The Online Business Models Investors Love

As the online marketplace for buying and selling websites continues to evolve, more and more opportunities to buy an online business open up. It only makes sense that as your marketing experience grows, you might consider the option of buying an online business.

There are a few predominant business models that are popular in various marketplaces today, such as:

Each of the above business models fits a certain set of skills and there is no “one size fits all” here. But it’s more about understanding what you can bring to the table in terms of operational and marketing experience.

As a digital marketing agency that offers SEO, SEM, ASO, and other PPC channels, we have a wide range of skill sets that could potentially fit more than one business model.

That being said, the fact that we understand the marketing aspect does not guarantee success.

For example, E-commerce websites require understanding the operational side of a product. This includes maintaining stock, shipping coordination, customer service and more.

SaaS businesses require a technical team to update and maintain the product. Since it is a service, you would also have to demonstrate a decent level of customer service.

Then there are display advertising and affiliate websites. These sites, for the most part, are publisher sites that utilize search engine optimization (SEO) and social media as their main traffic sources, which means that they’re often held hostage by Google’s algorithm updates.

The main reasons we like content sites that monetize with affiliate programs or display advertising are:

- They have a simple business model

- They’re not customer-based

- They have low workloads

- They’re within our level of expertise

We’ve developed a great understanding of SEO and conversion rate optimization (CRO) over the past years, which gives us the confidence to buy sites that fit within that scope.

1.1 Content as a Commodity

According to Wikipedia, “In economics, a commodity is an economic good or service that has full or substantial fungibility”. Is content a commodity?

Yes. That gets proven every time a person buys a book, goes to a show, turns on a TV, or watches online video. Owners of sites that provide content provide a commodity for visitors to consume.

In the Internet era, where we have almost unlimited access to information, the demand for information and content is growing rapidly.

This is why content sites make for a solid business investment over time. And the better your content is, the more valuable it becomes as a traded commodity.

1.2 How to do your Due Diligence

Not every content site is a good investment that you can scale as a buyer.

So here are some of the things we look at as part of our due diligence process prior to purchasing an SEO-oriented affiliate or display site:

Scale– Understanding the potential of a business before buying is a must. When looking at a particular site, you need to get an understanding of where the site can grow and scale so you can maximize your investment. This is especially true for niche sites.

Here are a few questions you should ask yourself:

Can I add more content to the site?

You’ll need to do some research with SEO tools, such as SEMrush or KWFinder, to understand what the growth potential is for adding new content to the site. You can then estimate the effect the new content would have on the site’s revenue.

Is the site already ranking in the top five positions for most of its ranked keywords?

If you’re looking at a great site that ranks well for most of its ranked keywords, then usually the potential impact you can make is not that high. Additionally, there is a chance that, if not properly updated, the site might even lose ranking in the future.

That being said, if you’re a first-time buyer, you are buying a solid business with a low risk factor.

Does it have expert content?

The first thing we look for at a content site is that it has solid, trusted information with a professional writing team that knows what it’s writing about. Preferably, look for sites where most of the content was written by an expert that really understands what he or she is writing about. This will support a higher conversion rate, since the content has more credibility for its readers.

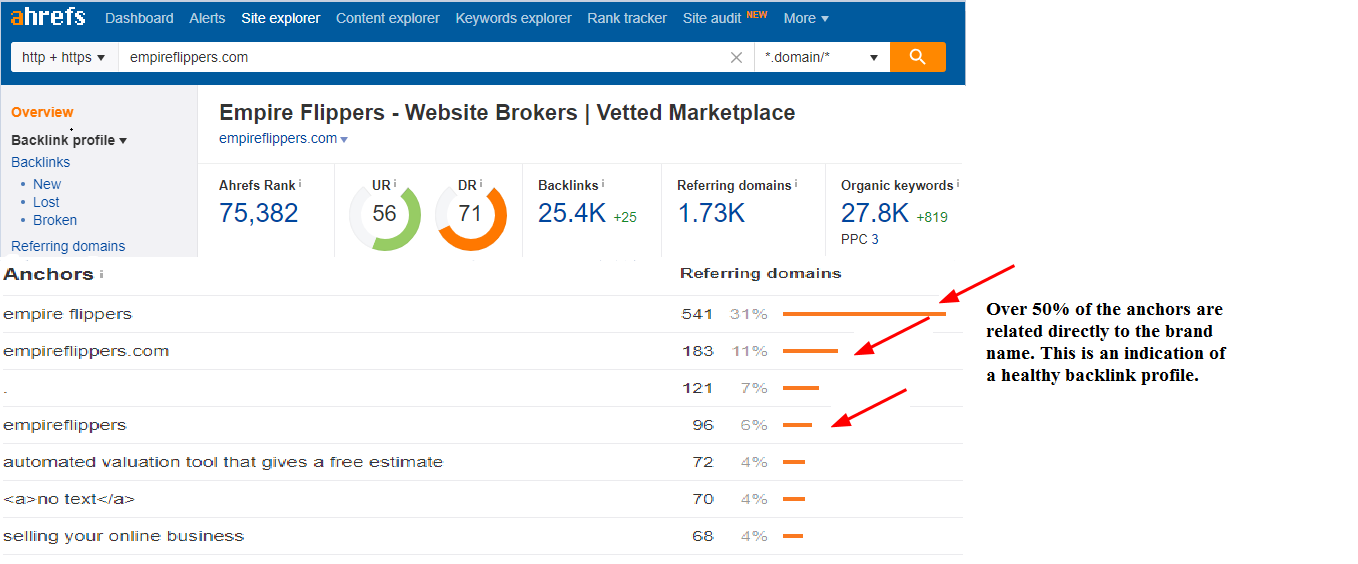

Backlink profile– The two biggest ranking factors for SEO sites are content and links. We covered content, so now it’s time to examine links. You will want to use a tool like Ahrefs or Majestic to run an analysis on the site’s link profile, checking the following:

- Relevant links– Relevant links from similar websites operating in the same space is a good sign. The more relevant links from multiple referring domains, the better the site will perform on SERPs.

- Branded anchor– Sites that have a high ratio of links going to their home page under their branded terms indicate that the site has a higher credibility in the online space.

- High ratio of exact match anchors– This is an aggressive way to promote the site by using exact match anchor text links to promote the site’s keyword ranking and it is not something Google likes to see in general.

- Spammy links– A site that has multiple low-quality links for relevant domains can be subjected to a Google penalty in the future.

Using Ahrefs.com, let’s look at empireflippers.com as a good example of what a healthy link profile would look like:

Is this a trendy space? Is this niche likely to grow or decrease in the next 2-3 years?

This is where I like to use Google Trends as my #1 tool for the job. Let’s do a quick exercise: we’re going to look at the search trends in the US over the past five years to get a better understanding of mounting searches related to the topic of the business. If I’m looking at a site that provides info about kid’s bikes:

It’s fair to assume that there would be stable demand for children’s bikes in the next few years.

Now let’s look at a site that provides information on yoga pants:

1.3 Verifying Site Revenue and Operational Cost

We’ve done deals with most of the major marketplaces as well as independent broker services. Verifying site revenue and operational cost is always kind of tricky.

You want to make sure that you can review all the relevant accounts (like Amazon associates, ClickBank, or any other account for that matter) to make sure that the numbers add up and make you see a visitor/earning ratio that makes sense. Something Empire’s business analysts can help you do.

1.4 What Sets Empire Flippers Apart from the Other Brokerages?

Two words. Vetting process.

Empire Flippers has, by far, the best vetting process I’ve worked with, and it relieves a lot of pressure from both the buyer and seller.

You always want to make sure the person you’re buying a business from is credible. If he has sold sites before, you should ask to speak to at least one of the other buyers.

Here’s a seller feedback page I stumbled upon a while back on another marketplace for buying and selling websites:

If you don’t have any previous experience, I recommend you hire someone to review it for you in case you’re using a different brokerage service or online marketplace. Or you can just give Empire Flippers a call to help you through the process.

1.5 Key Takeaways from Two Years of Buying and Selling Websites

Over the last two years, we have had some big success stories, but have also endured major failures. So we’ve learned quite a bit about the business model that works well for us.

- Look for sites you can scale – There should be clear strategy on how to grow site revenue over the next 6-12 months. We aim for at least 25% improvement on a site’s revenue.

- Manage your expectations– You can’t double or triple your revenue on each deal you make, and you don’t really have to. The key is to manage everyone’s expectations on deal flow and revenue.

- Make sure you understand what you’re getting into– A huge setback for us was when we bought an e-commerce site in the furniture industry. We knew how to do the marketing side of the business, like running the paid campaigns, but we knew little about running the operations of an e-commerce business, which resulted in an extremely time-consuming project with negative ROI.

- Low workload– Some sites require frequent updates; a good example would be sites that operate in the technological space. We prefer looking for sites that operate in an “evergreen space”, where content does not require frequent updates.

Final Thoughts

Flipping sites can be a lucrative business venture with the right risk mitigation strategy in place. The key to success is choosing a business model you understand and successfully scaling it up. I would love to hear your comments on the subject and share insights with you.

Discussion

Very informative and well explained. Thanks for sharing this!

Thank you for the great post. I’ve just started working in this field, tbh, I’m still confused about marketing skills/terms.

Glad you enjoyed the post Chloe!

Keep reading, we got plenty of resources on our blog and tons of other great websites out there to sharpen your knowledge

Ahrefs and SEMrush such a great tool for SEO.

Great post!

Thanks Doron.

Glad you liked the post Jonathan!

Agreed, great tools!

Thanks a lot Tuto!

I’m glad you liked it 🙂

Clear, simple and helpful! Thank you!!