Why Are Multiples For FBA Businesses Dropping?

The years 2020 and 2021 were spattered by a sea of historic events, and in the M&A space, they might be known predominantly for the epic ecommerce boom.

During this time, consumer shopping activity shifted almost exclusively online, and due to this, ecommerce stores were seen more seriously as profitable future-proof assets.

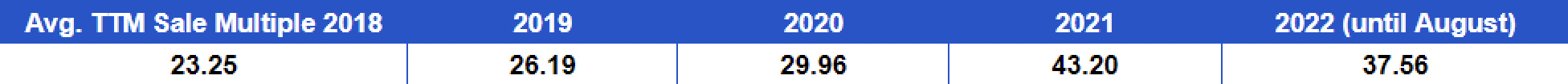

As a result, business valuations spiked with many ecommerce stores entering million-dollar levels. From 2020-2021, the average valuation multiple increased from 29.96x to 43.20x, a 13.24-point increase.

Markets can fluctuate tremendously, however, and ecommerce is no exception. Now in 2022, a new series of dramatic world events are causing business valuations to drop. As of August 2022, the average multiple has decreased by 5.64 points, to a 37.56x multiple.

Ecommerce store owners looking to sell their business now are feeling frustrated, finding it more difficult to exit for valuations that were possible in the not-so-distant past.

In this article, we’ll explain the primary factors contributing to the current drop in ecommerce business valuation multiples and what sellers can do about this.

First, let’s look at what contributed to the ecommerce boom to see how this was a bubble that in retrospect was bound to burst.

How Did We Get Here?

The pandemic sparked a worldwide shift in online shopping thought to permanently change buying behavior. Brick-and-mortar stores were going out of business and Amazon was purchasing empty buildings to turn into fulfillment centers.

Meanwhile, this was giving rise to a few online companies, known as ecommerce aggregators, who invested entirely in physical product businesses (primarily Amazon FBA) to create one large ecommerce portfolio managed by a team of specialists.

The aggregator to make this business model public was Thras.io, who in 2020 reached a $1B valuation, and in 2021 was claimed to be valued between $3B-$5B.

Almost overnight, new aggregators and VCs swarmed towards this business model, resulting in a buying frenzy of new institutional buyers equipped with millions in cash, all looking to acquire large businesses as quickly as possible.

The name of the game became to acquire individual brands and businesses, have them managed by a team of ecommerce specialists, and grow the value of the portfolio as a result.

This became an amazing time for ecommerce store owners, who would in some cases have multiple aggregators competing to buy their business and receiving astronomical offers within a matter of days or weeks.

However, now in 2022, ecommerce owners are having a more difficult time selling their business and most are unable to sell at valuation multiples seen just a year prior.

There are several reasons why business valuation multiples are declining, the primary reason being a shift in the buyer’s market.

1. A Shift In The Buyer’s Market

Valuation multiples are essentially a reflection of what buyers are willing to pay for specific investments. As such, the first and perhaps most significant variable that determines whether a multiple goes up or down is the current state of the buyer’s market.

In this case, there are two major reasons why the main buyer pool (the aggregators) are unable to continue buying businesses at valuations similar to those seen in 2020 and 2021: VC funding and their existing portfolio performance.

A Decline In VC Funding

In the current period of global market uncertainty and economic decline, VCs have significantly cut funding to aggregators.

Aggregators who would want to acquire new businesses at this stage would likely need to fund their purchases using the profits generated from their existing portfolio.

This leads to the next issue, which is the decline in performance of their portfolios.

Portfolio Profit Problems

The ecommerce buying frenzy had three problems:

Firstly, valuation multiples collectively increased and valuations were further inflated by sales and profit figures that were unique to that specific timeframe. These investments only made sense if the businesses maintained the levels of profit experienced during the pandemic.

Secondly, the amount of buying competition caused aggregators to make quick purchase decisions with lower levels of due diligence. Due to this, some businesses ended up as underperforming investments and aggregators have become far more selective with the brands they’re purchasing now.

Thirdly, aggregators bought too many businesses and were overwhelmed by the sheer number of separate brands. They found themselves trying to simply sustain operations, rather than scaling their brands and growing their portfolio.

Due to these three issues, the aggregator portfolio has shifted to one with fewer, stronger businesses and the business model focuses on dedicating more resources to growing the prized few, as opposed to spreading themselves thin over a large number of sub-par brands.

The second variable influencing valuation multiples is related to the seller’s side, specifically the general decline in performance of their businesses.

2. Declining Business Profits

There are currently two significant factors contributing to a worldwide decline in ecommerce business profits: a drop in revenue and an increase in costs.

Revenue Drop

World events are creating rippling effects on consumer behavior. During times of uncertainty, the default is to spend less and save more.

This has led to a decline in sales volume and revenue for many Amazon FBA businesses. Declining businesses are in most cases more difficult to sell and the valuation also decreases due to lower average monthly profits.

Increases in COGS

Global supply chain issues have made it more expensive and slower to ship products. As a result, the costs of goods sold (COGS) are higher, thus decreasing the profit per unit sold.

Ecommerce supply chain issues are still around. Expenses are greater than before. This decline in monthly profitability decreases the valuation and can also reduce buyer confidence.

What Sellers Can Do

Depending on what you want to accomplish through the sale of your business, your decision comes down to selling now for possibly less, or holding and seeing what happens in the market.

The Option to Hold

Some sellers choose to hold onto their business for a potential rebound in valuation multiples. Just understand the opportunity cost of not having liquidity to invest into something else.

It’s also uncertain as to whether valuation multiples will rise again, or if the current level is a sign of normalization.

Another thing to note is that with inflation on the rise, liquid capital will decline in value, so if you don’t plan to reinvest after selling your business, you might be better off holding.

The Option to Sell Now

For many sellers, the best option is to sell now for lower multiples but reinvesting their profits into other assets that can produce higher returns.

This could mean reinvesting in online businesses that are performing well in this market, scaling them, and selling them for profit.

This method of buying and selling is known as the asset flywheel, and can be a powerful method of building wealth quickly while adapting to change through diversifying your online business portfolio.

Other sellers choose to sell now to allocate their capital into other asset classes (i.e. real estate, stocks, or crypto), or to have liquidity to capitalize on opportunities.

Beware of Brokerages with Inflated Multiples

If you decide to sell, and you decide to work with a brokerage, just be careful of brokerages that use tactics to entice sellers, such as promising inflated multiples.

In this situation, sellers will be tempted by the offer of a high multiple, only to find there are no buyers interested in purchasing the business at that level, and the seller is now stuck on the marketplace due to a long exclusivity contract. This either wastes the seller’s time or they are pressured to reduce their multiple to sell their business.

Additionally, make sure your business is listed on a protected marketplace, where buyers must unlock a listing to view more of the sensitive details. Doing otherwise is putting your business at unnecessary risk.

How Does Empire Flippers Calculate Sales Multiples?

At Empire Flippers, we use real sales data from selling hundreds of Amazon FBA businesses to calculate multiples that are aligned with the current market appetite.

The objective, of course, is to sell businesses as quickly as possible for the highest justifiable valuation. We adjust our multiples according to what will accomplish this outcome.

Discuss Your Options With Our Advisors

Every seller is different and the decision to exit is a very personal one. We recommend speaking with a sales advisor to determine what would be the right decision for you given the current market conditions and what your goals are.

Otherwise, you can use our free valuation tool if you’d like to see an estimate of your business’s potential value.