This Week in M&A Issue #190

Hey champ!

Today’s trend of the week is “adult social sports leagues”. 🏀

Adult social sports leagues are booming, with millions of people now lacing up their cleats for kickball, dodgeball, pickleball, and more. Adult team sports are growing even faster than individual sports, outpacing popular activities like running and weightlifting.

What used to be run by city rec departments is now a thriving private industry, with many entrepreneurs scoring big off the field by creating million-dollar businesses. One entrepreneur launched a small bocce league to meet people, and today, it’s a national brand with over half a million players and $21 million in backing.

For online business owners, this trend could be a home run. Tech platforms that handle registrations, match players, and manage logistics are in high demand. Digital marketers can tap into highly engaged niche audiences. eCommerce sellers can provide league gear and merchandise. And content creators can offer content, guides, and cover events in this growing lifestyle niche.

Today we have for you:

- Prime Day 2025 expands to 96 hours

- PayPal turns ads into instant online stores

And:

- Amazon is no longer the only game in town

- How bad bookkeeping can kill an exit

- Amazon and Walmart may launch dollar-pegged stablecoins

Alright, let’s dive in.

Amazon

Prime Day 2025 Launches Across 20 Countries Starting July 8

Amazon Prime Day 2025 is set to be the biggest yet, expanding to a four-day event from July 8–11, double the usual 48-hour window.

The 96-hour sale will unleash deals every five minutes during peak periods, making it a major opportunity for sellers to drive traffic and conversions. This year’s event introduces “Today’s Big Deals,” themed daily promotions spotlighting top brands and trending categories.

Amazon is also supporting independent sellers with early Prime Day deals starting June 23. Through “Buy with Prime,” sellers using their own storefronts can tap into Prime benefits and offer savings of up to 40% to U.S.-based Prime members, broadening reach beyond Amazon’s marketplace.

84% of U.S. adults say they plan to shop Prime Day this year, up from 81% in 2024. That momentum comes after a record-breaking $14.2 billion in online sales during last year’s event, a year-over-year increase of 11%. Shoppers are targeting practical purchases, with top categories including clothing and footwear (36%), pet supplies (29%), grocery and pantry items (28%), kitchen appliances (25%), and health and wellness products (25%).

However, while the upcoming Prime Day may look bigger on the outside, sellers behind the scenes are approaching it with caution. According to several eCommerce agencies, sellers are becoming more selective about the deals they submit for Prime Day. Some have had to raise prices by 15–20% due to tariff-related cost increases, making steep discounts harder to justify. Brands are also treating pre-tariff inventory as a precious asset, knowing that restocking later this year, particularly in Q4, could be more expensive or delayed.

Prime Day will kick off on Tuesday, July 8 in Australia, Austria, Belgium, Canada, Colombia, France, Germany, Italy, Ireland, Japan, Luxembourg, the Netherlands, Poland, Portugal, Singapore, Spain, Sweden, Turkey, the U.S., and the U.K.

Prime members in Brazil, Egypt, India, Mexico, Saudi Arabia, and the United Arab Emirates can shop Prime Day deals later this summer.

Ads

PayPal Launches Ads That Let You Shop Without Leaving the Page

PayPal is rolling out a new ad product called Storefront Ads, aiming to help merchants tackle declining web traffic in an era where AI and “agentic commerce” are changing how people shop. Instead of directing users to a retailer’s site, these ads let consumers browse and buy products directly within the ad itself, on any website they’re already visiting.

Storefront Ads are powered by PayPal and Venmo’s secure payment systems and use PayPal’s transaction graph, which draws on data from over 430 million consumer and merchant accounts around the world. This allows the ads to show relevant products to the right people and to offer a smooth, fast checkout process. Once someone makes a purchase, they’re returned to the content they were browsing, no extra steps or page loads needed.

Fewer consumers are visiting retailer websites directly. Instead, they’re discovering products through AI-generated suggestions, smart assistants, and content like social media posts and news articles. Storefront Ads are meant to help businesses stay visible by placing interactive shopping experiences where consumers already are.

PayPal plans to launch Storefront Ads in the U.S. this summer as standard display units and later expand into more advanced formats like product carousels and sponsored listings.

As online shopping becomes more fragmented and decentralized, PayPal’s new ad format reflects a larger trend: bringing the store to the shopper, rather than the other way around.

ecommerce

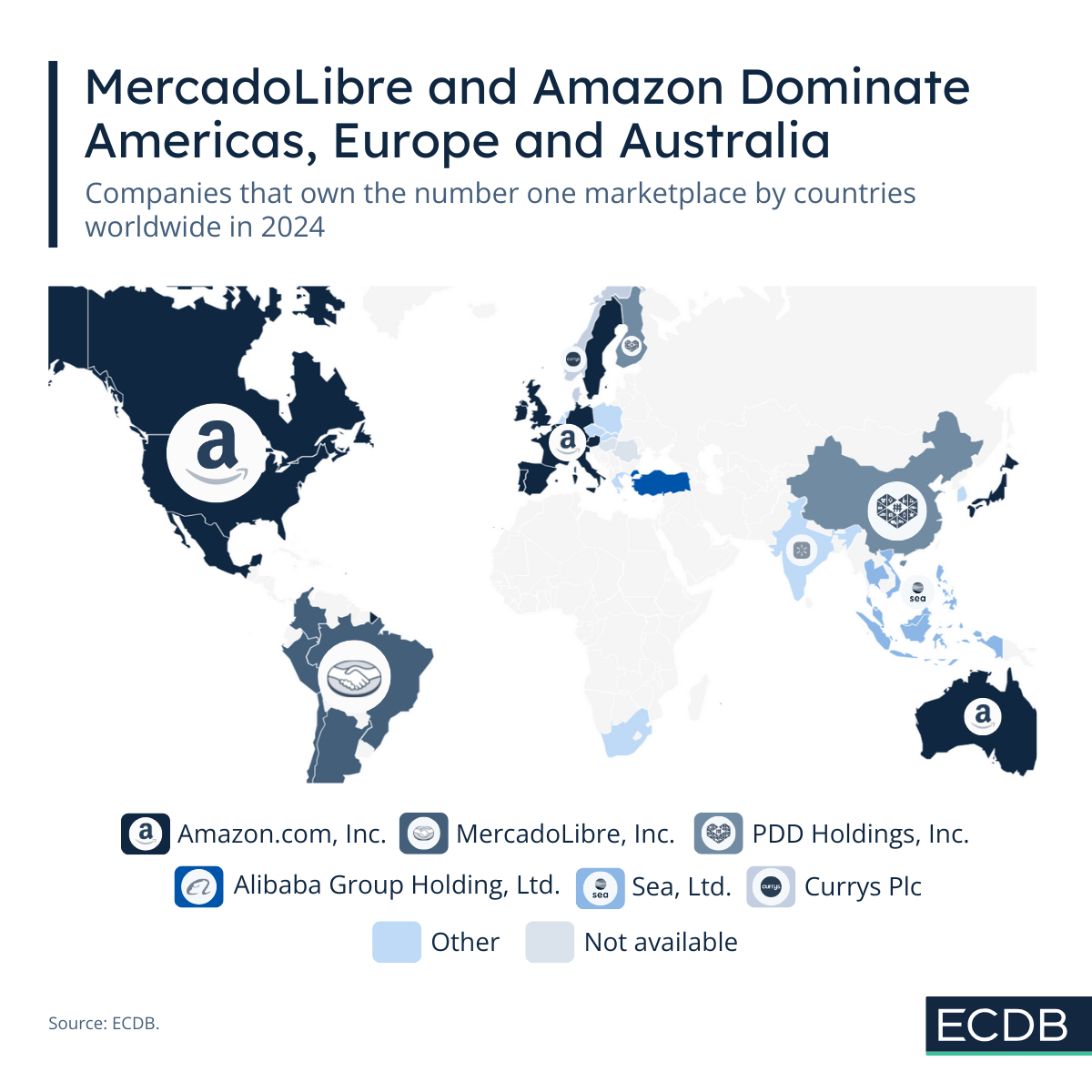

New Ecommerce Leaders Are Emerging to Challenge Amazon’s Monopoly

PDD Holdings, the Chinese company behind Temu and Pinduoduo, is quickly rising as a major force in global eCommerce and could soon rival, or even surpass, Amazon as the world’s leading marketplace provider.

While Amazon remains the dominant marketplace in over 16 countries and continues to set the global standard for eCommerce, its dominance isn’t universal. In regions like South America and Southeast Asia, platforms like MercadoLibre and Shopee have secured top spots, each leading in five countries and generating billions in gross merchandise value (GMV) annually.

Despite Amazon’s expansive reach, several key markets are proving resistant to its dominance. In India, Walmart has outpaced Amazon through its acquisition of Flipkart, and in China, PDD Holdings holds the crown with Pinduoduo. Meanwhile, Temu, its international arm, has already become the top marketplace in Finland and continues to gain traction globally, positioning PDD as a real challenger to Amazon’s long-held supremacy.

Interestingly, local marketplaces are thriving in smaller countries. Bol.com leads in the Netherlands, Coupang rules in South Korea, Allegro is huge in Poland, and Takealot.com is South Africa’s go-to shopping site. These platforms succeed by understanding local needs, building smart delivery networks, and getting into the market early.

As Temu expands and local platforms continue to grow, eCommerce is becoming less dominated by any one giant. Amazon’s still powerful, but it’s no longer the only route to global success.

For eCommerce sellers, this opens up exciting opportunities. Expanding into the leading marketplace in a specific country, even if it’s not Amazon, could lead to better visibility, more trust from local customers, and greater long-term growth.

Read All About It!

🔥 How to build a $100 million Shopify brand: top Shopify categories right now

📬 Build a $400k per year paid newsletter in 5 steps: scalable & profitable

💵 How financial publishers and creators make millions: revenue stream breakdown

⭐ 9 ways to get more Google Reviews for your business: boost your reputation

YouTube

The Unsexy Reason Your Business Might Not Sell

There’s one critical factor buyers look at first, and if you get this wrong, your big exit could fall apart fast.

It’s not flashy. It’s not fun.

It’s your accounting system.

In this video, Greg reveals why clean, accurate financials aren’t just a nice-to-have; they’re non-negotiable if you want serious buyers at the table. He’ll walk you through the financial systems you need before listing your business… and why a color-coded spreadsheet simply won’t cut it.

If you’re aiming for a profitable, stress-free exit, this is a video you can’t afford to skip.

Amazon

Amazon and Walmart Explore Stablecoins to Reduce Payment Costs

Amazon and Walmart are considering launching their own stablecoins, digital currencies linked to the U.S. dollar, as a way to reduce costs and improve payment systems.

According to The Wall Street Journal, both companies have held internal discussions about creating these coins. Amazon has been exploring blockchain since 2021, and Walmart filed a patent in 2019 for a digital currency aimed at serving unbanked customers.

The primary driver is cost savings. Every time a customer pays with a credit card, merchants lose 2–3% of the transaction in fees. For Amazon, with over $447 billion in eCommerce revenue in 2024, that could amount to $9–13 billion annually. Using stablecoins would allow companies to avoid those fees and make international payments easier by bypassing currency conversion and wire transfer costs.

Issuing stablecoins also offers a revenue opportunity. These coins must be backed by reserve assets, typically U.S. government bonds, which generate interest. Experts say this could bring in hundreds of millions of dollars per year.

With existing digital wallets and large customer bases, Amazon and Walmart are well-positioned to introduce their own digital currencies. Still, they would need to solve technical and regulatory challenges, such as fraud prevention, handling refunds, and meeting financial compliance standards.

News of these plans has unsettled the payments industry. Shares of companies like Visa, Mastercard, PayPal, and Block fell between 2% and 6% amid fears that stablecoins could eventually replace traditional payment methods.

Meanwhile, the Senate passed the GENIUS Act this week, a bill that establishes a regulatory framework for stablecoins. This could speed up the arrival of retailer-issued digital money and change how consumers and businesses handle everyday payments.

Subscribe to the This Week in M&A Newsletter

to Get Content like This in Your Inbox Every Friday