A Data Driven Analysis of the Amazon FBA Marketplace

Amazon FBA (Fulfilled by Amazon) is hot.

If you have no idea what Amazon FBA is, you can see the Amazon FBA business model laid out here. In 2016, we have sold 13 of these businesses. The lowest price tag was around $9,000, and the biggest was a whopping $500k deal.

In 2015, Amazon FBA took over the internet business scene. Now in 2016, we are seeing many of these businesses maturing and getting to the point where they are ready to sell off their asset. It was also in 2016 that we were thrusted into this industry as people began to approach us with their businesses to sell on our marketplace.

With 13 Amazon FBA businesses sold, anywhere from $9k all the way up to $500k, we have learned some interesting data points that show where the Amazon FBA marketplace is going and where it is at currently. For those looking to get involved in Amazon FBA, right now is one of the greatest times to start shopping around as the data points towards a buyer’s market, which we will get into why later.

What Are People Selling?

It is always interesting to see what kind of niches are hot. Here is a look at Amazon FBA businesses that are not only profitable but also were sold to new owners through our marketplace:

Sold Amazon FBA Business Niches

- 1 Beverage

- 2 Sports

- 1 Beauty and Cosmetics

- 3 Health and Personal Care

- 1 Household

- 1 Home Management

- 1 Consumer Products

- 1 Apparel and Accessories

- 1 Gun Accessories

- 1 Accessories

If we look at the 13 businesses we sold throughout 2016, the biggest thing that stands out is there is no real “leader” here. The niches are varied throughout multiple different verticals. As it stands, Amazon FBA is still wide open for people to tackle multiple different niches and looks like it will be that way for the foreseeable future.

Health and personal care products come out as the most popular type of items being sold, with sports being a close second.

The leading niche being health and personal care should come as no surprise. This evergreen niche has been around and profitable for a very long time. People have been building content sites, ecommerce and even SaaS around the topic for well over a decade and succeeding — it is a topic that never grows old and has a huge market. It is also one of the more lucrative (and thus more competitive) niches around.

When we look at sports, it would make sense that this would be a good market. After all, there are a lot of physical product ideas that go into almost every sport. Plus, the people participating in those sports tend to be enthusiastic hobbyists who are very passionate about the niche. This coupling makes the sports niche a strong contender for creating a lucrative Amazon FBA business — one of which was sold for over six figures on our marketplace.

It will be interesting to revisit this data in a year or so when we have even more Amazon FBA businesses sold under our belt and see if sports keeps up with health and personal care.

Why We Are Currently Experiencing a Buyer’s Market for Amazon FBA Businesses

The data that we have on buying and selling an Amazon FBA business is that it is a buyer’s market. While most of the other businesses we list and sell are going for 26X-28X or higher, the final sales price on FBA businesses has been just over 20X, similar to what content sites had a few years back when they were being brought to market.

A savvy buyer can enter the market today with a fully operational business for a lower investment cost than what will be available to them in the future if the Amazon FBA multiple trends continue to mirror content sites like Adsense & Amazon Associate sites. Sellers can still make big paydays here, and they can get around the 20x multiple by building businesses with more unique, hard to copy products in more competitive niches.

This makes sense if we look at the history of this monetization strategy.

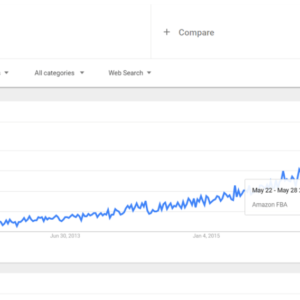

After all, Amazon FBA has only been around for a few years, and, as Google Trends show, it has only recently grown with a large uptick of interest. According to the graph below, it looks like that growth is going to continue. This means that we will likely be heading into a seller’s market in the coming months/years as demand and interest in these businesses continue to rise, thus more buyers will be competing to acquire these businesses.

With increasing interest in Amazon FBA businesses, we will see more people getting into the space. This means there will be even more businesses maturing into real sellable assets.

This is great news for us, as we are currently the leading broker for both Amazon FBA businesses sold and the amount we have on our marketplace. As more Amazon FBA business owners exit their asset through us, hopefully this trend will continue.

These businesses are really emerging as strong cashflow assets for buyers. They also appeal to both the Portfolio Paul and Lifestyle Larry buyer personas.

FBA businesses can be low maintenance, high cashflow, but it’s important to take the strong cashflows with a grain of salt. Growing Amazon FBA businesses needs can be capital intensive as you’re constantly reinvesting in inventory and new products to fuel that growth.

Setting aside a healthy marketing budget will also help you stay ahead of the competition. Compared to other eCommerce platforms, Amazon FBA marketing is made relatively easy through the platform’s internal advertising system, Amazon PPC. These keyword-driven pay-per-click advertising campaigns promote your individual product listings on various pages throughout the Amazon site.

Marketing on Amazon FBA can be expensive if you’re not sure what you’re doing so if marketing isn’t one of your strengths, consider adding the cost of an Amazon FBA marketing agency into your budget too.

For those looking to simply maintain an Amazon FBA business though, you can pump out quite a healthy stream of profits. There are a lot less moving parts with an Amazon FBA business than a full ecommerce store as well, so in maintenance mode it is not terribly uncommon to be spending just 5-10 hours a week in maintaining the business. When it comes down to taking profits, it is really a choice of whether you want to grow the business (thus very little profits) or maintain where the business is to start cashing out on what it is earning.

If you are looking to acquire Amazon FBA businesses, now is the time to do it. Over 13 businesses, the average listing multiple is 23.14x but the actual average these businesses are being sold for is 20.67x. That means you are getting a fantastic deal and can buy these businesses “on the cheap” right now. Considering that we will be likely heading into a seller’s market, now is the best time to buy these businesses.

While the average sold multiple is 20.67x, the range of these businesses vary quite a bit with the lowest sold multiple being right at 14x and the highest being at 25x. What this means is that there is a lot of room for a savvy Amazon FBA seller to do better than the average multiple. It comes down to making sure your business first of all is easy to operate and then having a defensible product i.e a unique product or a product that is hard for competition to break into successfully.

The average sales multiple of 20.67x calls back to the early days when AdSense and Amazon affiliate sites sold for almost always a 20x multiple. Over the years, that multiple has crept upward where now we are seeing them being sold for 25-28X+ starting to become the new norm for these style of sites.

For the savvy website investor, now is the time to start purchasing these Amazon FBA businesses before other investors start catching on to these cashflow assets and start driving the multiples up as demand for these style of businesses continues to grow.

If the Amazon FBA market mirrors the early AdSense / Amazon Associates market, then the multiples are bound to continue to grow. You can see the Amazon FBA businesses we have listed right now: Click here for our marketplace’s current listings.

What Should an Amazon FBA Seller Do to Maximize a Buyer’s Market?

You might be thinking that you should wait to sell your Amazon FBA business with these style of businesses selling at an average 20 multiple and on average taking 43 days from time of being listed to actually being sold. You wouldn’t be totally wrong either to wait. We mentioned earlier it’s a buyer’s market, so that means you will be selling your Amazon FBA business cheaper than if you waited for when the market switches to a more seller-friendly market. However, there are still arguments as to why you might want to sell your Amazon FBA business.

If you’re an FBA owner, you know that you have to worry about:

- Logistics (Shipping by boat or air?)

- Suppliers (Backup suppliers?)

- Product management (How much to order and when?)

- Researching new products (And all the other tasks that comes with making a real brand)

These same worries are also the same skill sets that could allow you to get around that average 20.67x sales multiple and sell for a higher multiple, or allow you to cash out on your business to redeploy capital into more lucrative (And thus higher multiple) niches.

That means during that 43-day average sales period, you can research new products in preparation of redeploying your capital into more lucrative and unique products. Since you have the research skills, you could be focusing all of your time on researching new products to bring to market. Using the capital from the selling your Amazon FBA business, you can then put these profits towards more complex products that might have a higher barrier to entry and insulate your business for the future. Deploying capital into more unique, harder to copy products, will also raise the eventual multiple you can get on your Amazon FBA business by a considerable amount. Since so many new Amazon FBA entrepreneurs are coming onto the scene, many of them will be going after lower hanging fruit i.e products that are easy to produce but also easy to be copied. While you might have a business right now that is easy to copy, you could sell this off and use that capital to get into markets that these new sellers just simply don’t have the capital to gain access to.

For buyers, you will have be careful when looking at these businesses. Can they be copied easily? If so, are you okay with that risk? While less defensible, these businesses can still make very healthy profits in maintenance mode as long as you keep up with the marketing to stay ahead of any competition that pops up and they can be a good foundation for creating a brand that does produce more unique products.

Right now it is a buyer’s market, but that doesn’t mean you can’t be making a killing selling off your Amazon FBA businesses and using those profits into building a business that competes in more competitive (and thus more desired) spaces. You just need to prepare more and think a little bit more outside of the box.

Once you have a good workable system you can repeat, you can either use the capital to build wide to start a bunch of different products or you can deploy the capital into more lucrative niches that are harder to break into.

The key to making a lot of money in a buyer’s market for a seller is going to be ability to do quality research and take action and make something unique – not just a copy and paste business.

Our Two Biggest Tips for Amazon FBA Buyers and Sellers

#1 Outsourcing Quality Control

There are plenty of opportunities to automate your processes, but the one that most sellers miss out on is outsourcing their quality control and packaging operations.

This is one of the easiest wins you can do for your business. Not only will it open up your business to a much larger pool of buyers (not everyone has the ability to package goods in their home after all), but it will also free up a ton of your time. Calculate how many hours you are spending packaging your goods on a monthly basis. Those precious hours could be better spent researching new products or promotion strategies for your current products. If you are looking to sell, this needs to be done. Buyers are from all over the world, some on the beaches of Bali and others in high rise cities like New York and very few are wanting to package the products themselves. This process should be fine tuned before selling your business.

Outsourcing tasks like this is important because you should be doing more high value tasks than packaging your goods to send off to Amazon (such as researching new products to sell).

While it will add an expense to your business, it is money well-spent. It is also something that could give you a higher multiple because the business becomes more “hands-off” with effective outsourcing. The more hands-off your business is, the more attractive it will be to prospective buyers.

Likewise, a more hands-off business will allow buyers to acquire these businesses and grow them easier since there are already procedures and systems in place for them to use as a solid foundation if they decide to scale the business rather than just maintain it.

#2 Master Logistics

Since many sellers do not understand the finer points of shipping their products (for example, many will ship by air at much higher costs versus shipping by boat), this can be a very easy win to make an Amazon FBA business you purchased even more profitable.

Here’s an example:

Say your business had an air shipping cost of $0.60 per unit and you are shipping 10,000 units per quarter and by just switching to shipping by freight you could bring down that cost to $0.30 per unit.

That saves you $3,000 per a quarter or $12,000 a year in additional expenses that are not adding (but rather subtracting) value from your business. By making this switch, you would add an additional $21,000 to your listing price at the 21x multiple ($3,000 x 21).

If you are a buyer and see that the seller is using air shipping, learn how to convert it into freight shipping and you could see an easy win with your acquired business doing more overall while moving the same amount of product.

If you can negotiate shipping discounts as well, then more power to you.

When you find a good formula for how much product you need to reorder to match month over month demand, you should write this formula down into a super detailed SOP.

This is a valuable tool for both the seller to sell their Amazon FBA business and to give the potential buyer confidence that they can purchase and operate the business successfully.

What to Do Next?

If you’re looking to get into the Amazon FBA game, there is no shorter path than flat out buying an Amazon FBA business that is already profitable.

If you already have a profitable Amazon FBA business and are looking to sell, there are still reasons to sell even though you likely will get a lower multiple than if you waited down the road to sell the business.

As a seller, you can use the profits from selling your business to “level up” in the niches you are competing for. You can use the capital to be able to enter markets you might not have been able to enter in before (with unique, hard to copy products) and have the marketing / investment capital to bring those products successfully to Amazon’s marketplace.

If you want to get the capital going so you can start competing in more lucrative niches, you can sell your business here.

Discussion

Great post, Greg! Learned a lot from this 😉

Hey Victor!

I’m really glad to hear you got value out of this. We’re trying to do more research style posts like this, so be on the lookout 🙂