Average Revenue Per User: How to Calculate, Track and Improve It

Average revenue per user (ARPU) might not get as much attention as other subscription metrics, but that doesn’t mean it’s not an important metric to track.

After all, ARPU measures how much revenue you’re earning from each active customer. It’s useful because it looks at earnings on a more granular level and provides insights into your business’s scalability.

Companies typically calculate ARPU on a monthly basis, but it can be calculated over annual timeframes as well. This article will focus on ARPU in a monthly context and explain why it’s a popular metric for SaaS and subscription founders, sellers, and buyers alike.

How to calculate ARPU

To calculate ARPU, divide your MRR by the total number of active customers within a particular month.

MRR is your recurring revenue normalized into a monthly amount. Active customers are your customers with an active subscription, including those on free plans.

ARPU = MRR / number of active customers

Here’s an example of the ARPU formula using actual data from an Open Startups company:

MRR / number of active customers = ARPU

$1,278 / 102 = $12.78

In some forecasting and decision-making situations, companies might want to exclude users on free plans since they don’t generate revenue. In that case, use the ARPU formula but divide MRR by your active, paying customers.

This version of ARPU is known as average revenue per paying user, or ARPPU.

ARPPU = MRR / Number of Active, Paying Customers

Why ARPU is important

ARPU is important for two main reasons:

1. ARPU helps you gauge the popularity of your pricing tiers

Pricing SaaS products is challenging. Whether your pricing is based on usage, number of users, features, or a combination of these, the perceived value of your product can be difficult to quantify.

It helps to know which pricing levels attract the most consumers and earn you the most revenue. By segmenting ARPU by pricing level, you can identify which pricing levels you should prioritize.

2. ARPU helps you understand your ability to scale

If your ARPU is low, you’ll have to spend more on resources like marketing and customer success to acquire and support new customers. If the cost of these resources outpaces your revenue, your business will neither sustain itself nor grow.

If your ARPU is high, congratulations! A high ARPU indicates that you’re charging an advantageous amount for your services and delivering high value.

What is a “good” ARPU?

If you’re a subscription business owner, you’re probably wondering if your ARPU is where it should be.

The answer is…well, it can be hard to tell immediately.

Benchmarks for ARPU depend on industry, location, and pricing model. It’s tricky to evaluate by itself. Teams should look at ARPU in relation to other information, such as their customer acquisition costs and their competitors’ ARPU.

Compare ARPU with customer acquisition costs

Comparing ARPU with customer acquisition costs (CAC) helps you understand how much you’re earning per customer versus the amount you’re paying to get them to sign up.

There’s no commonly used ratio to assess this relationship, but generally speaking, ARPU should always be higher than CAC.

Comparing ARPU with competitors

Another way to gauge where your ARPU stands is by comparing it with your competitors’ ARPUs. As mentioned earlier, try to look at competitors with a similar pricing model and location as yours.

If these factors are the same between two companies, the company with the higher ARPU is more profitable.

What variables impact ARPU?

As you calculate ARPU, it’s important to consider variables that impact your figures. If your ARPU dipped one month, you can usually pinpoint the reasons why it did.

Upgrades and downgrades

The open-ended nature of how SaaS products are used translates to a variety of paid plans and add-on features. Upgrades and downgrades are a result of this variety.

Upgrades occur when customers move from one plan to a more expensive paid plan. Downgrades, of course, are the opposite. Both directly impact your MRR and thus impact your ARPU as well.

Customer churn

Customer churn rate, the rate by which customers cancel their subscriptions, also directly impacts your MRR. Losing a higher-paying customer is going to hurt your MRR and ARPU much more than a lower-paying one.

It’s essential to identify who your higher-paying customers are so you can devote more resources to keeping them around.

ARPU vs. LTV

Speaking of other subscription metrics, some people confuse ARPU with customer lifetime value (LTV).

Generally speaking, ARPU and LTV both calculate value received from customers on the individual level. In fact, ARPU is part of the simple LTV formula.

That doesn’t mean, however, that they tell you the same information.

LTV measures how much revenue you can expect to earn from a customer before they churn. It’s typically a way to determine how well you’re finding the right customers and retaining them over time.

ARPU, on the other hand, is best for evaluating your pricing structure and product positioning.

Tracking ARPU

The first step in increasing ARPU is figuring out what it is currently. From there, you should keep an eye on ARPU to make sure it’s increasing as your business grows.

If you’re savvy with Excel functions, tracking can be done using spreadsheets. A better solution, however, is using analytics tools like Baremetrics that calculate metrics in real time.

The gradual increase was the result of this company increasing the price of its paid plans starting on May 7th. The dip was caused by one enterprise customer churning.

How to increase ARPU

When it comes to ARPU, the higher, the better. Here are three strategic ways to increase ARPU.

Increase prices

Simply put, increasing your prices will increase how much each customer pays you.

This, of course, is easier said than done. As we talked about earlier, pricing SaaS products is notoriously difficult.

As a result, many founders set prices in the beginning and leave them as is for way too long.

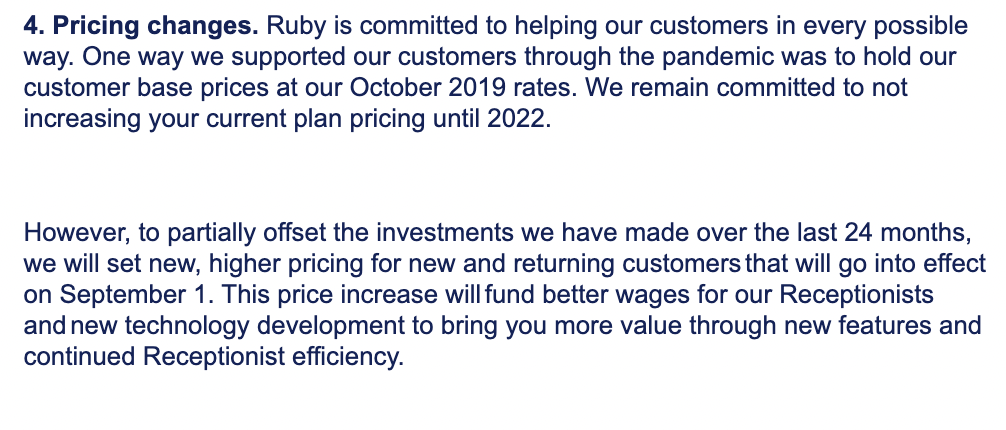

If you decide to increase product prices, it’s a good idea to communicate why you’re doing so. Check out this section of a price increase email from Ruby.

This is a wise way to frame a price increase. By the time the reader arrives at this part, they already have an understanding of why the increase is happening and how it will improve their customer experience.

Consider getting rid of free or freemium plans

Free and freemium plans are effective for getting people to sign up for and use your product. These plans are typically the most basic version of the product or service.

Ideally, the structure and limited offerings of free and freemium plans encourage users to upgrade their plans to access more features, support, the ability to white label, and more.

The problem with free and freemium plans, however, is that they can quickly overwhelm your resources like customer support, marketing, and sales without bringing in any revenue.

Charging all customers is a straightforward way to increase ARPU. It also helps increase ROI for those aforementioned resources.

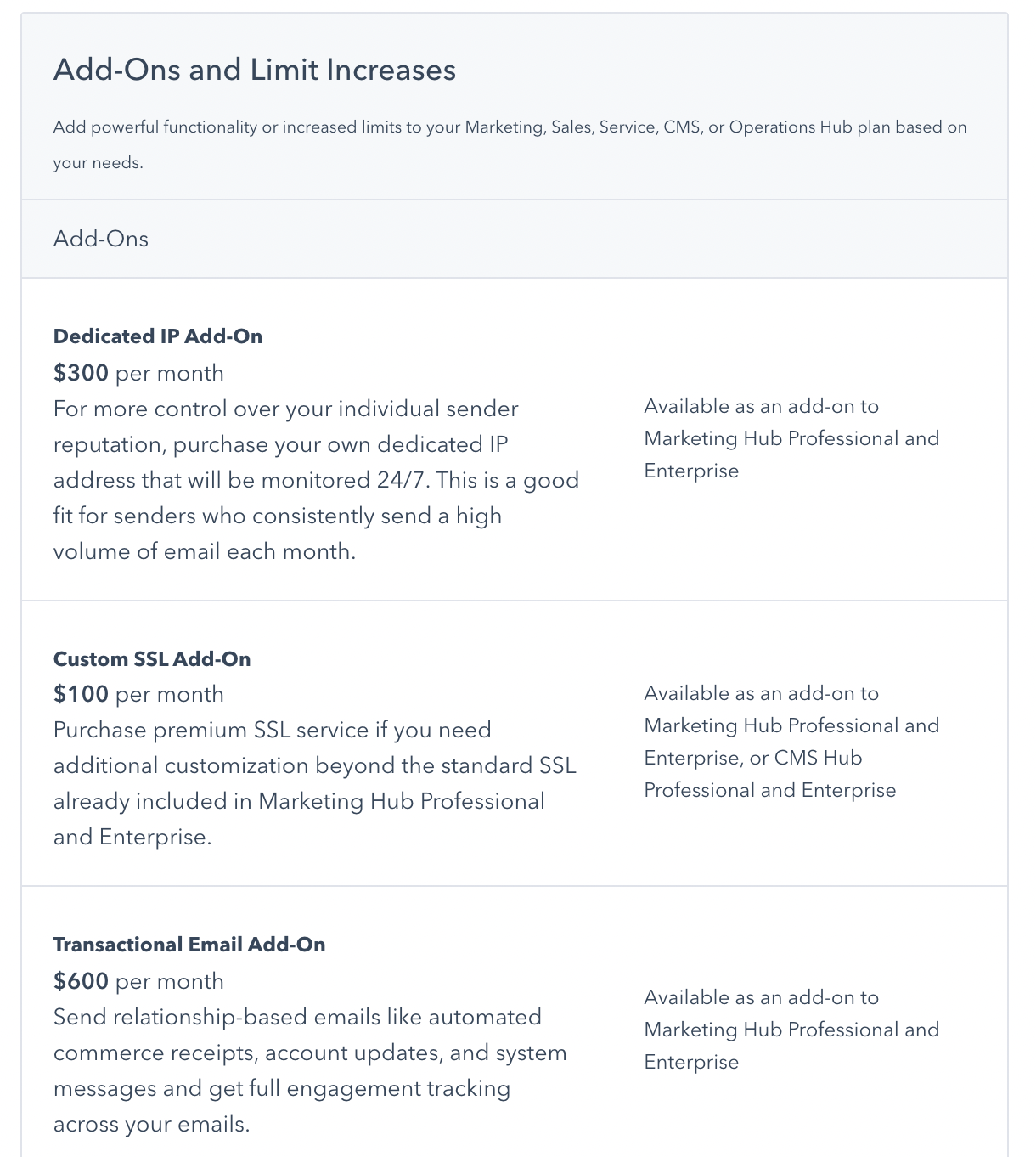

Offer add-on features

As we talked about earlier in the article, SaaS products can be used in many different ways. The way one company uses a product won’t necessarily be the same as how another company uses it because their needs are different.

Add-on features can address these individual needs and bring value to customers in a way that feels flexible to them. For you, the business owner, they provide additional opportunities for people to spend money on your product or service.

Here’s an example from HubSpot.

HubSpot’s core product is a customer relationship management tool (CRM), but they also offer several other products and add-on services to serve a wider range of needs.

HubSpot’s add-on features are designed for larger, enterprise-level companies, but this tactic works for customers of all sizes.

By offering add-on features, you could be earning an additional $10-$600 per customer every month.

Conclusion

ARPU is a powerful metric. While it’s granular in nature, ARPU helps you understand big picture things like pricing strategy and scalability. That’s why it’s a popular metric for SaaS and subscription founders, investors, and those seeking to buy businesses.

If you’re a SaaS or subscription business, you should definitely be tracking and working to increase ARPU.