How to Identify Profitable Amazon Category Opportunities

Introduction: How Picking the Best Category Drives Success

Thriving on Amazon goes beyond just selling a quality product. Choosing the right category plays a major role. The category you select affects how customers discover your product, the level of competition you deal with, and whether you can market yourself as high-end or low-cost. Many growing brands succeed because they made smart category decisions, while others fail to take off for the opposite reason.

With over 12 million products spread across countless categories, finding opportunities can be challenging (Marketplace Pulse, 2024). Some areas are crowded with seasoned competitors, while others have untapped potential waiting for innovation. This guide shares practical methods backed by data to help you spot profitable categories and grow without depending on random guessing.

Use Amazon Data to Understand Category Patterns

Amazon provides strong insights into both demand and competition. Analyzing these clues helps you pinpoint areas with long-term potential.

Look Beyond Rankings to Study BSR Trends

The Best Sellers Rank provides an easy way to gauge demand. Chasing top-ranked products in every category might seem appealing, but the bigger picture is about the trend over time. For instance, if a subcategory shows steady, gradual improvements in BSR across several listings, it suggests demand is growing and competition is spread out. This creates a favorable spot for newcomers.

Compare Short-Term Seasonal Changes to Steady Growth

Interest in types of products changes over time. Fitness equipment sells more each January, and gardening supplies become popular in the spring. Tools like Google Trends and data on Amazon searches help figure out if a trend is just a short-term spike or if it might grow over time. Statista’s 2023 Consumer Market Outlook noted that eco-friendly products like sustainable household goods keep seeing steady yearly growth. This hints at longer-lasting opportunities.

Understand How Categories Change Over Time

Categories move through different stages. These stages are introduction, growth, maturity, and decline. Harvard Business Review (2021) explained that getting into a category at the right time matters a lot. Growth-stage categories where demand grows while customers still want better options tend to provide a good mix of risk and reward.

Look for Gaps by Checking Reviews and Prices

Numbers don’t tell the whole story. Customers themselves share gaps in products or pricing problems, which highlight areas to improve or grow.

Search Reviews to Find Frequent Complaints

Three-star and four-star reviews often provide the best clues to what needs fixing. Buyers point out problems in products that are otherwise “decent”—things like fragile build, hard-to-follow instructions, or sloppy packaging. For example, in kitchen storage items, several reviews point out that lids don’t seal. Sellers who focus on fixing these issues with sturdier materials or smarter designs could grab more buyers.

Explore Gaps in Pricing Tiers

Markets tend to split into high-end and low-end zones, often leaving the middle range empty. By studying price patterns, it’s possible to spot overlooked customers. Say a subcategory offers budget items at $10 and premium ones at $60, but nothing near $30. This gap could mean a chance to launch a unique mid-tier product. McKinsey’s 2022 Consumer Sentiment Survey showed that 70% of shoppers around the world care about “value-for-money,” hinting at opportunities to target the middle market.

Check Demand Against Supply

When demand outweighs supply, it creates clear chances to act. You can gauge this by matching how often people search for something each month to how many varied listings exist.

Think about “organic dog treats.” If 50,000 people search for it every month, but there are a few unique options, this shows an opportunity. This mismatch shows customers are looking for more choices than what’s available now. Sellers who can improve features, packaging, or branding can tap into subcategories with such gaps and find success.

Use AI to Gain Better Insights

Old-school research works but doesn’t cover as much ground. Tools powered by AI help sellers work through large amounts of data more effectively.

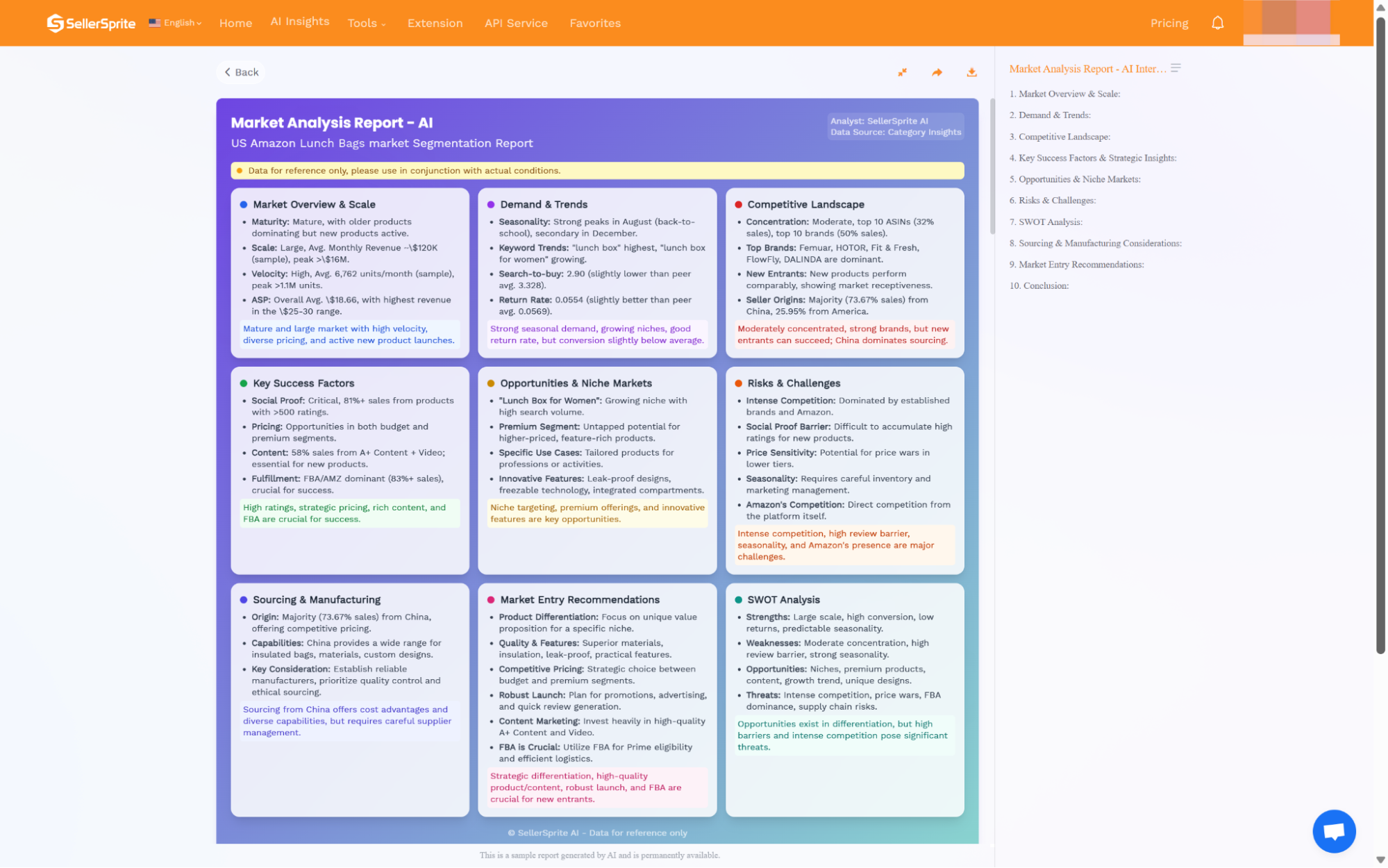

How to Use AI for Category Insights

SellerSprite’s Category AI Insights provides a way to break down complicated research. It looks at factors like sales speed, keyword patterns, and how competitive the market is. Then it points out categories where new chances to grow might be available. Sellers no longer have to guess; they can target categories that are growing, backed by clear numbers.

Use AI with Practical Business Sense

AI spots trends, but results depend on how you act on them. If AI suggests that “pet grooming gloves” are becoming popular, the actual work is in handling branding, managing the supply chain, and planning marketing. Sellers who pair AI results with solid business skills can achieve the best outcomes.

Stand Out With Sharp Positioning

Tough markets can still offer chances if sellers set themselves apart in smart ways. Success depends on how you position your product, not just on stepping into the market.

Case Example: High-End Design in Everyday Items

Amazon’s coffee accessories category is packed with competitors. A seller decided to stand out by introducing a high-quality stainless-steel pour-over set. They focused on creating a design that was both durable and appealing. This approach attracted buyers who valued professional-level quality and were ready to spend more. By being different, they thrived even in a crowded space that others saw as too competitive.

Case Example: Using Sustainability as a Fresh Approach

In the personal care sector, one brand stepped into the busy shampoo bar market by focusing on eco-friendly packages and shipping with a carbon-neutral footprint. Statista (2023) shows that 68% of shoppers think about sustainability when deciding what to buy. By tapping into this growing trend, the brand built a loyal audience without relying on price to compete.

Check Market Possibilities Before Committing

Even the best opportunities need testing before heavy spending.

Start with Small-Scale Tests

Rather than ordering large stock amounts, try smaller runs of 300 to 500 units. Watch metrics such as keyword rankings, conversion rates, and feedback in reviews. This careful method helps cut financial risks and gather useful data from real customers.

Compare Findings with Industry Insights

External approval boosts trust in a product category. McKinsey’s 2022 report shared insights that showed long-term growth in health-focused snack sales. This data can guide sellers looking to explore similar categories on Amazon.

Test Financial Scenarios

You need to plan both optimistic and pessimistic financial outcomes before expanding:

- Optimistic outcome: The product ranks on the first page and maintains 20% growth each month.

- Pessimistic outcome: Sellers overestimate demand, causing slow sales and high storage charges.

Planning for these situations helps create strategies that balance risks with opportunities.

Checklist: Steps to Spot Amazon Category Potential

- Monitor BSR patterns and shifts in subcategory rankings over a period of time.

- Look at 3 or 4-star product reviews to find out what customers feel is missing.

- Study pricing differences between various category levels.

- Match search interest with the variety of products available in the market.

- Try AI tools such as Category AI Insights to validate findings more effectively.

- Experiment with small inventory batches to test ideas.

- Verify findings using outside sources like McKinsey, Statista, or HBR.

Conclusion: Turning Research into Results

Spotting opportunities in Amazon categories isn’t about jumping on trends. It requires using a structured process to uncover valuable insights. By blending data on demand, customer feedback, advanced AI tools, and small-scale experimentation, sellers can discover profitable market gaps.

The best sellers don’t sit around waiting for the “perfect product idea” to come along. They begin by researching categories, experimenting, and adjusting as needed.

The next big category is already waiting. You just have to notice it before your rivals get there.