Flippa’s Pricing Increase – What Sellers Need To Know

Don’t you hate it when people try to pass bad news off as good?

Flippa recently published a blog post and sent out an email announcing a decrease in their listing fee.

Nothing wrong with that, eh?

Except that’s not the WHOLE story.

They also dropped these little gems:

- 5% success fee doubled to 10%

- $3,000.00 success fee cap removed COMPLETELY

As it turns out, the listing fee decrease was actually a pricing INCREASE for the vast majority of sellers with profitable websites.

Check out the email they sent to their readers and customers:

No mention regarding the success fee change, eh?

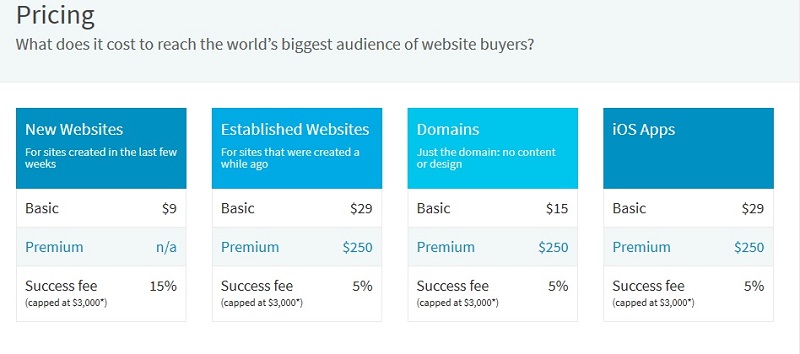

Doesn’t it sound like it’s going to cost you less to list with them? Let’s compare their pricing charts from 2013 to 2014.

Flippa Fees In 2013:

Flippa Fees In 2014:

What This Means For Website Sellers

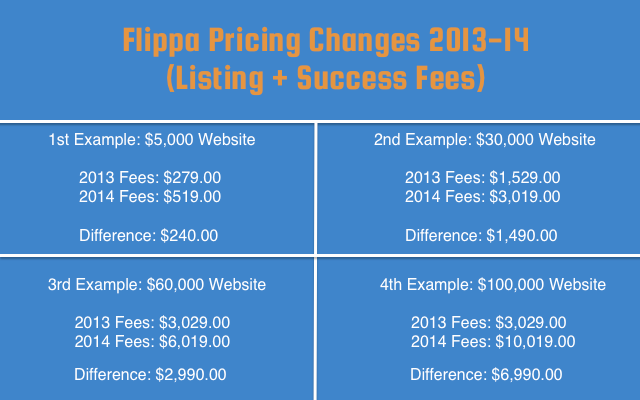

For anyone selling established websites over $200, they’re going to pay more. How much more depends on how much the site ultimately sells for. Here’s a chart showing a few examples:

As you can see, the difference in pricing is significant the higher the sales price. Things really start to change once the site sells for more than $60,000.00 without the cap.

None of this would really matter if they would have been more transparent with their pricing changes. The real problem here is ignoring the bump and cap removal on the success fee and only focusing in on the decreased listing fee.

One seller nearly got burned for more than $17,000.00 on this change.

Kirk listed his site on Flippa in October and it didn’t sell. As reported on the Warrior Forum, he went to re-list in January and didn’t notice the success fee changes. He went from an expected $3K in fees to over $20K in fees when the site sold successfully. (Funny enough, I’d actually come across this site as a user/searcher quite some time before and thought it was an interesting niche. Check out Kirk’s Flippa listing to find out more about his approach…great stuff.)

Update: Kirk has been in contact with Flippa and, to their credit, they’ve agreed to lower the success fees in this instance.

What Others Are Saying

I reached out to Thomas Smale from FE International who reported the changes on sites like BHW to see if I could get some insights. Here was his reply:

“It is an interesting move from Flippa and a clear signal that they are no longer interested in trying to compete at the mid-five figure range and above – where using a broker is now priced similarly (with a broker being marginally more expensive but with no upfront fees) with less benefits. A broker brings real deal experience, vetted buyers, fully prepares sales materials, more confidentiality and a far higher success rate (a decent broker will close 80%+ of all listings vs. Flippa at less than 50%). I believe this to be a generally sensible move from Flippa (from a business perspective) as they already have a relative monopoly over 3-4 figure listings so can almost charge what they want. Higher than that, it only makes sense to use Flippa if you don’t know of the alternatives.

Flippa’s counter is a service called “Deal-Flow” which is pitched as a “premium brokerage service” but in reality is more of an assisted listing service and far more hands on for a seller than with a real broker. As Flippa generally attracts a very poor quality of listings, multiples for genuinely good sites also suffer accordingly. Whilst Deal-Flow might seem cheaper on the surface, the actual value proposition is inferior . Good brokers have buyers who trust them, and in turn are willing to pay more for a quality business. Flippa does not, even with Deal-Flow. A business that might sell on Flippa for $80k would cost you just over $8k in listing and success fees to net around $72k. A broker might get $100k for that same business and even with a 15% success fee, you will still net more ($85k).”

Thomas makes some interesting arguments about Flippa’s focus on the lowest end of the market and on the value proposition regarding Deal-Flow Vs. professional brokers.

I also reached out to Justin @ Centurica to get his thoughts:

“It’s certainly an interesting strategy, and I’m sure it’s part of a larger plan. I would guess the aim is to increase front end listing volume and ultimately revenue per user. It seems to coincide with the arrival of Adsense display adverts appearing on the platform.

With total selling fees now rivaling that of a specialist broker, I would guess that Flippa (marketplace) have no plans to target the + $30K section of the market, which is a wise move as you can’t be everything to everyone. Sub $1K listings are unlikely to make the company any substantial revenue, unless they’re listed in high volumes. That would explain the reduction in listing fees.

This leaves a ‘sweet spot’ of around $5K – $30K which often doesn’t make sense for brokers due to the low commissions, but would make sense for a marketplace. Their focus should be on attracting more sellers to that particular area. I believe this is where the largest buyer demand will be in 2014, as more potential buyers realize that paying less than $5K for a ‘business’ is more than likely to result in tears.

It’s easy for everyone to take a shot at the market leader and I’m sure this move will attract a fair few critics. It’s also easy to forget that they’re a business, not a forum or social enterprise and they have to do what they believe is best for them as a company in order to serve their users long-term.

Personally, I hope that the increased revenue will be reinvested into marketplace security and moderation to remove and prevent some of the issues they currently have with listing quality.”

Justin again highlights a move towards the lower-end of the market. I agree that spending some of that increased revenue on controls and moderation to improve the quality of sites listed would be an interesting move.

What Was Flippa Thinking?

While they have every right to change or adjust their pricing as they see fit and to meet their business goals, their message and approach to this communication was flawed. It’s not just the email they sent, though…here’s the blog post where they left that out too. (Incidentally, the link to their pricing page on the post isn’t working either.)

The claim that they’re responding to requests to lower listing fees seem to have missed the point. Looking at the comments on their blog post, I haven’t found anyone that seems to respond positively to the change. While Flippa’s entitled to raise their fees whenever they’d like, wrapping it up as a fee decrease is where their users are feeling burned.

Note: A reader Josh @joshuasturgeon brought up an interesting point – He argued that Flippa might be feeling the competitive pressure put on them by Apptopia in the app buying/selling space. They might have seen they’re charging 15% and are looking to up their fees there because they can. Interesting observation.

In Flippa’s Defense

1. They Have Every Right To Change Their Pricing

While it might not have been communicated very well, I don’t think they’re “screwing” over sellers as some have mentioned. Adjusting prices to keep up with the market and their business needs is perfectly acceptable.

2. They’re Still Priced Lower Than Brokers

While the gap has closed a bit, they’re still charging less than us and others that sell in the $5K+ space. This move may simply be signaling that they’re looking to close the value gap as well.

3. We All Make Mistakes

It’s not easy being the market leader. They’re bound to screw up communication from time to time – People make mistakes. This could be a case of the right hand not talking to the left and a simple miscommunication. While Flippa isn’t the huge corporate giant some think them to be, there are things that get missed when you have lots of different people on the team.

What This Means For Brokers

This is relatively good news for us and other brokers like FE International. Flippa has closed the gap in fees, but haven’t much in terms of added value. The shrinking difference between Flippa’s rates and those of a professional broker will (likely) further fragment the market and create opportunities for brokers to offer differentiated service and white glove treatment.

I know that plenty of brokers list and have sold on Flippa as well. This pricing increase is likely to decrease the amount of sites listed on Flippa by brokers, further cutting into their $10K – $50K sites for sale presented by these 3rd party brokers. Flippa still provides a lower-cost alternative for the DIY crowd, but they’ll have to find a way to off-set the brokers that are bound to list elsewhere with the additional cut Flippa is now charging.

So, what do you think? Did they deliver a wrapped-up turd in a box with this one or was it a smart move and a sign that they’re heading in the right direction? Please feel free to leave a comment – we want to know what you think of the changes.

Dig this post? Help us get the word out!

“Is Flippa’s pricing decrease an increase? You should check this out!” – Tweet This!

Discussion

This is good except that Empire Flippers wont sell a profitable e-commerce site if the owner does ANY shipping themselves. Flippa might be the only option in some cases because legit sites are being turned down for brokering (15% fee) so that the percentage (we sell 95% of the sites we list) does not suffer from a marketing perspective. I have a legit money making site that I have worked to build and Flippa might be my only option.

Hey “Concerned Seller”

My first question is, why would you be shipping the products yourself? There are so many options from warehouse fulfillment agencies to just hiring someone to do it for you. We have sold these in the past, but we typically don’t like to and the reason why is you’re going have a hard time getting a buyer for it because of this. This is one of those scenarios where it is best to spend instead of save money to make your business ultimately more attractive and more sellable.

I get it if you’re just starting out why you might do it yourself, but as your business begins to profit more and more, I would highly encourage you to look at sourcing this task to someone else whether that’s in-house or outsourced. You should be focusing on higher income producing activities instead of packing boxes

Deceptive. This reminds me of escrow.com

They have a Standard Service, and a Premium Service (that costs double).

I selected Standard Service for the sale of my domain.

When escrow closed I was charge Premium Service.

When I contacted the company, they said since my buyer used a credit card it was classified as Premium Service.

Reviewing the website it IS state there, but buried in the details. I’m sure many sellers are caught off guard by this.

Does this news will help my blog http://www.guruofmovie.blogspot.in/

Sounds like they are going downhill like eBay. Dropping listing fees to get more sellers and scraping more profit on the backend. A downward slide for Flippa. Why use them when you could use a broker?

Flippa’s been the dominant player for years. While I don’t think that’s going to change in the short-term, I do wonder what they’re thinking and what they’re up to over there…

Well, to me this is just another slap in the face to sellers on Flippa, and another sign they really don’t care about their customers. Look at how they are promoting this – their email says “Save up to 70% on flippa fees” – what a joke. So not only are the fee’s ultimately more expensive, they also put adsense ads on the site! How is that helpful to a site seller ? And as a buyer, It is very distracting. The reality is if they did not have such a monopoly in this marketplace they would not be in business. Their customer service is amongst the worst I have seen of any site both in terms of response time and quality of response – usually taking a minimum of 24 hours or more. To me they should be spending way more time on the quality of experience for both buyers and sellers which would warrant a fee increase, instead of giving a poorer experience.

Whoah – they put AdSense ads on Flippa? On the listings? I haven’t seen that and it would REALLY surprise me to see, actually.

We’re working on the buying/selling process. Hopefully we can provide a much better experience, while keeping costs down from some of the other brokers that typically focus on $100K+ sites. 🙂

I’m so sorry for the 5 figure sellers, but you can get burned easily on Flippa as a buyer also.

I’ve seen a lot of crappy sites sold for more than 500-1000$, just because the seller comes with some bogus proofs of revenue, have 10k Facebook fans who are all fake profiles or 5k “users database” which is just some bulk email addresses bought for 5 dollars.

And they are not that hard to spot for somebody who knows this business, it’s a complete mystery how that they leave the game so free at this level.

Hey Alex,

You’re right in that buyers can get burned as well. In fact, I’m thinking that they may end up with many more lower-end sites. It’s not always the case, but there’s definitely more crap and potential scams in that space. 🙁

Thanks for reporting on this Justin and thank you Thomas for uncovering this sneaky little price increase. It certainly appears that Flippa has decided to price itself out of the market for 5-6 figure deals.

My prediction is that Flippa will begin trying to forge strategic partnerships with Brokers and offer special pricing/incentives to continue to bring those types of deals to their marketplace.

Overall, should be a good move for the brokerage industry and possibly for Flippa too. They can focus on what they do best – selling the low/medium size sites and brokers can better help clients at the high end.

Possible win-win for everyone.

Hey Ryan,

That’s a positive/optimistic way to look at it and I hope you’re right. It will be interesting to see how this plays out. I wonder if there is some shifting going on over at Flippa in terms of strategy and direction for the company. Time will tell, eh?

It certainly seems like some of the key players at Flippa have moved on to other positions. So with new management it certainly makes sense there could a change in strategy.

However it unfolds, it should be interesting to watch.

Thanks for the mention, Justin, it is a shame that I had to discover this and call them out on it (which then lead to various forum and blog posts like this) rather than just being transparent. I have no problem at all with price rises as it is good for established brokers like myself, I just found it very misleading. I am sure lawyers (as mentioned by Jakub) would have a field day with this.

Hey Thomas,

Thanks for pointing this out. I get a ton of emails and missed this the first time around and I’m glad you caught it. We have quite a few site builders/sellers that read our posts and sell on Flippa – hoping we let them know.

Their pricing isn’t horrible, I just wish they would have been more transparent. I thought it was a smart to have a low-priced DIY option, though…great differentiation from brokers. Now…

I agree with you. I felt that 5% + listing fees DIY option vs. 15% average broker fee offered a fair gap in value. Now, aside from the fact a broker will make the process a lot easier for you and likely bring a higher quality buyer to the table than Flippa, the fee gap is much smaller and thus the value proposition decreases significantly. Of course, Flippa could just be ignoring the brokers and backing their relative monopoly/marketing power to continue controlling that market, but I’ve seen in the last 12 months more and more sellers discovering brokers and preferring that over Flippa. I expect this trend to continue, especially now fees have at least doubled.

They should have taken a page out of Netflix’s book. Anyone remember when they raised prices by splitting DVD and Streaming services? http://www.geek.com/news/netflix-splits-dvd-and-streaming-plans-raises-price-for-both-1402177/

Customers made a stink about it, but their stock price has continued to soar. Transparency always wins in the long-run, even if you get flack for it upfront.

Yeah – I remember that Netfix issue. They definitely took the heat, but I think that’s a much better approach.

Great Post, Justin. I wonder why they didn’t want to control the message… Now, they will need to defend their move.

Good news for EF!

Thanks, Doug.

I really don’t understand the move, honestly. I think it was just piss-poor messaging…or maybe they were trying to head-off the backlash by keeping it private/quiet? Doesn’t make much sense, though.

You’re right it’s good for us and other brokers in this space/range, for sure!

One of the first thoughts I had was if they consulted this step with a lawyer. Considering that http://www.accc.gov.au enjoys giving huge fines to businesses for misleading customers like that.

Interesting point, although…they technically DID drop their listing fees across the board, right? It just came across as corporate-speak when you look at the details – I think that’s the problem.

This looks like a great way for Flippa to scare off the higher priced sellers. It was already a last resort, now it definitely is.

Nice find.

Thanks for the comment, Travis.

Yeah, it will be interesting to see if they come up with a value proposition to match the success fee increase. IMO it will be hard to compete with the niched-down hand holding and specialized service that brokers offer.