How to Get Your Customer Retention Measurement (and Improve It)

Customer retention is your business’s ability to keep its customer base by reducing the number of customers that defer away from your product or service.

Many businesses concentrate on continually bringing in new customers, but what about after you’ve earned their business? You’ve gone to so much effort to convert them, but you’re not thinking about retaining them. If this is the case, then you’re potentially missing out on a great deal of profit.

To address this, there are several customer retention metrics that you should be tracking. Before you can work out how to improve them, you first need to establish where you’re at currently. Let’s look at how to measure customer retention and why you should improve it.

Customer Retention Metrics

Customer Retention Rate (CRR)

CRR is the percentage of customers you’ve retained over a certain period of time. This is the overarching retention metric that shows how well you’re doing with keeping your customers and making repeat sales.

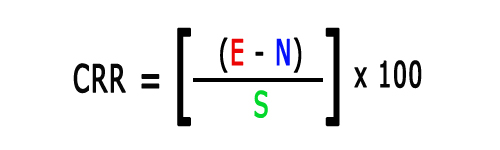

The Formula for Customer Retention Rate

E = Number of customers at end of the time period

N = Number of new customers during the time period

S = Number of customers at the start of the time period

These three data points will help you work out your CRR. You will also need to choose a time period to measure over—anything shorter than a month is unlikely to provide enough data to make accurate conclusions.

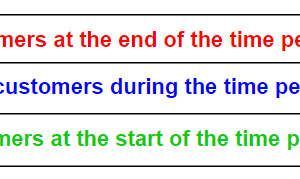

Let’s look at an example of the CRR formula in action. Say we want to measure the CRR for our SaaS company over a three-month period. First, we need to establish our three main data points.

Breaking this down further, our SaaS product started with 70 customers and then acquired 30 new customers over a three-month period. However, during this time, it also lost 20 customers, which is why we ended up with 80 customers.

Knowing these numbers, we can enter them into the formula:

This gives our SaaS product a retention rate of 71%.

What’s considered a good retention rate will differ by industry. A report by MIxpanel (2017) found that a CRR of over 35% is considered good for a SaaS business. While it might not be possible to get to 100%, working to increase your CRR is only going to make your business more profitable.

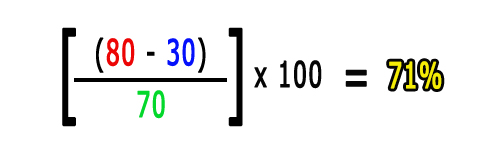

Customer Churn Rate (CCR)

If the customer retention rate is the percentage of customers you’re holding on to, then the CCR is the opposite.

CCR is the percentage of customers who decide to stop doing business with you over a given period of time. This could be someone who cancels their monthly subscription from your SaaS product or someone who deletes your mobile app from their phone. Whatever the action, it means that you have lost them as a customer.

The data points for churn should be taken from the same time period. For example, users at the start of the month minus users at the end of the month. It’s standard to measure churn on a monthly basis.

A rough average CCR for a SaaS company is 3–7% monthly. This will vary depending on the industry, and the churn for a newly formed company will nearly always be larger than a well-established enterprise, for example.

What all of these companies can agree upon is that too high of a churn is detrimental to the growth of your business. The number of new customers has to be higher than the churn rate; otherwise, your business will be heading in the wrong direction.

Working out your churn rate allows you to forecast how your business will perform. When it comes to selling your business, buyers will want to know your CCR. If it’s lower, then it becomes a much more attractive business to buy.

Because you’re going to be spending to bring in new customers, you want them to stick around for as long as possible to make it worth your while. This is why the CCR has a direct effect on customer lifetime value.

Lifetime Value (LTV)

LTV is the total revenue a customer generates during their time as a customer for a business.

It is a metric that works in tandem with customer acquisition costs to make sure your expenditures on acquiring customers do not exceed the money you make from them.

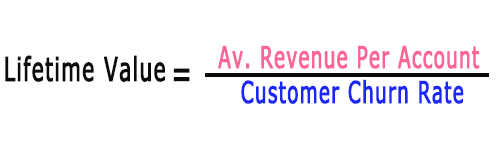

There are several formulas for calculating LTV depending on your business model, but a basic formula for a subscription model is as follows:

To give you an example, our software company made $10,000 in monthly recurring revenue from 200 customers over the same time period. We can transfer that to the first part of the formula:

ARPA: $10,000 / 200 = $50

Our SaaS product has a monthly churn rate of 5%. Using this, we can calculate the customer LTV:

$50 / 0.05 = $1,000

To get a more accurate LTV, you need to have a larger customer base so that the sample size provides you with enough data.

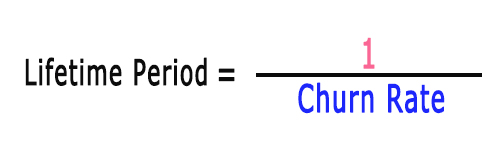

Another interesting metric is the lifetime of the customer, which is specifically the length of time someone remains your customer.

1 / 0.05 = 20 months

Repeat Customer Rate

A repeat customer is someone who has bought from your business previously and has come back to make more purchases. It’s often used as a measure of customer loyalty, and a high repeat customer rate is proof that customers have had a positive experience.

The repeat customer rate can be calculated using the following formula to give you a percentage of returning customers:

Ensure both data points are from the same time period to keep the results accurate. Anything under a month isn’t going to give you much to work with, so keep it to a month or more.

This kind of retention metric will be more applicable to e-commerce stores selling physical products. Most e-commerce platforms will give you a breakdown of orders by new and returning customers.

Shopify has found that 27% is a good benchmark for repeat customer rate. How your store fares will depend on the type of products you sell. For example, a store selling consumables will usually have a higher repeat customer rate compared to a high-end jewelry store.

It’s obviously in your best interest to increase this value. A returning customer is actually more likely to spend more than a new customer. In addition, every time a customer returns, the possibility that they’ll return again goes up with each visit.

Upsell and Cross-Sell Conversions

An upsell is a marketing technique that encourages customers to purchase a similar but higher-end product than the one they’re interested in. This is beneficial as your return on the more expensive product is greater, meaning more profit for you.

A cross-sell is when a different but complementary product is offered in addition to the product the customer is interested in.

Both of these are incredibly valuable tactics, as they allow you to market products to customers with no additional advertising expenditures and increase your return on investment for your existing ad spend. They also increase your minimum order value, which is one way to boost your customer LTV.

When done correctly, upsells and cross-sells can avoid appearing spammy and improve customer satisfaction. Promoting relevant products helps meet the customer’s needs by showing them all the options and making it easier for them to buy from one place.

Why Should You Care About Your Customer Retention Metrics?

The long and short of the matter is that customer retention is highly profitable and improves your customer loyalty.

A Bain & Company report found that increasing customer retention by 5% results in a minimum 25% increase in profit. This kind of return is difficult to find in any other kind of marketing, and it makes total sense.

Convincing a consumer to buy from you is the hardest part of marketing, which is why the probability of selling to an existing customer is much higher than a new customer. Returning customers spend an average of 33% more per order than other customers.

They do this because they feel much more comfortable with you and were impressed with the service they received. Because of this, even a small lift in customer retention can lead to outsized gains in terms of revenue.

Customer acquisition is still an important part of a successful company, but there is untapped potential in the customers that you already have. When you factor in that the cost of advertising is reported to be increasing year-on-year, then it becomes even more valuable.

Have we convinced you that customer retention is important yet?

Good! Let’s outline the factors involved and get started on improving it.

What Affects Customer Retention?

A large part of customer retention is making the customer journey as frictionless as possible.

Customer Service

Customer service is a big driver in customers’ desire to stay with your company.

The support that you offer customers is just one part of this. Make sure that you’re easy to contact should any questions need to be answered or any problems arise.

Also, respond in a timely manner and let people know how long they can expect to wait for a reply. Putting in the extra work can pay dividends in the long run.

The other side of this is that a bad customer experience is a surefire way to lose a customer. A Zendesk study found that consumers who have had a bad experience with a business are 50% more likely to leave a review than if they had a good experience. This increases your CCR and limits your growth rate.

Customers who have had a positive customer service experience will spread good words about your company. Word of mouth and user-generated social media posts are free advertising for your brand.

Delivery and Ease of Using Product

Be upfront with your customers on how long delivery takes. Not getting something when you expect it is incredibly frustrating and will usually ruin your chances of getting repeat customers.

In this day and age, people expect things to be delivered quickly, and standard delivery that takes more than seven days is a rarity. If your delivery time is longer than this without a good reason, then try to shorten it first. It might cost you more money initially, but as we discussed earlier, even a 5% increase in customer retention is a massive revenue generator, so it will likely pay for itself.

Where possible, free delivery and quick 1–2-day delivery are options that never fail to impress customers. Look at Amazon; they’ve built an empire based on good customer service and delivery.

Your product should also be easy to use right out of the box. Before any new products or software features are released to customers, they should be rigorously tested. Do instructions need to be included in the box? Should you include a video walkthrough of the new software features you’re releasing? Doing so will cut down the number of people reaching out to your customer support.

Price

People have become very astute when it comes to online shopping. More often than not, they’ll shop around for the best price before committing to buy something.

Convincing them to buy once is one thing, but if they find a similar quality product cheaper elsewhere, then they might decide to take their business elsewhere.

While you don’t have to be the cheapest retailer on the market, consumers should know why your product warrants the higher price. Maybe you offer better customer service, a longer warranty, or use higher-quality materials. People are willing to pay extra if they feel like they’re getting their money’s worth.

Your Presentation

How your storefront or website looks and performs is a massive factor in whether people will buy from you again.

If it’s slow and difficult to use, then you’re shooting yourself in the foot. You’re also making it easy for competitors to step in and offer a similar product with better presentation.

Run speed tests and use software like Crazyegg—it allows you to view your customer’s activity while on your website. This will show you if there are people struggling to use your site and where you might be losing customers.

Stored Payment Details

Make it easy for customers to come back by offering to store their payment details. It takes the friction out of repeat purchases and is one less thing that they have to do.

Loyalty or Retention Programs

Loyalty programs are a great way to reward both regular customers and those that have only bought from you once.

Implementing some kind of VIP program that rewards customer retention is beneficial for both parties. You’re forming a connection with your customers, which earns you repeat sales and improves your customer LTV. In return, the customer receives a discount, a gift, or something similar.

You can also use some sort of win-back retention program that entices customers who haven’t bought from you in a while. Again, they get something in return and you’re making additional sales. This type of marketing is usually more cost-effective as you already have their details; it could be as simple as setting up a single email campaign.

How to Improve Your Customer Retention Rate Measurement

Get Feedback

Stop guessing what the customer wants and start asking them through surveys and more rigorous user interface testing and reports.

Customer surveys can help you anticipate what the customer wants. You can then start offering it before it becomes a problem and people churn because of it.

Set Proper Expectations

Be transparent with people by setting up proper expectations. If consumers feel like they’re being lied to, then they’ll jump ship in an instant. It’s best not over-promise and under-deliver; if anything, you want to do the opposite.

You’re not going to get it right every time, and customers are usually understanding of this. Be upfront about your mistakes and be the first to talk about them if possible. This can actually work in your favor by endearing customers to you.

Go After the Right Kind of Person

Don’t just work out your customer retention metrics—analyze what’s influencing them. By looking at who is churning the most, you can create an avatar for these problem customers. Do they have anything in common?

If they do, then maybe that thing can be used to exclude them from becoming a customer in the first place. Also, perhaps you could alter your product description to be more explicit about what you offer.

Key Performance Indicators (KPIs)

Create and monitor key KPIs for your team to ensure customer satisfaction. We’ve already established that customer satisfaction is a massive part of retention, but it can be hard to track.

To make sure that it doesn’t start slipping, set up KPIs so that everyone on your team knows what they’re aiming for and how well they’re doing. For example, emails must be responded to within 24 hours, or orders must be processed on the same day. You could even set up bonuses that reward good performance to incentivize them even more.

Build Relationships

Your relationship with your customers is what helps to build an emotional connection between them and your brand.

Don’t be afraid to show a bit of personality on emails and through social media. It can make your brand more likable, and people prefer to buy from places that they know and trust.

Improve Your Onboarding Process

Make it easier for your customer to get to grips with your product. This is particularly true for software that takes significant time and effort to learn.

Perhaps you could offer a video walkthrough series to teach customers all the features of your product. What about offering a live chat service to troubleshoot problems? The more customers get familiar with a product, the less likely they are to go through the process of learning something else.

Improve Your Customer Retention Rate Measurement to Improve Your Chances at a Lucrative Exit

Improving your customer retention rate increases your profit in the short run, which also increases the valuation your business will receive when you go to sell it. It’s a win-win situation that stops you from leaving large amounts of money on the table.

In addition, when buyers are searching for businesses to buy, they love to see returning customers making purchases. It’s a telltale sign that you’ve built a strong brand and customers enjoy purchasing from you.

There are hundreds, if not thousands, of high network buyers out there looking to purchase online businesses. If you’re interested in seeing how much your business would be worth, then you can use our free valuation tool. It takes less than five minutes to fill out and you’ll get free advice on how to improve your final valuation.

Your customer retention rate could help you to generate a very profitable exit.