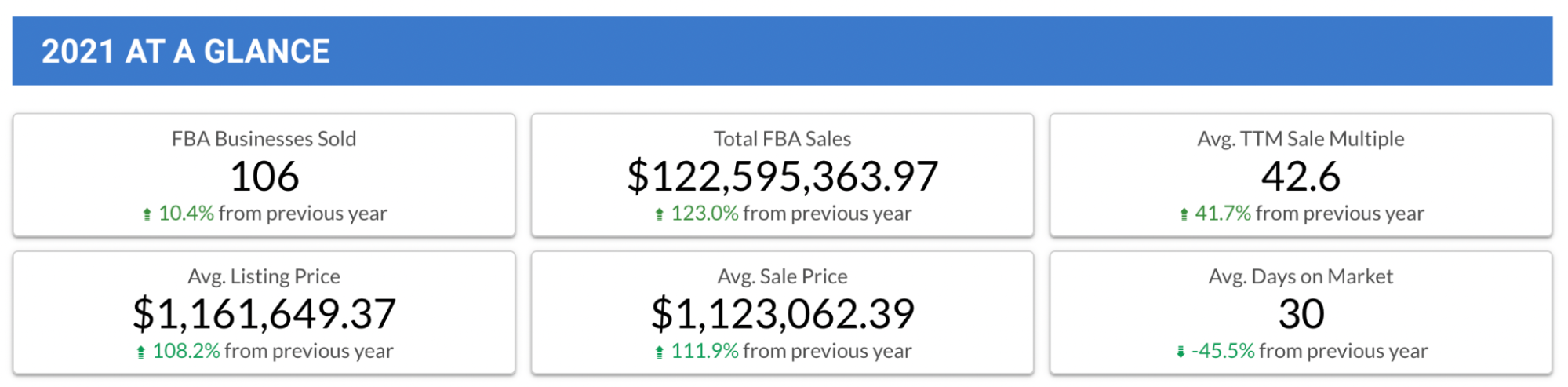

In 2021, we sold 106 businesses with Amazon FBA as the primary monetization, for a total of $122,595,363.97. This accounted for about 31.6% of all transactions on our marketplace but 72.4% of total volume in sales.

When we wrote our mid-2021 State of the Amazon Industry Report, we had sold 43 FBA businesses—the number of FBAs we sold increased almost 150% in the second half of 2021.

This resulted from aggregator competition heating up and more capital being deployed toward FBA and ecommerce acquisitions. In Europe, there has been a rise in aggregators reaching unicorn status, which has upped the acquisition game in the global markets.

Another contributing factor on the seller side is the supply chain crisis. Many sellers don’t have the capacity or are unable to find ways to navigate this crisis. Thus, they’re opting to sell their businesses to buyers who have the capital and resources to keep these businesses going.

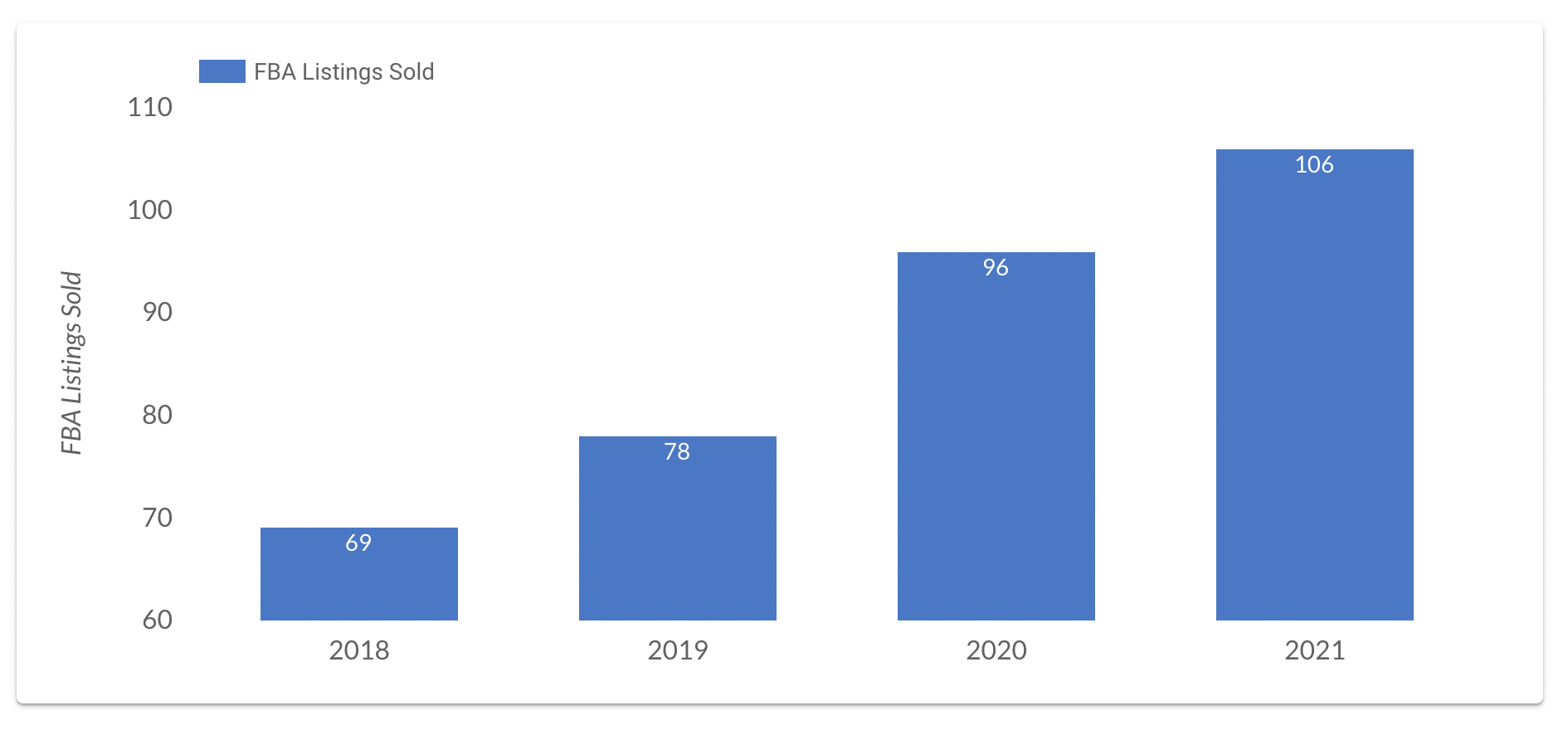

Let’s compare 2021 to previous years. Compared to 2020, we sold 10.4% more businesses, and our total sales increased 123%. Compared to 2019, we sold 35.9% more businesses, and our total sales increased 345.4%. Compared to 2018, we sold 53.6% more businesses, and our total sales increased 675.9%.

This consistent increase in businesses sold is due, in part, to a growing awareness of the online business mergers and acquisitions (M&A) industry. We’re seeing more investors from different asset classes, like stocks and real estate, take note of the return-on-investment (ROI) potential of digital assets and consequently make investments.

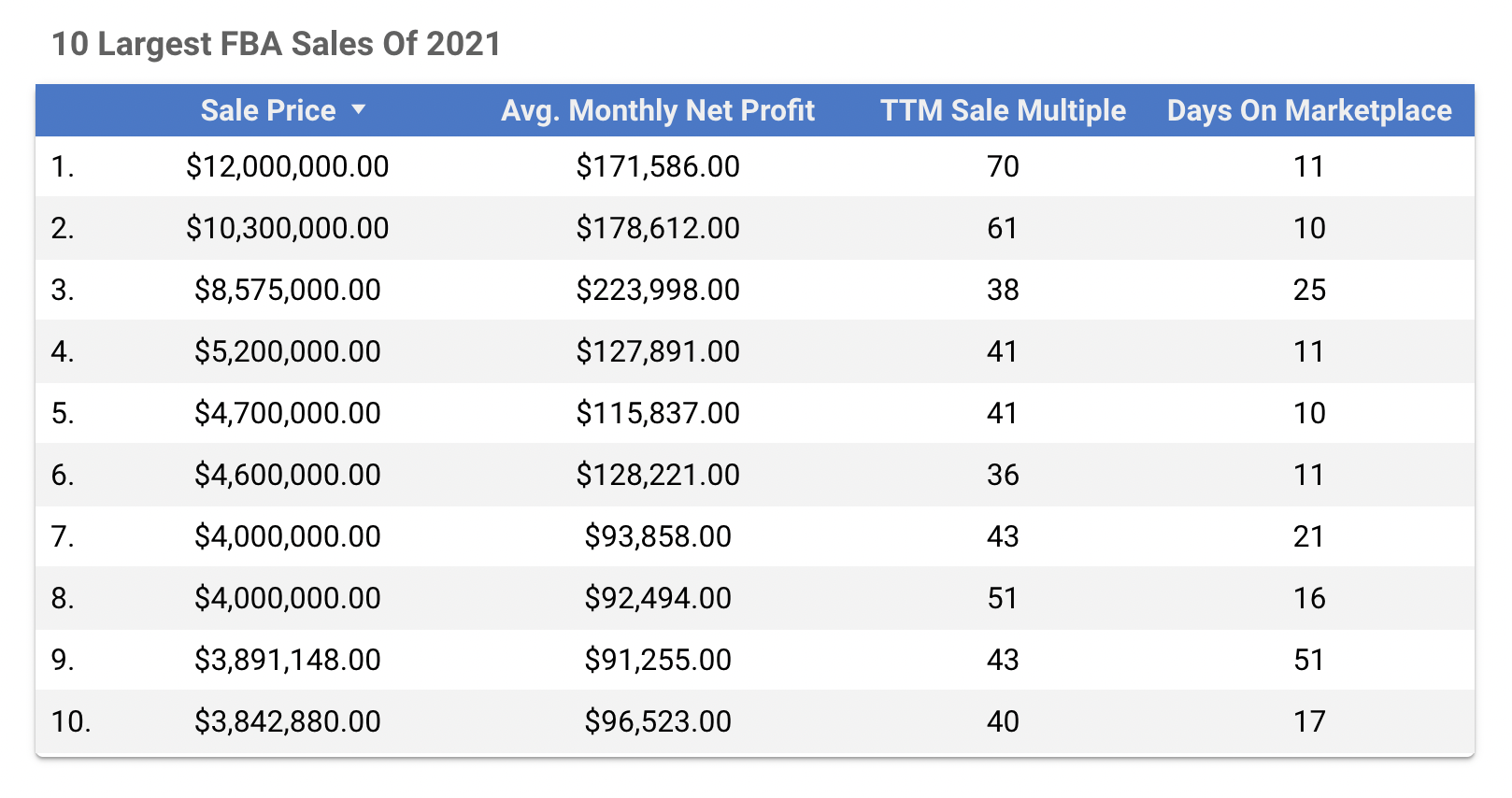

What stands out about these eight-figure deals is the days on market: just 10 and 11 days. In less than two weeks, we were able to facilitate negotiations and connect the seller with the right buyer, with over $10M on the table. It also shows the extent to which buyers are willing to move quickly, even in the eight-figure range.

The maximum time it took to sell a business was less than a month, with a week to spare. This is fast, considering we are looking at the top FBA deals to close on the market.

We were able to sell these businesses so quickly because we’ve refined the sales process and we have a gigantic buyer pool that, at the time of writing, has over $6,000,000,000 in verified liquidity on our marketplace.

Another interesting quality of the data is the variety of sales multiples. We were able to sell a wide range of FBA businesses with different histories and builds because we have a wide range of buyers, each with their own levels of capital, qualification criteria, and skill sets. It’s not often that we’re not able to find a buyer for a business we list for sale.

Amazon FBA Listing and Sale Prices

If you’re interested in the trajectory of sale prices, multiples, and how many FBA businesses are being sold, take a look at our visual report that has all of that data and more.

The average list price for FBA businesses in 2021 was $1,161,649.37, with an average sale price of $1,123,062.39.

Both the list and sale prices have increased dramatically year over year. The average list price in 2021 increased by 108.2% compared to 2020, 243.8% compared to 2019, and 385.7% compared to 2018. For average sale price, the percentage increases were 111.9%, 309.1%, and 429.5%, respectively, over the past three years.

The increase in aggregator competition is the biggest contributing factor to the increase in the list and sale prices of FBA assets.

Aggregators have agreements with their investment firms to acquire a particular number of digital assets, and they all want the best businesses. Some can specialize, but most have the same fundamental criteria: strong SKUs with a high number of positive reviews, a high-quality product in an evergreen and expandable niche, a solid supply chain, dependable operations, and opportunities for growth.

In Q3–Q4 of 2020, the average list price crossed the seven-figure mark for the first time in our history, reaching $1,068,799.52. This translated to an average sale price of $1,034,996.58.

Amazon FBA Days on the Marketplace

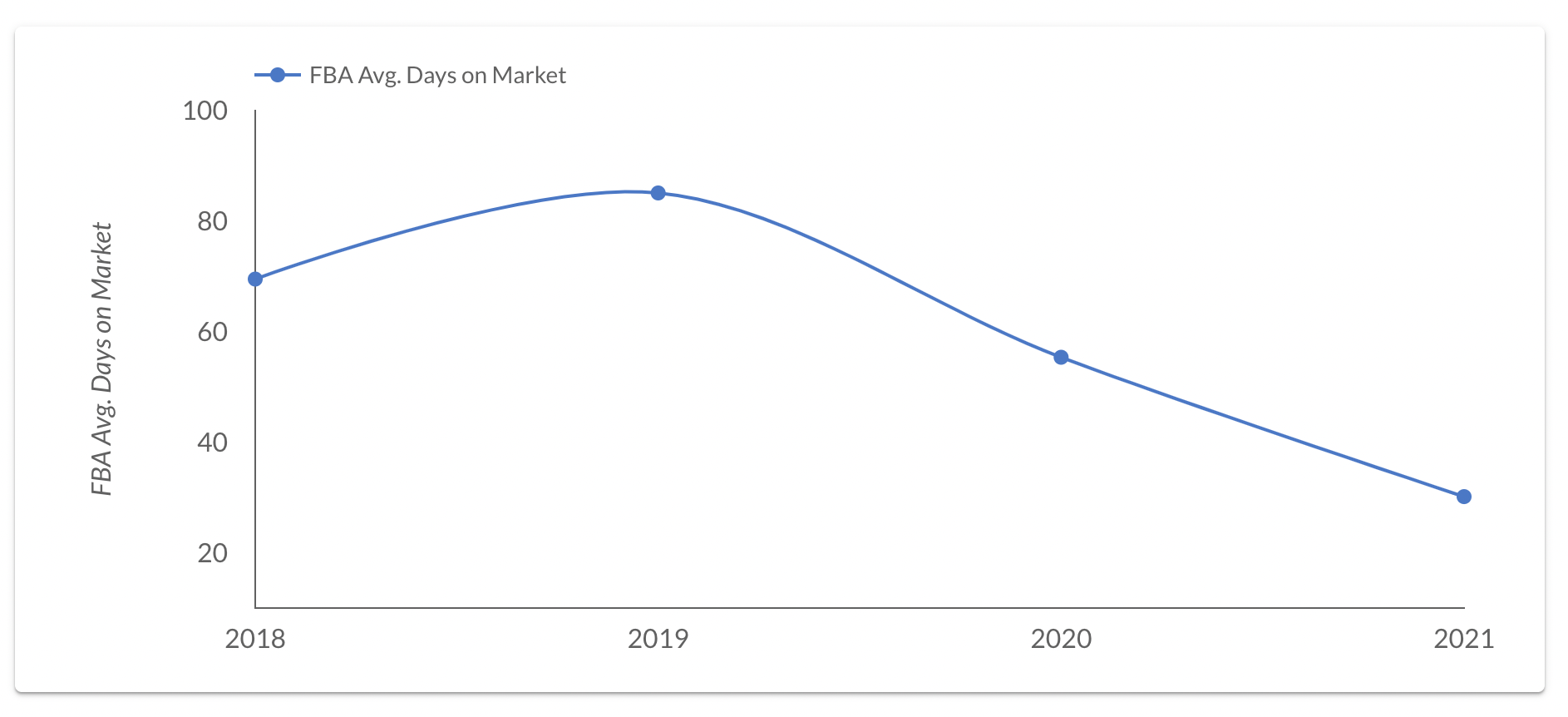

FBA businesses averaged 30 days on the marketplace in 2021. This is a:

- 45.5% decrease from 2020

- 64.6% decrease from 2019

- 56.6% decrease from 2018

With the increase in the number of buyers coming to our marketplace, competition for FBA assets has increased, resulting in more offers for businesses and less time to make the sale. This increase in buyers has also resulted in a greater willingness to deploy capital into assets faster, as buyers don’t want to miss out on quality businesses.

This data correlates with the increase in the size of businesses we list on our marketplace, as aggregators look to find big brands so they can own a larger share of the Amazon FBA market.

Additionally, 2021 was a big hiring year for us. With new additions to our sales team, we were able to connect buyers with sellers more efficiently. We also expanded our marketing team, which allowed us to attract more buyers and high-quality FBA businesses to our marketplace.

With a larger sales team, we were able to develop our select listing process. This is a new way to accelerate large business deals by streamlining considerable buyer interest to allow businesses to make their most competitive offers while providing the seller with the best-possible financial reward for their business.

Amazon FBA Earnouts

- 22 from 2020

- 18 from 2019

- 26 from 2018

This increase correlates with the considerable increase in the average list price of businesses on our marketplace.

Since traditional financing is difficult to obtain in our industry, seller financing through an earnout is often the best form of leverage for buyers looking to make a deal. More than ever, creative earnout structures have come to the deal table to incentivize sellers to close, protect buyers against downsides, and enable newer buyers to outcompete their biggest competitors.

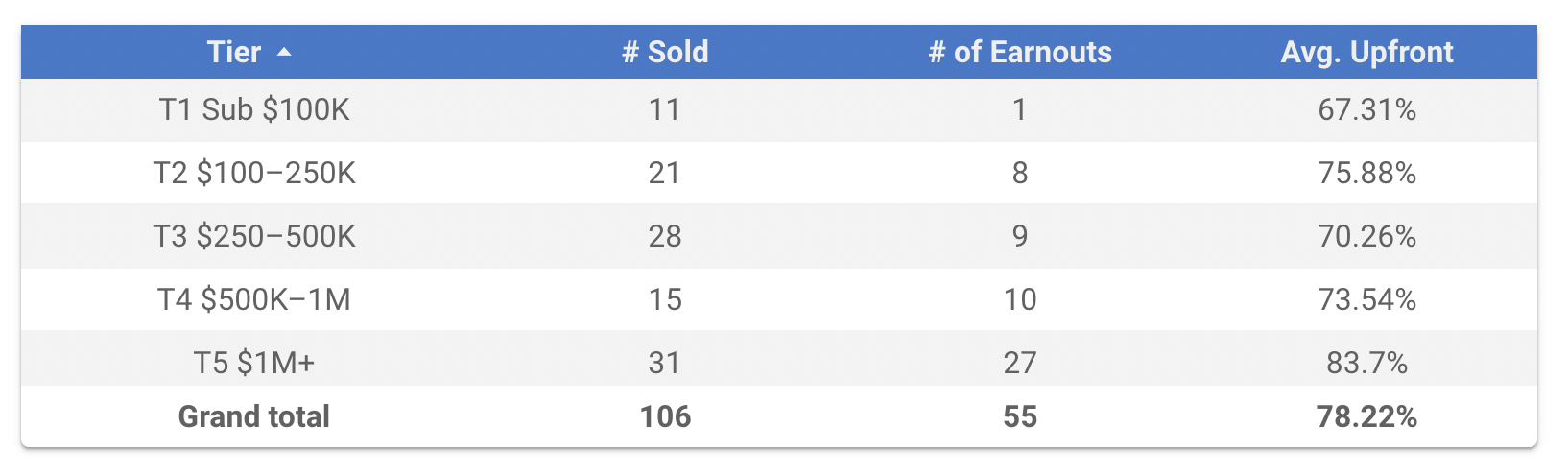

The average amount paid up front for these earnouts was 78.22%.

You can see in the table above that the vast majority of these earnouts occurred in the $1M+ pricing tier, which accounted for 27 out of the 55 total earnout deals. The average amount paid upfront in this tier was 83.7%, which is substantially higher than in the other pricing tiers.

This makes sense—Amazon aggregators make the majority of their transactions in this pricing tier, so the amount of capital available for businesses in this price range is the highest out of all tiers. Moreover, since most of the aggregators are searching for businesses in this price range, the competition is fiercer than in other pricing tiers, pushing aggregators to offer more upfront in the deals.

In the sub-$100K tier, only one deal was an earnout.

Again, with the increase in the number of buyers in the industry, earnouts are becoming less common in this price range, as buyers make full-price offers to secure the business before another buyer does.

The pricing tiers from above $100K to below $1M all have similar numbers of earnouts, with a difference of only two. In this range, sellers are offered a higher multiple on their business in exchange for selling full price upfront for an earnout deal.

Earnouts are a strong negotiation tool that sellers can use to boost the price of their businesses. If you let a buyer pay you over a number of months or years, they will almost always be willing to offer you more money.

However, the number of earnout deals at these price ranges is considerably lower than the $1M+ range because there is plenty of capital in these ranges and many sellers prefer a quicker, full-price upfront deal to waiting to be paid through an earnout.

The $500K–1M range is one of the harder segments in which to sell a business. This segment is slightly out of reach for most mainstreet investors and slightly too small for institutional investors that have eyes on bigger assets. If your business is near the top of the $500K–1M range, you should work to increase its valuation above the $1M mark before you sell—we can help you with this increase when you schedule an exit planning call.

For buyers other than institutional buyers, the lack of competition means there is opportunity in the $500K–1M range. Buyers can forge partnerships and pool their money to make attractive offers for sellers in this space, whereas this strategy might not work in pricing tiers with fierce buyer competition.

Check out our visual report to view the data on how the FBA industry has performed over the past few years.

Amazon FBA Average Trailing Twelve-Month Sales Multiples

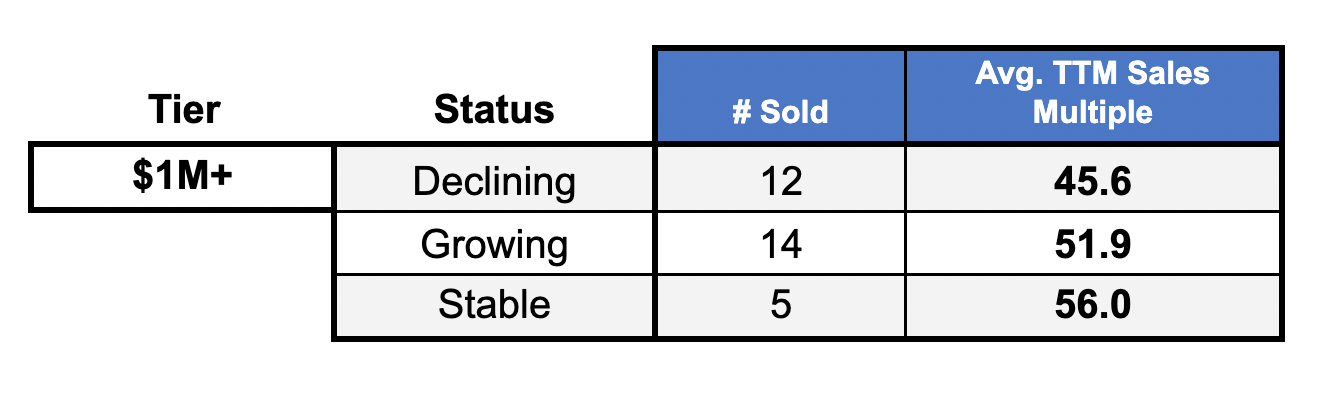

As you can see in the table above, we’ve broken down the trailing twelve-month sales multiples into pricing tiers to give you a granular view of the averages for your current or desired business size.

The status column represents whether a business had growing, declining, or stable profits.

We also compared our normal average sales multiple against the average adjusted multiple displaying the TTM numbers.

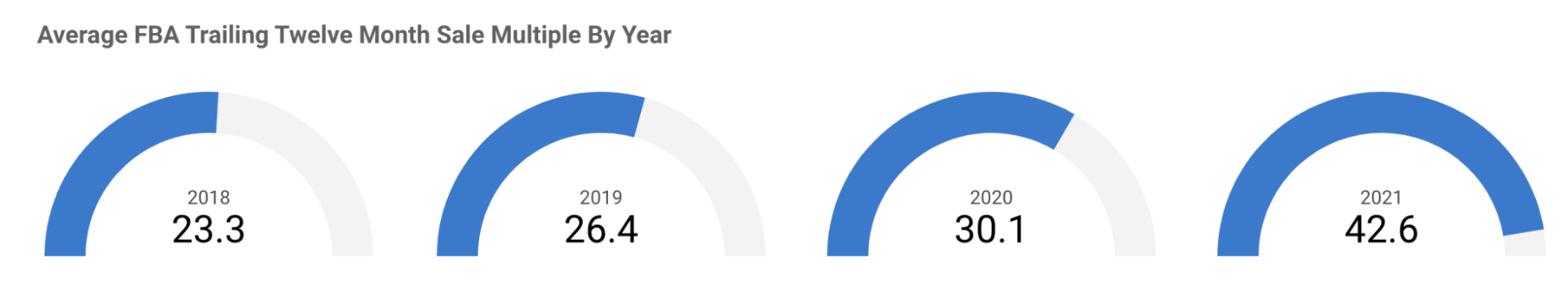

Across the board, TTM multiples have increased. The average trailing twelve-month sales multiple (TTM) in 2021 was 42.6X.

By the first half of 2021, more investors had been able to secure funding for acquisitions than in the end of 2020, thus driving up competition and multiples.

The rise in multiples may give buyers pause, but sellers should be excited to see the multiples go up. FBA assets have increased by 82.8% in just three years and by 41.7% in one year. Few assets can climb this much this quickly.

FBA owners should be elated. Rises in multiples obviously raise your business’ value. It really is a seller’s market—there has never been a better time to sell your Amazon FBA business.

Overall, you can see that across all pricing tiers and subcategories, the TTM shows that multiples have increased. These figures make it easy to compare selling with us versus other brokers, because most brokers use a TTM model regardless of the pricing window.

The TTM difference was a 19.3X increase to the sales multiple from 2018, a 16.2X increase from 2019, and a 12.5X increase from 2020. Keep in mind again that the average multiple and the average TTM multiple produce the same actual sale price; one just uses a customized pricing window, and the other uses the TTM method.

All the information we covered on sale price increases still holds true using TTM.

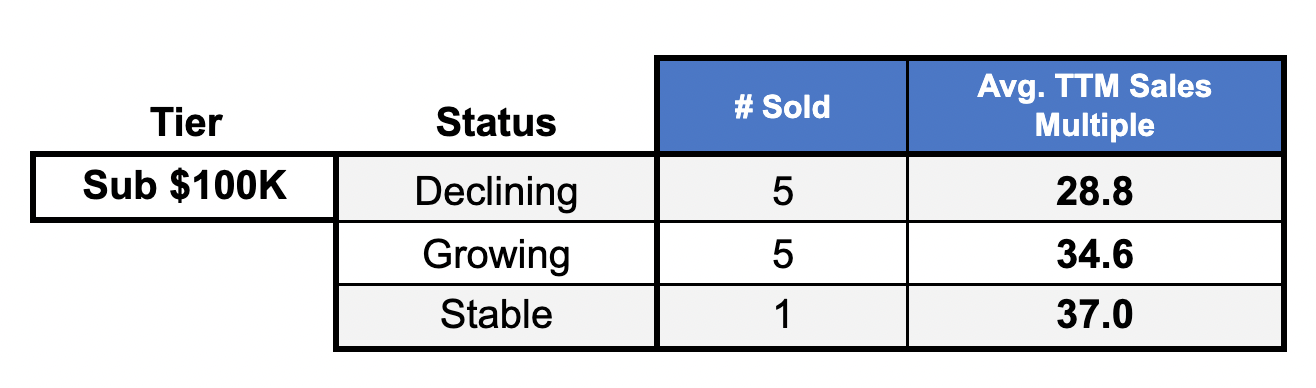

Sub-$100K Pricing Tier

In 2021, we sold 11 FBA businesses in the sub-$100K pricing tier. Of the 11, five were declining, five were growing, and one had stable profits.

The average TTM multiple for a declining business in this tier was 28.8X. For an increasing business, the multiple was 34.6X and for a stable business it was 37X

You might be wondering why stable businesses had a higher multiple than growing businesses—something we’ve seen before in previous reports. The going theory is that a buyer likes stability, as a business in maintenance mode most likely has not reached its fullest potential; it’ll have various growth engines that are underused.

Alas, with only one data point here, there is nothing we can say for sure.

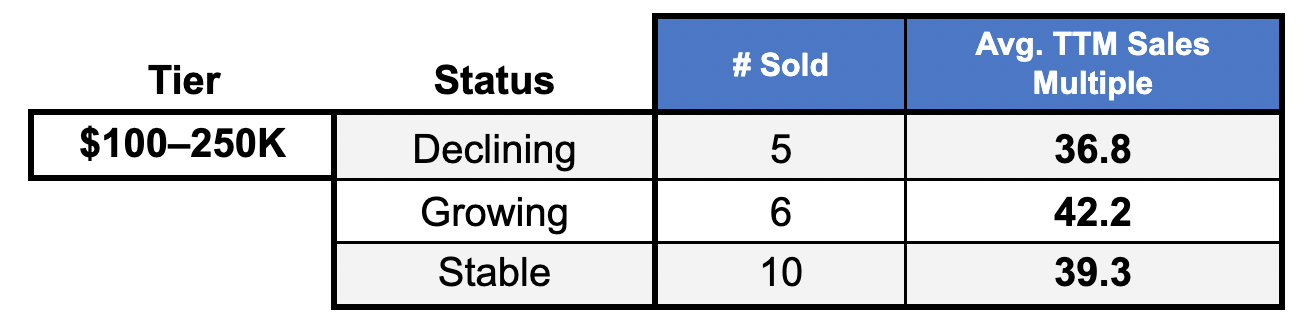

$100K–$250K Pricing Tier

In 2021, we sold 21 FBA businesses in the sub-$100K pricing tier. Of the 21, five were declining, six were growing, and 10 had stable profits.

The average TTM multiple for a declining business in this tier was 36.8X. For a growing business, the TTM multiple was 42.2X, and for a stable business it was 39.3X.

Since there is a more even data set here, compared to the sub-$100K range, we can see that the multiples correlate nicely with the state of the businesses. However, the multiple increases from declining businesses to stable businesses to growing businesses aren’t that large. This is likely due to the sub-$100K range’s variety of buyers, including those who like to fix up businesses on the decline and those wanting to jump on a business that’s in a growth phase.

There are also buyers looking for stable investments. This pricing tier has a competitive number of buyers seeking these deals, leading to less disparity in multiples as buyers compete for the acquisition.

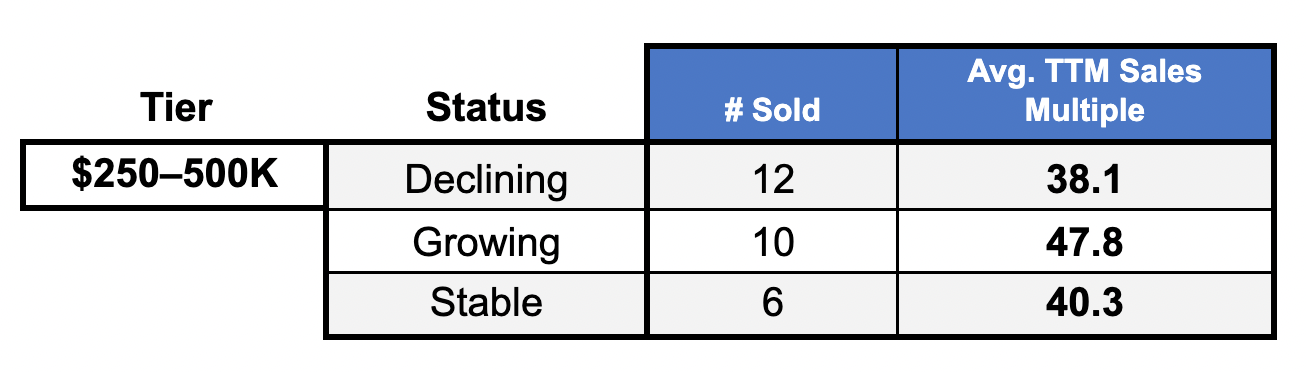

$250K–$500K Pricing Tier

In 2021, we sold 28 FBA businesses in the $250K–$500K pricing tier. Of the 28, 12 had declining profits, 10 were growing, and six had stable profits.

The average TTM multiple for a declining business in this tier was 38.1X. For a growing business, the TTM multiple was 47.8X, and for a stable business it was 40.3X.

Similar to the $100K–$250K pricing tier, buyers at this level can get excited about businesses on the rise in this pricing tier, and this excitement is likely a significant contributing factor to the big jump in average multiple for growing businesses. With a business that is already growing, a buyer is likelier to make a fast, easy return on their investment than with a stable business. They will have the job of maintaining the growth and stabilizing the business’ logistics and operations to handle the growth, as opposed to searching for growth through new costly marketing campaigns.

Also, buyers with a growing business tend to order more inventory, which can be a desirable asset for buyers, as it sets up the business to take on future orders without any delays.

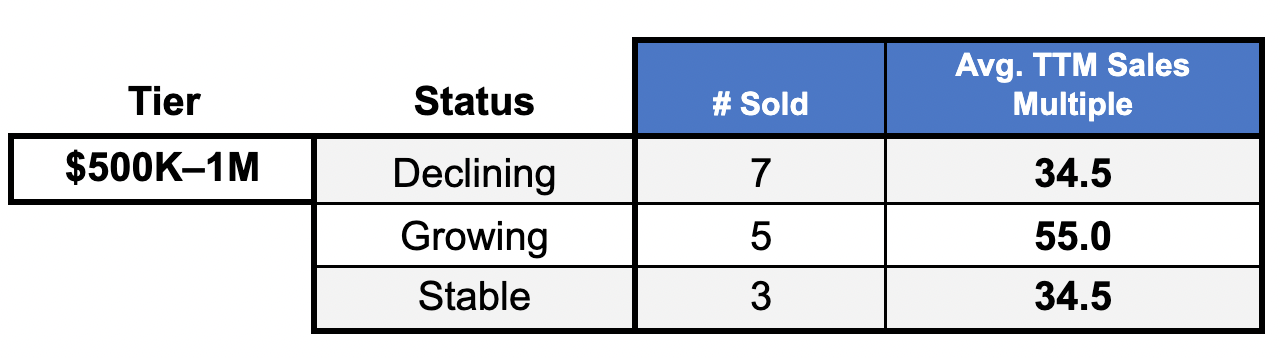

$500K–$1M Pricing Tier

In 2021, we sold 15 FBA businesses in the $500K–$1M pricing tier. Of the 15, seven had declining profits, five were growing, and three had stable profits.

The average TTM multiple for a declining business in this tier was 34.5X. For a growing business, the TTM multiple was 55X, and for a stable business it was 34.5X.

What’s interesting about this data is that the average multiple is exactly the same for stable and decreasing businesses. One could argue that a declining business, depending on the circumstances, could be just as good an investment asset as a stable business.

For example, if the business had previously earned more money more consistently than the stable business in the past, and had just taken a hit due to a stockout, then a savvy buyer can recognize the declining business as one with more potential than a lower-earning stable business. A change to inventory management could quickly and significantly turn this business around, earning the buyer a nice ROI.

At this point, you might also notice the gap widening between the multiples of growing businesses compared to those of stable and declining businesses. This could be because growing businesses at the higher pricing tiers are rarer.

A business that has scaled from $0 to $1M in just one year might not be the most desirable asset due to a lack of stability, whereas a business that has scaled gradually over a number of years and continues to grow is highly desirable to investors. Usually, businesses enter a growth phase and then earnings stabilize until the owner invests in the next phase of growth. A business that continues to grow organically is desirable for obvious reasons.

If the seller has been investing heavily in the growth, this is also desirable for buyers because it usually means the seller will have a future growth plan ready for the buyer to take over.

In general, this remains the most challenging pricing tier for a seller to get a deal done. However, a growing business in this sector could still attract high-net-worth buyers, such as aggregators, family offices, and private equity firms.

Among ultra-high-net-worth buyers just starting out, some may choose to enter the fray here rather than compete with their peers in the $1M+ range. For that to happen, though, your business must be of high quality and ideally growing.

$1M+ Pricing Tier

In 2021, we sold 31 FBA businesses in the $1M+ pricing tier. Of the 31, 12 were declining in profits, 14 were growing, and five had stable profits.

The average TTM multiple for a declining business in this tier was 45.6X. For a stable business, the TTM multiple was 56X, and businesses with increasing profits were at 51.9X.

At this stage, the stable multiple has finally crept past the growing multiple, and we think we know why this could be.

First, the data set is considerably smaller for the stable businesses compared to the others. However, buyers in this pricing range are really looking for stability. Businesses of this size tend to be older than lower-priced businesses and, thus, have a longer earnings history.

The gold standard for old businesses is stable earnings over a long period of time. If you compare a stable business to one that has fluctuated in earnings over its lifespan, experiencing dramatic highs and lows, or even just general seasonal fluctuations, then you can see why this is the case.

A business with stable earnings is a predictable source of income, and when you invest over $1M in an asset, you want some assurance that it will be stable (not just for your stress levels, but for your wallet, too).

However, don’t forget, the multiples for growing and declining businesses in the $1M+ pricing tier are considerably higher than those in the lower tiers.

Businesses in all states have their advantages. For example, declining businesses can have the advantage of being quickly scalable. An FBA that has been having trouble with stockouts due to poor inventory management could actually be a desirable asset for a buyer with experience in logistics who could stop the stockouts and quickly stabilize and scale profits.

Growing businesses have the obvious appeal of being projected to generate an ROI for a buyer. There is also the snowball effect of Amazon rewarding the brand’s performance with increased organic exposure and access to exclusive tools.

The $1M+ pricing tier is where Amazon aggregators make the majority of their acquisitions. The potential rewards for them and their investors are the greatest in this price range.

These aggregators have contracts with their investors to consistently invest in FBA businesses, so the competition between the 89 aggregators currently in the space is high, especially since generating ROIs from FBA acquisitions is the core of the aggregator business model.

The best way to get your FBA business seen by these investors in a controlled environment where they will compete for your business is to list your business for sale on a broker’s marketplace. It’s the only way to present your business to all the biggest investors in the industry, with a broker working on your side to have them compete to buy your business.

Although investors do reach out to businesses privately, without the presence of other brokers boosting the demand and price of your business, you can leave significant money on the table if you sell directly to an aggregator, even when you factor in a broker’s commission.

There is a common myth in the industry that we like to call “the off-market fallacy” whereby many believe that because you pay a broker a commission on the sale of your business, you will earn more money if you sell without a broker and not pay commission.

However, the truth is that a broker connects you with many of the biggest buyers in the industry, and they also value your business for what it’s actually worth, so you can avoid selling for too low. Because the broker makes a commission on the sale, it’s in their best interest to get you the biggest possible sale, and they have the capacity to do so with their contacts.

For example, we currently have well over $6,000,000,000 in verified funds on our marketplace; that’s capital that our buyers have proven they have to invest in online businesses with us. And this number is rising all the time, as our real time updated scoreboard shows.

If your business is earning $25K+ per month in net profit, on average, over the past 12 months, it is likely to be in the seven-figure range. One of the best next steps for you would be to schedule an exit planning call with us or get the selling process started here to take advantage of the growth in the market.

Opportunities with FBA Assets: Scale for Higher ROI or Sale Price

FBA businesses of all sizes and builds have opportunities for growth. Identifying these growth levers is the key to success with an FBA acquisition, or, even better, you can replicate what the most successful FBA buyers—Amazon aggregators—are doing.

Global Expansion

One of the most straightforward growth initiatives Amazon aggregators execute is launching their newly acquired brand on international Amazon marketplaces. While the USA still remains at the top of the Amazon tree, markets like Europe and South America are experiencing explosive growth.

Amazon has built its platform to make the global expansion process as straightforward as possible. Their logistics infrastructure has surpassed that of FedEx and is on track to overtake UPS. Therefore, as an FBA business owner, you have access to the biggest global consumer markets.

It’s no secret that the world is going through a supply chain crisis. However, there are ways to navigate this.

Supply Chain Management

Many Amazon sellers are using 3PL warehouses next to FBA fulfillment centers so they can store more products than they are allowed to on Amazon. Nevertheless, they can still take advantage of Amazon’s on-ground delivery network to fulfill orders. Some also explore air options that, while more expensive, help their products jump shipping queues.

There are many FBA communities to support you; see what other sellers are doing to navigate the crisis. If you’re able to weather the storm with an FBA asset, you’ll come out into a low-competition market and thus instantly own a larger market share.

To offset the increased shipping costs, if you decide to go for air shipping, you could save money on product packaging. With smaller, lighter packaging, you could save on warehousing costs without affecting product quality.

We talked about expanding into international Amazon marketplaces, but another option for scaling your business is expanding into other ecommerce channels.

Platform Expansion

Opening a store off Amazon—on Shopify, for example—can open up new revenue streams for your business. Doing this shores up your business’ earning power; if you have a problem on Amazon, such as one of your listings getting taken down temporarily, you still have extra revenue coming in from Shopify, Walmart, Etsy, or wherever you decide to expand.

By building your brand on Google, you get the additional benefit of boosting your brand on Amazon, as Amazon will greatly reward you for off-Amazon traffic coming to your Amazon listings by increasing their rankings.

This isn’t the only way to market your brand off Amazon.

Affiliate Marketing

You can Google search your product category and find content sites that are already generating traffic that you can tap into. Reach out to these site owners and offer them a nominal fee to rank your product first in their roundup reviews and offer your product for free so they can create content about it. This is a win-win deal: when the affiliate marketer helps you sell your product, they make a commission.

If you want to take this strategy to the next level, you can look at buying or building Amazon Associate sites in your own space. This can allow you to double-dip on both your profit margin and the Amazon Associate’s affiliate earnings.

You’ll then get access to the Amazon Associates report, which will show you what kind of items your site is selling through Amazon’s affiliate program. This information can be fantastic free product market research on the next product you decide to source and launch. You’ll know some ballpark sales figures for the product before spending any money on inventory.

A directly accessible audience is an asset that will give you considerable power over your competitors. Those who only sell on Amazon don’t have control over their consumer data.

Audience Building

It is difficult to build an email list for an FBA business, which is why building a content site or your own store can be a huge boon in creating a lucrative email list. Every time you launch a new product on Amazon, you can tap into this traffic source you’ve nurtured, creating external sales that will help Amazon raise your product in its organic ranking system.

For advertising, you can navigate the iOS restrictions and create highly targeted lookalike audiences to increase your brand’s advertising power thanks to owning first-party data.

Yes, there are many opportunities with FBA businesses as an asset, but we shouldn’t cover this business model without addressing the risks.

It is these very risks that might help you consider selling your business today rather than later.

Risks with FBA Assets

While all business models operate in a competitive environment, Amazon is the Roman Colosseum of business competition—your risk can be ultra-high-stakes.

Amazon aggregators, Amazon buyers, and consolidators of Amazon businesses can be thanked for upping the stakes. Backed by venture capital firms and high-net-worth individuals, these companies acquire Amazon brands on behalf of the investment firms to scale the asset and increase the firm’s investments for ROI.

The aggregators are made up of expert teams in all areas of Amazon FBA: PPC, inventory management, organic marketing, product optimization, and operations. When an aggregator buys out one of your competitors, you’ve just been thrown into a lion fight in the Colosseum.

They have everything needed to take over a niche: enormous spending power; expert teams; swaths of data from all of the businesses they operate; and many industry connections with suppliers and warehouses.

Another difficulty for FBA sellers is the fact that Amazon’s platform is ever evolving. You can get used to a way of operating in a certain area, then Amazon suddenly changes its terms or processes, or updates the platform functionality.

These changes can be difficult to keep up with, especially for a solopreneur who is constantly spinning multiple plates at once.

All the normal ecommerce risks are present with an FBA business, too. Supply chain logistics, in particular, have ushered in a global headache.

Throughout the pandemic, “supply chain” has been synonymous with “crisis.” The world has struggled to weather global disruptions and still transport goods.

Rising supply chain costs eat away at your margins, so you have to find a way to navigate these increased expenses to keep earning enough profits to keep scaling your business. With low profit margins, your business isn’t very agile, so you’re not able to deploy capital when needed.

For example, if your business experiences an unexpected increase in demand but you don’t have enough capital generated from your profits, you won’t be able to keep your products in stock.

Inventory management is a fine art. If you order too much inventory, you have to pay high storage fees, and you might even need to carry out a fire sale to liquidate your inventory—not to mention that you could lose perishable goods altogether. If you order too little inventory, you put your business at risk of a stockout, which not only prevents you from making sales but also sinks your products’ rankings on Amazon—problems that are difficult and costly to overcome.

What’s more, you still need to make sure you have multiple manufacturers to secure product sourcing, and all departments of your business, from marketing to customer service, must work in sync with each other. While there are fewer moving parts in an FBA business than in a traditional ecommerce store, there are still more elements to actively manage than in a content business or DropShipping business.

Understandably, all this might sound daunting. After facing tremendous global upheaval over the past few years, the last thing Amazon sellers need is another risk to contend with in their businesses.

It’s tiring to face fire after fire as an FBA owner when your livelihood is on the line. Thankfully, there is a way to protect your investment and avoid these risks altogether.

Selling your FBA business while the market is strong allows you to step away from fighting fires and ensures that you don’t lose masses of capital to the latest Amazon risk.

You are able to walk away with the value of your brand plus additional years of profit up front. It’s the safest way to protect all the capital that was poured into the business and still has the potential to see additional upside.

The decision to sell is just the first step. How you sell is the true litmus test for how much of your business’ value will make it back into your bank account.

When Is It Time to Buy or Sell?

The landscape of the online business M&A industry consists of Amazon aggregators competing for brands, smaller buyers who are self-funded or who have raised funds searching for businesses to acquire, and almost two million third-party Amazon sellers.

Buyers and sellers connect directly or via an online business marketplace.

When buyers reach out to sellers directly to acquire their business, they are unaware of what other buyers are offering, so they don’t know what their offers are competing with. As for sellers, they are faced with offers they don’t know how to judge.

On an open, unregulated marketplace, it’s the same situation but with more offers for the seller to choose from. The risks for buyers with these methods are that they have to spend time searching for businesses to acquire and then spend more time checking whether each business meets their minimum requirements. Then they have to verify the finances with the seller, which, as you can imagine, isn’t an easy task.

The risks for sellers are that they could be dealing with a scam buyer or a savvy negotiator who is capable of making them sell for less than what their business is actually worth.

The third option for carrying out online business M&A transactions mitigates nearly all of these risks: selling or buying through a broker.

We vet all the businesses that come to our marketplace with our experienced vetting team. We have a pool of buyers who have verified over $6,000,000,000 in liquidity; that’s over $6,000,000,000 in capital ready to be invested in profitable businesses like what you have most likely built.

We have teams to handle negotiations, deals, and business migrations to help both buyers and sellers walk away with the best deal.

If you’d like to find out more about the process of selling your business, speak to one of our friendly business advisors. Or, if you’re ready now, sell your FBA business here.

If you’d like to find high-quality, pre-vetted FBA businesses for sale, create a free account and start using our search tools to narrow in on your ideal business today.