Empire Flippers Capital: Round 1 Performance Update—Q4 2021

Empire Flippers (EF) Capital has continued to gain momentum, and if Q4 was any indication, that momentum won’t be slowing down anytime soon. The approach to the one-year anniversary of EF Capital was an exciting time for the program.

Last year, EF Capital raised $13M for eight operators across Rounds 1 and 2 of funding.

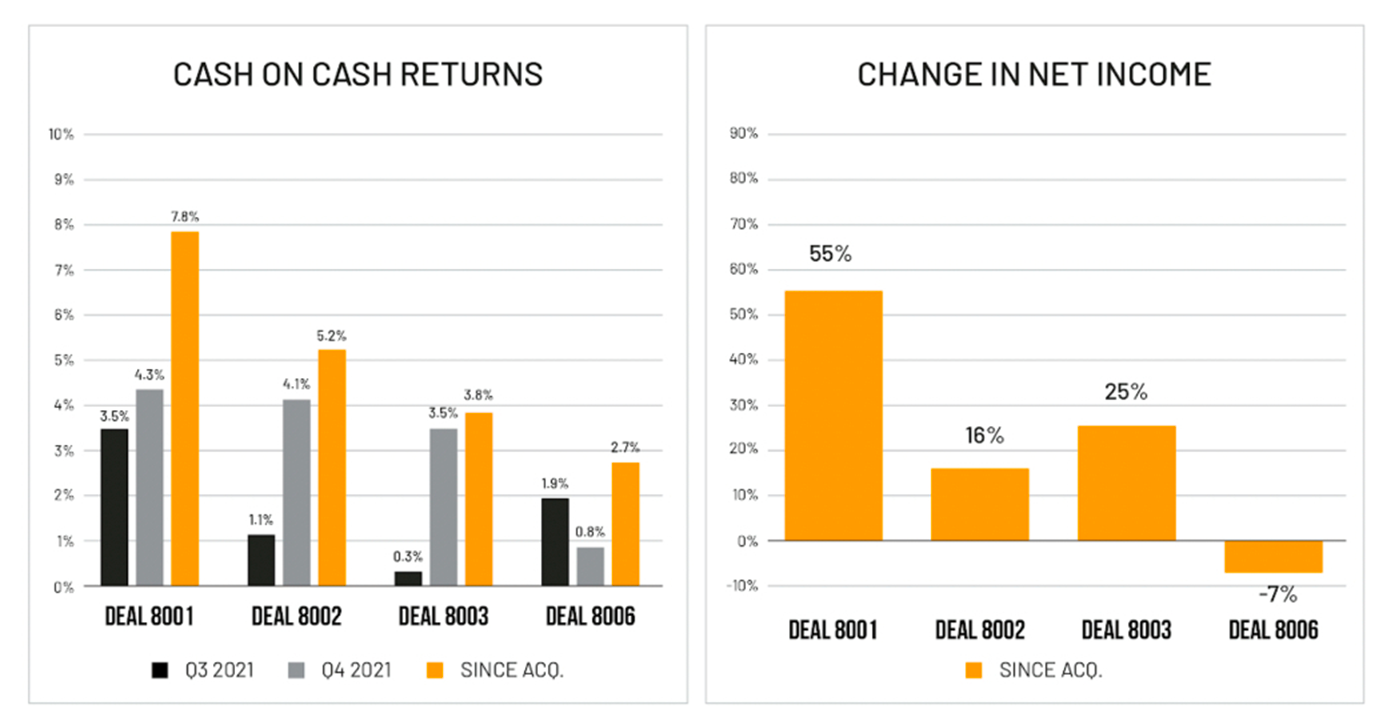

Round 1 businesses began to see their growth strategies pay off, providing investors with excellent cash-on-cash returns on their investments (more on those numbers later).

At the completion of Round 2, four operators had received funding totaling over $6M, and 87% of this capital was successfully deployed into 12 acquisitions.

At the time of writing, Round 3 is open for investment, with over $4.5M in funding received in the past month. If you are interested in participating in this round or future rounds, fill out the investor interest form here.

Alright, let’s dig into the Round 1 performance data!

In Round 1 2021, EF Capital raised $7M, of which 82% ($5.75M) was deployed into 11 businesses in the content and Fulfilled by Amazon (FBA) monetizations acquired by four operators. All unspent funds were returned to investors, who have the option to redeploy this capital into future EF Capital deals or withdraw it to their bank account. We rarely expect to deploy 100% of the funds raised in any round.

Q4 2021 was the first quarter in which the businesses acquired in a funding round were run by the operators.

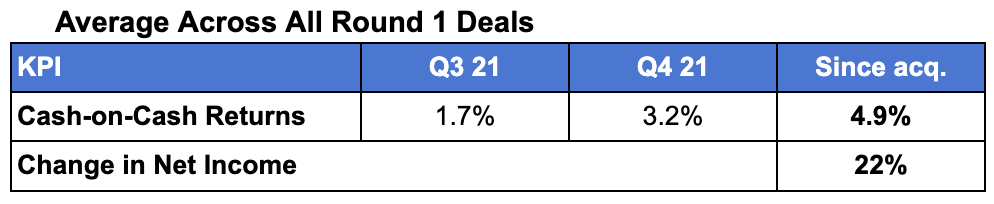

After this quarter, the investors received a 5% cash-on-cash return. The net income across all businesses has increased 22% since acquisition. In EF Capital’s return projections, the team anticipated a net income increase of 12%. Needless to say, the team is extremely pleased with these results, but they won’t increase projections until they see a few additional quarters of similar performance.

To measure the change in net income, the team compares the current average net profit of an acquisition to its adjusted monthly net profit at the time of acquisition. This is a leading indicator of the businesses’ performance after their short period of management by the operators.

In addition to quarterly distributions, all investors receive detailed quarterly reports with P&L statements and commentary from the operator on the acquired business’ performance. While we do not share these reports publicly, we have published redacted versions that we can share with interested investors.

Contact our team at efc@empireflippers.com to see additional details on performance. You can also click the image below for more details on Round 1 performance.

Operating Performance

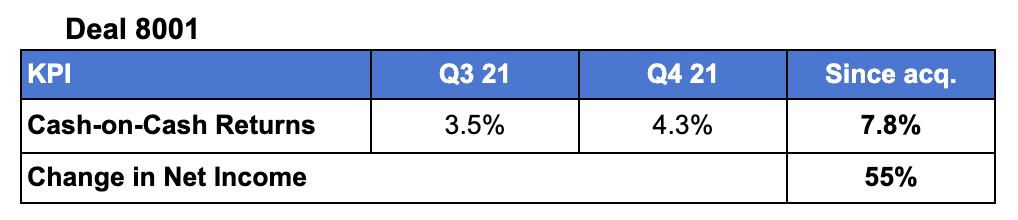

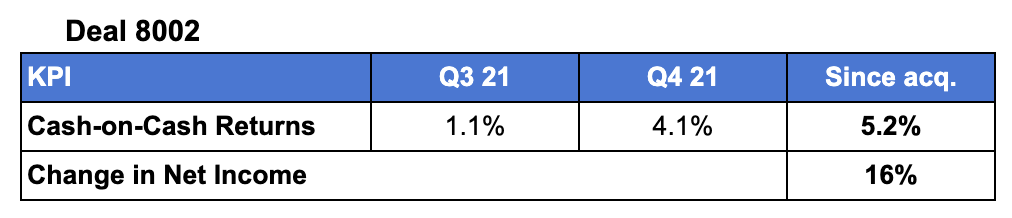

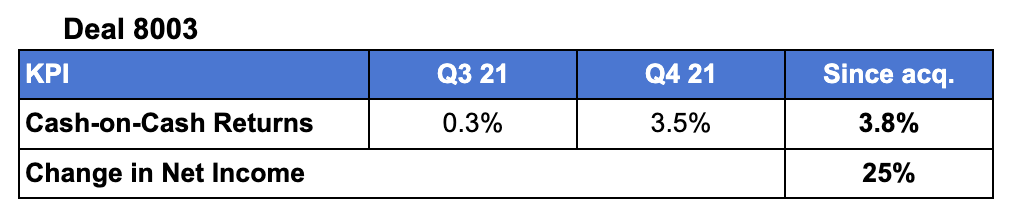

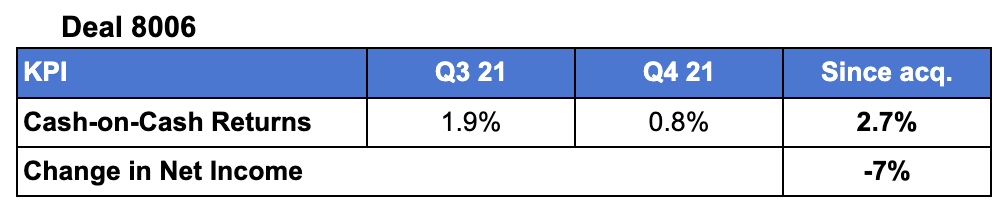

Below is a summary of the Q4 report numbers across Round 1 deals.

EF Capital uses accrual-based P&Ls to monitor the ongoing performance of the businesses. These P&Ls will also be used to value the businesses when it comes time to sell them.

Each quarter, distributions are provided to investors based on cash-on-cash returns for the previous quarter.

Change in net income since the time of acquisition is used as a key performance indicator of growth in each business. Although this is not a full representation of a site’s or portfolio’s performance, it is a leading indicator of a business’ performance after the short period during which they have been managed by the operator.

Those interested in diving deeper into this information can find links to the redacted versions of the Round 1 quarterly reports here: Deal 8001, Deal 8002, Deal 8003, and Deal 8006.

Round 3 is Open for Investment

At the time of writing, EF Capital Round 3 is open for investment.

This round features two FBA operators with unique strategies, as well as a content operator. The round is closing soon, as over $4M has been raised in the last month, and all deals have crossed the minimum funding threshold.

To get more details on the current offerings, visit our deal page here.