Mid-2021 State of the Amazon FBA M&A Industry

The FBA model has exploded in popularity more than any other e-commerce business model and arguably more than any online business model that we sell. This business model is attractive given that it is easily scalable in a way that most other business models aren’t.

We decided to put together this updated report to help you, the actual Amazon FBA entrepreneur looking to sell, to get a better understanding about what is happening in the space.

It’s only been a few months since we published our full State of the Industry Report using last year’s numbers, but already things have changed in the space.

If you’re looking to make a meaningful exit, never has there been a better time than now.

In this report, we’re going to go through the hard numbers first, and then finish out this report helping you understand the common Exit Traps that can prevent you from selling your Amazon FBA business for the highest dollar amount.

Let’s dive in.

Amazon FBA Data and Trends

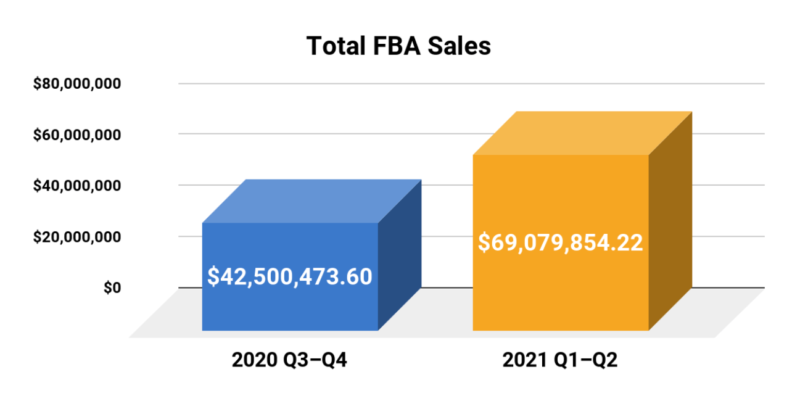

In the second half of 2020, we sold 43 businesses with Amazon FBA as the primary monetization for a total of $42,500,473.60. As reported in our 2021 State of the Industry Report earlier this year, these were huge numbers and exhibited clear evidence this business model was rapidly growing. This trend continued into the first half of 2021 where we sold 51 businesses for a total of $69,079,854.22.

That’s a 19% increase in the number of FBA businesses sold and a 63% increase in their total sales volume.

Quick Snapshot

Amazon FBA Prices

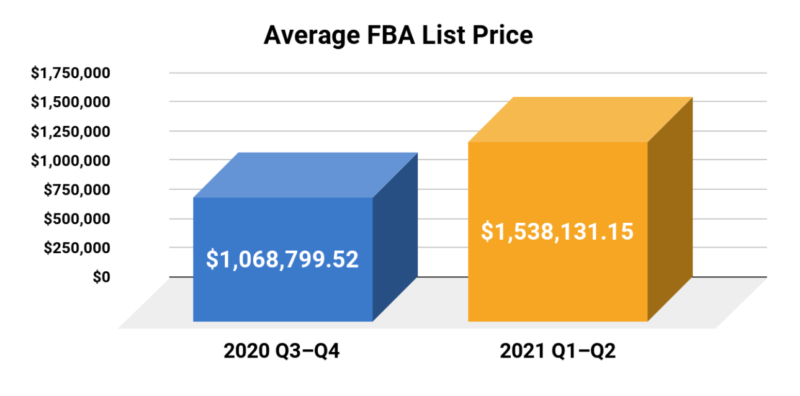

The average list price for FBA businesses in 2020 was $564,142.43, with an average sales price of $538,741.62.

Both the list and sales prices have seen a dramatic increase year over year. For 2020, the average list price increased by 55% as compared to 2019 and 136% as compared to 2018. In terms of average sales price, there was an 80% increase in 2020 as compared to 2019 and a 154% increase as compared to 2018.

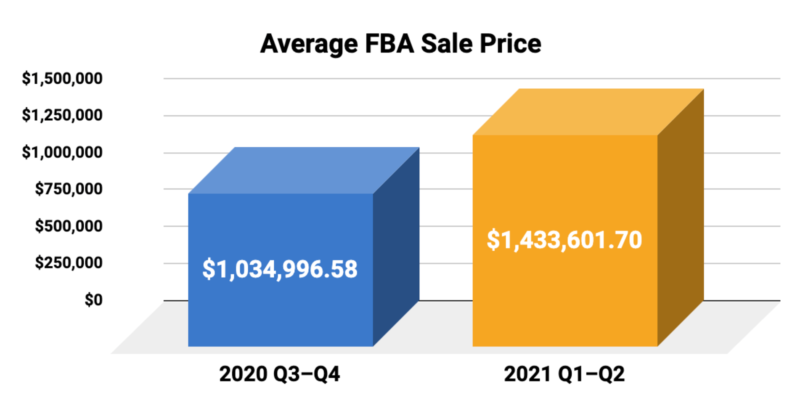

An upward trajectory was evident when you take a look at Q3–Q4 of 2020. The average list price crossed the seven-figure mark, coming in at $1,068,799.52. This translated to an average sales price of $1,034,996.58.

As we went through the first half of 2021, there was no sign of a let-up, in fact, quite the opposite.

The average list price rose to $1,538,131.15 which is a 44% increase from the second half of 2020. Similarly, the average sales price went up 39% to $1,433,601.70.

Amazon FBA Mulitples

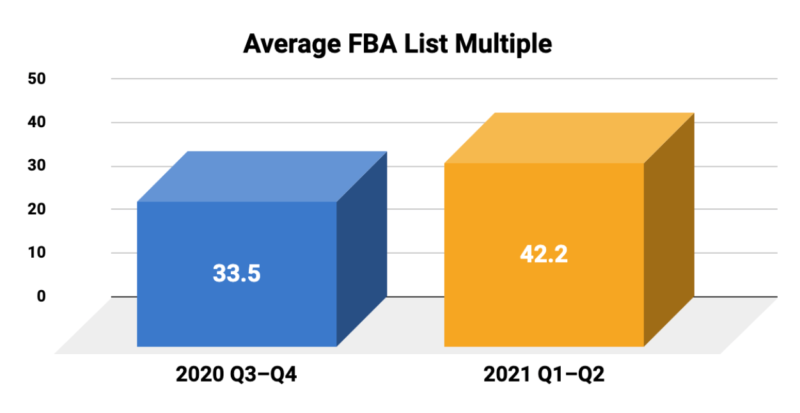

The average list multiple in 2020 was 30.2x, and the average sales multiple was 28.5x. This was a 4% increase in the average list multiple and an 11% increase in the average sales multiple as compared to 2019 and a 15% increase in the list multiple and a 23% increase in the sales multiple as compared to 2018.

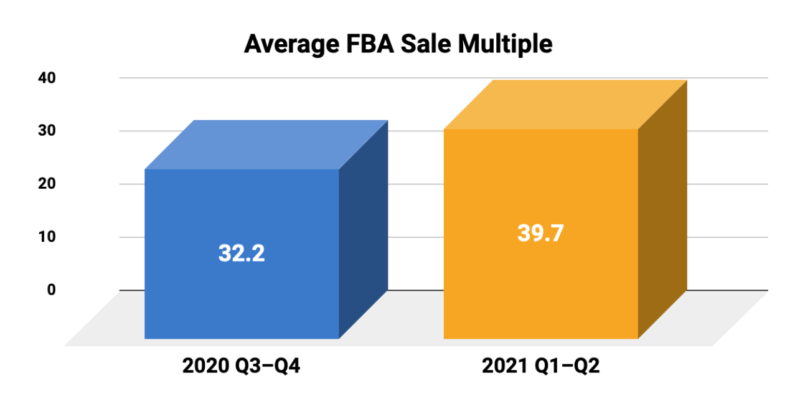

While we had seen impressive growth during 2020 as a whole, it bears reminding that the majority of these increases to both prices and multiples really started to take off around the second half of 2020.

This led to an average list multiple of 33.5x and an average sale multiple of 32.2 for that period.

The growth in multiples really came to fruition during the first half of 2021. There was a 26% increase in average listing multiple compared with the second half of 2020, where it rose to 42.2x.

The average sales multiple increased 23% to 39.7x.

This data reveals an important trend.

Buyer demand for FBA businesses has increased more dramatically than any other business model.

What does seem to have stabilized are the prices and multiples we have through 2021; these will likely stay relatively the same for the rest of the year, unless buyer demand goes through another massive increase like it did in 2020.

Again, all of this indicates that we are firmly in a seller’s market, making right now one of the best times ever to sell your Amazon FBA business.

Amazon FBA Days on the Marketplace

The average number of days on the market for an FBA business in 2020 was 67 days. This was a 21% decrease from 2019 and a 3% decrease from 2018.

In the second half of 2020, we were starting to see the competition from buyers, particularly aggregators, really heat up. The average days on the market for that period was 51 days, which decreased by 64% to just 19 days for the first half of 2021.

Overall, this is a clear sign that FBA business sales have picked up dramatic speed considering that the actual size of the businesses on the market in 2021 were larger by several orders of magnitude.

Buyers are becoming savvier and deploying capital at more efficient rates to acquire FBA brands, and this is reflected in the decrease across the board of average days on the market and is even more dramatic when we take business size into account.

Amazon FBA Deeper Insights

Amazon FBA Earnouts

As the size of the business sold increases, it’s only natural that the number of earnouts also increases. In Q3–Q4 2020, there were 19 businesses sold that included an earnout. This rises to 24 for Q1–Q2 2021 which reflects the pattern that we expected.

The average amount paid upfront across all the earnout deals was 70.42% for Q3–Q4 2020 and 79.82% for Q1–Q2 2021.

Since we sold so many FBA businesses, we have been able to break down the average upfront payment into pricing tiers to give you a more granular view of these deals.

The most earnouts for both 2020 and 2021 were for deals above $1 million. All nine businesses sold in the second half of 2020 in this price range included an earnout. For the first half of 2021, 13 out of 16 businesses sold included an earnout. This drew an average upfront percentage of 66.89% and 84.63% respectively.

At the lowest pricing tier, sub $100k, we only saw one earnout deal out of 17 total deals, which came from Q3–Q4 2020. A similar story is seen in the $100k–250k range, with only three of the 17 deals including an earnout. While that is a higher percentage than the bottom tier, it’s still less than a quarter of the deals.

Amazon FBA Trailing Twelve-Month (TTM) Multiples

Now let’s look at our TTM data on FBA businesses.

We have broken down this data into multiple categories. The first and most obvious is sales price. In each pricing tier, we’ve broken the businesses down into three more categories: those with declining profits, stable profits, and increasing profits.

We also compare our normal average sales multiple against the average adjusted multiple displaying the TTM numbers. Overall, you can see that across all pricing tiers and subcategories, the TTM shows that multiples have increased. These figures make it easy to compare selling with us versus other brokers because most brokers use a TTM model regardless of the pricing window.

In Q3–Q4 2020, there was a 2.2x bump in the overall average TTM sales multiple compared to the average sales multiple. For Q1–Q2 2021, there was a slightly bigger increase of 3.2x. Keep in mind again that the average multiple and the average TTM multiple produce the same actual sales price; one just uses a customized pricing window and the other uses the TTM method. All the information we covered on sales price increases still holds true using TTM.

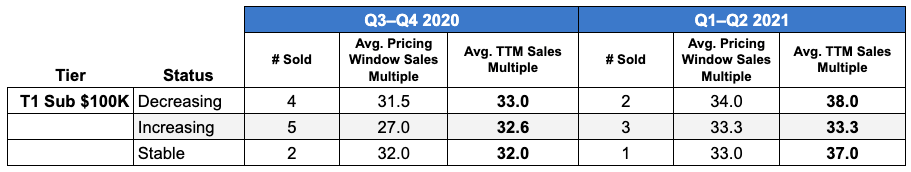

Sub $100k Pricing Tier

In the sub $100k pricing tier, we sold 11 FBA businesses in Q3–Q4 2020. Out of these businesses, four were declining, two were stable, and five were increasing in profits.

The average TTM sales multiple during this period for a declining business was 33x, the highest of the three categories. For a stable business, the TTM multiple was 32x, and businesses with increasing profits earned a TTM multiple of 32.6x.

There were six FBA businesses sold in Q1–Q2 2021, these included two that were declining, one that was stable, and three that were increasing.

For Q1–Q2 of 2021, the FBAs that were declining also earned the highest TTM multiple, 38x, in the sub $100k tier. The stable business came in one under that at 37x and the increasing businesses had a TTM multiple of 33.3x.

$100k–250k Pricing Tier

Again, we sold 11 FBA businesses in Q3–Q4 2020 for this pricing tier. This was made up of three declining businesses, six that were stable, and two that increased.

The declining businesses for Q3–Q4 2020 had a TTM multiple 27.3 whereas increasing businesses saw a big jump to 44x. Stable businesses came in between those figures at 30.3x.

From the six FBAs that we sold in Q1–Q2 2021, three were declining, two were stable, and one was increasing.

The FBA from Q1–Q2 2021 that was increasing, saw the same multiple as the second half of 2020—44x. The stable businesses in this period saw the highest multiple of 47x while the decreasing business earned the lowest multiple of 38x.

$250–500k Pricing Tier

There were six FBA businesses sold in this pricing tier in Q3–Q4 2020. Out of those, four were declining, one was stable, and one was increasing.

Declining businesses saw a TTM multiple of 34x which came in behind the 38x the stable business earned. The increasing business saw the lowest multiple of 26x.

During Q1–Q2 2021 we sold 15 businesses in the $250–500k pricing tier. Seven of them were declining, three were stable, and five were increasing.

Declining and stable businesses had similar TTM multiples of 39.9x and 39.3x respectively. Increasing businesses saw a large rise in the multiple to 48x.

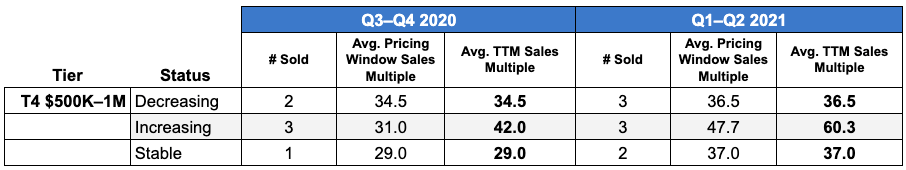

$500k–$1 Million Pricing Tier

We sold six FBA businesses in the $500k–$1 Million pricing tier in Q3–Q4 2020. From these six, two were declining, one was stable, and three were increasing.

The average TTM multiple for a declining business in this price tier was 34.5x. The stable business was the lowest at 29x and the increasing businesses the highest at 42x.

During Q1–Q2 2021, we sold eight FBA businesses in this pricing tier. We saw that three of the eight were declining, two were stable, and three were increasing.

Declining businesses had an average TTM multiple of 36.5x while stable businesses were just ahead on 37x. Increasing businesses had one of the biggest average multiples at a staggering 60.3x.

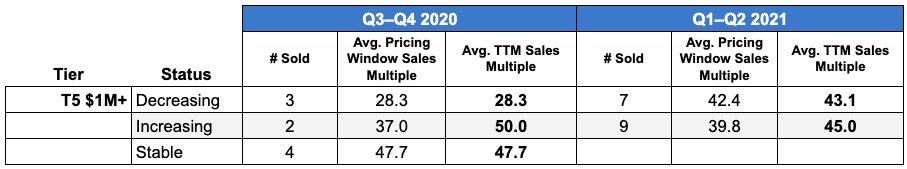

$1 Million and Up Pricing Tier

There were nine FBA businesses sold above the $1 million mark during Q3–Q4 2020. Out of that nine, three were declining, four were stable, and two were increasing.

Decreasing businesses saw an average TTM multiple of 28.3x. Multiples for stable and increasing businesses came back into the expected range for this pricing tier at 47.7x and 50x respectively.

For Q1–Q2 2021, we sold 16 FBA businesses in the seven figures and above range. Seven of the sixteen were declining while the other nine were increasing. We didn’t sell any stable businesses in this pricing range so we don’t have the data on how they performed.

The average TTM multiples for this period remained fairly high across the board, with decreasing businesses still earning a 43.1x multiple and increasing businesses slightly higher at 45x.

So How Do We Make a Millionaire Every 11.3 Days On Average?

Avoiding the Common Exit Traps that Leave Money on the Table

We’ve been around the block when it comes to selling FBA businesses.

In fact, we were one of, if not the very first broker, to start selling Amazon FBA businesses way back in 2016. We’ve done more deals than any other broker, and probably more deals than the combined deal flow of several of the leading brokers.

I say this not as a point to brag, but rather to emphasize that we’ve seen all the obstacles, challenges, and opportunities that arise when it comes to exiting these assets.

It is a hot market right now.

In fact, it is the hottest market we’ve ever seen.

Just because it is a frenzy of investors rushing to buy Amazon FBA businesses, that doesn’t mean you’re going to get the highest possible exit for your business. A lot of the buyers coming into this space are business savvy, wield a plethora of M&A experience, and they’re in the trenches every day making deals happen.

All of this means that right now it is easier than ever to fall into one of these common exit traps.

Each of these exit traps represents a very real potential for you to lose money you deserve.

Let’s break these down, as we help FBA sellers just like you to overcome them every day of the week to make sure you get the exit that can change your life in the smoothest possible manner.

The Off-Market Fallacy

This is the biggest myth of them all.

It is also the one that sounds absolutely the most self-serving thing we could say as an M&A broker. Yet, it would be unfair to you not to talk about it so we are going to break it down anyways.

The Off Market Fallacy is where sellers believe that they shouldn’t use an M&A broker because they’ll take home less money than if they went privately. Entrepreneurs believe this because of the commission they pay to a broker when they do sell the business.

On the surface, this makes a lot of sense. However, when you dive a bit deeper into this issue you’ll quickly realize that this is one of the most dangerous myths to believe in if you plan to exit your business.

On average you will sell your business for far more when you use a reputable M&A broker like us, even when you factor in the commission you’ll pay.

You’ll see that a few of these other myths are really related to this Off Market Fallacy.

They tend to play into each other, and it is a widespread idea that many sellers hold that ends up costing them huge amounts of money.

A recent example of this where a seller avoided SEVERAL of the myths on this list, including the Off Market Fallacy, was an Amazon FBA seller who got offered $1.4 million for their business in a private deal. It was a solid offer to be sure, but the seller decided to check with us to see what we thought of the deal. We told him we could do better.

And we did.

That same business sold on our marketplace for $2.1 million, with $1.8 million paid upfront.

The seller walked away with $400,000 more in his pocket in an upfront payment than the entirety of the original offer he got privately.

While it is true you will pay a good M&A broker a commission upon the successful sale, it is also true that the commission is often more than worth it because of the higher sales price you’re going to get.

The Urgency Factor

The Urgency Factor often plays into the Off Market Fallacy in making FBA sellers exit their business for far less than they could’ve.

How it works is that a large institutional buyer, such as an aggregator, will do private outreach to you. They will mention that it is better to go private than to use a broker to save on commissions paid to the broker. This is a winning strategy because it plays right into the narrative many sellers consider when selling their business.

The seller knows aggregators are some of the best buyers you can have for your brand, and so those aggregators often represent a person of authority with real knowledge about the industry.

Then they hit the seller with an awesome offer… that you have 3 days or less to accept.

Take it or leave it.

How often have you turned down a million dollars or more?

Probably not often.

It is a wildly tempting offer to take. Few can resist that kind of offer and so they’ll take it right then and there. After all, missing out on a million dollars because you were slow to get back to someone is an ultra painful experience for most people.

The problem here is that the use of urgency with the offer can rob you of hundreds of thousands of dollars.

Remember the story I mentioned earlier? The $1.4 million private offer also had this urgency attached to it. It takes a lot to break out of the spell that urgency and scarcity can create in us.

Whether you use a broker like us or not, it is important to remember that it is a hot market right now. If someone offers you a deal with a short timeline to accept, ignore the timeline. It is very likely they’ll extend it if they really want your brand, and even more likely you can get a whole lot more than their initial offer.

Always remember that the first offer is just the start of the conversation.

The Private Buyer Discount

Following the same trend, it is important to mention WHY buyers are doing such heavy private outreach to brands like yours.

The reason is very simple. They want a good deal. By going private they are far more likely to get that good deal because they understand how valuations, acquisitions, and M&A finance works whereas the FBA entrepreneur often doesn’t.

When you combine the narrative of the Off-Market Fallacy with the Urgency Factor, you get the Private Buyer Discount. They scoop up your brand for less than it is actually worth, and you may walk away feeling great about the deal until… well probably until you read this.

Buyers don’t get charged any fees by M&A brokers like us. So using a broker is effectively a free service for them with a slew of awesome benefits. The problem for them when using brokers is that a broker knows the true value of the business, which means it is far harder for a buyer to get a deeply discounted deal.

This is the main reason why buyers go private. You can get around this without using a broker, just always keep in mind that the main reason a buyer wants to do a private deal is because they want to get the business for cheaper.

The Profitable Calculus of Competition

A seller might take the very first offer they get.

And as you can see, that can lead to an underwhelming exit in the grand scheme of things. Perhaps nothing leads to a lesser exit more so than not inviting in the competition.

The Private Buyer Discount is counting on the fact that there won’t be any competition making offers to you.

It is this ingredient that can allow them to get a truly great deal on your business. The moment competition comes into play though, they know they have to bring in the big guns with fantastic offers to win against the competition.

This is another reason many buyers will play heavily into the Off Market Fallacy narrative to make sure competition doesn’t enter the equation.

When an FBA entrepreneur decides to sell with us, they’re tapping into a vetted buyer network with over $4 billion worth of liquidity ready to be deployed into acquisitions. You get to force the entire buyer network, many of them who are doing private outreach and maybe even made an offer on your brand already, to compete against each other for your brand.

This competition breeds truly life-changing exits.

If you take one thing away from this report as an FBA seller, then learn how to invite in competition to make offers on your business. Your bank account will thank you.

You can create this pool of competing offers by going private, just realize it is likely going to be a messier prospect and tougher to pull off. If you want to tap into the calculus of competition on easy mode, then just use a broker.

All of the biggest business buyers from aggregators to ultra-high net worth individuals all use brokers to help with their deal flow.

Bringing High Finance M&A Strategies to the Solopreneur

This is really an Empire Flippers exclusive for the most part.

Unlike other brokers, our labor force and company structure allow our whole team at any given time to work on your deal and to help sell it. Other brokerages are more like a loose confederacy of brokers that may or may not be working with each other.

In some cases, the brokers might even be infighting against each other.

Every broker wears every single hat from the marketing, vetting, to negotiations and actual legal contracts of the deal. As you might imagine, this is a lot for one person to do. It is so much, in fact, that they can never specialize and truly master any one area perfectly.

This means you’ll get subpar service somewhere along the line.

At Empire Flippers we’ve separated out each of these roles into their own assembly line-like process that produces repeatable results at scale.

This means we can do things like a traditional M&A firm can that other brokers in our space just cannot spare the resources to do.

For example, Amazon FBA businesses that meet our Select criteria will be inundated with offers round after round by our buyer network. Each round is fueled by a business advisor speaking with their buyers, each round sending feedback on what deals you liked or disliked, and helping you play up the calculus of competition.

Other brokers can’t do this, after all, they’re commissioned based at an individual level. They eat what they kill so-to-speak.

At Empire Flippers though, our entire team gets paid as a team and thus it creates these collaborative opportunities that economically speaking, just can’t really exist with other M&A brokerages in our space.

All of this works in your favor as a seller, honestly even as a buyer, to give you the best possible experience.

We’re Here Not Just for Part of the Journey, But the Whole Way

We like to think that we are more than just a brokerage to our customers. We want them to consider us an ally, an advocate, a mentor in certain aspects, and a friend looking out for them at the end of the day.

Whether you end up selling, or buying, a business private or with us, we’d love to help if we can.

If you have questions, if you want to see if an offer makes sense, all you need to do is connect with us. Sometimes a private offer really will be worth it, but other times it’ll be similar to the story I shared earlier where you should definitely not do the deal.

This is the best seller’s market we’ve ever seen in the business after more than 10 years of brokering businesses.

If you have a personal or business goal that selling your business can help you achieve, you couldn’t ask for a better time to sell.

Just keep in mind everything in this report, especially the exit traps above and you’ll do just fine.

If you’d like to see what your business is worth, you can use our free valuation tool here. Or if you’re ready to sell your business with us, click here.

Regardless of what you do, we hope to continue providing this type of content and more to help you as an entrepreneur, whether you’re a seller or an acquirer.

Here’s to your growth 🙂

P.S If you want to talk to us about exit planning and create a plan for your eventual sale, then schedule a call here with our exit planning team. It’s totally free, doesn’t take long, and it’s going to help you make a meaningful exit whether you decide to use a broker or not.