10 Ways to Increase Your SaaS Valuation in the Next 90 Days

When you’re preparing to sell your SaaS business, timing matters.

But here’s what a lot of sellers don’t consider. It doesn’t take years to make improvements to significantly increase your valuation. Within 90 days, it’s possible to increase what buyers are willing to pay by making the right decisions.

It’s unrealistic to expect you can double your valuation, but with small, focused changes, you can add five or even six figures to a final closing price, depending on the business. The key is to understand what to prioritize and implement those changes well.

In this article, we’ll cover 10 potential things you can do to increase your SaaS valuation.

How Do SaaS Valuations Work?

Most SaaS companies sell for a multiple of their monthly recurring revenue (MRR) or annual recurring revenue (ARR). Empire Flippers values businesses using a monthly net profit × multiple model, where net profit is calculated using your 12-month average revenue minus all expenses.

Multiples vary widely, but it is generally accepted that SaaS businesses command higher multiples than other business types due to scalability, profitability, and recurring revenue. Smaller SaaS businesses often sell for 3-6x ARR, although exceptional or struggling companies can fall outside this range.

The multiple you will get depends on several factors, including scalability, revenue predictability, operational independence (i.e., how dependent the business is on you), strategic positioning, and growth infrastructure. The 10 strategies we cover today focus on improving these valuation drivers.

You can calculate the approximate value of your SaaS business using this online business valuation calculator.

1. Reduce Churn Immediately

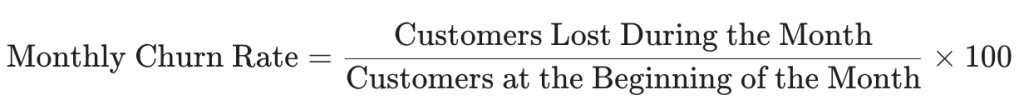

Churn is the silent killer of SaaS valuations. A SaaS business with 3% monthly churn rate versus 5% monthly churn rate is fundamentally more valuable.

Lower churn is desirable as it means more predictable revenue, higher customer lifetime value, and it reduces risk for the buyer.

Start by identifying why customers are leaving. Pull your cancellation data from the last six months and look for patterns.

Implement exit surveys using something like Churnkey or Typeform (three to five questions maximum) about what they were trying to accomplish, what fell short, and what would have kept them as a customer.

Focus on your “golden cohort,” customers who stay the longest and get the most value. Figure out what they have in common, and double down on what you do to attract more customers like them while improving the experience for everyone else.

Check in with customers 30 days after they sign up. Give premium customers a personal message, and send automated helpful tips to everyone on cheaper plans.

If you can reduce monthly churn from 5% to 3% over 90 days, you’re fundamentally changing the risk profile and, by extension, the valuation.

2. Raise Prices Strategically

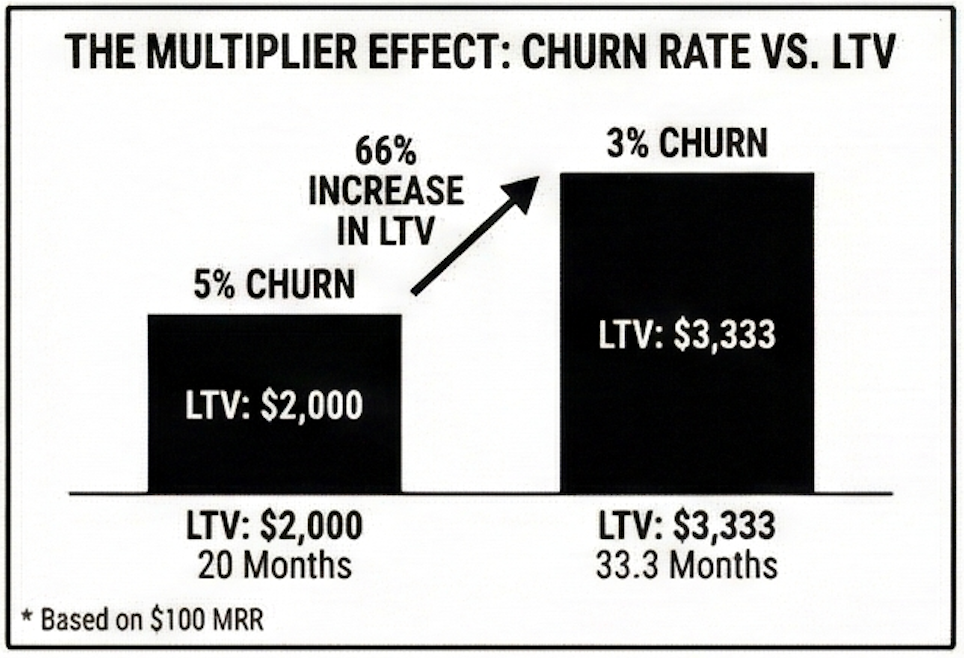

Raising prices is the fastest way to increase valuation, assuming it’s done right. If this is done correctly, a price increase can quickly increase MRR by 20-30% with minimal effort and customer loss.

The math is simple: if you increase prices by 25% and lose 10% of customers, you’re still ahead by roughly 12.5% in revenue.

However, you must do this strategically.

Start by “grandfathering” existing customers at their current rates for 60-90 days. This protects your immediate revenue while you test new pricing on new customers signing up.

Remember, base your new pricing against the value delivered, not your costs. If your SaaS saves customers five hours a week, figure out what those five hours are worth to them, and focus on setting your price to match that value.

If you’re raising prices, don’t increase every plan by the same amount. Raise the prices more for your higher-level, more expensive enterprise plans, and raise them less for your basic or entry-level plans.

When increasing prices, document every step of the way. Buyers want to see that your pricing is defensible and that there’s room for future increases (not something everyone considers!)

3. Lock in Annual Contracts

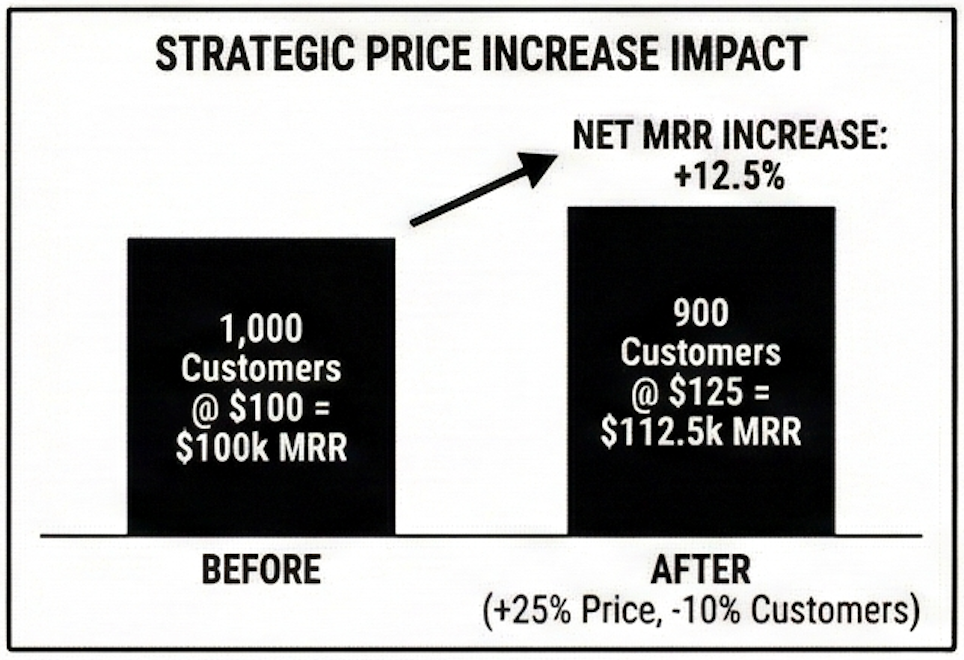

Monthly contracts give customers flexibility, but closing annual plans provides your SaaS with stability, which buyers are willing to pay for.

A business with 60% of customers on annual plans is significantly less risky than one with 90% on month-to-month billing.

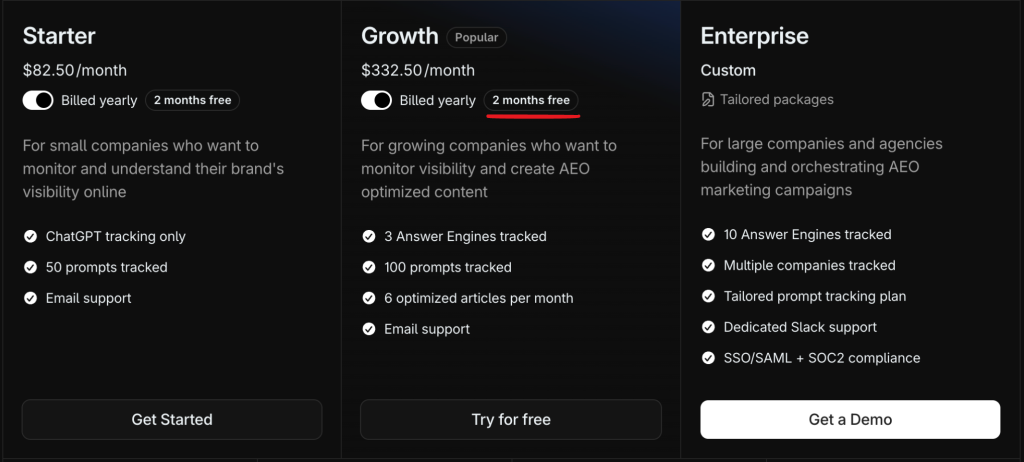

Offer a meaningful discount for annual commitments (typically 15-20% off the monthly rate), while advertising it as “X months off”, like the following example.

Source: https://www.tryprofound.com/pricing

You’re getting cash upfront, reducing churn risk for the buyer, and showing that customers find the product helpful enough to commit for a year.

To make an impact within 90 days, you could create urgency with limited-time offers by emailing your customer base a special deal available for 30 days.

For higher-value customers, reach out personally. Offer to lock in their current rate for two years if they commit to an annual plan now.

Track your annual contract percentage closely. If you can increase annual contracts from 20% to 40% within 90 days, it can significantly boost the valuation of your business.

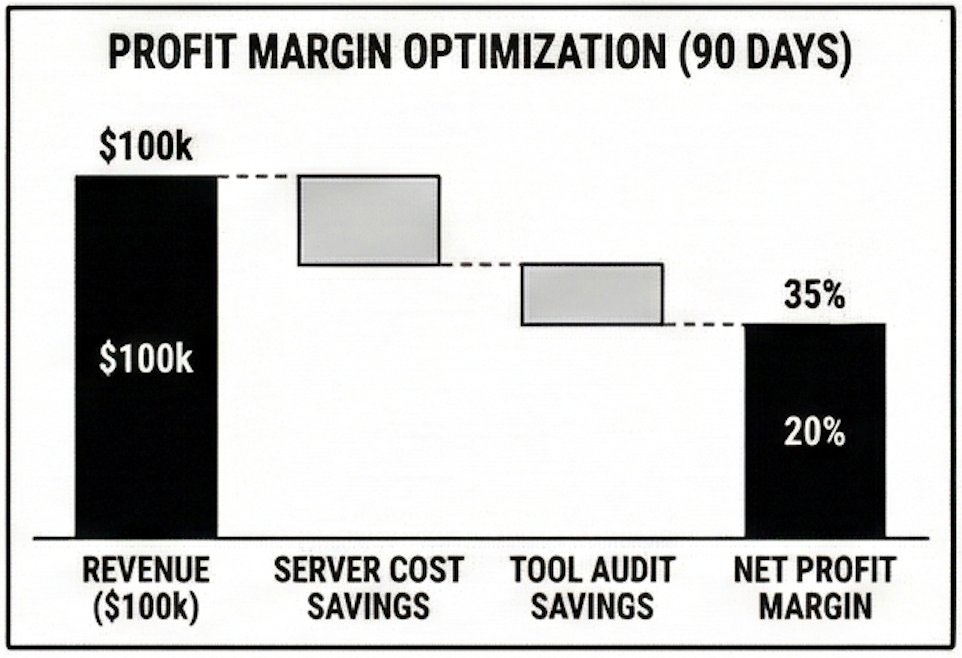

4. Improve Your Profit Margins

Revenue is one thing, but profit is what buyers are primarily interested in.

In most cases, a SaaS business with 40% profit margins will be valued at a higher multiple than one with 20% margins, even at the same revenue level.

To start, audit your biggest expenses: server costs, software subscriptions, and contractor or employee costs.

Review your server and infrastructure costs. A lot of SaaS businesses scale up fast during growth phases, but forget to scale down. There are a lot of opportunities founders miss when it comes to negotiating hosting rates and other opportunities.

Audit your software stack. You might have redundant tools or subscriptions that no one uses anymore. Cancel anything that isn’t critical to operations, downgrade plans, and in some cases, consider alternatives.

Look at your customer acquisition costs (CAC) by channel. Double down on your most efficient channels and pause or reduce spending on underperforming ones.

Most importantly, document the changes you make, which can be done with a simple spreadsheet showing expense cuts and the savings.

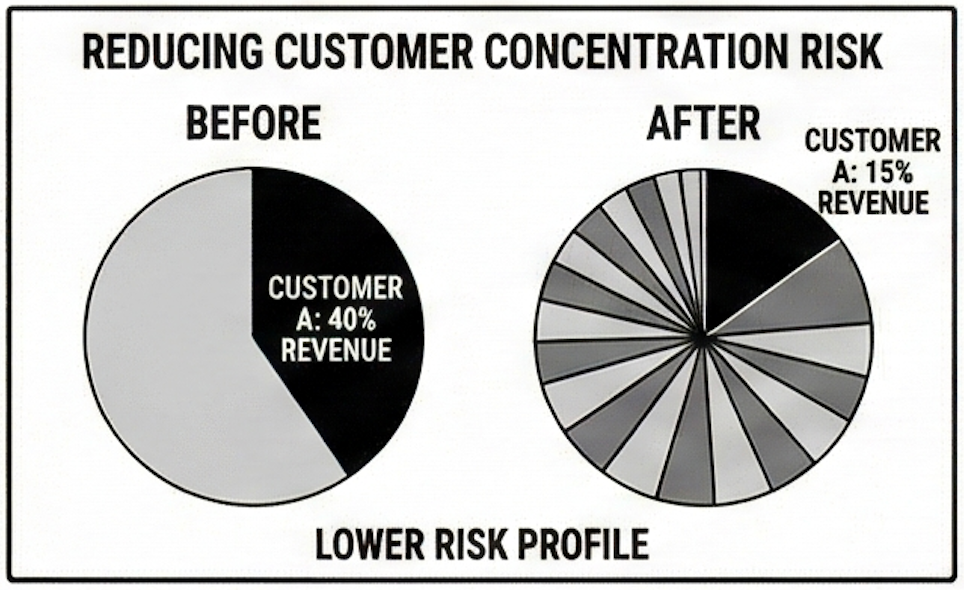

5. Diversify Your Customer Base

Customer concentration is a major risk factor for buyers. If 30% of your revenue comes from one customer, that’s a red flag.

Think about it from their perspective. In an ideal world, no single customer should account for more than 5-10% of your revenue, though with an enterprise customer or two, that might not be possible.

If you have one or two large customers dominating your revenue, the solution is to grow your base of smaller customers quickly. This means prioritizing volume over deal size.

To accomplish that, increasing marketing spend or just marketing (without paid spend) on channels that bring small to mid-sized customers is a good idea. That could mean paid ads or cold email campaigns. It’s realistic within 90 days, as smaller customers should have shorter sales cycles.

Consider launching a self-service tier if you don’t have one. This can automate the sign-up process without having to involve sales, which might accelerate customer acquisition.

If you still end up with larger customer concentration risk, try to showcase that customer concentration is reducing over time (e.g., from 40% to 20% over six months).

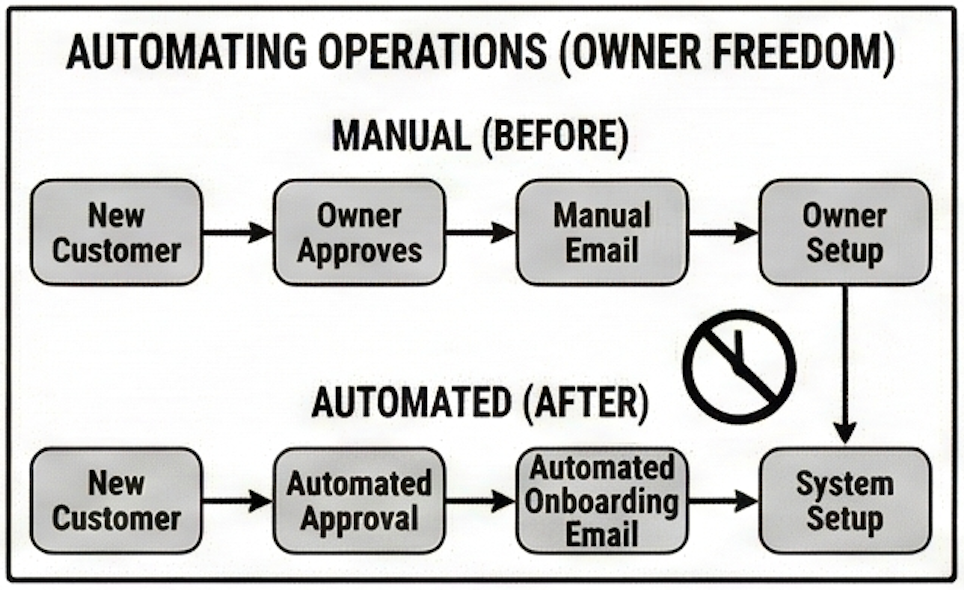

6. Automate and Document Your Operations

Buyers don’t want to buy a job. They want a business they can work on, not in, as they say. The more automated and documented things are, the better.

Create simple SOPs for every recurring task, which can be as simple as a Google Doc with steps and screenshots. A buyer should be able to take that doc and run the business without asking questions. Think of it like a recipe.

Identify tasks you personally handle and decide what can be automated or delegated. If you’re manually approving customers or doing basic support, automating that ASAP should be the priority.

Use automation tools to cut manual work (like Zapier, Make), to help with automated onboarding emails, billing reminders, reporting, etc. If that’s not your strong point, consider hiring a specialist to help out.

Put together a basic “operations manual” covering marketing, acquisition, support, product processes, vendor relationships, and key metrics. It’s a bit of a headache, but it’ll make your business far easier for a buyer to acquire.

Track your time for two weeks and show buyers what’s automated, what’s delegated, and what still requires people.

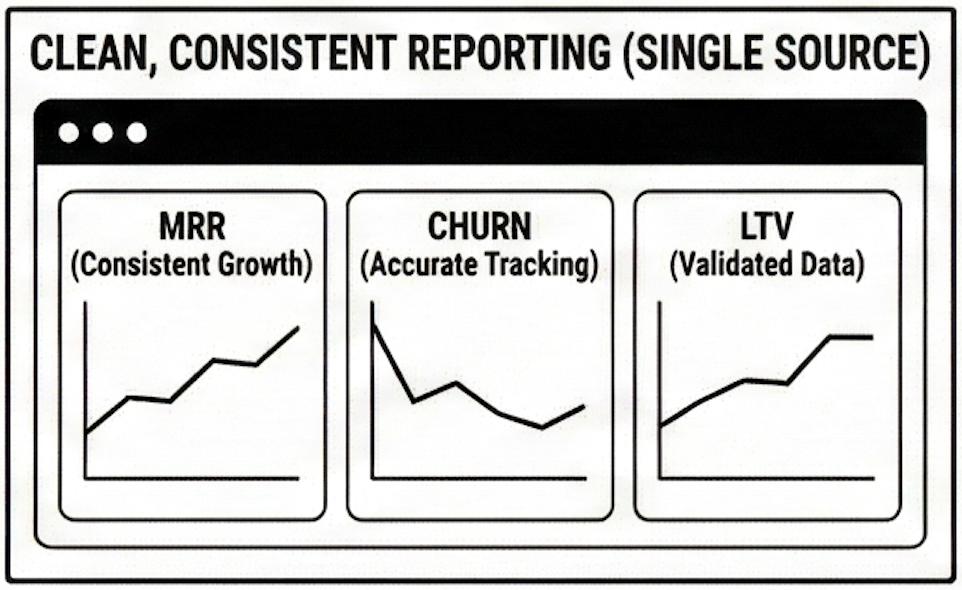

7. Clean Up Your Metrics and Reporting

Buyers want clean, accurate, transparent reporting for all data — financial and performance data. If everything is messy, hard to understand, and disorganized, even if accurate, it can create doubt and skepticism about the legitimacy of the data.

Setting up a single “bird’s-eye view” for your data is a great way to make buyers love you! You can use tools like Baremetrics, ChartMogul, and Paddle to achieve this.

The goal should be to have a simple and clear executive dashboard that shows your key metrics over time. Include MRR, growth rate, churn, customer count, CAC, LTV, profit margin, and other key SaaS metrics.

Make sure your financial data is accurate. Use proper accrual accounting so your financials reflect the real state of the business.

Reconcile your payment processor data with your accounting software (FreshBooks, Xero, QuickBooks). Any mismatches, even small ones, can raise red flags for buyers, so pay extra attention here and ideally get the help of a professional accountant.

Document any one-time events or irregularities clearly. Buyers value transparency, and they don’t expect you to be perfect, just honest.

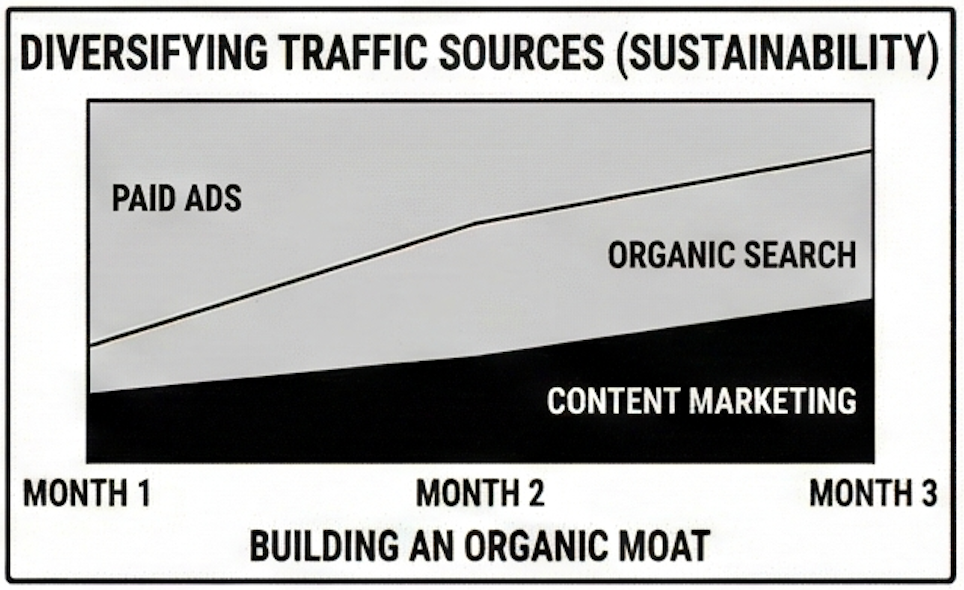

8. Diversify Your Traffic Sources

While paid acquisition is fine, relying heavily on it isn’t ideal.

If 90% of your customers come from LinkedIn Ads or Google Ads, this increases risk as you’re more vulnerable to platform changes and rising ad costs.

Similar to avoiding having a single customer make up a large percentage of sales, to a lesser extent, avoid one traffic source driving the majority of traffic.

In SaaS, buyers like organic traffic as it’s defensible, signals a product market fit, lowers customer acquisition costs, and compounds naturally over time.

Start by auditing your current content and identifying quick wins: this might include doing “content refreshes” for content lagging behind, strengthening internal linking, figuring out better content attribution to revenue, and improving your current content strategy.

Link building is also worth considering, according to Matilda Lee, Head of Operations at SaaS Backlinks, but with a caveat:

“Backlinks are valuable for long-term SEO, but it typically takes 3-6 months to see ranking improvements, so for a 90-day window, focus on quick wins: update existing content, optimize metadata, and fix technical issues. Link building is worth it, but for setting up the new owner for long-term success, not short-term traffic spikes.”

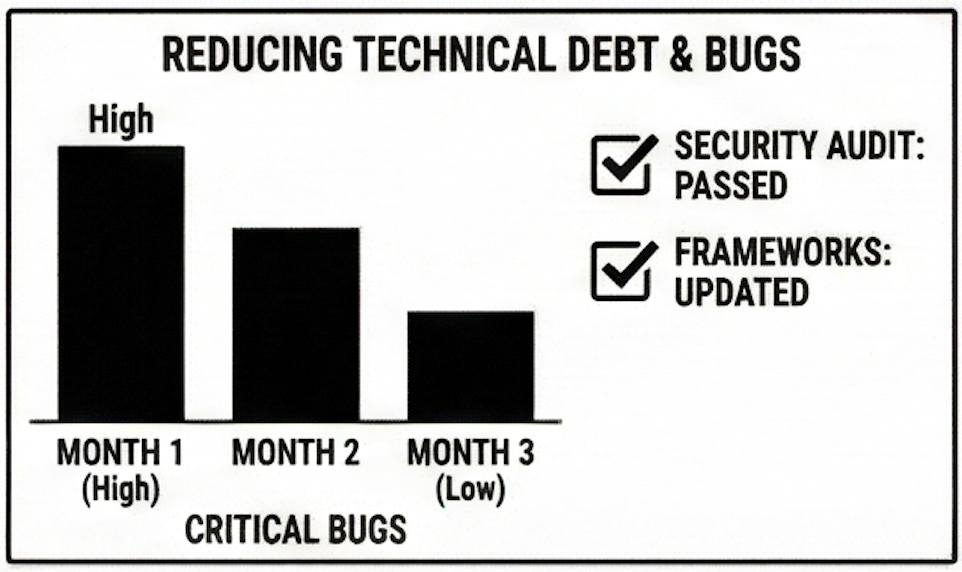

9. Reduce Technical Debt

Technical debt is another hidden valuation killer that isn’t talked about enough. Any SaaS buyer worth their time will conduct technical due diligence, and if your codebase is a mess, they’ll either walk away or offer a low number.

Start with security. Run a security audit and fix any major vulnerabilities. For larger deals, buyers will worry about breaches and compliance issues.

Update dependencies and frameworks, so if you’re using outdated libraries or tools, see if you can upgrade them.

Improve how your code is documented. Add comments to complex functions, create simple architecture diagrams, and document your deployment process. If you’re not the technical one, ask your developer(s) to help.

Fix your biggest bugs and reduce your backlog. Use the next 90 days to clear out as many issues as you can.

If you have technical debt you can’t fix in time for the sale, then document it for the buyer. They’ll value transparency a lot, and it’s better than them finding issues themselves.

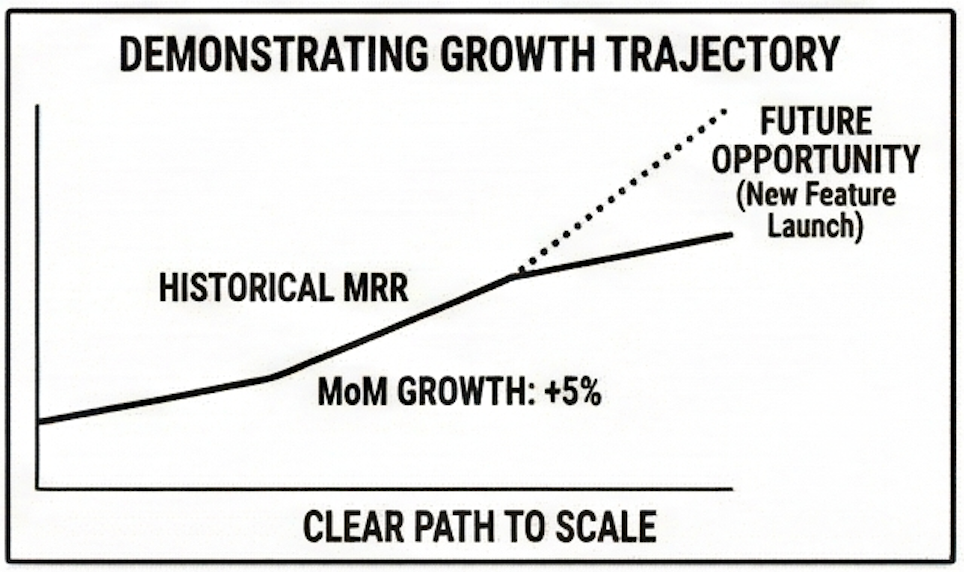

10. Build a Growth Story

Remember, valuation isn’t just about today; it’s where it could be. That’s why some stocks trade for a seemingly illogical price. It’s about where you’re headed.

Buyers pay premiums for businesses with clear growth trajectories and potential.

Show consistent month-over-month growth in key metrics that matter. And even if it’s modest, consistent growth is superior to sporadic spikes.

Identify and document low-hanging growth opportunities for the future buyer, and create a simple roadmap. A lot of people forget that many buyers are first-timers, even if the acquisition is for millions, so you often need to guide them like a coach.

You could even build early traction on a new idea. If you’ve been considering a feature or a new market, you don’t have to build it now, just explain how they could do it (or do it if it’s low risk).

Create a one-page growth plan with three to five clear opportunities for the next owner. Get them excited about the potential growth opportunities, and show them how.

At the end of the day, this all comes naturally if you’re invested in actually helping the buyer succeed (because you should!)

The Bottom Line

Increasing your SaaS valuation doesn’t need to take years! Focus on the right priorities, such as reducing churn, optimizing pricing, delegating, and automating (among other points in the article), and you can make a meaningful difference to your valuation in just 90 days.

The most important factors are showing steady growth across key metrics, healthy margins, and clear opportunities for the next owner to scale.

You can maximize your valuation with Empire Flippers’ services.

They specialize in vetting and selling SaaS businesses, connecting you with serious buyers who understand SaaS valuations and are ready to pay premium multiples for well-prepared businesses.

The work you put in now could add tens or hundreds of thousands of dollars to your exit.