Increasing Your SaaS Brand Value: The Good, The Bad, The Churn

Creating a popular Software as a Service (SaaS) product is incredibly satisfying.

Having a lot of subscribers surely means a lot of people are finding your product useful, right? But, what if you’re losing subscribers at the same rate you’re gaining them?

Two words will probably come to mind: churn rate.

What is churn rate? Put simply, it’s when a subscriber stops subscribing to your services. The goal of all SaaS owners is to keep the rate of churn as low as possible and gain as many subscribers as possible.

Churn rate isn’t exactly the opposite of growth; it’s better to think of it as a suppressant, since you can technically grow at such a fast rate as to beat the churn rate.

Nevertheless, it’s a key metric all SaaS owners are wary of, and in the widely referenced Totango survey, 80% of SaaS owners reported that they tracked churn.

A common myth exists that churn is simply unavoidable.

But how true is that?

Generally, a higher churn rate is seen as bad for business. More customers unsubscribing from your product sounds like you’re losing money.

To see how much churn can be avoided, it’s important to understand that there is “active” and “passive” churn, which we’ll explore in more detail later. We’ll also explore how to determine what an acceptable churn rate is and some of the ways you can lower it.

Before we can reach that stage, we need to understand how to calculate churn. Time to get the calculators out!

Calculating Churn Rate

What comes to mind if someone told you that their churn rate is 5%? You’re probably wondering “over what period of time and 5% churn rate of customers or revenue?”

As many SaaS owners have found out by this point, reporting on churn rate is where things can get confusing.

Despite the general consensus that monitoring churn rate is important, there isn’t a standard measure for reporting churn rate.

SaaS owners tend to use a combination of both user and revenue churn to inform their customer retention strategy.

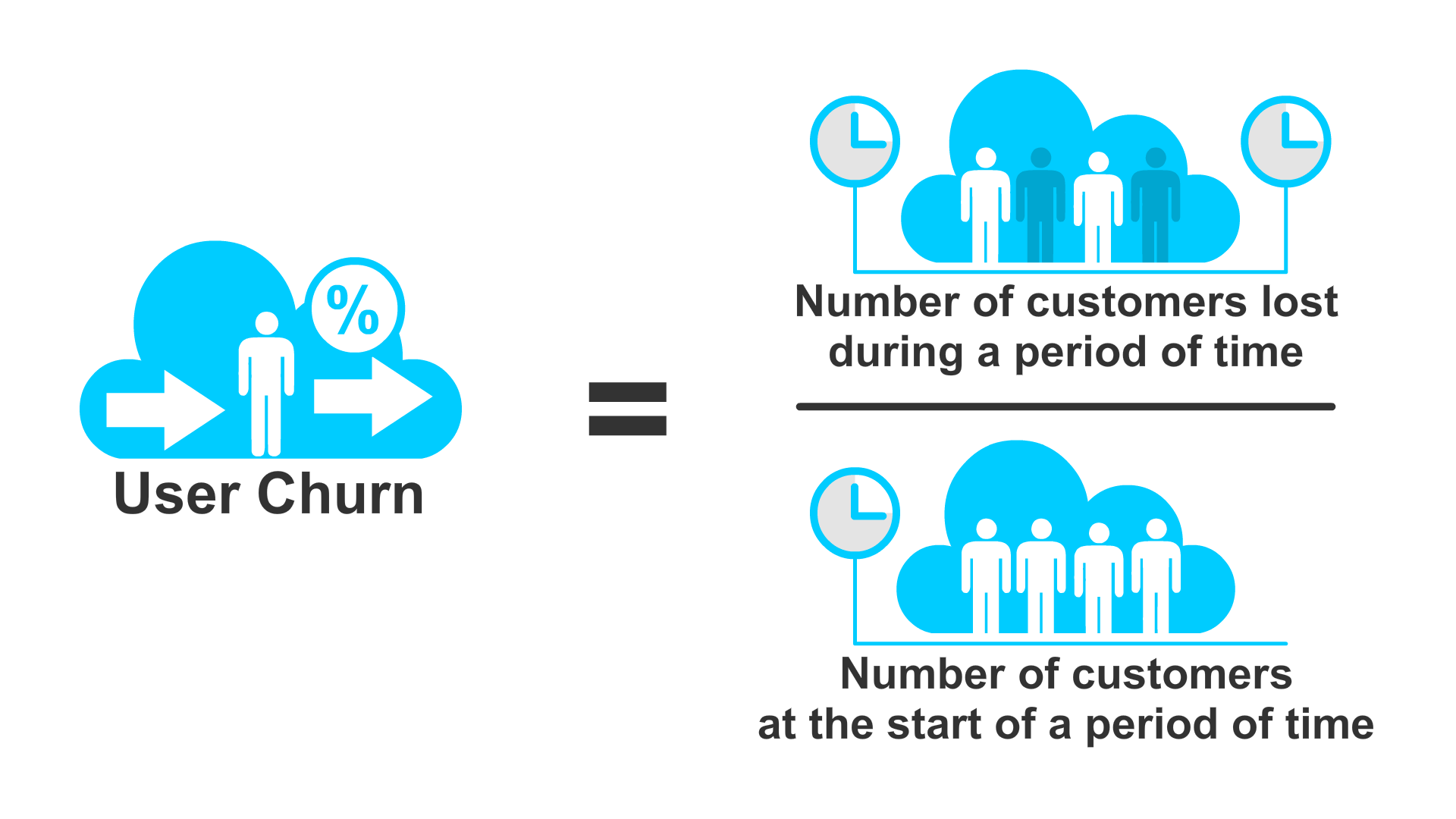

You might hear user churn referenced to as logo churn, and it’s usually expressed as a percentage. Many interpret this figure as an indicator of your customer’s satisfaction with your product.

With revenue churn, two formulas are used that tell slightly different stories.

The first is for gross revenue churn, also known as monthly revenue rate churn, which provides a benchmark of how much revenue has been lost because customers have downgraded or cancelled.

The second is for net revenue churn, which is considered a critical health indicator of a SaaS business.

Understanding net revenue churn can get confusing, as a positive percentage is actually a bad thing and a negative percentage is good.

In this formula, SaaS owners aim to have zero or negative net revenue churn, as it suggests that the business will continue to grow even if no new monthly recurring revenue (MRR) is added for that month because the company is expanding through upgrades.

These formulas provide you with proactive ways to work out the churn rate of your SaaS business.

Another misconception that can easily be cleared up is the difference between monthly and annual churn rate.

Put simply, a 5% monthly churn rate is potentially fatal for your business, as seen in the table below.

For example, let’s take a tribe of 1000 customers.

If you have an annual churn rate of 5%, it means you’ll have only lost 50 customers by the end of the year.

Doesn’t sound too bad, right?

However, if you have a 5% monthly churn rate, you’ll lose 460 customers at the end of the year.

Another way of thinking about this is that you will have an entirely different set of customers subscribed to your product at the end of the year.

An annual churn rate of 5% is equivalent to a 0.4% monthly churn rate—much more palatable!

It’s clear that you want to avoid falling into a situation where you’re losing five percent of your subscriber base each month and keep the churn rate down as low as possible.

But how do you find the threshold where your business is still profitable?

Let’s see if there is such a thing as an “acceptable churn rate”.

What’s an Acceptable Churn Rate?

People often quote 5% as a suitable churn rate, but some SaaS owners suggest that 3% is the sweet spot for maximized profits and a quality subscriber base.

However, Totango’s survey showed that only 32% of SaaS owners achieve the advised benchmark of 5%rate of churn.

You’ll be pleased to know that 5% isn’t a universal standard that’s make-or-break!

A quick look at survey results reveals that, in reality, an acceptable churn rate varies according to the size of the company.

Key consistently conducted annual surveys over the past five years. They’ve discovered the median churn rate stands at 15%, which interestingly enough has increased over the years.

At a more granular level, Baremetrics Open Benchmarks showed that bigger companies had lower churn than startups. After examining over 600 SaaS companies, they found that the lowest revenue churn rate was seen in companies where the average subscription price per user was $250 and above.

This could be due to the fact that customers put more consideration into committing to a higher-priced subscription and plan to use the product for a longer period of time.

The relatively low user churn for lower-priced SaaS products might be because the owners are targeting leads who are a product-market fit. You’re much more likely to stick with a tool that meets your needs and can be used out of the box with minimal fuss.

Many companies don’t hit the 5% benchmark. However, lowering churn rate by even 5% can increase profits by 75%.

You might be wondering if it’s possible to reduce the likelihood of customers unsubscribing from your product, since it seems like churn happens no matter how large or small your company is.

So what can we do to keep the churn rate down and the growth train running?

How to Reduce Churn Rate

Identifying why customers unsubscribe gives you a chance to implement systems to increase customer retention.

Remember “active” and “passive” churn that we mentioned earlier?

Active churn is when a customer intentionally quits using your product, which can be challenging to prevent since a customer has decided they don’t need to use your SaaS tool.

Passive churn is when a customer doesn’t want to quit their subscription, but something is causing them to be unable to continue. It can be frustrating for both parties when this happens, but there are a few steps you can take to reduce the likelihood of passive churn.

Continue Delivering Product Marketing

The underlying key to lowering churn is to continually provide value while communicating what that value is to the customer.

After researching products on the market, we as consumers often stop looking further into the benefits of different SaaS tools after we’ve picked one to subscribe to.

With smartly placed tips on how to maximize the use of the tool through different mediums (articles, videos, GIFs, etc.), you can continue to help your customers grow beyond what they initially wanted to use your tool for.

This is especially useful if you add more features to your SaaS product that augment the core features. Consumers often aren’t aware of these new features, especially when they’re announced in a single post on social media or received in an email notification.

When you demonstrate how the product works and explain how it saves customers time and energy, you’re demonstrating how important your SaaS tool is to the business. As your customer uses the tool in its full capacity, they’ll discover that your tool is integral to their business’s growth.

As a result, untangling the tool from their business would be extremely painful as they wouldn’t be able to achieve what they have up until now.

Provide an Off-Boarding Cancel Flow

Nobody likes a long and drawn out negotiation. Being bombarded by persistent sales people when you’re trying to leave a service is annoying.

That’s why making the process of cancelling simple and intuitive is such a powerful tactic. You’re still providing value to your customers and truly trying to help them, even when they’re looking to stop using your product.

To this end, make the option to cancel easy to find. This might be a dedicated button in an app or clear instructions on how to cancel on a dedicated page.

Customers might not be quitting because they’re dissatisfied; they may have run out of budget, or they may not have a use for it at that moment.

You can build in a workflow where you provide an even more compelling offer, reminding the customer of what they potentially lose out on if they quit.

As part of the workflow, offer a downgrade, freemium plan, discount, or suggestion for partner services that bridge any service gaps.

If the customer doesn’t feel any of these suggestions help, then you’ve assisted them to the best of your ability and parted ways on amicable terms. Further down the line, they’ll be more likely to return to your product because they’ll remember how helpful you were.

It’s great news if the customer takes you up on your offer at this step and continues as a subscriber. However, take caution; although you’ve saved a customer from becoming a former-customer, you still need to follow up to address any concerns.

They showed intent to cancel, so you’ll need to take time to understand why and how you can improve.

Offering Better-Priced Plans

Keep an eye out for your customers’ service utilization, specifically how many user licenses are used versus how many were purchased.

If a customer is adding more users to their plan as a result of rapid growth, this could be a great opportunity to upsell by suggesting higher paid plans to accommodate more users.

Alternatively, if the customer isn’t filling up their licence quota that quickly, you can also suggest downgrading them to a plan with similar features in a bid to help them save costs.

Either way, you’re reducing the likelihood of active churn by looking out for the customer, which won’t go unnoticed.

Keep Your Service Simple

One of the main suspects of passive churn is outdated or incorrect customer information. This might be a billing address or an expired credit card.

Left unaddressed, it can cost you up to 20% of lost subscribers.

Instead of sending out a hoard of email reminders to update a card shortly before its expiry date (also known as pre-dunning emails), consider updating the card details with the issuing bank.

Attention is at a premium in today’s digital economy. If your customer opens an email from you, you’d prefer that it provided excellent value instead of a warning in big bold letters.

Managing passive churn in the background gives your customers one less thing to worry about, which contributes towards creating a pleasant and memorable customer experience. As the saying goes, “Ignorance is bliss”!

If you’re unable to help your customer update their card details and they don’t respond to your dunning emails, you might consider downgrading their account instead of deactivating it altogether.

This is especially helpful if you can see the customer is very active using the tool. The restricted features will serve as a prompt to find out why they can’t use some of the things they had access to previously.

Stay Ahead of the Curve

It can dent your ego when your SaaS product is constantly getting bashed.

For the sake of your churn rate, you’ll need to set your ego aside and stick with the pursuit of improving your product.

You can ask for feedback from existing customers subscribed to different pricing plans through impromptu surveys, or you can drop a line sporadically to get more intimate details.

All types of feedback are helpful, even from churned customers. It’s very useful if constructive feedback is left.

Put your copywriting hat on when you’re asking for opinions, especially when a customer is on their way out of the door. At this point, they aren’t obliged to give you any feedback, so they’re actually doing you a favor.

If you can make the feedback process pleasant and throw in an exclusive offer, it can leave a positive lasting impression and might increase the likelihood of someone coming back, or at least improve your reputation when they talk about your product to their friends or family.

Master the Art of Lowering Churn Rate to Increase SaaS Business Value

At this point, we’ve established that there isn’t a universally acceptable churn rate that applies to all SaaS businesses.

Larger SaaS companies need a lower churn rate to keep up with their expenses and for a healthy rate of growth to occur, while smaller startups have more margin for error during their early stages when they’re still trying to find their product-market fit and improve the quality of their subscriber base.

It’s evident that working on lowering churn rate is helpful across the board. Whether you’re trying to increase retained revenue or working towards a profitable exit, having a firm handle on your SaaS business’s churn rate is a great way to increase your business’s value.

You’ll be in an excellent position to explain to potential investors how you manage to keep customer retention high when it’s time to sell. Low user churn rate indicates that your subscribers are really happy with your SaaS tool, and a low revenue churn rate is an encouraging indicator of growth.

Many smart investors often buy SaaS businesses because of their hands-off business model and as a means of diversifying revenue or synergizing with other products to support their primary business.

If you’re not looking for a profitable exit, getting a grip on your business’s churn rate will improve your income stream.

If you are looking for a profitable exit, feel free to try out our valuation tool to see how much your company might be worth—you might be sitting on a valuable asset that’s worth 7-figures!