Our Q4 Business Report – October, November, December 2015

We’ve been writing these reports for several years now, starting with our first in December 2010 through today.

Even though we started these off monthly, I think we’ll continue with a Quarterly Report going forward. As our business matures, giving ourselves three months to collect and report the data just makes more sense. We’re more secure in the company we have, know where we’re headed, and don’t need to report monthly as it’s more about the process than the changes at this point.

As always, our goal with these reports is to provide a high level of transparency in showing both our successes and failures with the hope that it helps you build your own online business. It also provides us with public accountability. We have a record of what we’re working on and can review, track our progress, etc.

We hope these reports encourage and inspire as you continue to grow your online empire.

Executive Summary – Q4 2015

This was our second best quarter ever with October being our strongest and November being our weakest month.

Here’s a look at month-by-month deals:

[wider_blog_insert img=”https://empireflippers.com/wp-content/uploads/2016/02/EF-Marketplace-Monthly-Q4-2015.png”][/wider_blog_insert]

And our overall deals:

[wider_blog_insert img=”https://empireflippers.com/wp-content/uploads/2016/02/EF-Marketplace-Overall-Q4-2015.png”][/wider_blog_insert]

Q4 2015

Business Data:

- Total Team: 21

- Customer Heroes: 10

- Management: 6

- Apprentices: 0

- Contractors: 5

- Email Subscribers: 24,619

- Site Visits: 116,575 (Oct: 39,748, Nov: 39,141, Dec: 37,686)

Revenue:

- Brokered Site Sales: $1,106,162.84 (Oct: $517,339.54, Nov: $219,299.16, Dec: $369.524.14)

- Listing Fees: $11,668.00 (37 New, 7 Returning)

- Investor Program Raised: $0.00

- Investor Program Overall Earnings (Actual): $36,567.77

- Other: $1,392.21

Total Revenue: $1,155,790.82

Earnings:

- Brokered Site Earnings: $141,943.05 (Oct: $74,379.00, Aug: $29,723.88, Sep: $37,840.17)

- Listing Fees: $11,668.00 (37 New, 7 Returning)

- Investor Program EF Earnings (Actual): $10,970.33 (Portfolio One)

- Additional Revenue: $1,392.21

Gross Earnings: $165,974.16

Revenue Breakdown

Now that we have the totals, let’s break it down a bit further to look at the individual components of the business and how they did for the quarter.

Brokered Site Revenue

We were able to successfully broker:

- 34 deals in Q4, 2015 @ $1,106,162.84

- 176 deals in all of 2015 @ $4,557,347.88

We ended up breaking through our 2015 goal of $4M and our all-time sales currently stands at $6.5M+.

Keep in mind that we only receive a percentage of these total sales – the commissions we earn from closing the deals. Our total commission for Q4 came out to $141,943.05.

Our Q4 totals were a little lower than we wanted them to be, but we’re very happy with how our year shaped up overall.

We ran into a bit of a problem towards the end of the year where other brokers were posing as buyers so that they could contact the sellers and steal their business. We also had some sellers who wanted to remove their listing because they “sold privately”.

To solve this, we’ve recently implemented a 6 month exclusivity contract. While this does protect our interests and the work we do to get the listings published/sold, it also protects our buyers in that they know they’ll have enough time to do their due diligence in preparation for a purchase.

Website Listing Fees

We’ve continued to collect listing fees from new and repeat sellers, which brought us $11,668.00 in revenue for Q4.

- 37 First-Time listings @ $10,989.00

- 7 Repeat listings @ $679.00

Sourcing new listings and sellers remains a top priority for our company in 2016. The more deals we can bring to our buyers the more opportunity we have in closing those deals.

Just 12-18 months ago, we were wondering just how much business we might be able to do if we had a wide range of sites available by price point, monetization methods, etc. We’ve got our answer…if you look at our marketplace you’ll find a fairly wide selection available right now – anything from the $5K AdSense/Amazon sites up to the 6-7 figure international eCommerce brands.

Investor Program

If you’ve never heard of our investor program, I’d suggest listening to this podcast along with this one, or checking out April’s report for more details.

Investment Raised

We didn’t raise any funds in Q4 and instead focused on finishing up the website purchases and expanding the sites already in the portfolio. The plan is to continue to work on this portfolio for the next few months and then raise money for a second portfolio in March/April.

If you’re an accredited investor and would like to hear more about our Investor Program, please click here and select “Investor Program” to let us know.

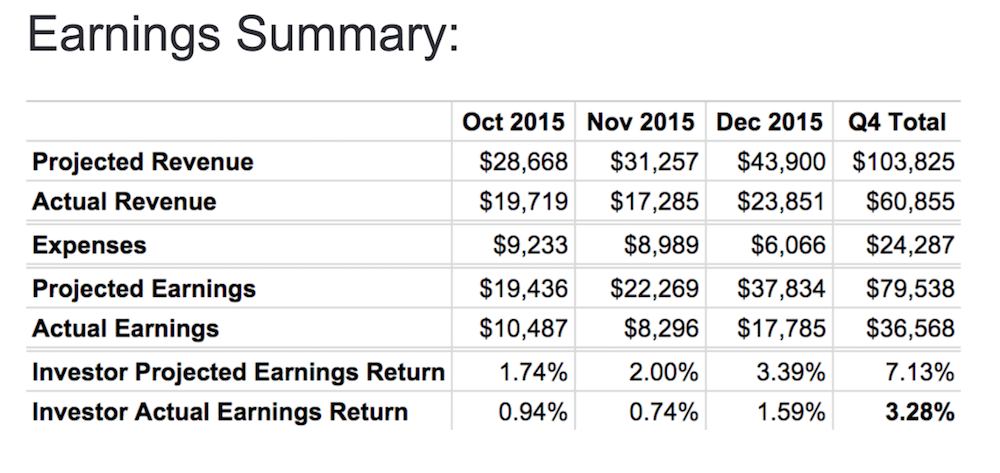

Quarterly Earnings

Since many of the sites were purchased in Q3/Q4 and it takes some time to fully migrate the sites, we weren’t able to realize a full month’s earnings until December 2015. Now that we have all of the sites purchased and in place, we’ll be able to report on earnings a bit more regularly in future updates.

There’s also the problem of “projected” Vs. “actual” when it comes to affiliate earnings. (i.e. Amazon) We’re paying out the investors based on actual earnings, so those payouts can be delayed up to 60 days based on the actual payouts we receive from Amazon.

Projected Earnings for Q4: $79,537.56 – This is the reported amount from Amazon, AdSense, etc. in terms of earnings for the quarter.

Actual Earnings for Q4: $36,567.77 – This is the actual amount we’ve been paid out on all earnings for the quarter.

Based on a 70% / 30% split on actual earnings, our investors received payments of $25,597.44 while the Empire Flippers share was $10,970.33.

That’s still not a major percentage of our business at Empire Flippers, but once we start paying out the “projected earnings” from Amazon in Nov/Dec it starts to get much more interesting.

Portfolio Update

Each quarter, we prepare a 12-15 page report for the investors and invite them to a call where we discuss what we’ve done and where we’re going. This is modeled after more traditional investments, but with a focus on things like SEO, expansion strategies, etc.

As anticipated, we’ve seen some big changes on the individual sites (one site penalized, another tripled in earnings, etc.) which is why we focused on diversification. Overall, the portfolio performed at slightly above expectations in Q4 and looks to be continuing that trend into Q1 2016.

We’ll continue to expand the sites that are performing above expectations and take corrective action for those that aren’t performing as well. Our overall outlook for 2016 is positive and we expect to continue to move forward in expanding this program.

Additional Revenue

We brought in $1,392.21 worth of additional revenue in Q4, most of which came from affiliate earnings, eBook sales, and other things not so easily categorized.

This will remain a catch-all section for any earnings I can’t really place elsewhere in the report. I don’t see significant growth here in 2016.

Traffic And Audience

Here’s a detailed look at audience for Q4 2015 that includes our blog traffic, podcast downloads, and email list.

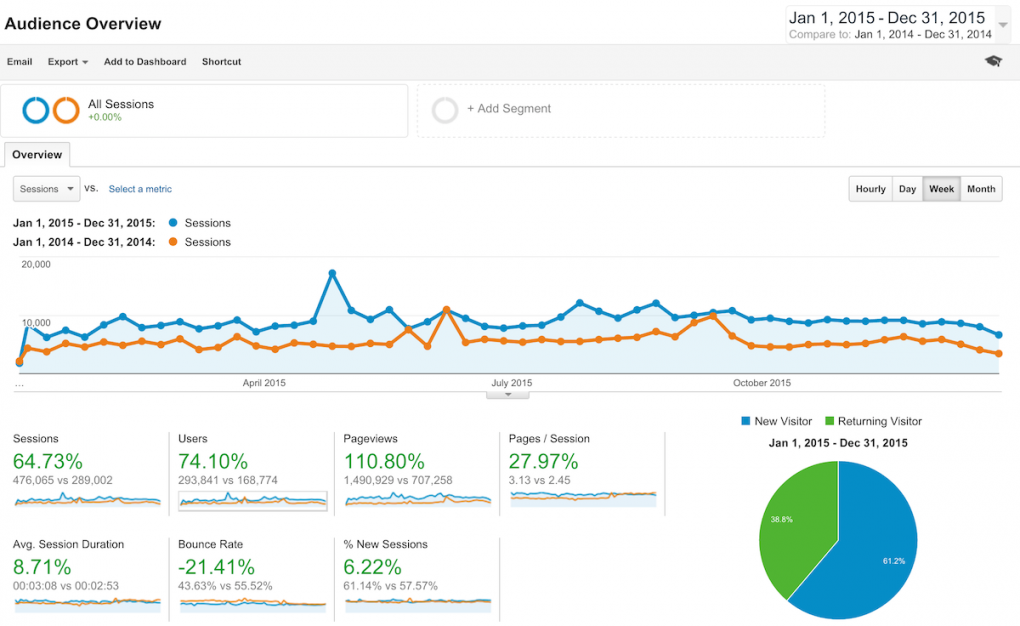

Blog Traffic & Analytics

We had 116,575 sessions in Q4 2015:

and 476,065 sessions for the entire year:

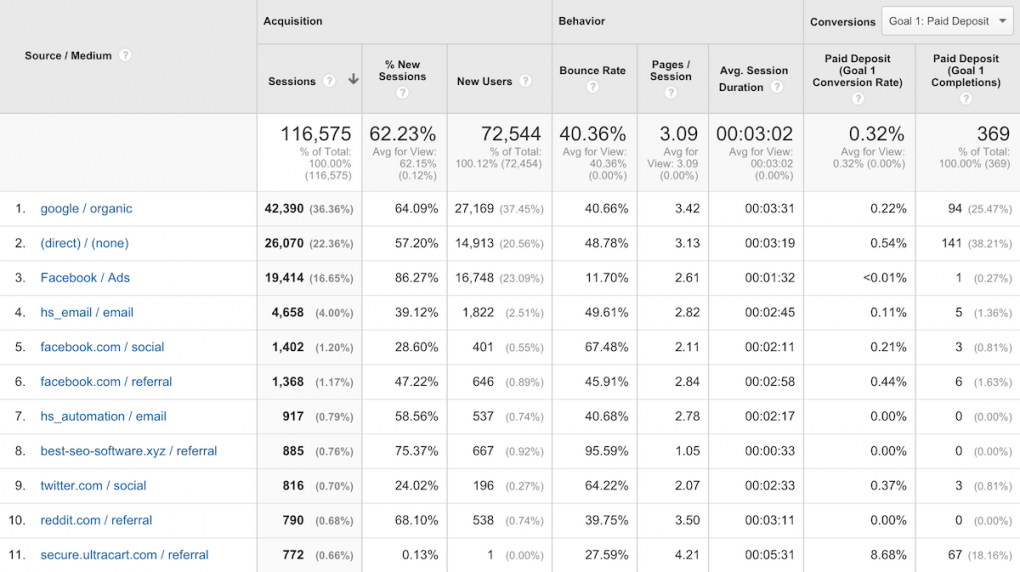

The majority of our traffic for Q4 came through organic search, direct traffic (Those typing in empireflippers.com or visiting us from bookmarks), and Facebook (along with other social media).

Here’s a look at those sources for Q4:

Deposits were at 369 for the quarter, down from 510 in Q3.

Here are our 2015 sources overall:

Here are our top 3 pages on Empire Flippers for Q4:

Our top 3 listings:

- Listing #40343 – (Sold) $9K affiliate site

- Listing #40319 – (Available) $160K Amazon affiliate site

- Listing #40322 – (Available) $700K news site

and our top 3 content pieces:

- AdSense Account Disabled

- Debate: Dropshipping Vs. Amazon FBA

- Scuttlebutt Approach To Website Due Diligence

We’ve been working to expand our blog and podcast content in 2016 and we’re started that recently. Expect more blog posts and podcast episodes from us in the coming weeks/months.

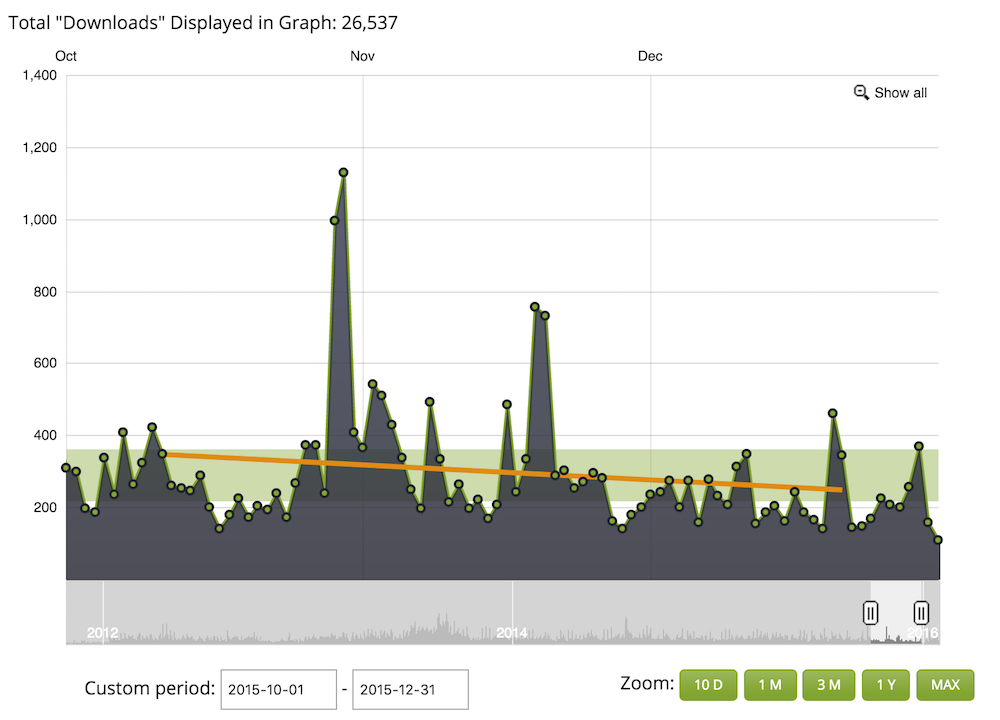

Podcast Downloads

We’ve dropped down a bit with the Empire Flippers podcast downloads, pulling in 26,537 for the quarter:

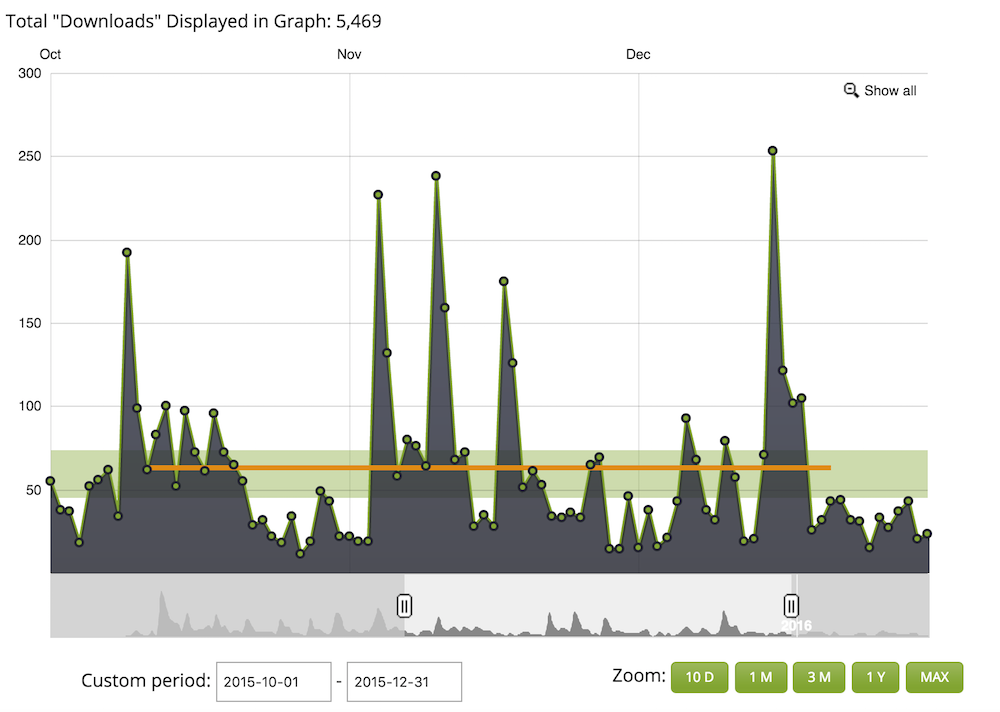

We pulled in 5,469 downloads for Q4 on the Web Equity Show:

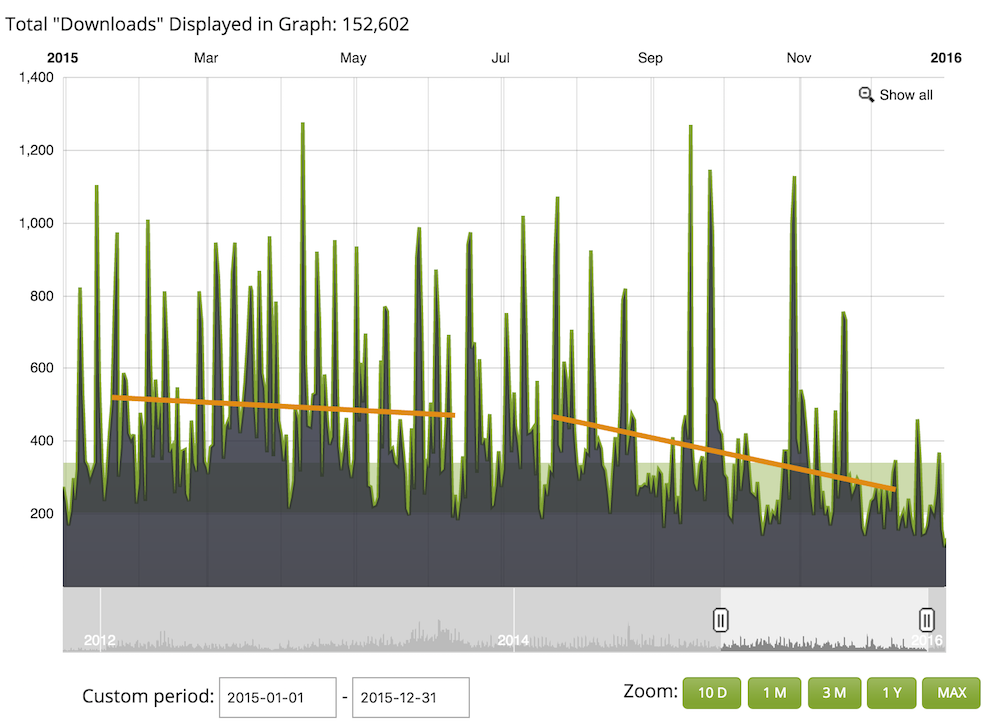

In looking at all of 2015, we had a total of 164,246 downloads across both shows. That’s quite a decline from where we were previously. Here’s a look at 2015 overall for the EF Podcast:

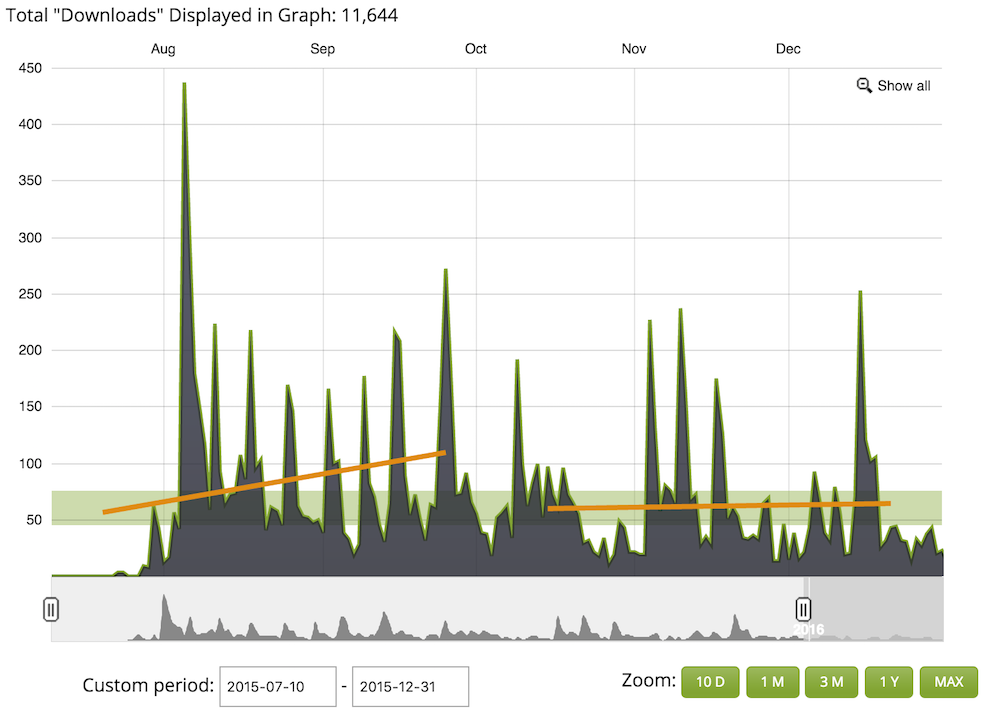

and Web Equity Show:

I attribute the large majority of that to our inconsistent publishing schedule and our lack of publishing in Q3/Q4 2015. That’s something I’d really like to fix in 2016, for sure.

If you’re new to either the Empire Flippers Podcast or the Web Equity Show, here are a few good episodes to get you started.

Empire Flippers:

Episode 72: 6 Types Of Website Buyers

Episode 121: Creating Your Dropship Lifestyle

Episode 128: The Lifestyle Larry Guide To Job Replacement Income

Web Equity Show:

Episode 11: How Non-Techies Can Buy Online Businesses

Episode 9: What’s My Online Business Worth?

Episode 16: How We Would Start Over From Scratch

Emails & Contacts

We switched from using Ontraport to Hubspot in Q4. (Mentioned below) As a part of that switch, we ended up removing old email subscribers that hadn’t responded in some time, others that had bounced, etc.

We ended up with 23,041 email subscribers in Hubspot through December 2015.

Now that we’re fully migrated over I still need to pull some stragglers over from Ontraport, which might be an additional 1-2K subscribers. I’ll mention that in the next quarterly report.

Customer Experience

Taking good care of your customers is important in our industry. Even more so as we move up the value chain and start to list/sell 6-7 figure websites and online businesses.

We’re including some insights on customer experience to both hold ourselves accountable and to look at areas we can improve.

Zendesk Support

Note: I was only able to look at Oct 1st – Dec 29th due to Zendesk limitations.

Here’s a look at our performance for Q4:

Unfortunately, we have tickets from both Empire Flippers and one of our investor sites included in these numbers. With a not-so-great satisfaction rating on the portfolio site, this has brought our numbers down a bit.

I don’t love the 9.6 hour average response time, but I’m happy that 85% of our customers receive a response within 8 hours. (And around 75% of those within just one hour)

Customer Feedback

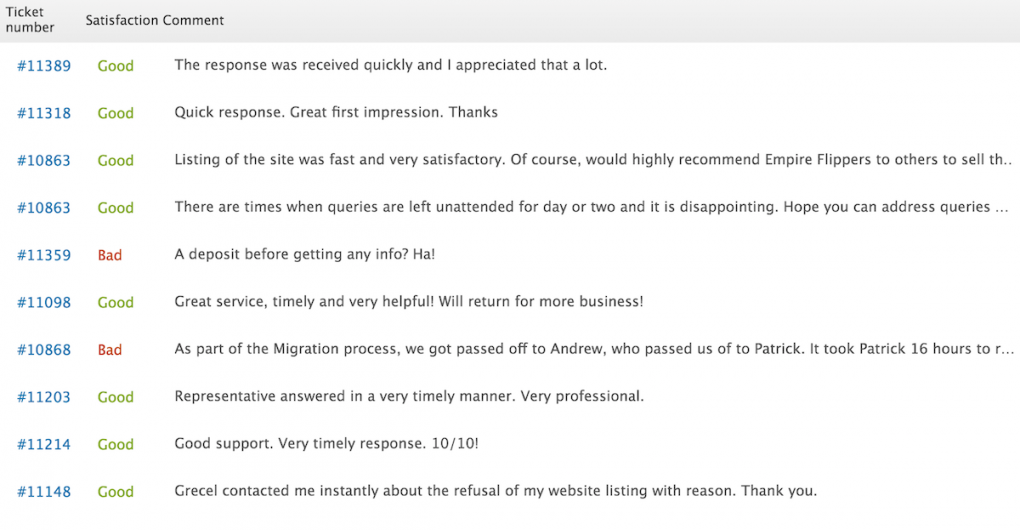

Out of 2,614 tickets, we received good feedback from 288 and bad feedback from 40.

Here’s a snapshot of what they had to say:

The feedback was generally positive. The critical feedback seemed to revolve around:

A) Slower follow-ups – While we’re pretty good with responses to new tickets, many of our processes are multi-step and require much more back and forth. The current limitations of Zendesk don’t allow me to see what our follow-up times are after initial submission. IF we could track this I’m sure we could improve, but it’s not something we can see currently.

B) A feeling of being passed around – If we were only closing 2-3 deals per month it would be much easier for us to just have one point of contact, but because we’re doing so many deals and handling depositors, offers, etc. that come with those deals, we have to have a team to manage the process. This can sometimes feel like you’re being passed around. (You get a response from Andrew, then Michael, then Sabine, etc.) Everyone has a full view of the situation and is up-to-date on what’s going on, but we need to have a better way to share that with our customers, I think.

What Happened In Q4 2015?

1. Continued Our Investor Program

We were able to complete all of the website purchases for Portfolio 1 and even made enough money to deliver the investors a reasonable return in Q4, as mentioned above.

“Portfolio 1” (as we’re calling it) has performed slightly above average, and that’s considering the fact that we’ve had problems with one of the larger sites blocked from AdWords. If we can turn that site around and get it running profitably again, we’ll be crushing it – well above expected returns – which is why we’re so focused on making that happen.

2. Completed Hubspot Integration

A few years ago, we upgraded our marketing automation software from Aweber to Ontraport. This change allowed for much better personalization and was a sort of first step into having a truly automated system. Last quarter, we decided it was again time to switch to a new system and migrated from Ontraport to Hubspot.

Right away, we noticed significant improvements. Things just “worked”. The UI was much nicer and easier to work with too, which made figuring out the system much less hassle. The enterprise version wasn’t cheap, but it is the platform we think is best suited to handle our growth over the coming years.

3. Management Retreat In Thailand

After spending a month in June with our management team in the Philippines, we knew we needed to do this again. After attending the DCBKK event in Thailand, we all met up again in Thailand for a month of knocking out some work together. (I’m not really sure “retreat” is the right word. Maybe “work-ation” is better?)

We decided to invite some of the contractors that work with our company out as well and that turned out to be an excellent move. We got to work much more closely with our designer, developer, and content manager and they got a chance to get to know our business even better.

We splurged a bit on this trip, but the savings we get from not having an office allow us to do things like this.

As part of hitting our Q3 goals, we also took the team on a Royal Caribbean cruise in December.

Our Plans For 2016

1. Investor Program

All things considered, Portfolio 1 is performing well and we’re planning to roll out “Portfolio 2” in the near future. We’ll likely start taking on new investors in March/April and acquire the sites through Q2/Q3. We’re looking to raise quite a bit more in this next round ($2M – $3M with $200K minimums) which will give us a significantly larger portfolio.

We’ll have to take into account the time it takes to find and acquire the right websites and online businesses, so we’ll likely still be spending that money through Q2 and well into Q3. There’s also a learning curve to taking over the businesses that we’ll want to space out – especially for those businesses that require more hands-on work.

I had some questions about competition with our own buyers. Won’t the Investor Program be in direct competition with our own customers?

Yes and no.

First, I should mention that all sites purchased for the Investor Program are from publicly available sites on our marketplace. We don’t cherry pick sites before they get listed or otherwise give the Investor Program first dibs – all buyers have the same opportunity to purchase, including us. (Which, by the way, is unique to Empire Flippers. Other brokers have VIP’s and priority lists where select buyers get to see and buy sites BEFORE they hit the market. Not so with us!)

Second, we have to make offers with the Investor Program just like others buyers do. In fact, we disclose this to each seller in each case – acknowledging the potential conflict. This becomes a bit problematic when sellers ask us for advice on what they should do, but our policy has always been transparency and honesty and that seems to work well for all parties.

Are you interested in Portfolio 2 and an accredited investor? If you’d like to be informed when we’re opening up the next round, please click here to let us know.

2. Deal Center

One of the things we’ve struggled with is trying to run our business with a mix-and-match set of disparate, 3rd party systems. WordPress, Hubspot, Zendesk, Google Docs – all are used to store information we need to run our business.

Things would be so much easier if we had one custom system of our own – a “database to rule them all” so to speak. With this “Deal Center” we could do a number of things:

- Send email updates when sites meet a buyer’s exact criteria

- Allow a “watchlist” that gives updates on what’s going on with the listings

- Gives buyers (and eventually investors) a dashboard to review current and previous targets

- Streamline communication between potential buyers and sellers

All of this is somewhat difficult as-is, but this Deal Center should really make things easier.

It’s an awfully expensive and time-consuming project, though. There’s an open question – do our buyers/sellers really need this or is it just a fun, cool technical project that WE want?

We’d like to launch a version of this by the end of 2016, but need to talk to our customers a bit more to better understand which pieces we really need to include.

3. Sourcing Channels

Sourcing new sellers and listings remains a priority for us. As our list of buyers grows, their demand for sites grows (and changes) over time. We’re constantly on the lookout for new ways to attract sellers to list their sites with us.

We’ve got some paid traffic strategies that are working, but we’d like to add a couple of new channels in 2016 as we continue to expand. We’ll be testing through additional ways to attract new sellers throughout the year.

That’s it for our Q4, 2015 business report. We have some pretty aggressive goals lined up for 2016 ($10M in total sales – $7M in brokered sales + $3M sales through the Investor Program) and we’ll continue to update as we work towards those numbers.

“New – Business Report for Q4 2015 from the @empireflippers!”

Now – over to you. How did your quarter turn out? Any thoughts on what you’d like to see in future reports from us? Let us know in the comments!

Discussion

Wow.. That are great numbers. Thank you for being inspiration 😀

Your income reports are great and inspirational

I am just starting out and this is my first income report

http://juliescafebakery.com/my-income-reports-julies-cafe-bakery/

Really nice. I listen your podcasts also they give me motivation.

Recently I used Flippa DealFlow to sell my website but I will definitely consider EF for my next deal. 🙂

I would love to hear about your work flow, how you find right people to with with you from their own places, how to manage them. I would really love to hear these in your podcast if possible. I am into building SEO and IM for 5 years but finding right people for remote work is really hard thing for me.

Thanks in advance.

Thanks for the report.

How much do you burn quarterly? Can’t you also report your net profit? Also do you pay taxes in the Philippines?

Also another question. I see your FB ads resulted in only one deposit. Can you explain it a bit more? How much did you pay and what are your advertising goals on FB?

Hey Amir!

We don’t cover net profit numbers for the business in these reports. I can tell you, though, that it’s safe to assume we’re making pretty close to $0.

We pay ourselves comfortable salaries, pay our team, etc…but the rest has been spent on growth over the last couple of years. We’re bootstrapped, so we can’t go too negative for growth, but we’ve generally spent any extra profits on growth.

That may not be the case in 2016, though. We’ve been able to reasonably dump profits into growth, but that might not be the case this year. We’ll likely take distributions in 2016 instead of retaining business profits.

We don’t pay taxes in the Philippines, no.

FB ads are more geared towards sellers, not buyers.

Justin, I love reading your business reports. It must be a beast to put these together and I totally understand why you move them to a quarterly schedule.

I’m very interested in seeing if the FBA businesses you have right now will move. I’m building an FBA business myself looking to sell it in 12-18 months or so :).

Thanks, Gunnar!

Yeah – these are a bit of a monster to put together. Glad you dig them though and I’m happy to be switching to a quarterly schedule with these, hehe.

We already sold one of the FBA businesses for just under $100K. We have interested parties looking at the others – I think there are definitely buyers who are interested.

Definitely kick some ass over the next 12-18 months and we’d be happy to help you list/sell the business, man!

Amazing and insightful as always! Thank you for posting these!

“…but the savings we get from not having an office allow us to do things like this.”

I wasn’t aware you all didn’t have a centralized office. Do the customer support heroes work from home? Is there a blog post or podcast about this? I’d love to hear more! Thank you once again for these business reports!

Hey Ahmed,

Yep, all of our Customer Heroes work from home. (Or with each other at coffee shops, co-working spaces, etc.)

We used to have an office in the Philippines, but we sold our outsourcing company a couple years ago and the office went with it.

We rent spaces or temporary offices sometimes for our management team or on a case-by-case basis, but mostly everyone works on their own as part of a “remote workforce”.

More on remote work here:

http://wpcurve.com/remote-worker/